Here’s a quick recap of the crypto landscape for Monday (September 22) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

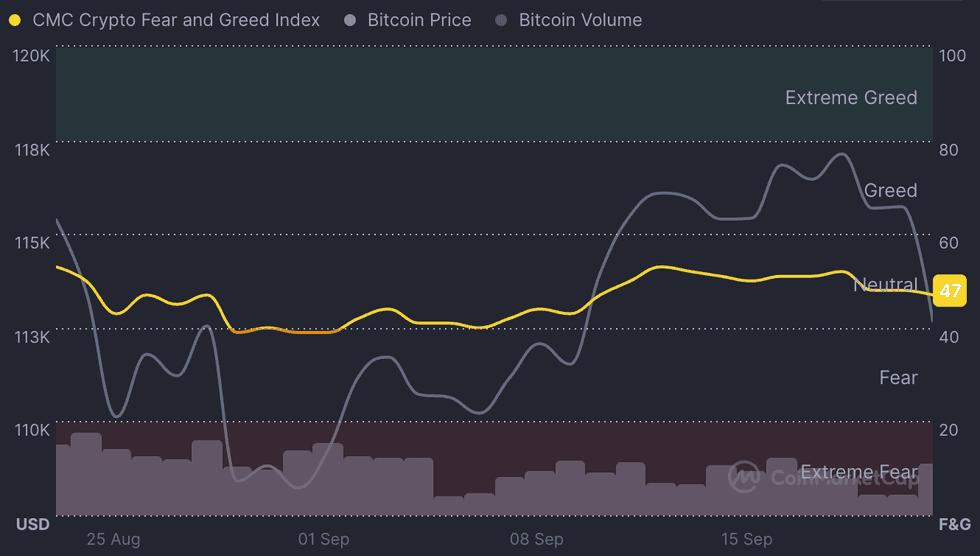

Bitcoin (BTC) was priced at US$112,214, a 2.9 percent decrease in 24 hours and its lowest valuation of the day. The cryptocurrency’s price peaked at US$113,384 on Monday.

Bitcoin price performance, September 22, 2025.

Chart via TradingView.

Bitcoin dropped to the US$112,000 range after falling below a key support level, triggering the year’s largest long-liquidation event — over US$1.7 billion in leveraged long positions were closed.

The decline came even as some investor accumulation showed through surging exchange outflows and rising longs on platforms like Bitfinex, which added pressure from both sides.

Bitcoin dominance in the crypto market is 56.74 percent, showing a slight rise week-on-week.

Ether (ETH) was trading at US$4,141.26, down by 7.9 percent. Its lowest valuation as of Monday was US$4,138.92, while its highest was US$4,213.42.

Altcoin price update

- Solana (SOL) was priced at US$217.12, a decrease of 8.7 percent over the last 24 hours to its lowest valuation of the day. Its highest value was US$223.83.

- XRP was trading for US$2.83, down by 5.2 percent in the past 24 hours, also reaching its lowest valuation of the day as markets wrapped. Its highest level was US$2.86.

- Sui (SUI) was valued at US$3.32, trading at its lowest valuation of the day and down by 8.8 percent over the past 24 hours. Its highest price point on Monday was US$3.40.

- Cardano (ADA) was priced at US$0.8156, down by 8.2 percent over 24 hours to its lowest value of the day. Its highest was US$0.832.

Crypto market insights

Total cryptocurrency liquidations have reached US$132.07 million in the past four hours, with long positions accounting for US$81.71 million and short positions reaching US$50.36 million. This activity signals bearish pressure in the derivatives market, as forced selling of longs often reflects market downside pressure.

Conversely, the BTC perpetual futures funding rate sits at 0.0081 percent, an indication of bullish sentiment.

Ethereum shows similar dynamics, with a funding rate of 0.002 percent; however, bullishness for Ethereum is milder versus Bitcoin. Open interest for BTC and ETH futures stands at US$81.91 billion and US$57.95 billion, respectively.

Anticipated regulatory hearings on crypto oversight, tentatively scheduled to be held by the end of the month, as well as key macroeconomic data releases and remarks from US Federal Reserve policymakers at the Greater Providence Chamber of Commerce 2025 Economic Outlook Luncheon, are expected to influence market direction this week.

Existing US home sales data is also due on Wednesday (September 24). It will give insight on the state of the housing market, one of the key components of consumer spending and overall economic health.

