Here’s a quick recap of the crypto landscape for Monday (September 29) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

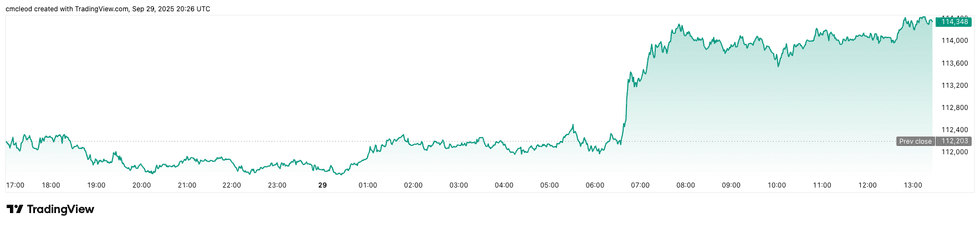

After opening on Monday at its lowest valuation of the day, US$112,168, Bitcoin (BTC) reached a high of US$114,336, a 3.6 percent increase in 24 hours. The cryptocurrency dipped below US$110,000 last week, but its Sunday (September 28) night rebound liquidated roughly US$250 million in short positions.

Bitcoin price performance, September 29, 2025.

Chart via TradingView.

Despite the rally, some market participants aren’t convinced the bull market is back in full force. Crypto investor and entrepreneur Ted Pillows noted that Bitcoin’s pump is “mostly due to short positions getting closed.”

Meanwhile, bulls argue that Bitcoin usually follows gold’s price moves with a three to four month delay, suggesting a strong rally could come in October or November.

Targets mentioned range from US$150,000 to as high as US$300,000 over the next few months.

Ether (ETH) is also performing well, up 3.8 percent over 24 hours to US$4,190.47. Like Bitcoin, Ether opened at its lowest daily valuation, US$4,112.40, before peaking at US$4,202.65.

Supply reduction, increased DEX activity and seasonal bullish trends could set the stage for an Ether price pump in October, with predictions pointing toward US$4,300 or higher.

A looming US government shutdown could increase short-term volatility in the cryptocurrency market this week due to delayed economic data and regulatory uncertainties.

Decisions on 16 crypto exchange-traded funds (ETFs) — including those tied to Solana, XRP, Litecoin and Dogecoin — are expected from the US Securities and Exchange Commission throughout October.

Altcoin price update

- Solana (SOL) was priced at US$212.91, an increase of 3.3 percent over the last 24 hours and its highest valuation of the day. SOL opened at US$206.31, its lowest valuation of the day, and trended upward.

- XRP was trading for US$2.90, up by 2.5 percent over the last 24 hours. Its lowest valuation of the day was US$2.85, while its highest was US$2.91.

ETF data and derivatives trends

The Fear & Greed Index currently reads 39, indicating fear amongst market participants.

Bitcoin dominance in the crypto market is at 56.66 percent, showing a slight fall week-over-week.

Last week, the cumulative net flow for spot Bitcoin ETFs was predominantly negative, with several days of outflows. According to data from the week of September 22 to September 26, spot Bitcoin ETFs had outflows on four days, with September 24 being the only day of inflows at US$241 million. The inflows were led by BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT) and the ARK 21Shares Bitcoin ETF (BATS:ARKB).

Overall, the weekly trend showed significant withdrawal pressures despite the one day inflow exception. Cumulative total inflows for spot Bitcoin ETFs stood at US$56.78 billion as of September 26.

On the derivatives side, CoinGlass data shows Bitcoin futures open interest at US$82.89 billion, an increase of 6.73 percent over 24 hours and a rise of 0.32 percent over four hours. Open interest for Ether futures is at US$56.04 billion, up 2.71 percent over 24 hours and a 0.06 percent boost over four hours.

Bitcoin leveraged positions have resulted in liquidations totaling US$5.61 million in four hours.

Ether saw significantly greater liquidations, amounting to US$9.53 million. Bitcoin’s max pain price is US$114,000.

The Ether funding rate is positive, signaling bullish sentiment and more demand for long positions, while the Bitcoin funding rate is in the red, signaling bearish sentiment.

Today’s crypto news to know

SWIFT to debut blockchain to facilitate cross-border payments

According to a Monday announcement, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) is developing a blockchain in collaboration with over 30 financial institutions and Consensys.

The initial focus is on developing infrastructure for “real-time 24/7 cross-border payments.” SWIFT CEO Javier Pérez-Tass made the announcement at SWIFT’s annual Sibos conference, held in Frankfurt, Germany, on Monday:

“We provide powerful and effective rails today and are moving at a rapid pace with our community to create the infrastructure stack of the future. Through this initial ledger concept we are paving the way for financial institutions to take the payments experience to the next level with Swift’s proven and trusted platform at the centre of the industry’s digital transformation.”

SWIFT will consider feedback on its design from financial institutions from 16 countries.

Polkadot users show support for potential stablecoin

Bryan Chen, co-founder of Polkadot and chief technology officer of its Acala blockchain, introduced a proposal on Sunday to develop a native stablecoin for the Polkadot network.

The stablecoin (pUSD) would be algorithmic and backed by Polkadot tokens, and would use the pUSD ticker. It would also include an optional savings module, allowing holders to lock their stablecoins and earn interest from stability fees. It will utilize the Honzon protocol on the Acala network. The aim is to reduce reliance on USDt and USDC.

The proposal is gathering support among users. The ballot will close in 24 days.

Qatar financial group adopts Kinexys

One of the largest financial institutions in the Middle East, Qatar’s QNB Group, has switched to JPMorgan Chase’s (NYSE:JPM) blockchain platform for US dollar corporate payments processing.

By adopting JPMorgan’s Kinexys Digital Payments system, QNB can now process US dollar-based payments for its business clients in Qatar in minutes and 24/7, the companies said in a statement.

Kazakhstan debuts crypto fund

Kazakhstan, in partnership with Binance, has launched a state-backed crypto reserve called the Alem Crypto Fund, according to an announcement on the country’s government website.

The fund, established by the Ministry of Artificial Intelligence and Digital Development and managed by Qazaqstan Venture Group, aims for long-term digital asset investments and strategic reserves. Its initial asset is BNB, Binance’s utility token. The announcement does not specify the amount of BNB purchased or future investments.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web