The price of gold rose to staggering new highs in Q1, gaining nearly 20 percent during the period.

Its strong performance has come on the back of global financial market uncertainty following Donald Trump’s inauguration as US president. His administration’s sweeping changes have created chaos and benefited gold.

What happened to the gold price in Q1?

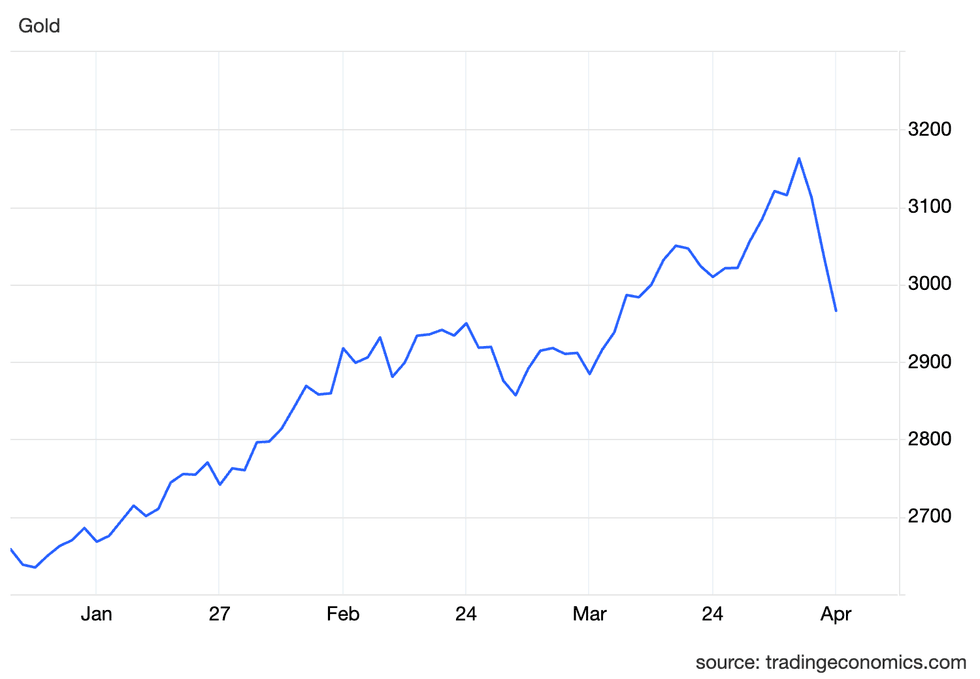

Gold began the year at US$2,658.04 per ounce on January 2, and continued to rise throughout the first month of the year, reaching US$2,710.30 during Trump’s inauguration on January 20.

Gold price, January 2 to April 7, 2025.

Chart via Trading Economics.

Its upward trajectory accelerated in February. Gold climbed above the US$2,800 mark on February 3, broke through US$2,900 on February 10 and reached a monthly high of US$2,949.90 on February 24.

The metal retracted before the start of March, falling to US$2,856.90 on February 28.

However, March brought more excitement for investors as the price once again started to climb, rising above the US$2,900 mark by March 4. Gold continued to set records during the month, closing above US$3,000 on March 18 and then establishing a new record of over US$3,165 in early April.

Gold had once again dipped below the US$3,000 mark as of April’s second week.

Gold and Trump’s tariff threats

When Trump won the US election, analysts widely predicted his presidency would be defined by chaos.

Much of his first presidential term saw him challenge standard operating procedures on diplomacy and rhetoric, but he was largely constrained by experienced Washington insiders.

During his second term, Trump has chosen to surround himself with loyalists who agree on policy direction.

Mind Money CEO Julia Khandoshko told the Investing News Network (INN), “The problem is not just their content, but the overall consequences — each one heightens market volatility and creates waves.”

The first quarter brought about destabilization in world financial markets as Trump threatened to impose sweeping 25 percent tariffs on Canada and Mexico, its longtime trade partners. According to the Office of the US Trade Representative, trade between the three countries totaled over US$1.5 trillion in 2022.

Initially Trump was demanding that Canada and Mexico tighten border rules to prevent the flow of migrants and fentanyl into the US. However, he also suggested that the tariff threat stemmed from trade deficits.

The first of Trump’s threats came on February 1, when his administration applied tariffs to imports from Canada and Mexico; he walked them back two days later, saying he would delay them until March. When the March deadline arrived, the US once again imposed tariffs on Canada and Mexico, but then retracted them, suggesting they would be added on April 2, when the US was also planning broader reciprocal tariffs against all countries.

