Key Points

- Make sure you fully understand your college bill, including tuition, fees, housing, meal plans, and applied aid to know exactly what’s owed and when.

- Confirm that grants, scholarships, and loans are applied correctly, and identify any discrepancies early.

- Combine savings, income, financial aid, and payment options into a realistic approach that minimizes borrowing.

When the college bill arrives, families often feel the weight of numbers that suddenly turn abstract costs into urgent deadlines. Tuition and fees, housing, and meal plans are all laid out in black and white, while financial aid and student loans may or may not align the way you expected.

It can be overwhelming, but a practical step-by-step plan can make the process manageable. By breaking down the bill, comparing it to your student’s financial aid award letter, adding in outside expenses, and mapping out the sources of funds, families can create a workable strategy that reduces stress and avoids unnecessary borrowing.

The bill may be large, but with a clear plan, it becomes something you can tackle semester by semester.

Would you like to save this?

1. Understand The Bill

The college bill should be very clear about:

- How much is owed for tuition, housing, meal plans, mandatory fees, lab fees, health insurance and other costs.

- The dollar value of scholarships and grants that have been applied for that semester.

- The amount credited to the student’s account for Federal Direct Student Loans for the semester.

- Payment details: due dates, payment methods, late fee & penalties.

Here’s an example statement from the University of Southern Indiana:

