Empire Metals Limited (LON:EEE), the AIM-quoted and OTCQB-traded resource exploration and development company, is pleased to announce several strategic technical appointments and partnerships that strengthen the in-house project development team and support the advancement of the Pitfield Titanium Project (“Pitfield” or the “Project”) in Western Australia.

These appointments coincide with the commencement of bulk-scale metallurgical testing, a critical step in progressing Pitfield toward commercial development.

Highlights

- Strategic Appointments to Accelerate Development

Empire has appointed Mr. Alan Rubio as Study Manager and Mr. Pocholo Aviso as Hydro-metallurgist. These appointments are aligned with the Company’s objective to evaluate mining scenarios, optimise product development, assess commercial process flowsheet options and progress the Project toward a feasibility study. - Mr. Alan Rubio, an engineer and seasoned Study and Project Manager with over 28 years’ experience working within the resources sector developing and evaluating mining projects, will lead the assessment of mining, infrastructure and oversee key economic studies to deliver a robust project development plan.

- Mr. Pocholo Aviso, an experienced hydro-metallurgist with a background in the TiO₂ pigment industry (including roles at Tronox and BHP’s Kwinana Nickel Refinery), will manage the titanium product development programme, focusing on product optimisation, process flowsheet designs and evaluating market pathways.

- Partnership with Strategic Metallurgy Pty Ltd:

Empire has also partnered with Strategic Metallurgy, a highly respected, Perth-based metallurgical consultancy. The firm will provide oversight of the metallurgical testwork programme and technical guidance to the Company’s internal metallurgists and process design engineers, helping transition from bench-scale process development to pilot-scale testing.

- Bulk-Scale Testwork:

The Company has commenced bulk metallurgical testwork that will produce significant quantities of mineral concentrate to support large-scale beneficiation testing and, for the first time, enable the supply of bulk product samples to prospective end users. In addition, this testwork will provide critical technical information for the development of a commercial process flowsheet.

These key appointments advance the Company toward confirming project economics and assessing mine design, process flowsheets and product options-critical steps in the development pathway to commercial mine production.

Commenting on the announcement, Shaun Bunn, Managing Director, said:

“I am delighted to welcome Alan and Pocholo to our team. Their technical expertise will be invaluable as we move toward defining the economic potential and product strategy for Pitfield. Building a strong in-house team has been key to our progress so far, and these appointments mark an important next step.

“We are also very pleased to be working with Strategic Metallurgy, whose reputation and experience in process development will significantly strengthen our metallurgical programme. The timing is ideal, with large-scale metallurgical testing now underway, including ore scrubbing and spiral gravity separation, using bulk samples collected earlier this year.”

Process Development Update

A large-scale metallurgical testwork programme, involving mineral separation techniques that require bulk feed samples, between approximately 0.5 to 1.5 tonnes each, has commenced using the material collected from the February 2025 Air Core drilling. The programme includes ore scrubbing, desliming and gravity spiral testwork. Alternative gravity separation unit processes, such as jigs and up-current classifiers, are also being evaluated.

Flotation testwork is also being carried out on the fines fraction, separated in the desliming step. As part of this programme, bulk mineral concentrates will be produced for downstream processing, testing both hydrometallurgical and product finishing flowsheet concepts. This will allow a consistent, common mineral concentrate stream to be assessed across the range of flowsheet options that are being considered downstream of the mineral separation step.

Figure 1. Photos of bulk testwork programme showing clockwise from bottom left: deslimed feed sample, wet scrubber unit, and gravity spirals .

Figure 1. Photos of bulk testwork programme showing clockwise from bottom left: deslimed feed sample, wet scrubber unit, and gravity spirals .

This bulk testwork programme will produce significant volumes of concentrates which will feed into beneficiation testwork and result in larger product samples which can be delivered to potential end users for assessment for the first time.

In addition, this programme is designed to assess different types of process equipment and analyse a variety of flowsheet options, resulting in technical information necessary for developing a commercial process flowsheet.

About Strategic Metallurgy

Strategic Metallurgy Pty Ltd, established in 2010, is a metallurgical consulting company whose business model is to work with mining companies to develop their metallurgical strategy and ensure that it fits into their overall business plan. With a proven track record of providing expert consulting, process development, testwork management, feasibilities and strategic reviews Strategic Metallurgy has the extensive hands-on experience that Empire requires to progress the Pitfield Project through the metallurgical testing, process modelling, flowsheet design stages to pilot plant design and operation.

