When Canadian-Russian programmer Vitalik Buterin penned a white paper in 2013 outlining a new kind of blockchain platform, few could have predicted the seismic impact it would have on the world of finance, technology, and beyond.

Today (July 30), Ethereum turns 10 years old, marking a milestone that represents a decade of one of the most influential blockchain platforms and a testament to the growing pains, triumphs, and resilience of the decentralized movement.

How did Ethereum go from a white paper drafted by a 19-year-old to a billion-dollar ecosystem that reshaped global finance?

Read on to find out more.

What is Ethereum and who invented it?

Co-founder Buterin said in a 2016 interview that Ethereum was born out of admiration for Bitcoin’s decentralized structure and frustration at its limited capabilities.

“I thought [those in the Bitcoin community] weren’t approaching the problem in the right way. I thought they were going after individual applications; they were trying to kind of explicitly support each [use case] in a sort of Swiss Army knife protocol,” Buterin said, summarizing his motivation to build something more adaptable.

From this foundational idea, Ethereum emerged as a decentralized, programmable blockchain — a “world computer” that would host smart contracts and decentralized applications (dApps), cutting out middlemen and enabling new forms of coordination.

The foundation of the fledgling project was laid between 2013 and 2014. After releasing his white paper in late 2013, Buterin attracted a handful of co-founders, including Gavin Wood, Charles Hoskinson, Joseph Lubin, Anthony Di Iorio, Jeffrey Wilcke, Mihai Alisie, and Amir Chetrit. Together, they spearheaded a crowdfunding campaign in mid-2014 that raised over US$18 million, one of the earliest and most successful Initial Coin Offerings (ICOs) in crypto history.

Despite this momentum, the Ethereum blockchain didn’t launch until July 30, 2015. That release, dubbed “Frontier,” was a basic, raw, and developer-focused version of Ethereum designed for building the infrastructure that would follow.

ETH, Ethereum’s native coin, initially traded for under a dollar. The early months saw little market movement as ETH hovered between US$0.70 and US$2.00, supported mainly by enthusiasts and developers interested in dApp potential.

When was Ethereum’s first major peak?

Ethereum’s first major price rally came during the 2017 crypto bull run, when rising global interest in blockchain technology and the initial coin offering (ICO) boom brought ETH into the mainstream.

After beginning the year at just barely US$8, Ethereum surged to a then-record high of around US$1,400 by January 2018, capping off one of the most explosive price increases in the history of digital assets. This more than 17,000 percent rise was driven by a combination of speculative demand and the emergence of Ethereum as the preferred platform for launching new tokens via ICOs.

By early 2018, however, the market began to reverse. A sweeping crypto correction saw Ethereum’s price fall back below US$100 by the end of that year. The drawdown exposed Ethereum’s technical bottlenecks, such as high gas fees and slow confirmation times during network congestion.

What was the DAO Hack, and how did it influence Ethereum’s trajectory?

Ethereum’s ethos of decentralization was also tested early on. In 2016, an experiment in decentralized governance — the Decentralized Autonomous Organization or DAO — raised about US$150 million in ETH from the community. The idea was to create a venture capital fund governed entirely by smart contracts and token-holder votes.

But just weeks after launch, a vulnerability in the DAO’s code that allowed for recursive call exploit was discovered, draining 3.6 million ETH or about a third of the fund.

At just ten months old, Ethereum was now facing a crisis that tested its fundamental principles, chief among them the immutability of the blockchain and the inviolability of smart contracts.

Three primary responses were debated. One option was to do nothing, honoring the hacker’s actions as legitimate under the rules of the code and accepting the theft. Another was to implement a “soft fork” that would blacklist the child DAO’s address, effectively freezing the stolen funds.

The most radical option was a “hard fork” that would roll back the ledger and return all stolen Ether to the original investors, which would undo the hack entirely.

