Not happy with your mutual fund performance?

Do you think its a bad mutual fund, because it is not doing well from last many years?

A lot of mutual funds investors lose their patience looking at their mutual fund’s returns after they invest for 2-3 yrs. Its commonly suggested that an equity mutual fund will perform very good over the long term and one can expect double-digit returns, however, if the fund does not return back good returns within 2-3 yrs itself, the investors get very nervous and start judging their mutual fund quality and wonder if they made a right choice or not!

Today I will tell you how to judge the returns of mutual funds using “Rolling Returns” analysis, which will help you to get more confidence in your mutual fund and will help you learn many aspects!

Let’s start!

You Returns will invest a lot depending on when you invested!

Before we go into rolling returns, let’s understand the issue!

Take HDFC Midcap opportunities growth for example

- 10 yrs CAGR return: 14.96%

- 5 yrs CAGR return: 11.26%

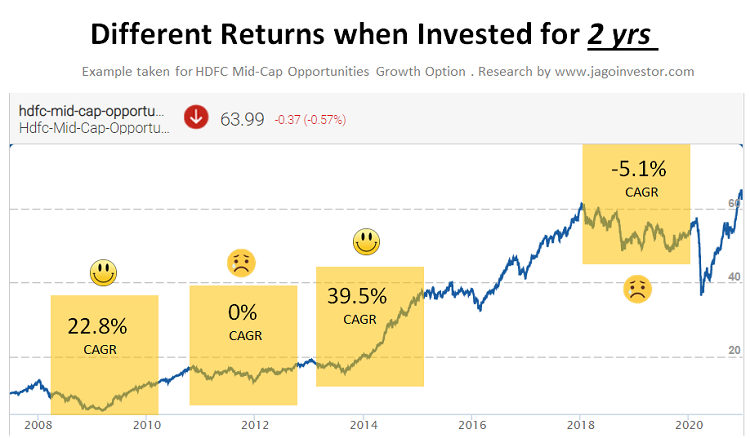

At the time of writing this article, the returns from this fund are very good. But can this fund give bad returns in a 2 yr period. The truth is that this same “good fund” can give very different kind of returns in a 2/3 yr period depending on when you bought the fund.

Here is some data.

You can see that the 2 yrs return can be 22.8%, 0%, 39.5% or -5.1% depending on when a person entered the fund. So a lot depends on when you entered in the fund.

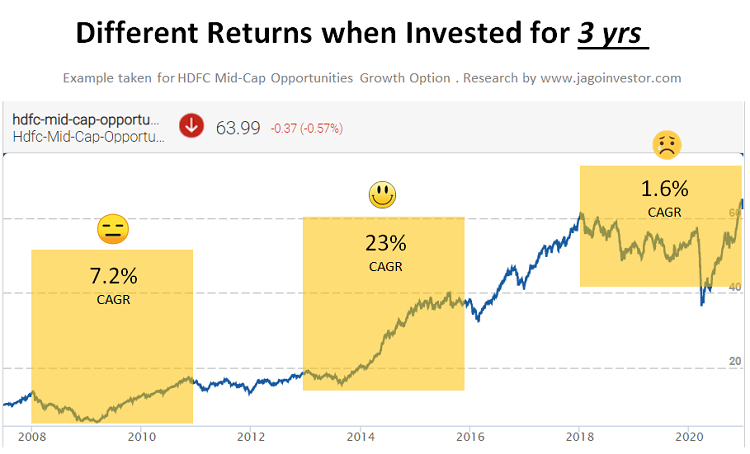

Now let’s see the same thing for 3 yr time frame.

Again, you can see that for a 3 yr period – the experience can be very very different. It’s not always possible to enter at the lowest point and many times, investors invest their money for the long term when the near term returns are going to be bad. However, they never get prepared for this.

Investor mind is also not designed to stay calm when returns go in negative and that’s when investors make a wrong choice of exiting the funds even if at the fundamental level, the fund has no issues and its just the volatility of the equity which is driving the fund into negative return zone!

You can see that this approach of just looking at the point to point return does not give you enough detailed information about the fund and its volatility.

Rolling Returns – What it is and How to look at it!

Rolling return means a series of returns data for each and everyday investment for a certain time frame.

So in our example of HDFC Midcap opportunities, lets assume a period of 14 yrs from 1st Jan 2007 to 30th Dec 2020. Thats approx 5110 days. If you do a 2 yr rolling return analysis, it means that a period if investing for 2 yrs and you are plotting the CAGR return for each day of investment from the start. (that’s 730 days of investment)

So you invest on

- 1st Jan 2020 and exit on 1st Jan 2022 (1st instance)

- 2nd Jan 2020 and exit on 2nd Jan 2022 (2nd Instance)

- 3rd Jan 2020 and exit on 3rd Jan 2022 (3rd Instance)

- ….

- ….

- ….

- 30th Dec 2018 and exit on 30th Dec 2020 (4380 instances: 5110 – 730)

So you can plot these 4380 data points and that graph is called a rolling returns graph. In the same way, you can have a 3 yr, 5 yr or even 10 yr rolling return graph.