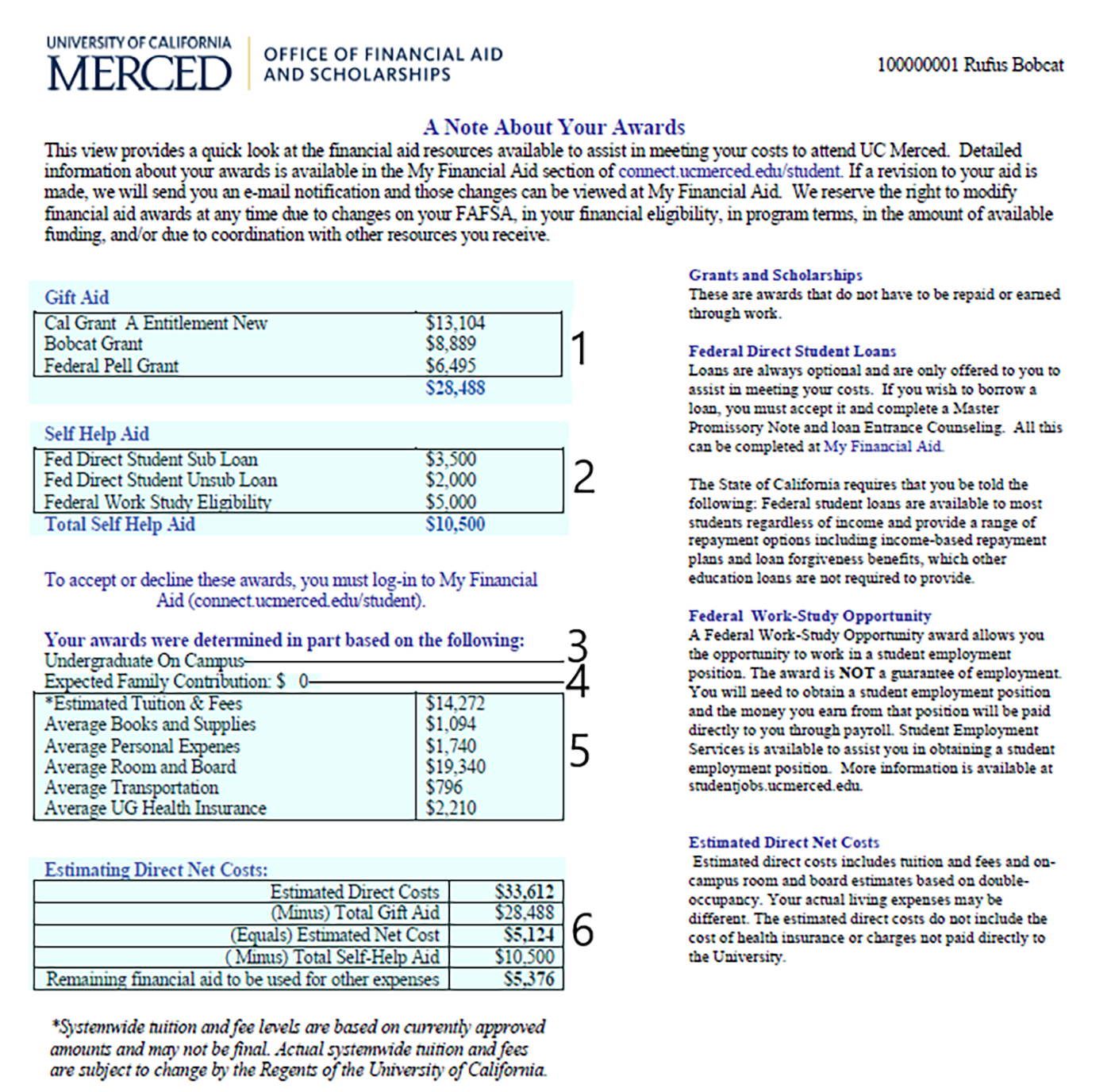

2. Compare The Bill To Your Financial Aid Award Letter

Ensure the price aligns with the costs and the grants, scholarships, student loans and other ways to reduce the price as outlined in the award letter. Mistakes happen. Contact the bursar’s office if something doesn’t look right or if you need an explanation of the bill.

A few nuances to understand:

- Work-Study awards do not reduce the bill. Work-Study is a part-time job that will pay the student as work is performed, like any other job.

- Federal aid as well as grants and loans from the college are usually disbursed equally over the semesters. A student must first accept the Federal Direct Loan and then complete the process to get the loan before it can be credited to their account. A $5,500 Federal Direct Student Loan to a freshman in a two-semester program will be credited $2,750 per semester. The college will get the cash directly from the U.S. Department of Education.

- Check with third-party scholarship providers to determine how the scholarship will be paid, i.e. in a lump sum or disbursed over the semesters.

- Sororities and fraternities send separate bills for housing and meal charges.

- The second semester bill will likely look a lot like the first semester bill. When paying for the next semester, will you need to make adjustments to your plan from the first semester? Sometimes there may be new student fees that don’t carry forward to future semesters.

Remember, here’s a sample financial aid award that should look similar to what you would have received back in the Spring:

3. Add Other Expenses

In addition to the fees outlined on the bill, there will be other costs during the semester:

- Transportation. Travel to and from campus for drop-off, Parent’s Day, Thanksgiving, and end of the semester adds up. Planning and setting travel alerts for discounts on air fares and hotels can save money! And remember, transportation is never a qualifying 529 plan expense.

- Miscellaneous school expenses. Textbooks, computers, course materials, supplies etc.

- Supplemental meals, entertainment, and miscellaneous expenses. Working with students to establish a budget for these discretionary expenses will help students lay the foundation for financial success in the future.

Some families also consider purchasing insurance to protect against unexpected events:

- Tuition insurance for withdrawals from school for documented medical events. GradGuard offers reimbursement when a student cannot complete an academic term due to an unforeseen, covered accident, injury or other covered reason.

- Renter’s Insurance for housing and personal belongings. Realize that many “normal” homeowners and renters insurance companies don’t cover dorm rooms – so make sure you find a provider that does.

With a firm understanding of the college’s costs, a reasonable estimate of other costs, and the amount of financial aid a student received, you’re ready to pay the bill. You now know how much you will need immediately and good projections of additional costs for the first and second semesters.

4. Know The Source Of Funds That Are Available

Absent winning the lottery, a GoFundMe page, or some found “free” money when the college bill arrives, these are the sources of funds to pay the full college bill:

- Financial aid from the federal government in the form of Pell and other grants, work-study, and Federal Direct Student Loans

- Financial aid from the college, most often in the form of institutional grants and scholarships

- Scholarships from third parties

- Parent and student savings in 529 or other college savings or brokerage accounts

- Tuition Payment Plans

- Parental income

- Student income during the semester from work-study or a part-time job

- Parent loans and/or loans co-signed by the parent and student

- Gifts from family and friends

You may also have been told to consider other sources including loans from your retirement account, credit cards, home equity loans, and insurance policies. Although these may be part of your plan, each have drawbacks to consider:

- Retirement savings are sometimes considered attractive because you can “borrow from yourself” and pay the interest back to your retirement account. That’s true, but it could also take a big chunk out of your account at a critical time when your nest egg should be building before retirement. If the repayment plan falls apart, you could imperil your financial future: you can’t borrow for retirement.

- Credit cards charge interest rates often two or three times the rates available for student and parent loans. If you want to pay to get frequent flyer points or cash back, be sure to make the payment in full the next month to avoid excessive fees. Using credit cards to pay for college may be the most expensive way to fund an education!

- Tax benefits do not reduce the college bill so you should not count on them to provide cash for the first year.

- Insurance products are complex and not often go-to vehicles to pay current college bills.

5. Make A Specific Plan To Pay For Each Semester

Now is the time to identify which sources of funds are available to you and how much of each you will use to pay for college.

Although there is no hard-and-fast rule of thumb on how to pay for college, some believe that the cost of college should be covered:

- 1/3 by financial aid

- 1/3 by savings

- 1/3 by student loans

That’s great in theory, but it’s a little late now that the bill has arrived. Here’s some data from a recent study on how families pay for college, and you can see it’s a pie:

Here are a few practical considerations when constructing your plan to pay the college bill:

- There is no “right” answer or silver bullet to construct the optimal plan because there are many moving unknowns from now until graduation. Furthermore, prices tend to rise every year after the first year as well – tuition and housing costs have been rising anywhere from 4-8% per year.