Ultimately, the hard fork went ahead, and Ethereum split into two chains: the main Ethereum chain (ETH), where the funds were returned to investors, and a new chain called Ethereum Classic (ETC), which preserved the original ledger including the DAO hack.

How has Ethereum performed post-2020?

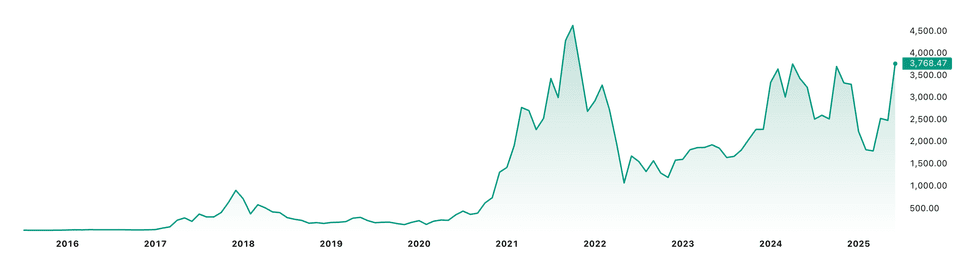

Ethereum price performance July 30, 2015 – June 30, 2025.

Chart via TradingView.

Ethereum reached its all-time high price of US$4,878 on November 10, 2021, during the peak of the 2020–2021 crypto bull run. The rally was driven by a convergence of factors: institutional adoption of crypto, a massive expansion of decentralized finance (DeFi), and explosive interest in NFTs, most of which were built on Ethereum’s ERC-721 standard.

By late 2021, Ethereum was settling billions in daily transaction volume and powering thousands of decentralized applications, cementing its position as the leading smart contract platform.

However, the peak was short-lived. Inflation fears and global risk aversion in early 2022 triggered a sharp correction across risk assets, including crypto. Ethereum’s price dipped below US$1,000 in June 2022 amid cascading liquidations and platform collapses like Terra and Celsius.

Still, even through the drawdown, Ethereum remained the backbone of DeFi, NFT markets, and layer-2 innovation, setting the stage for its long-planned transition to proof-of-stake later that year.

In the years that followed the fork, Ethereum faced growing pressure to scale and reduce its environmental impact, particularly as DeFi and NFT activity surged.

These challenges set the stage for a major protocol overhaul: Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) was considered to be one of the most ambitious technical feats in blockchain history. Officially known as “the Merge,” the upgrade combined Ethereum’s execution layer (the mainnet) with the Beacon Chain, which introduced staking-based consensus.

The Merge took place in September 2022 and the environmental impact was immediate: Ethereum’s energy consumption dropped by over 99 percent.

While the Merge had little short-term effect on price, it marked a crucial moment for Ethereum’s long-term viability. At the time of the upgrade, ETH was trading at around US$1,600, which was a sharp decline from its all-time high of US$4,891 in November 2021 during the height of the crypto bull market.

That price peak had been driven by unprecedented network demand as NFTs and decentralized finance exploded in popularity, both largely built on Ethereum. By mid-2022, however, macroeconomic tightening, rising interest rates, and a series of high-profile crypto failures, including the collapse of TerraUSD and the insolvency of major lending platforms, had triggered a broad downturn.

After the Merge, ETH remained volatile. It already lost ground by as much as 70 percent against crypto leader Bitcoin since the Merge, and the introduction of EIP-1559 in 2021 had already created a more deflationary pressure on ETH supply through base fee burns.

Despite this setback, ETH showed relative resilience compared to many altcoins. In 2023, Ethereum hovered mostly between US$1,200 and US$2,100, with price movements closely tracking investor sentiment toward regulatory developments, Bitcoin’s performance, and broader market liquidity. Institutional interest in Ethereum also grew during this period, with more funds launching ETH products and staking services expanding.

