Here’s a quick recap of the crypto landscape for Wednesday (August 20) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

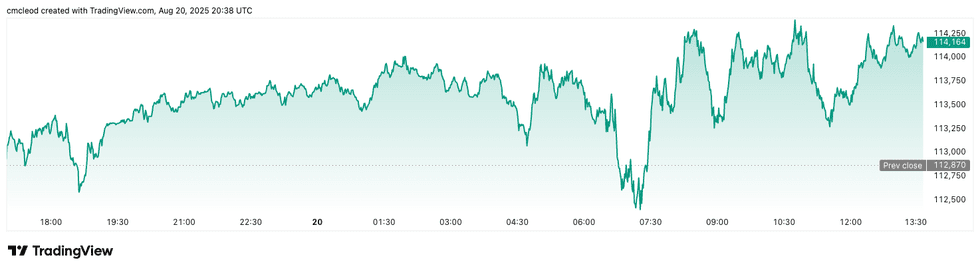

Bitcoin (BTC) was priced at its highest valuation of the day at US$114,179, a modest 0.8 percent increase in 24 hours. Its lowest valuation of the day was US$112,460.

Bitcoin price performance, August 20, 2025.

Chart via TradingView.

The crypto market recovered some losses after Tuesday’s (August 19) widespread selloff as risk-averse sentiment led to a wave of liquidations. Wednesday’s recovery was driven by a rebound in market sentiment, with some investors viewing the correction as a healthy retracement in a longer-term bull market.

Despite short-term pressure, data shows long-term holders remain confident in Bitcoin’s outlook. The crypto sector’s market cap was up by 1.6 percent over 24 hours at Wednesday’s close at US$3.96 trillion.

Investors are now awaiting signals from US Federal Reserve Chair Jerome Powell’s Friday (August 22) speech.

Ethereum (ETH) was priced at US$4,340.67, up by 4.7 percent over the past 24 hours, and its highest valuation of the day. Its lowest valuation was US$4,118.81.

Today’s crypto news to know

Bitcoin and Ether ETFs shed nearly US$1 billion

Bitcoin and Ether exchange-traded fund (ETF) outflows hit nearly US$1 billion in just three days.

The wave of withdrawals came on the back of negative investor sentiment, with spot Bitcoin ETFs recording US$533 million in outflows on Tuesday, more than quadruple Monday’s (August 18) figure. Ether ETFs also faced steep losses, with outflows jumping from US$200 million on Monday to US$422 million the next day.

Together, the two asset types have seen US$1.3 billion in withdrawals since August 13, coinciding with price declines of 8.3 percent for Bitcoin and 10.8 percent for Ether.

The widely followed Crypto Fear & Greed Index dropped to 44 on Wednesday, slipping into the “fear” category for the first time in weeks. The index tracks volatility, market momentum and trading activity to gauge overall mood, and its decline reflects mounting concerns over recent price drops.

Wyoming reveals first state-issued stablecoin

Regulatory clarity and the future of digital finance are at the forefront at this year’s SALT Wyoming Blockchain Symposium, a high-level, invitation-only event for industry leaders and lawmakers.

The most significant announcement came on Tuesday as Wyoming became the first US state to issue its own dollar-linked digital currency, called the Frontier Stable Token (FRNT). FRNT, issued in partnership with LayerZero, will be operational across seven networks: Ethereum, Solana, Avalanche, Polygon, Arbitrum, Optimism and Base.

It is fully backed by cash and short-term US treasuries and carries an additional 2 percent reserve.

Tuesday also saw the launch of the American Innovation Project, a nonprofit lobbying arm consisting of a group of crypto industry figures who will engage with US policymakers and the public on digital asset issues.

The event also featured pro-crypto lawmakers, including longtime advocate Senator Cynthia Lummis, who, alongside Senate Banking Committee Chair Tim Scott, said that a crypto market structure bill will cross US President Donald Trump’s desk before 2026. “I hope it’s before Thanksgiving,” she added.

US Securities and Exchange Commission (SEC) Chair Paul Atkins spoke as well, indicating that the agency will take its own approach to treating tokens as securities under his leadership.

“From the SEC’s perspective, we will plow forward and on this idea that just the token itself is not necessarily the security, and probably not. There are very few, in my mind, tokens that are securities, but it depends on what’s the package around it and how that’s being sold,” he said.

China reportedly exploring yuan-backed stablecoins

A Wednesday Reuters article indicates that Chinese authorities may authorize yuan-backed stablecoins for the first time to promote global use of the country’s currency. The publication cites sources familiar with the matter, who said that China’s State Council will review a plan to expand global use of the yuan later this month.

The sources also said the plan outlines measures to counteract US advances in stablecoins and establish risk prevention guidelines, with Hong Kong and Shanghai singled out as priority hubs to implement the policy.

The issue is reportedly expected to be discussed at the Shanghai Cooperation Organization Summit, which will be held from August 31 to September 1 in Tianjin.

Fed supervision chief pushes for crypto integration

Michelle Bowman, the Fed’s new vice chair for supervision, signaled strong support for crypto adoption in her first major policy speech on the subject at the Wyoming Blockchain Symposium.

She argued that banks risk becoming irrelevant if they fail to embrace digital assets, calling for a “clear, strategic regulatory framework” that is tailored to crypto as opposed torelying on outdated banking standards.

Bowman, who was nominated by Trump and sworn in two months ago, will play a central role in shaping US rules for stablecoins under the GENIUS Act.

In her remarks, she highlighted the potential for tokenization to reduce costs and improve financial efficiency, while stressing that regulators must distinguish digital assets from traditional instruments.

The vice chair even suggested Fed staff should be allowed to hold small amounts of crypto to gain hands-on experience, likening it to learning how to ski by actually putting on skis.

“We stand at a crossroads: we can either seize the opportunity to shape the future or risk being left behind,” she said.

South Korea halts new crypto lending amid investor losses, regulatory scrutiny

South Korea’s financial watchdog has ordered domestic crypto exchanges to stop offering new lending products, citing rising risks and investor losses. The country’s Financial Services Commission (FSC) confirmed that exchanges must suspend fresh lending operations until official guidelines are finalized.

Existing contracts, including repayments and maturity rollovers, will be allowed to continue in the meantime.

The decision follows reports of forced liquidations, with one exchange seeing over 3,600 users lose funds out of 27,600 participants in just a month, representing roughly US$1.1 billion in trading volume. Regulators also flagged cases of Tether-based lending that triggered unusual selling pressure on the stablecoin.

The FSC said it will carry out inspections and take enforcement action against platforms that fail to comply.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.