Here’s a quick recap of the crypto landscape for Wednesday (July 16) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

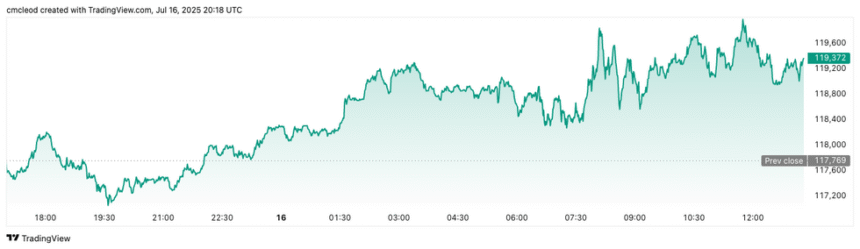

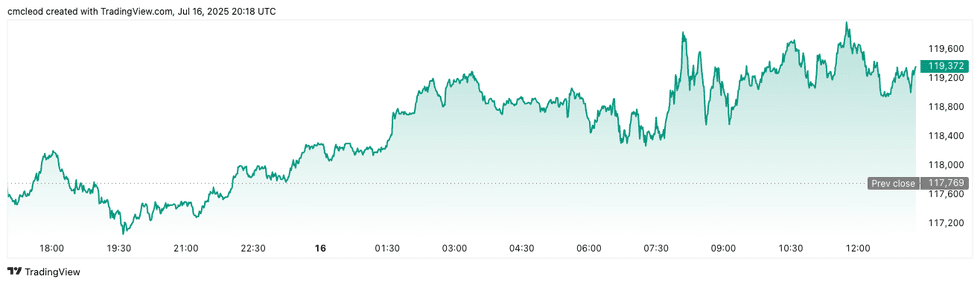

Bitcoin (BTC) was priced at US$119,299, up by 2.4 percent in the last 24 hours. The day’s range for the cryptocurrency brought a low of US$118,433 and a high of US$119,676.

Bitcoin price performance, July 16, 2025.

Chart via TradingView.

Institutional demand also fueled the rally, as Bitcoin spot exchange-traded funds (ETFs) continued to attract significant capital, marking sustained interest from both large and retail investors alike.

21Shares strategist Matt Mena says Bitcoin is unlikely to see a prolonged pullback thanks to surging demand and historically low supply — spot ETFs have absorbed more BTC than will be mined this year, while exchange and OTC balances are at all-time lows. In addition, Bitcoin is setting new highs during the most illiquid part of the year, signaling strong momentum. Short-term corrections are possible, but the broader outlook remains bullish.

The ETH-BTC ratio hit a four month high, breaking out of a bull flag pattern and supported by its 200 day exponential moving average (EMA). Analyst Michaël van de Poppe has noted the 0.02425 breakout’s significance for altcoin momentum. Holding above the EMA could see ETH rally 30 percent to 0.035 BTC by August/September.

Ethereum (ETH) was priced at US$3,369.15, up by 10.7 percent over the past 24 hours and its highest valuation today. Its lowest valuation on Wednesday was US$3,173.01.

Today’s crypto news to know

US lawmakers advance crypto legislation

In a 215 to 211 vote, the US House of Representatives passed a resolution to move three crypto bills toward a full floor vote. This development occurred after an earlier vote on Tuesday (July 15) was delayed due to lawmaker concerns about the GENIUS Act and its lack of central bank digital currency (CBDC) provisions.

Przemysław Kral, CEO of zondacrypto, said in an email, “‘People deserve to know if their government plans to track how they spend their money. Even if you support digital currencies, this debate needs to happen.’”

House Republican leaders later passed resolutions on the crypto bills after a record-long procedural vote, ending a nine hour stalemate with a 217 to 212 vote late on Wednesday. House Majority Leader Steve Scalise said that Republicans will now add a CBDC ban to the must-pass National Defense Authorization Act.

The push for clarity extends to specific areas, with Representative Max Miller announcing during a Wednesday House Ways and Means subcommittee hearing that he will soon introduce draft legislation to clarify the taxation of staking and rules for digital asset contributions to charities, retirement plans and loan.

Industry leaders have been closely watching the implications of this vote.

Bitwise’s Matt Hougan expressed optimism in his weekly newsletter, saying that while strong crypto legislation won’t eliminate volatility, “if these bills pass, I doubt we will ever see a 70 percent+ drawdown in crypto again.”

In correspondence with the Investing News Network, Ignacio Palomera, CEO and Founder of Web3 professional networking and job platform Bondex, highlighted the potential for growth driven by the vote’s outcome.

He noted that “The CLARITY and GENIUS acts have the potential to electrify the US digital assets industry, driving the sort of investment that will supercharge demand for workers with crypto proficiency, similar to what we are currently seeing with (artificial intelligence).” Palomera also suggested they could “tempt greater numbers of top-tier traditional finance and tech talent to enter the Web3 space.” However, he cautioned that overly burdensome regulations resulting from this process could lead to a “brain drain of US talent” to other jurisdictions.

