Here’s a quick recap of the crypto landscape for Wednesday (July 9) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

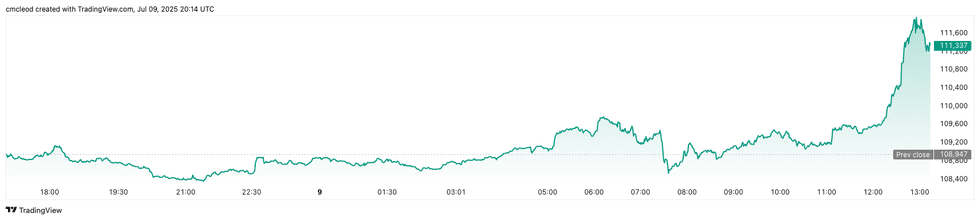

Bitcoin’s (BTC) price peaked at US$111,744 as the market wrapped, a 2.7 percent increase in the last 24 hours. The day’s range for the cryptocurrency also brought a low of US$108,644.

Crypto analyst TradingShot believes Bitcoin may not experience another rally this cycle, despite projections exceeding US$160,000. This assessment is based on Bitcoin’s historical four year patterns.

According to TradingShot, Bitcoin has not broken out of its current upward channel to trigger the explosive rallies seen in 2017 and 2021. If the four year cycle holds, time is running out for such a breakout.

Ethereum (ETH) is priced at US$2,772.50, up by 6.3 percent over the past 24 hours. On Wednesday, the cryptocurrency hit a low of US$2,635.74 before rallying to finish the day at its peak, mirroring a broader market trend.

Altcoin price update

Bitcoin price performance, July 9, 2025.

Chart via TradingView.

- Solana (SOL) was priced at US$157.12, up by 3.7 percent over 24 hours. Its lowest valuation as of Wednesday was US$153.45.

- XRP was trading for US$2.42, up 4.5 percent in the past 24 hours. The cryptocurrency’s lowest valuation was US$2.36

- Sui (SUI) was trading at US$3.05, up by 4.9 percent over the past 24 hours. Its lowest valuation was US$2.93.

- Cardano (ADA) is priced at US$0.6217, up by 5.6 percent in the last 24 hours. Its lowest valuation as of Wednesday was US$0.6027

Today’s crypto news to know

US Senate committee gathers for hearing on digital assets

The US Senate Banking Committee held a hearing on Wednesday dubbed “From Wall Street to Web3” to discuss proposed legislation regarding digital assets, including the Clarity Act.

Massachusetts Democrat Elizabeth Warren, a longtime crypto critic, said she is in favor of laws regulating digital assets that strengthen the financial system in the US, but criticized aspects of the Clarity Act that she said would allow non-crypto companies to “put their stocks on the blockchain,” evading US Securities and Exchange Commission guidelines.

“That is a serious problem for our country,” she warned.

Ahead of the hearing, Warren sent a statement to analytical publication the Block, accusing Republicans of enabling “industry handouts” to crypto lobbyists. Other vocal critics of the bill include New York Attorney General Letitia James and the ranking member of the House Financial Services Committee Maxine Waters.

Both she and Warren have questioned the ethics of US President Donald Trump’s business ties to the industry. At the hearing, former chief White House ethics lawyer Richard Painter, who was invited to speak by Warren, said:

“We cannot have the people who are in charge of passing legislation and enforcing legislation, implementing legislation, have conflicts of interest with their official responsibilities. You should be divesting from crypto if you’re going to be regulating crypto.”

Lawmakers are now facing a September 30 deadline to define cryptocurrencies, address Trump’s crypto interests and finalize industry rules.

RLUSD gains traction via Transak integration and BNY Mellon custody

Transak, a Web3 onboarding infrastructure provider allowing users to buy and sell digital assets using traditional payment methods, officially integrated Ripple’s US-dollar pegged stablecoin, RLUSD.

The move expands the token’s reach to 8.3 million additional users across 64 countries.