Entering 2024, Ethereum gained momentum amid improving macroeconomic conditions and renewed optimism about real-world applications for blockchain technology. The network saw moderate success in sectors like tokenized assets, layer-2 infrastructure, and decentralized identity.

ETH briefly reclaimed the US$4,000 level in early March 2024 before retreating again due to renewed regulatory scrutiny in the US. Despite the pullback, Ethereum remained the second-largest cryptoasset by market capitalization and retained the majority share of developer activity across all chains.

The 2025 Swing

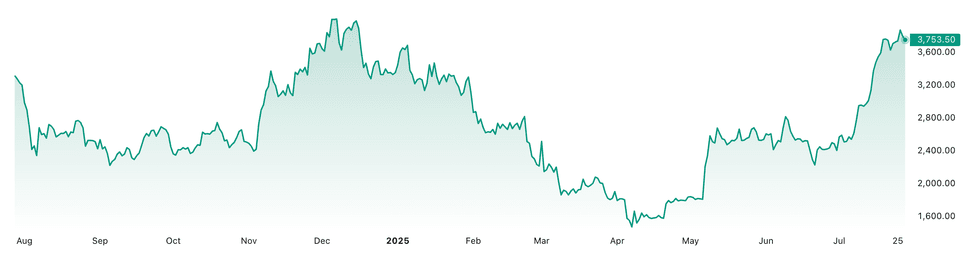

Ethereum 1-year price performance, July 28, 2024 – July 28, 2025.

Chart via TradingView.

Ethereum, as well as the rest of the crypto landscape, saw a full positive swing in 2025 as regulatory clarity dominated the first half of the year.

In June, the US Senate approved the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act with bipartisan support. President Donald Trump, now serving his second term, publicly backed the bill, calling it “a win for American innovation and financial leadership.”

The GENIUS Act establishes a regulatory framework for US-pegged stablecoins, requiring full reserve backing, independent audits, and federal licensing for large issuers. It also clarifies that qualifying stablecoins are not securities, pulling them out of the SEC’s jurisdiction and instead aligning oversight with banking regulators like the OCC and Federal Reserve.

Crucially, the law defines “payment stablecoins” as a new category of digital cash, and Ethereum has emerged as one of the largest beneficiaries of this policy shift. The majority of dollar-backed stablecoins, which include USDC, USDT, and newer entrants like PayPal USD, are issued and transacted on Ethereum.

The GENIUS Act’s legal recognition of stablecoins has given institutional players more confidence to engage with Ethereum-based infrastructure.

As a result, capital inflows into Ethereum have accelerated, with analysts noting a sharp uptick in demand for ETH as a “platform asset” powering tokenized dollars and digital settlement rails.

ETH’s price also soon followed. Following the Senate’s approval of the GENIUS Act in June 2025, ETH jumped over 25 percent in two weeks, briefly reaching US$3,824 — outperforming Bitcoin and breaking out of a multi-month consolidation range.

The act has also prompted strategic shifts among financial institutions. BlackRock, Fidelity, and JPMorgan have expanded their Ethereum-based offerings, including on-chain fund administration, tokenized treasuries, and collateralized lending protocols that rely on smart contracts.

Several US banks are also piloting internal payment rails using tokenized dollars on Ethereum rollups.

What’s next for Ethereum?

Buterin himself has acknowledged that Ethereum’s current roadmap is not the end. Speaking in late 2022 before the Merge, he noted that “Ethereum is 55 percent complete.”

The long-term vision includes greater privacy features, zero-knowledge proofs for secure scalability, and expanding the reach of dApps to a billion users.

As of mid-2025, Ethereum currently trades around US$3,400, buoyed by strong institutional adoption, continued growth of layer-2 networks like Arbitrum and Base, and early signs of real-world asset tokenization gaining traction among banks and fintech firms.

While Ethereum’s price remains well below its 2021 peak, its performance since 2020 reflects growing maturity, with fewer speculative surges and more interest anchored in a more crypto-friendly environment.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.