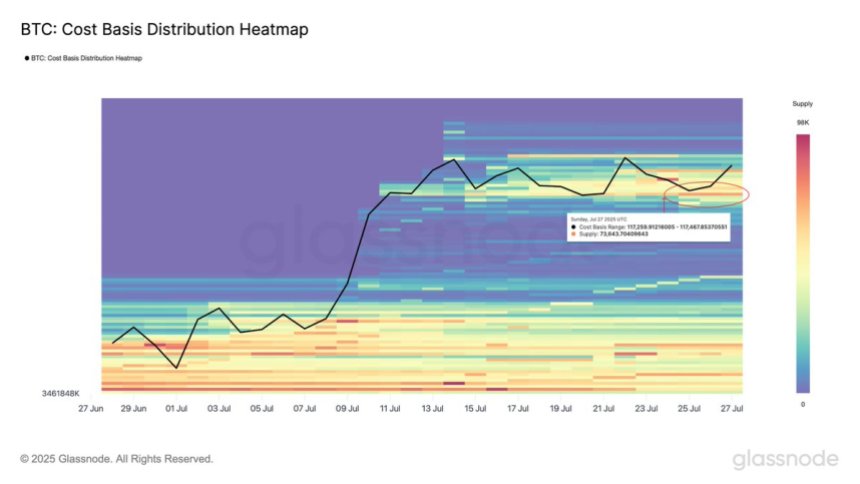

Bitcoin continues to consolidate between $115,000 and $120,000, with bulls maintaining control despite the lack of a breakout above $123,000. What stands out in this range-bound structure is the clear demand concentration around $117,000. According to Glassnode’s BTC Cost Basis Distribution Heatmap, this level has consistently attracted buying interest, acting as a key area where capital rotates into Bitcoin.

Related Reading

The heatmap reveals dense clusters of cost basis activity near key price levels. This reinforces its role as short-term support and a psychological anchor for bulls. As long as this zone holds, the risk of a full breakdown remains limited—even as BTC struggles to reach new highs.

However, repeated rejections near $120K and muted momentum raise concerns that upside exhaustion could eventually lead to deeper downside. If demand at $117K begins to fade, price may quickly revisit lower levels in search of fresh support. For now, though, on-chain data shows that accumulation remains healthy, and this zone could be the foundation for Bitcoin’s next attempt to reclaim the highs.

$117K Becomes Bitcoin’s Accumulation Stronghold as Market Shifts

Bitcoin’s $117,000 level has emerged as a key accumulation zone, with approximately 73,000 BTC now held at this cost basis, according to the latest data from Glassnode. This reinforces the idea that buyers continue to step in on every dip, absorbing selling pressure and stabilizing price action within the current range. The BTC Cost Basis Distribution Heatmap shows a consistent buildup of demand in this area, highlighting investor confidence around this support zone.

What makes this cycle particularly unique is the presence of legal clarity and accelerating institutional adoption in the US. Unlike previous cycles, where price action was often driven by retail speculation and extreme volatility, today’s structure appears more measured. Regulatory progress—especially around spot Bitcoin ETFs and clearer custody frameworks—has attracted a wave of long-term capital. This influx of institutional demand is not only stabilizing the market but also making it less reactive to short-term swings.

However, Bitcoin’s calm price action may not last much longer. As Ethereum gains momentum, driven by rising open interest and on-chain activity, capital is beginning to rotate into altcoins. Historically, such transitions have marked the end of Bitcoin-led phases and the beginning of broader market expansions. If ETH and altcoins continue to accelerate, Bitcoin’s tight trading range could break—either leading to a catch-up rally or a temporary pause as capital rotates elsewhere.

Related Reading

BTC Range Narrows As Price Holds Between Key Levels

The 8-hour chart shows Bitcoin consolidating tightly between $115,724 and $122,077, with the price currently hovering around $118,762. Despite a lack of strong momentum, the structure remains bullish as BTC holds above all major moving averages—the 50 SMA ($118,185), 100 SMA ($113,521), and 200 SMA ($109,754). This alignment signals continued trend strength, with short-term dips being supported by buyers.

Volume has declined during the consolidation, a typical sign of a neutral phase where market participants await a breakout. Notably, each pullback toward the lower boundary near $115,700 has been met with strong demand, confirming this zone as key support. Meanwhile, resistance at $122,000 continues to cap bullish attempts, forming a clear range that will likely define Bitcoin’s next move.

Related Reading

If BTC can reclaim $120,000 with a strong surge in volume, a breakout toward new all-time highs above $123,000 becomes likely. Conversely, a breakdown below $115,700 could trigger a sharper correction toward the 100 SMA around $113,500. For now, all eyes remain on whether bulls can sustain pressure and flip resistance, or if sellers regain control near the top of the range. The current setup favors patient accumulation as the market prepares for its next directional move.

Featured image from Dall-E, chart from TradingView