- The first-year plan will have to be modified each year as costs and other terms change. For instance, the interest rate on student loans will change based on market conditions and your credit history. Did the rates go up or down? Likewise, your savings may be bolstered or diminished based on ever-changing conditions in the financial markets.

- Savings: Allocating college savings to each year of college could be as simple as dividing by four (assuming a 4-year program that is completed in 4 years) or allocating smaller or larger proportions for each year. Knowing how the savings plan works is important. For instance, 529 Plan withdrawals need to be used for “Qualified Educational Expenses.” QEPs cover virtually all college expenses and up to $10,000 of student loans per student, but you need to be sure the withdrawal is for a QEP or you may face a penalty for an unqualified withdrawal. Also, understanding the process for making a qualified withdrawal is important. Contact your 529 plan provider well before you need the cash!

- Payment Plans: Most colleges offer a payment plan that, in effect, advances cash to the college to help you cover a portion of the bill, for a one-time fee. You can then use current income each month to repay the payment plan company. This is a great way to use current earnings to reduce the size of a parent or student loan.

- Student Loans: Student and parent loans should be the last resort, not the first option, to pay for college. Federal Direct Loans are the best deal in town for undergraduates because there is no required credit check, all students are eligible for a loan, and the repayment terms are favorable. If your plan to pay the bill requires a parent or parent/student co-signed loan, be sure to shop around and do not automatically assume the Federal Parent Plus Loan provides the lowest interest rate and best terms for you.

Example

Let’s assume the total college tuition and fees on the bill plus all the other costs you have projected for the academic year is $50,000: $25,000 for each semester. And your daughter’s financial aid award letter offered:

- $18,000: Scholarships and grants from the college

- $5,500: Federal Direct Student Loans

- $4,000: Federal Pell Grant

- $3,200: Federal Work-Study

In addition, she won your employer’s annual $2,500 scholarship paid in the first semester each year.

How much cash does she need for each semester?

- First Semester: $ 8,750

($25,000 [cost] – $9,000 [college aid] – $2,750 [Federal Loan] – $2,000 [Pell] – $2,500 [employer scholarship])

- Second Semester: $11,250

($25,000 [cost] – $9,000 [college aid] – $2,750 [Federal Loan] – $2,000 [Pell])

Notice that the Work-Study Award does not reduce the amount of the bill. Also remember that work study dollars have to both be earned by working, and then when the child receives the paycheck, actually used for college expenses.

How is she going to pay these bills? Further assume:

- She is the beneficiary of a $32,000 529 plan. You decide to use 25% per academic year so $8,000 will be used the first year.

- She saved $4,000 for college and will earn $2,500 each summer working.

- She earns $400/mo from a Work-Study job.

- You can pay $350/mo from your income each month during the school year.

For the $8,750 first semester bill, she could pay many ways including:

- Using a payment plan to cover $2,750 to be paid over 5 months. You pay $350/mo and she pays $200/mo.

- Withdrawing $4,000 from the 529 plan.

- Withdrawing $2,000 from her savings.

In this case, she would still have earnings of about $200/mo from the Work-Study job.

For the second semester bill ($11,250):

- Use the payment plan to cover $2,750.

- Withdraw $4,000 from the 529 plan.

- Withdraw $2,000 from her savings.

- You take a private student loan for $2,500.

She will continue to earn $200/mo. from the Work-Study job.

At the end of the year, the $50,000 was covered by 9 different sources of funds:

- $18,000: Scholarships and grants from the college

- $8,000: Withdrawals from 529 Savings Plan

- $5,500: Federal Direct Student Loan

- $5,500: Payment plans paid each month from current earnings: $2,000 from her Work-Study earnings and $3,500 from your income

- $4,000: Federal Pell Grant

- $4,000: Her savings

- $ 2,500: Employer scholarship

- $2,500: Private student loan – the very last resort to pay for college

This plan leaves your daughter with a cushion of $200/mo. for other expenses.

Pro Tip: Consider reallocating next year’s projected 529 withdrawal of $8,000 to a very conservative investment option.

Final Thoughts

Determine which combination of the following sources of funds will work best for your student: some college and federal aid, private scholarships, payment plans, family savings, current income and student loans.

Refining your plan for each semester and each year will help minimize loans and increase the return on the investment in college.

Student loans should be the last resort, not the first option to pay the college bill.

Don’t Miss These Other Stories:

Editor: Robert Farrington

The post Five-Step Practical Guide To Paying Your College Bill appeared first on The College Investor.