Here’s a quick recap of the crypto landscape for Wednesday (July 30) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

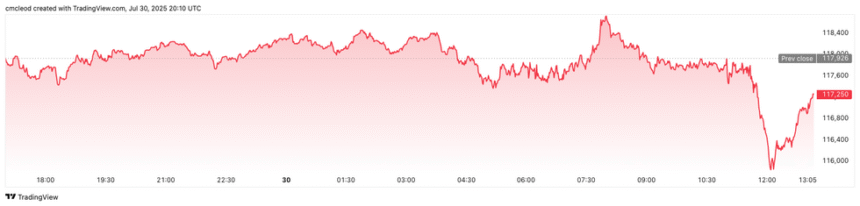

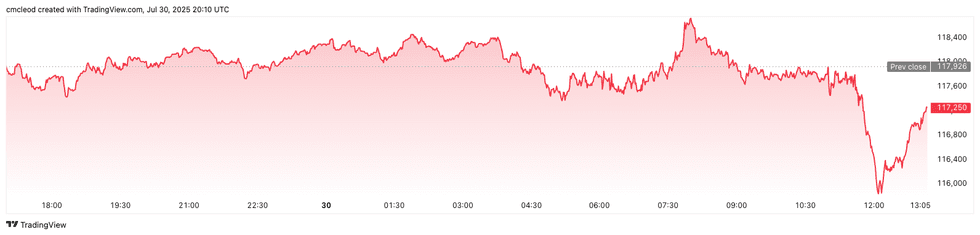

Bitcoin (BTC) was priced at US$16,964, down by 0.5 percent over the last 24 hours. Its highest valuation on Wednesday was US$118,644, while its lowest valuation was US$116,079.

Bitcoin price performance, July 30, 2025.

Chart via TradingView.

Markets rallied briefly following the release of the White House’s crypto policy report, which calls for greater clarity from the US Securities and Exchange Commission, as well as new legislation to regulate digital assets.

A pullback came after the US Federal Reserve left interest rates unchanged and warned of slowing economic growth.

Ethereum (ETH) was priced at US$3,764.26, down by 0.1 percent over the past 24 hours. Its lowest valuation on Wednesday was US$3,708.13, and its highest was US$3,820.17.

Today’s crypto news to know

Ethereum marks a decade since launch

Ethereum marked its 10th anniversary on Wednesday as corporate interest continues to grow.

The Ethereum network launched in 2015 and has since maintained uninterrupted uptime, becoming the backbone of the decentralized finance (DeFi) movement. In the lead up to the milestone, ETH approached US$4,000, driven in part by renewed institutional inflows and growing confidence in the asset’s long-term utility.

The Ethereum Foundation will commemorate the milestone by issuing celebratory non-fungible tokens and organizing more than 100 events globally. A live broadcast featuring Vitalik Buterin, Joseph Lubin and Tim Beiko will also be hosted to reflect on the network’s origins and future direction.

SEC greenlights in-kind ETP creations and redemptions

On Tuesday (July 29), the Securities and Exchange Commission (SEC) gave approval for in-kind creations and redemptions by authorized participants for crypto asset exchange-traded products (ETPs).

“It’s a new day at the SEC, and a key priority of my chairmanship is developing a fit-for-purpose regulatory framework for crypto asset markets,” said Chair Paul Atkins in the announcement.

“Investors will benefit from these approvals, as they will make these products less costly and more efficient.

“Today’s approvals continue to build a rational regulatory framework for crypto, leading to a deeper and more dynamic market, which will benefit all American investors. This decision aligns with the standard practices for similar ETPs.”

Authorized institutions can now directly exchange crypto assets like Bitcoin or Ethereum for shares of a crypto ETP, and vice versa, making these products more efficient and potentially cheaper to manage.

Lummis proposes bill to allow digital assets for mortgages

In a Tuesday notice, Wyoming Senator Cynthia Lummis introduced the 21st Century Mortgage Act, which could compel mortgage purchasers to consider digital assets in applications. Lummis said the legislation would initiate congressional action following a June order from the US Federal Housing Finance Agency mandating that US mortgage purchasers Fannie Mae and Freddie Mac “consider cryptocurrency as an asset for single-family loans.”

“This legislation embraces an innovative path to wealth-building, keeping in mind the growing number of young Americans who possess digital assets,” said Lummis.

A similar crypto mortgage proposal, the American Homeowner Crypto Modernization Act, was introduced by Republican Representative Nancy Mace on July 14. Mace’s proposed bill would mandate that mortgage lenders incorporate the value of a borrower’s digital assets held in cryptocurrency brokerage accounts into their mortgage credit evaluations.

The bill is one of three that the Senate may consider after a month-long recess, alongside a digital asset market structure bill and a bill aimed at barring the Federal Reserve from launching a central bank digital currency.

eToro expands 24/5 trading and tokenizes US stocks

eToro Group (NASDAQ: ETOR) announced plans to expand its current 24/5 trading for 100 popular US stocks and exchange-traded funds, meaning customers can now trade these assets five days a week, almost around the clock.

“We’re expanding a lot of the trading universe and trading hours on the eToro platform. Announced today, more 24-hour stock trading on the platform, as well as near 24/5 trading on exchange CME traded futures, a new type of futures product,” said co-founder and CEO Yoni Assia about the move on Tuesday. “That’s very exciting for our users worldwide. And very excited also about revamping tokenization in eToro, launching those 100 stocks that trade 24/5 on the eToro platform as tokenized assets, gradually available to people with the eToro crypto wallet.”

The company also launched tokenized versions of these same US stocks as ERC20 tokens on the Ethereum blockchain.

This will eventually enable true 24/7 trading and transfers, and is part of eToro’s strategy to tokenize all assets on their platform and integrate them into the broader decentralized finance world. The company is also rolling out spot-quoted futures with CME Group (NASDAQ:CME), a simpler futures product, currently in Europe, with plans for wider availability.

Trump working group calls for aggressive federal action on crypto markets

A White House-appointed working group on digital asset markets has released a sweeping set of recommendations to overhaul US crypto policy, according to a preview. The group, which was established under a January executive order from President Donald Trump, is urging Congress to pass the Digital Asset Market Clarity Act and calling on regulators to use existing powers to support immediate crypto market growth.

The report recommends that the Commodity Futures Trading Commission be granted broader oversight over spot markets for non-security tokens and that safe harbor provisions be used to accelerate product launches.

It also advises federal banking regulators to clarify permissible crypto-related bank activities and modernize capital rules to reflect token-based risks.The Trump administration said the proposals would help ensure US leadership in the “blockchain revolution” and usher in a “golden age of crypto.”

JPMorgan to let Chase customers buy crypto via Coinbase

JPMorgan Chase (NYSE:JPM) has announced a major partnership with Coinbase Global (NASDAQ:COIN) that will allow Chase credit card users to purchase cryptocurrencies directly from the exchange.

The service is expected to roll out in fall 2025, with full account-linking functionality available by 2026. Customers will also be able to redeem Chase credit card reward points for USDC, a stablecoin pegged to the US dollar.

The move marks a notable shift in the firm’s stance toward crypto, going from a cautious observer to an active participant in retail-focused blockchain infrastructure. With crypto’s total market cap recently crossing US$4 trillion, large banks are now racing to integrate digital asset capabilities into their core offerings.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.