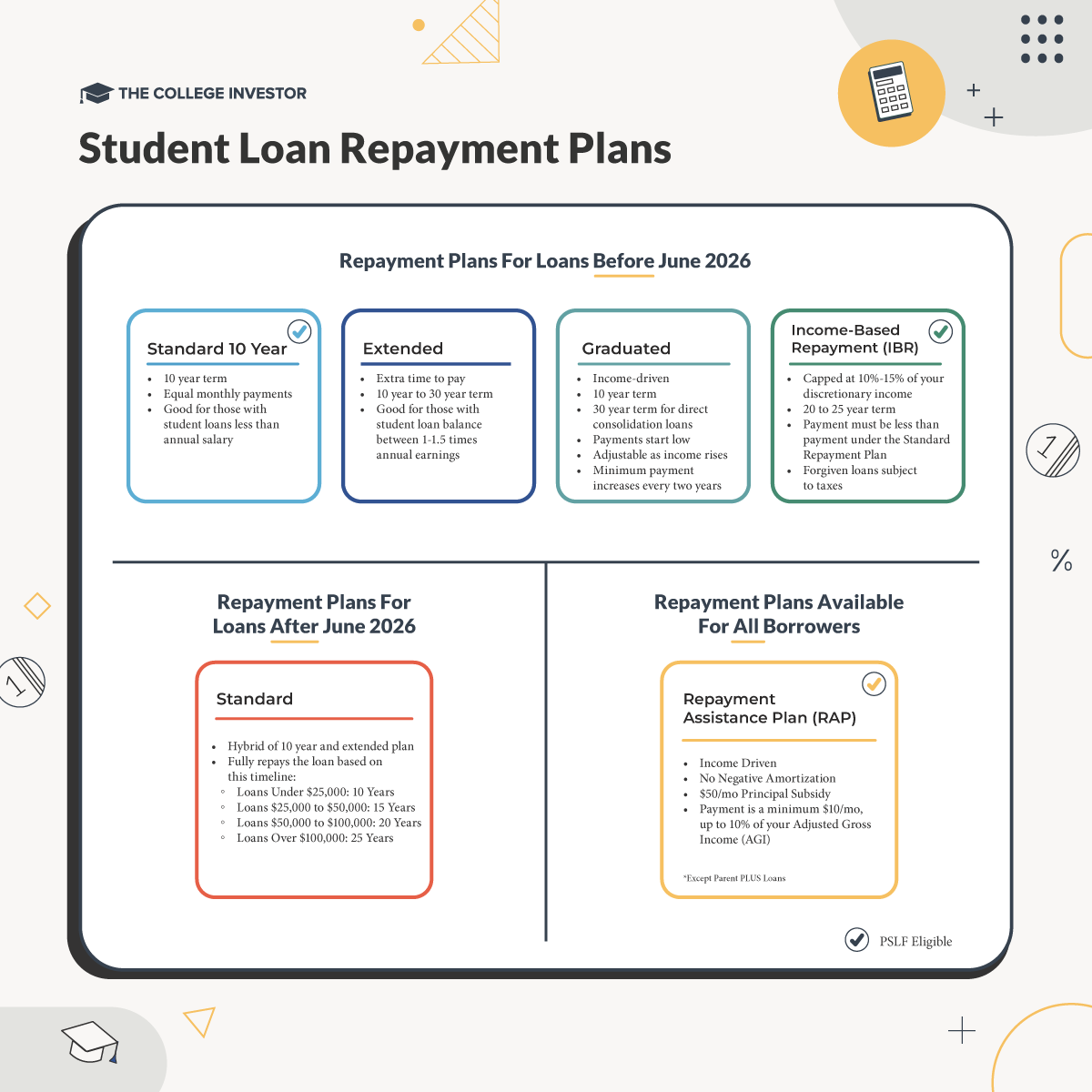

Our free student loan repayment calculator helps you estimate your monthly payments under various plans, including Standard, Graduated, Extended, IBR, PAYE, and ICR. You can also explore the proposed Repayment Assistance Plan (RAP) calculator for more options. Note that the SAVE plan is expected to end within the next 6-12 months, but you can still see what your payments would have been under this plan.

To use our student loan calculator, you’ll need to know some basic details about your loan, such as the interest rate and payment amounts. You can calculate each loan individually or combine them for a comprehensive view. Our calculator will take care of the rest, providing you with a clear picture of your repayment options.

Student Loan Repayment Calculator

// JavaScript code remains the same

Understanding Your Student Loan Calculator Results

When planning your student loan repayment, there are several key factors to consider. Our calculator is designed to help you navigate these factors and make informed decisions about your repayment strategy.

Loan Amounts and Repayment Terms

To get the most accurate results from our calculator, you’ll need to know your total student loan balance. You can choose to calculate each loan individually or combine them for a comprehensive view. We recommend calculating each loan separately to determine the best debt payoff method for your situation, such as the debt snowball or debt avalanche.

Loan Term and Repayment Plans

The standard repayment term for federal student loans is 10 years, but you may be eligible for other plans with longer terms, such as 20 or 25 years. Our calculator takes into account the full loan term, so if you’ve already been making payments, your results may vary. You can explore different repayment plans, including Standard, Graduated, Extended, IBR, PAYE, and ICR, to find the one that works best for you.

Interest Rates and Their Impact

While interest rates play a significant role in private student loans, they have a relatively smaller impact on federal loans. Recent loans may have interest rates as low as 2%, while older loans may have rates around 6% or higher. If you’re considering refinancing, it’s essential to weigh the benefits against potential losses, such as giving up access to income-driven repayment plans or student loan forgiveness programs.

Repayment Plan Options and Forgiveness

Our calculator provides results for various repayment plans, including Standard, Graduated, Extended, IBR, PAYE, and ICR. Each plan has its unique characteristics, and some may offer forgiveness options after a certain period. It’s crucial to understand the terms and conditions of each plan to make an informed decision about your repayment strategy.

Refinancing Your Student Loans: Is It Right for You?

Refinancing your student loans can be a viable option, especially for those with private loans. However, if you have federal loans, refinancing typically only makes sense if you’re not pursuing loan forgiveness and plan to pay off your loan within five years. You can explore refinancing options and find the best rates for your situation.

Additional Factors to Consider

Beyond monthly payments, it’s essential to consider other factors, such as student loan forgiveness options, hardship deferment, and income-driven repayment plans. These benefits can be invaluable, especially for federal loans. If you’re considering refinancing, your credit score and debt-to-income ratio will play a significant role in determining the best interest rate for you.

Editor: Clint Proctor

Reviewed by: Chris Muller

The post Student Loan Calculator appeared first on The College Investor.