Key takeaways:

-

Ether’s bullish structure remains intact even as the broader crypto market shows weakness.

-

Over 540,000 ETH have been accumulated by new whale wallets since July 9.

-

A concentration of buy orders between $3,000 to $3,400 raises the risk of a liquidity sweep before a rally to new highs.

After hitting a yearly high of $3,850 on Binance, Ether (ETH) has shown stronger resilience than Bitcoin (BTC) during the recent pullback. While BTC has slipped to new range lows at $115,000, ETH continues to trade above the $3,500 support level, keeping its bullish structure intact and potentially eyeing a move toward $4,000.

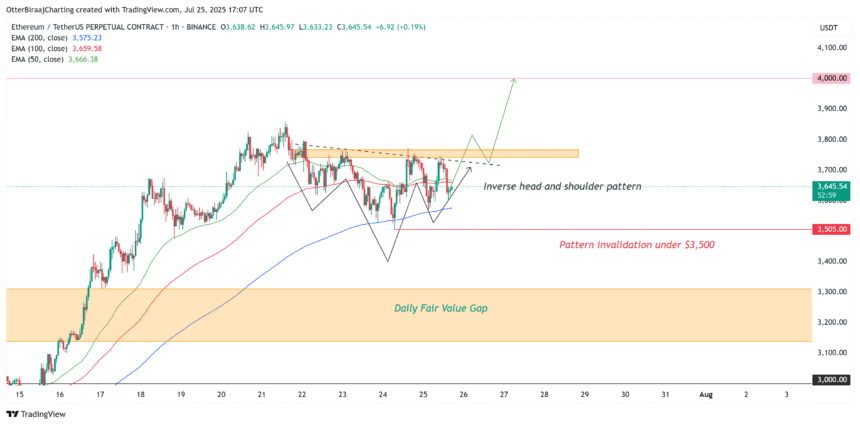

On the four-hour chart, ETH is holding above the 50-day exponential moving average (EMA). On the one-hour chart, it remains above the 200-day EMA, signaling continued strength across key lower time frames.

A potential inverse head-and-shoulders pattern is forming on the one-hour chart. A confirmed breakout above $3,750, a key resistance and descending trendline, could send the price to $4,000.

Crypto analyst Byzantine General also sees potential for ETH to revisit recent highs, stating the asset could be preparing for “another stab at the highs.”

However, if ETH loses the $3,500 level, the bullish setup would likely be invalidated. In that case, price could revisit the fair value gap between $3,150 and $3,300 before a recovery.

Related: Eric Trump ‘agrees’ Ether should be over $8K as Global M2 money soars

Will Ether retest $3,100?

Ether (ETH) has exhibited notable strength against broader market weakness, largely due to aggressive whale and institutional accumulation.

Since July 9, eight newly created whale wallets have amassed 540,460 ETH, worth nearly $2 billion. Three wallets scooped up another 74,207 ETH ($273 million) on Thursday, signaling strong confidence among large investors.

📊MARKET UPDATE: Fresh #Ethereum wallets are on an aggressive buying spree, with 74,207 $ETH worth $273M being scooped up in just the last 10 hours.

Since July 9, eight such wallets have added 540,460 ETH ($1.99B) to their holdings. 💵

(h/t: @lookonchain)

— Cointelegraph Markets & Research (@CointelegraphMT) July 25, 2025

Strategic accumulation of Ether has also surged in recent weeks. Holdings among large corporations have nearly doubled, rising to 2.3 million from 1.2 million in four weeks. Tom Lee’s investment firm, Bit Mine, which has acquired 266,119 ETH ($970 million) over the past week, now holds 566,776 ETH, valued at $2.06 billion, making it the largest Ether treasury among institutional entities.

However, one technical signal presents a short-term concern. Data indicated that ETH currently has a record 245,000 ETH in buy orders stacked on the bid side of perpetual futures books, mostly between the $3,000 and $3,400 range. This surge in demand signals strong interest, but also highlights a liquidity gap below current levels.

With spot and derivatives order books tightly aligned, ETH could still sweep into this buy zone before resuming its uptrend. A short-term drop toward $3,400 or even $3,100 remains on the table.

Related: Ether will ‘knock on $4,000’ and soon outperform Bitcoin: Novogratz

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.