In comments to INN, David Barrett, CEO of EBC Financial Group UK, suggested that the Trump administration’s tariff threats have had an impact on physical holders of gold.

“There has been a huge spike in the movement of physical gold from around the world into US depositories. This seems to have been driven by the global political stress and potential tariff impacts. The amounts involved have caused disruption in the real demand and promoted new buyers as well,” he said.

These movements created significant price differences between the London and New York markets, as UK buyers worried about a shortage of physical gold, while US banks sought to exploit the price gap.

Geopolitical conflicts creating tension

With Russia-Ukraine tensions remaining high and a Middle East conflict that seems poised to boil over, gold investors have responded by seeking the relative safety of physical and liquid assets.

“Broader global political tension, the Middle East conflicts and the Ukraine invasion all add uncertainty, and none of these should be ignored. All those inputs are real and do not look like they will abate anytime soon,” said Barrett.

Both major conflicts in Eastern Europe and the Middle East show no signs of easing.

A ceasefire negotiated between Israel and Hamas earlier this year has collapsed since the beginning of March.

This has led to a serious escalation, with Israel attacking more targets in Gaza and the US increasing its strikes against Iran-backed Houthi rebels in Yemen. The US has also begun more troop and equipment movements into the region, and some analysts believe it is preparing for direct action against Iran. This sentiment was reinforced when Trump stated, “If they don’t make a deal, there will be bombing,” during a call with NBC News on March 30.

The three year war between Russia and Ukraine continues with no end in sight. While it seems that both sides have accepted a ceasefire, the final terms and how it will be implemented remain uncertain.

In recent weeks, Russia has intensified its attacks on Ukraine, targeting critical infrastructure and civilian areas. This has drawn Trump’s ire, and he threatened oil and gas tariffs on Russia during his NBC interview.

Gold’s foundational drivers still present

Central banks have been a major gold price driver over the past few years, and data published by the World Gold Council on March 4 indicates that they remained active during the first month of the year.

In January, they added more than 18 metric tons of gold to their reserves.

Uzbekistan’s central bank led the way with 8 metric tons, while the People’s Bank of China contributed 5 metric tons, increasing its official total to 2,285 metric tons. The National Bank of Kazakhstan added 4 metric tons.

Barrett explained that central bank purchases have been crucial to gold’s increases over the past decade.

“Since late 2015, gold has risen from approximately US$1,000 to the present record highs above US$3,000, and central banks have bought up 10,000 metric tons, depending on who you ask. This demand removes supply from the market; they are the ultimate buy-and-hold participants — this has been the real driver for gold,” he said.

For her part, Khandoshko does not view central bank purchasing as significant in the current environment.

“The more important factor here is their monetary policies. Despite attempts to maintain a conservative stance, it is evident that the cycle of interest rate cuts is already underway,” she said.

Lower interest rates have long been correlated with increased gold buying from investors.

In another report, the World Gold Council states that physically backed gold exchange-traded funds (ETFs) saw US$9.4 billion in inflows during February, the strongest since March 2022.

February also marked the third consecutive positive month of “strong global inflows.”

Overall, assets under management for these ETFs rose by 4.1 percent to US$306 billion, with collective holdings increasing by 3.1 percent to 3,353 metric tons, the highest month-end level since July 2023.

Gold price forecast for 2025

Among the factors that could provide fresh tailwinds for gold is a new pilot program from the National Financial Regulatory Administration of China. It allows 10 insurance companies to invest in gold.

“Given the recent price rise, the global backdrop and the huge Chinese population, this may develop into a strong driver,” Barrett said. The program permits the designated insurance companies to allocate up to 1 percent of their assets to bullion, which could translate into US$27.4 billion in new gold investments.

Barrett emphasized the importance of monitoring the main drivers in the gold market.

“Clarity on the Trump administration’s tariff policy, even its overall economic plan, may alleviate some physical demand as well as those concerned about the need for a hedge,” he said.

Although he noted that conflicts in Ukraine and the Middle East are unlikely to change due to their complexity, he suggested that relief from ceasefires or a reduction in violence could help diminish investor anxiety.

Khandoshko mentioned that as long as geopolitical turmoil, economic instability and currency devaluation persist, the gold price will continue to benefit as these elements are driving its momentum.

“This surge over the US$3,000 mark is just the beginning,” she said.

“The yellow metal will continue to increase in price, setting new records. What we are witnessing is not a temporary spike, but a lasting shift in the market. With this breakthrough, a significant pullback seems unlikely. Corrections and volatility may occur, but the market has entered a new era, one that is here to stay.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web