“Transak has always strived to make finance truly accessible and that includes bringing on assets like RLUSD that balance blockchain ethos with compliance requirements,” said Sami Start, CEO and co-founder of Transak.

“With this integration, users gain access to one of the most thoughtfully designed stablecoins in the market, now available through a seamless and trusted fiat-to-crypto experience.”

The news was announced the same day Ripple chose Bank of New York Mellon to custody its USD reserves. This move by a traditional financial giant lends significant institutional credibility to Ripple’s stablecoin, which was built as an enterprise-grade stablecoin to improve the efficiency of cross-border transactions.

“As primary custodian for RLUSD, we’re proud to support the growth of digital assets by providing a differentiated platform, designed to meet the evolving needs of institutions in the digital assets ecosystem,” said Emily Portney, global head of asset servicing at Bank of New York Mellon.

South Korea to reclassify crypto businesses as venture companies

South Korea’s Ministry of SMEs and Startups announced Wednesday that it will lift current restrictions preventing crypto-related businesses from qualifying as venture companies. Firms in the virtual asset sector are currently restricted in their eligibility for various tax breaks and financial support due to crypto regulations implemented last year.

However, the minister said that the proposed amendment reflects “a shift in perception” regarding the industry.

“It is expected that the virtual asset business operators based on new technologies with innovation and business viability will be newly recognized as venture companies, and existing venture companies will also be able to promote virtual asset-related businesses,” the statement explains, “which will lead to the activation and expansion of the venture ecosystem and promote the fostering of the virtual asset industry.”

This change will be supported by the establishment of “legal and institutional safeguards” designed to protect users. Public comments on the proposal will be accepted by the ministry until August 18.

Tether reveals it holds US$8 billion in gold in private Swiss vault

Tether, the issuer behind the world’s largest stablecoin, USDT, has disclosed it holds nearly 80 metric tons of gold worth US$8 billion in a private Swiss vault, according to a Bloomberg report.

The company, which manages over US$159 billion in circulating stablecoins, says most of the gold is directly owned by Tether, making it one of the world’s largest private gold holders outside of sovereign institutions.

CEO Paolo Ardoino confirmed the gold is stored in a highly secure location in Switzerland, though he declined to disclose the exact facility for safety reasons.

The firm also operates a gold-backed token called XAUT, with each coin redeemable for one ounce of physical gold.

Tether’s increasing exposure to gold comes amid rising demand for safe-haven assets and ongoing concerns about US debt sustainability. However, new regulations in the US and EU may force the company to divest gold from USDT’s reserves if it seeks formal approval in those markets.

Trump Media files for Crypto Blue Chip ETF

Trump Media & Technology Group (NASDAQ:DJT) has filed to launch its third crypto-focused exchange-traded fund (ETF) under the Truth Social brand. Called the “Crypto Blue Chip ETF,” the fund will aim to allocate 70 percent to Bitcoin, 15 percent to Ether and the remainder to Solana, Cronos and XRP.

This marks the latest move by the Trump-affiliated media company to expand its crypto investment footprint following two prior filings focused more narrowly on Bitcoin and Ether.

The ETF is set to trade on NYSE Arca, and is being developed in partnership with Crypto.com.

The company had earlier disclosed plans to raise US$2.5 billion to directly acquire Bitcoin. While Trump Media shares rose nearly 3 percent on the day of the announcement, it remains down over 40 percent year-to-date.

Sequans soars 43 percent on Bitcoin treasury strategy

Chipmaker Sequans Communications (NYSE:SQNS) saw its share price jump 43 percent after announcing a major pivot to a Bitcoin-based treasury reserve strategy. The firm raised US$384 million through equity and debt instruments to begin acquiring Bitcoin as a long-term corporate asset, emphasizing Bitcoin’s scarcity and independence from central banks as reasons behind the move and its potential to strengthen the company’s financial footing.

More than 40 institutional investors backed the fundraising, including convertible debentures and warrants that could bring in another US$57 million. The company plans to allocate future cash flows toward Bitcoin purchases.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.