The Pitfield Titanium Project

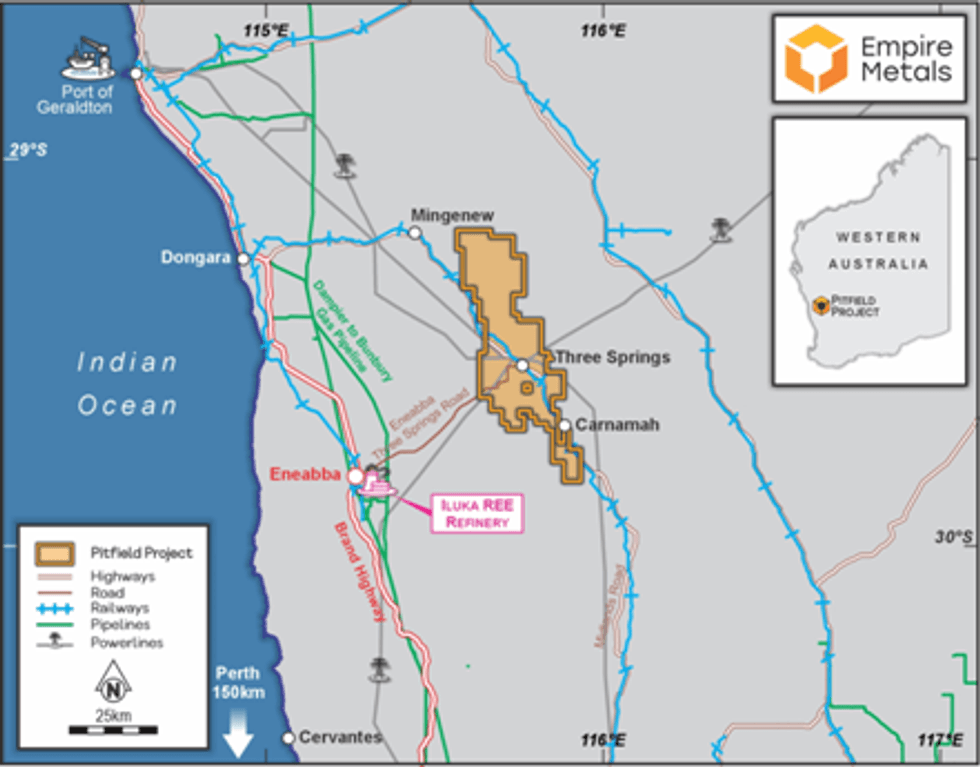

Located within the Mid-West region of Western Australia, near the northern wheatbelt town of Three Springs, the Pitfield titanium project lies 313km north of Perth and 156km southeast of Geraldton, the Mid West region’s capital and major port. Western Australia is ranked as one of the top mining jurisdictions in the world according to the Fraser Institute’s Investment Attractiveness Index published in 2023, and has mining-friendly policies, stable government, transparency, and advanced technology expertise. Pitfield has existing connections to port (both road & rail), HV power substations, and is nearby to natural gas pipelines (refer Figure 2).

Figure 2. Pitfield Project Location showing the Mid-West Region Infrastructure and Services.

Figure 2. Pitfield Project Location showing the Mid-West Region Infrastructure and Services.

Competent Person Statement

The scientific and technical information in this report that relates to process metallurgy is based on information reviewed by Ms Narelle Marriott, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Ms Marriott is a member of the AusIMM and has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code 2012. Ms. Marriott consents to the inclusion in this announcement of the matters based on their information in the form and context in which it appears.

The technical information in this report that relates to the geology and exploration of the Pitfield Project has been compiled by Mr Andrew Faragher, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Mr. Faragher is a member of the AusIMM and has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code 2012. Mr Faragher consents to the inclusion in this release of the matters based on his information in the form and context in which it appears.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON:EEE)(OTCQB:EPMLF) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the in-situ mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, in-situ bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the in-situ weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. See RNS dated 12 June 2024 for full details.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

Click here to connect with Empire Metals (OTCQB:EPMLF, AIM:EEE) to receive an Investor Presentation