The US stock market ended the year on a high note, with major indices reaching record highs, driven by steady consumer spending and investments in AI infrastructure. This growth was largely fueled by higher-income households, leading some analysts to describe the economy as “K-shaped,” where the upper and lower segments of the population experience different rates of growth. Despite challenges such as higher tariffs, government shutdowns, and declining net migration, the economy is expected to pick up steam in the first half of 2026, thanks to tax breaks from the One Big Beautiful Bill Act.

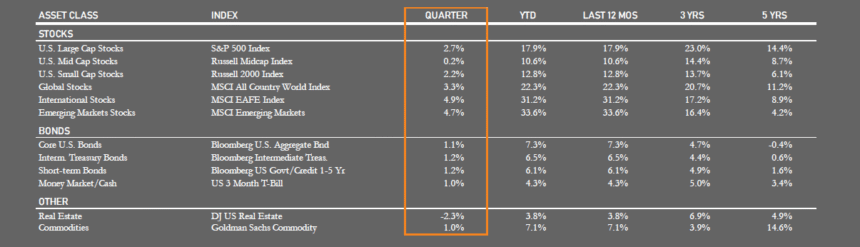

The US stock market’s performance in 2025 was dominated by the “Magnificent Seven” – Microsoft, Nvidia, Apple, Tesla, Amazon, Meta, and Alphabet (Google). The S&P 500 index rose by 17.9%, outpacing smaller companies, which grew by 12.8%. International stocks, as represented by the MSCI EAFE Index, saw a significant increase of 31.2%, largely due to a 9.4% drop in the dollar against other currencies. This decline in the dollar made overseas investments more valuable, benefiting investors who held assets in other currencies.

Bonds also proved to be a solid investment in 2025, with the Bloomberg US Aggregate Bond Index rising by 7.3% as the 10-year Treasury interest rate fell from 4.57% to 4.18%. Short-term bonds performed well, with the Bloomberg US Govt/Credit 1-5 year index up 6.1%, despite the Federal Reserve’s decision to cut short-term interest rates later in the year. Lower-quality, higher-yielding “junk” bonds gained about 8.5% during the year, as investor confidence in corporate fortunes returned.

In other asset classes, real estate investments were impacted by falling interest rates, with the Dow Jones US Real Estate (REIT) Index rising only 3.8% for the year. Uncertainty in global trade and weakness in office properties contributed to this weakness. Commodities saw a 7.1% increase, despite a sharp drop in oil prices, which fell from around $74 per barrel to $57 by year-end due to slowing demand.

Economy

The US economy rebounded strongly in the third quarter, growing by 4.3%, driven by consumer spending, export growth, and a drop in imports. Business investment in equipment and intellectual property also contributed to the gain. However, growth is expected to have slowed in the fourth quarter, with Goldman Sachs estimating just 1.7% growth, due to uncertainty surrounding the government shutdown. Looking ahead, US economic growth is expected to settle down to a 2% trend, barring any significant disruptions.

Changes in the labor market were a major story in 2025, with net immigration slowing to less than 250,000 per year, down from an average of over 1,000,000 per year in the past two decades. This decline has essentially eliminated growth in the working-age population, limiting future economic growth. Hiring has also slowed, from roughly 2 million jobs added in 2024 to less than 600,000 in 2025. Unemployment is expected to remain steady around 4.5%.

Inflation is expected to rise in 2026, as the delayed impact of tariffs seeps into prices and consumer spending surges due to tax refunds. However, this increase in inflation should settle down by the end of the year, falling back closer to the Federal Reserve’s 2% target. Without significant shocks, the economy is likely to muddle through, avoiding a recession with around 2% GDP growth and 2% inflation. This should provide a positive backdrop for corporate earnings, which grew by over 10% in 2025 and are likely to persist into 2026.

The Federal Reserve seems unlikely to continue cutting interest rates significantly, absent political interference. We expect one to three interest rate cuts, but if inflation creeps up to 3%, it would be hard to justify cutting interest rates, especially if unemployment remains steady. A falling dollar has been a key driver of investment returns and corporate profits from overseas operations, and if the Fed keeps cutting interest rates, this trend is likely to continue.

Outlook

With expectations for modest economic growth, continued consumer spending, and fairly stable employment, we remain cautiously optimistic for investment returns in 2026. Continued gains in corporate profits should support further increases in stock prices, although valuations in US stocks remain stretched. While the Magnificent Seven continue to drive index values higher, the rest of the stock market is more attractive on a valuation basis, offering some cushion in the event the tech bubble begins to deflate.

The Federal Reserve cut interest rates once during the fourth quarter, and markets have priced in roughly three more by year-end. Inflation and interest rate pressure from increased tariffs have been offset by a deterioration in hiring during 2025, a trend that is likely to continue. Though much ink has been spilled about the potential for higher interest rates from the OBBBA, we remain unconvinced that investors will significantly punish increased government borrowing.

S&P 500 valuations soared to roughly 22 times future earnings, though still not quite to the levels seen at the peak in March 2000. As corporate profits have shrugged off trade and policy uncertainty, investors have settled into an optimistic frame of mind about the direction of the economy and markets. As we said at the beginning of the year, volatility is to be expected and that remains true today.

Thus, our outlook remains cautiously optimistic for US equities, with risks in both directions. It’s been a while since we saw a 20% correction, so that can’t be ruled out, especially if there are significant shocks or policy mistakes. Trade uncertainty has been replaced by geopolitical concerns, and it remains to be seen what the ultimate policies will be, or the impact of a tectonic shift like the collapse of NATO. Our base case is positive, but election years tend to be volatile anyways.

Our Portfolios

Our stock exposure remains broad-based and weighted towards large US companies, but our international exposure has been a clear positive this year. Though we have reduced our exposure to smaller companies, there are still some under the hood in our core market funds, so their resurgence during the third and fourth quarters helped our portfolios. Smaller and medium-sized companies offer better valuations than larger companies but can also be more sensitive to economic volatility.

We are well-positioned for economic expansion, but if a recession does occur, we would expect our large company stock (and value bias) to hold up somewhat better than the broad stock market. Our international exposure remains balanced between (currency) hedged and unhedged investments and should continue to benefit from more attractive valuations than comparable US equities.

As we noted, the Federal Reserve’s current accommodative stance (with a bias towards lowering interest rates) should benefit our bond holdings. Expected returns on our bond portfolios going forward will be more attractive than they were three years ago. More importantly, if a recession occurs, interest rates will likely settle back down, resulting in good returns on bonds.

This year, we expect continued volatility as investors grapple with multiple potential risks in addition to the upcoming midterm elections. The possibility of a recession seems to have eased for now as investors remain cautiously optimistic about the direction of trade and economic policy, and tax refunds hit bank accounts during the quarter.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.