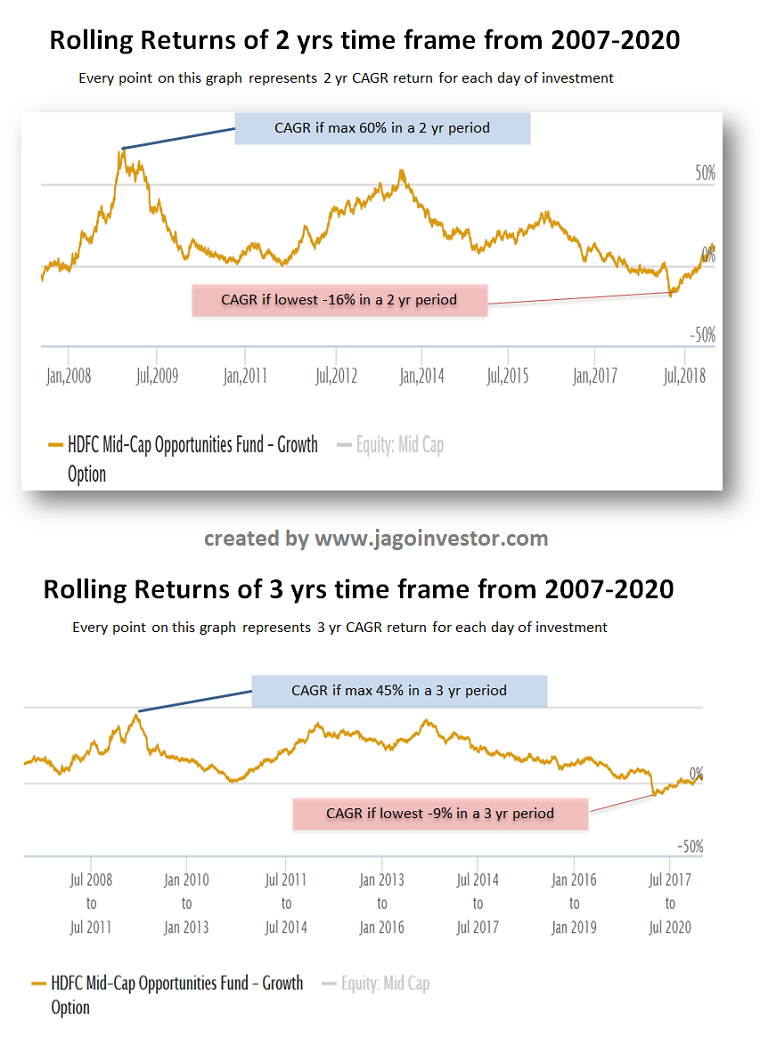

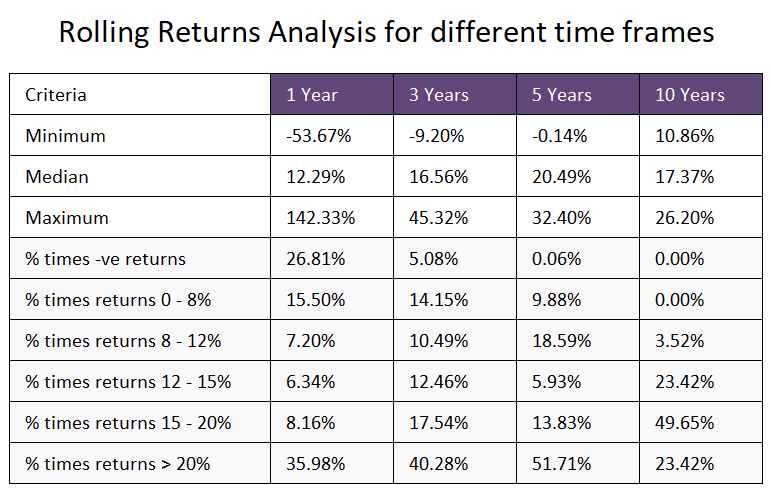

Check out the example of HDFC Midcap opportunities rolling return chart for 2 and 3 yrs period for last 14 yrs. You can see that in a 2 yr period, the highest CAGR has been around 60% and the lowest at -16% .. So it’s possible to see your investment go down by 16% in a 2yr period as per old data. The same kind of data is there for 3 yrs period too!

Rolling return graph will give you a deeper understanding of how volatile fund returns have been and even the probability of your return being in a certain range (only with past data). Note that its only historical data and the maximum and minimum returns can change depending on future performance.

If you look at the chart above, you can conclude that if you want to invest in this fund – then you can see a downside of up to 10% in a 3 yr period because it has happened in the past. Also, you can see flat returns even in 5 yrs period which has happened in the past.

This kind of analysis tells you that because of volatility even this kind of good funds can see a period of non-performance and flat returns.

I hope I was able to explain what is rolling return in a simple manner.

Conclusion

Remember that rolling returns exercise is a great tool for analyzing the mutual fund, but it’s not the final exercise in itself. There are many other kinds of analysis which is possible and this exercise alone does not give any final judgement.

If you are not happy with your fund performance, then I suggest going through this exercise!

Do share your comments on this!