Update (July 8 at 4:01 pm UTC): This article has been updated to include comments from Andrei Grachev.

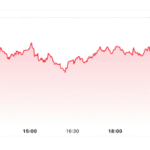

Falcon USD (USDf), a synthetic overcollateralized stablecoin issued by decentralized finance (DeFi) protocol Falcon Finance, dropped below its intended $1 peg on Tuesday amid rising concerns over liquidity and collateral quality.

CoinMarketCap data shows that Falcon USD (USDf) fell as low as $0.9783 on Tuesday morning. The drop triggered fresh scrutiny from the DeFi community, with some industry observers questioning the token’s backing and governance.

Obchakevich Research founder Alex Obchakevich told Cointelegraph that he is “concerned about the situation,” adding that rumors of collateral quality issues have undermined investor confidence.

Unlike fiat-backed stablecoins such as USDC (USDC) or USDt (USDT), Falcon USD is not directly pegged by US dollar deposits in bank accounts and is instead minted by locking up digital assets, including volatile cryptocurrencies.

Blockchain data explorer Parsec reported on X that onchain liquidity for USDf has declined. Parsec data indicates that liquidity stands at $5.51 million at the time of writing.

“The blockchain data shows a sharp decline in liquidity, which only adds to the panic,” Obchakevich said, citing Parsec data.

Related: How and why do stablecoins depeg?

Falcon USD issuer responds

Andrei Grachev, managing partner at both Falcon Finance backer DWF Labs and the stablecoin issuer itself, released a lengthy X post responding to the accusations. He claimed that stablecoins and Bitcoin (BTC) comprise 89% (about $565 million) of the collateral, with only roughly 11% (about $67.5 million) being altcoins.

Grachev also said that USDf is overcollateralized to 116%. In order to manage risk, Falcon Finance employs only market-neutral strategies for revenue generation with no directional trading and “every minted USDf must be backed by a stable coin or hedged position that represents dollar value and has no directional risk,” Grachev said.

He added that USDf’s peg is maintained organically by traders. If the stablecoin’s price exceeds $1, traders can mint and sell it, while if it is below $1 traders can buy and redeem it.

“Despite a brief depeg driven by market sentiment, the market has since stabilized and recovered quickly,” Grachev said, adding that the company “actively collaborates with multiple trading institutions to strengthen the peg.”

According to an asset attestation shared with Cointelegraph, the stablecoin is reportedly backed by nearly $544 million in assets. However, no details were provided about the specific assets backing the stablecoin. Cointelegraph has not independently verified the report.

Related: What happened to sUSD? How a crypto-collateralized stablecoin depegged

Community challenges Falcon’s claims

Obchakevich told Cointelegraph that the post raises many questions. For instance, he disputes the claims that “there is no alternative” to Falcon Finance as “overly optimistic” and a “marketing ploy.” He said:

“Competitors such as DAI or USDC have well-established positions with larger reserves and a wider user base.“

Others were less diplomatic. Pseudonymous developer 0xlaw, who manages yield farming protocol Stream Finance, accused Falcon Finance of holding “tens of millions of dollars in bad debt” and called USDf “a scam” in a post on X.

According to 0xlaw, USDf is allegedly backed by illiquid assets, including large reserves of Movement Network’s MOVE token. Coinbase suspended trading of MOVE in May, citing noncompliance with listing standards.

A separate risk assessment from DeFi research group LlamaRisk, published in late May, raised additional red flags. The report stated that “the Falcon team have unilateral authority over the operational management of the reserve assets.” The report also asserted possible over-issuance:

“Using DOLO as collateral, up to 50,000,000 USDf can be minted, which exceeds DOLO’s market capitalisation.”

The report also flagged concerns over missing disclosures, including a lack of full reserve asset breakdowns and an inaccessible insurance fund.

Magazine: Bitcoin vs stablecoins showdown looms as GENIUS Act nears