Liquid Collective expands with Solana staking token

Liquid Collective has expanded its offerings with Liquid Staked SOL (LsSOL), a new liquid staking token on the Solana blockchain. The move builds upon its established success within the Ethereum ecosystem, where its Liquid Staked ETH (LsETH) has already achieved substantial traction, boasting over US$1 billion in total value locked.

The launch of LsSOL is supported by a consortium of prominent industry players, including Coinbase Global (NASDAQ:COIN), Kraken, Galaxy Digital (TSX:GLXY,NASDAQ:GLXY), Anchorage Digital and Fireblocks. These partnerships are crucial for facilitating broad institutional access to LsSOL, ensuring that a diverse range of professional investors can seamlessly participate in Solana’s staking opportunities while maintaining liquidity.

Collaborative efforts with key industry participants are expected to drive significant adoption and further solidify Liquid Collective’s position as a leading provider of liquid staking infrastructure.

Bitlayer launches smart contract bridge BitVM on Mainnet

Bitlayer, a Bitcoin decentralized finance (DeFi) infrastructure startup backed by Franklin Templeton, has launched its smart contract bridge, called BitVM, on the mainnet.

The bridge enables users to deposit Bitcoin into a smart contract, where it is held in escrow and converted into Peg-BTC (YBTC), a tokenized version of Bitcoin that can interact with smart contract platforms.

The company describes the bridge as a trust-minimized bridging solution for Bitcoin holders. According to Bitlayer, Peg-BTC is designed to facilitate programmability and cross-chain compatibility. The company has already secured partnerships to integrate the bridge with networks including Sui, Base and Arbitrum.

Taproot, a Bitcoin upgrade activated in 2021, enhances Bitcoin’s scripting capabilities and privacy, which is crucial for BitVM as it allows for more complex, off-chain computations and multi-party interactions to be anchored and verified on the Bitcoin blockchain more efficiently and privately.

Tether acquires US$600 million in farmland in stablecoin push

Tether, the issuer of the USDT stablecoin, has acquired 70 percent of Adecoagro (NYSE:AGRO), a major South American agricultural producer, for around US$600 million. Reuters reported that the move represents a new strategy to connect stablecoin payments with physical commodities like rice, sugar and ethanol.

Tether aims to embed its dollar-pegged digital currency into global trade flows, allowing cross-border payments to settle in seconds instead of days and at significantly lower costs. The company believes controlling hard assets can provide inflation-resistant revenue and bolster confidence in USDT’s reserve backing. Adecoagro operates across Argentina, Uruguay and Brazil, producing food and energy-related commodities critical to trade in the region.

Tether’s broader plan appears to be building a vertically integrated ecosystem where crypto finance and traditional supply chains converge. With US$149 billion in reserves and US$143 billion in USDT in circulation, the company is using its financial heft to push deeper into real-world infrastructure. Executives say the long-term goal is for USDT to become a settlement layer in markets traditionally dominated by fiat and slow payment rails.

Citigroup CEO says bank exploring stablecoin launch

Citigroup (NYSE:C) is weighing the launch of a proprietary stablecoin as part of its broader push into blockchain infrastructure, CEO Jane Fraser confirmed during the bank’s Q2 earnings call.

While tokenized deposits remain the bank’s immediate priority, Fraser said a Citi-backed digital dollar could play a key role in future client solutions for cross-border transactions.

The bank’s digital asset strategy centers on four pillars: tokenized fiat deposits, reserve management for stablecoins, custodial services for digital assets and fiat-to-crypto on- and off-ramps.

Citi’s interest comes amid broader momentum for stablecoins in 2025, with the market expected to reach US$3.7 trillion by 2030 according to internal projections. Fraser emphasized that these innovations aim to modernize banking infrastructure and serve client demand for 24/7, multi-currency, compliant payment systems.

The potential Citi stablecoin would likely be dollar-pegged and integrated into corporate treasury services.

Citi joins a list of traditional finance heavyweights, even rival and formerly crypto skeptic JPMorgan, now exploring blockchain-based products as regulation for stablecoins gains clarity.

Polymarket cleared by DOJ and CFTC after years of scrutiny

Federal authorities have ended their investigations into Polymarket, a blockchain-based prediction market platform, effectively closing a multi-year regulatory saga.

The US Department of Justice and Commodity Futures Trading Commission (CFTC) notified the company this week that it will face no further enforcement actions.

This follows a dramatic period in late 2024 when FBI agents raided the Manhattan penthouse of Polymarket’s CEO, Shayne Coplan, seizing devices amid suspicions of continued US user access.

The company previously settled with the CFTC in 2022 for US$1.4 million after being accused of offering unregistered event-based options. Despite the settlement, regulators remained concerned Polymarket had violated terms by still allowing US residents to place bets. The closure of the case comes amid shifting regulatory winds, as the White House advances more structured digital asset legislation under President Trump’s administration.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.