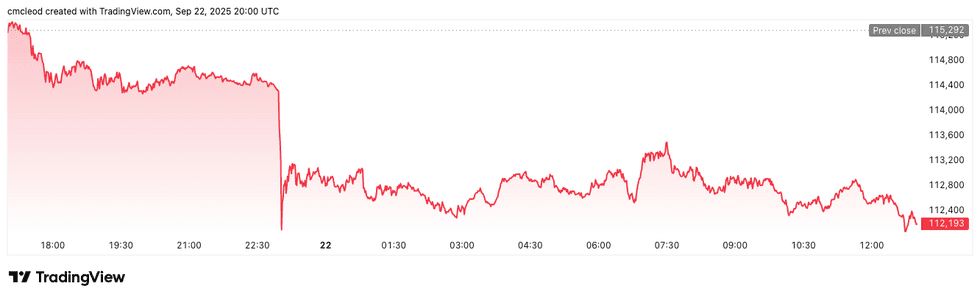

Fear and Greed Index snapshot

CMC’s Crypto Fear & Greed Index has remained firmly in neutral territory over the past week.

The past week’s negative funding rates on perpetual futures and long/short ratios suggest slight caution, but strong exchange-traded fund (ETF) inflows and recent whale buying show underlying bullish conviction.

Today’s crypto news to know

Coinbase launches Mag7 + Crypto Equity Index Futures

Coinbase Global (NASDAQ:COIN) announced the launch of Mag7 + Crypto Equity Index Futures, a monthly, cash-settled futures contract that offers equal exposure to 10 assets:

The index follows an even-weighting methodology, with all 10 components representing 10 percent each, and will be rebalanced quarterly. It marks the first US-listed derivative combining traditional equities with crypto.

Strive to acquire Semler Scientific

Strive (NASDAQ:ASST), a former asset manager led by former presidential candidate Vivek Ramaswamy, has agreed to acquire Semler Scientific (NASDAQ:SMLR), a former healthcare tech firm that shifted its strategy by adopting Bitcoin as its primary treasury reserve asset in 2024. Strive itself became a Bitcoin treasury company in 2025 through a merger with Asset Entities, going public to pursue its Bitcoin accumulation strategy.

The all-stock deal is valued at about US$1.34 billion. According to Reuters, the combined entity will hold over 10,900 BTC, making it one of the largest corporate Bitcoin holders globally.

Strive announced a significant US$675 million Bitcoin purchase alongside the acquisition, boosting its Bitcoin holdings from about 70 BTC to almost 6,000 BTC before the acquisition closes. The deal also includes a 210 percent premium offer to Semler shareholders, exchanging each Semler share for 21.05 shares of Strive Class A stock.

“We are proud to announce this exciting strategic merger combining two pioneering Bitcoin treasury companies to form a scaled, innovative and accretive Bitcoin acquisition platform,” said Matt Cole, chairman and CEO of Strive.

Metaplanet becomes fifth largest corporate Bitcoin holder

Tokyo-based Metaplanet (TSE:3350,OTCQX:MTPLF) has cemented itself as a heavyweight in corporate crypto holdings, announcing the purchase of 5,419 BTC worth US$633 million.

The acquisition boosts its total stash to 25,555 BTC valued at nearly US$3 billion, making it the fifth largest corporate Bitcoin treasury, according to BitcoinTreasuries.net. The buy came at an average of about US$117,000 per Bitcoin, leaving the firm temporarily down almost 4 percent as spot prices hovered closer to US$112,500.

Despite the purchase, Metaplanet’s share price has struggled to keep pace. The company has tumbled by more than 30 percent over the past month, even as shares rose modestly this week.

London prepares for US$7 billion Bitcoin fraud trial

The UK is bracing for one of its most significant crypto trials as Zhimin Qian, a Chinese national accused of orchestrating a US$7 billion Ponzi-style fraud, faces charges in London starting on September 29.

Qian allegedly ran Tianjin Lantian Gerui Electronic Technology, a scheme that lured nearly 130,000 investors in China with promises of triple-digit returns between 2014 and 2017.

After China’s crypto ban, she fled to Britain and converted proceeds into Bitcoin, some of which were later seized in UK money laundering probes linked to her associate Jian Wen, already convicted in 2024. Prosecutors have avoided direct fraud charges, instead focusing on offenses tied to the possession and transfer of illicit cryptocurrency.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web