With modern technology, a rising gold price and renewed government support for domestic mineral production, mining companies and investors are taking a second look at historic districts and brownfield projects once considered uneconomic — and California’s long-overlooked gold deposits are squarely back in focus.

The California Gold Rush of 1848 wasn’t just a pivotal moment in American history — it was one of the most profitable mineral booms ever recorded. Sparked by a discovery at Sutter’s Mill, the gold rush drew over 300,000 people and produced more than 25 million ounces of gold, much of it from the now-famous Mother Lode Belt.

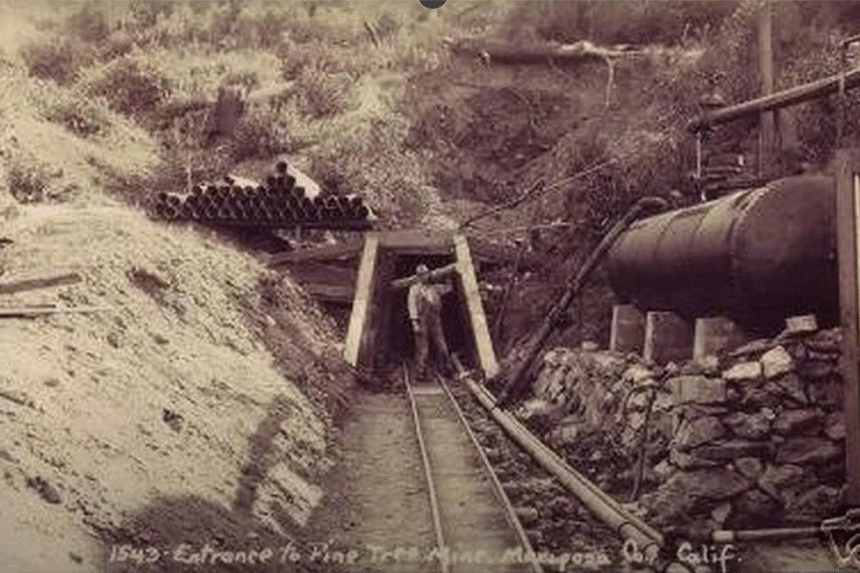

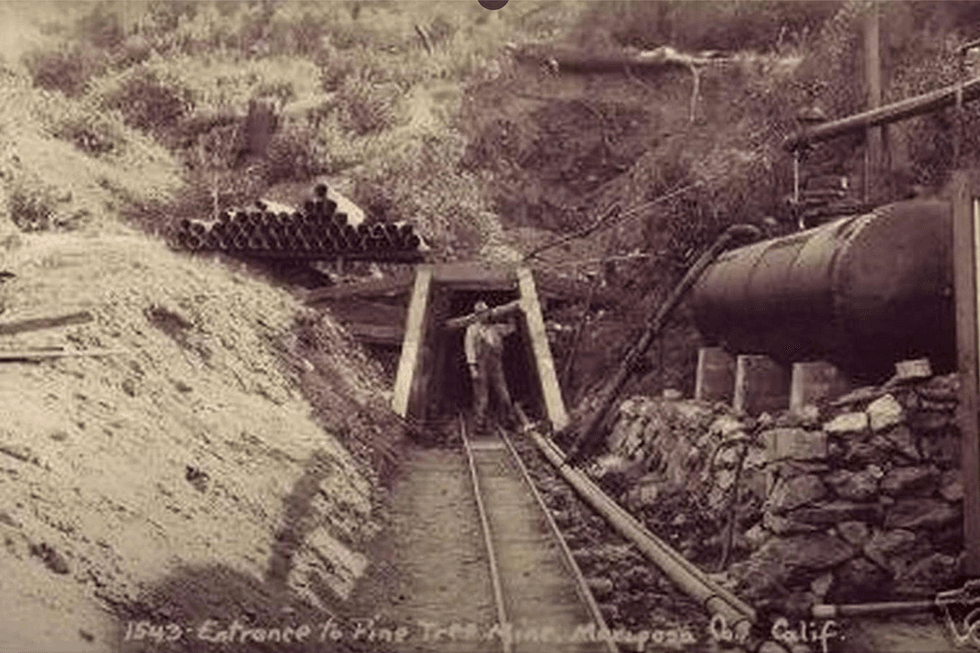

At the peak of the gold rush, California was producing nearly 1 million ounces per year, including an estimated 1.4 million ounces from the Mariposa District alone. However, the low price of gold at the time and limitations with mining methods during the 19th and early 20th century, have left much of the gold-bearing rock unmined.

In 1942, the US government suspended domestic gold mining to redirect labor and resources toward the war effort, effectively ending large-scale mining in the state. Many operations never resumed, leaving significant in-ground mineral potential untapped.

Today, California remains an important resource-producing state. According to the California Department of Conservation, the state hosts 700 active mines, including 14 gold mines.

California is also a key domestic energy hub — as of early 2025, 123,000 barrels of oil and 159 million cubic feet of natural gas are produced daily, according to California Resources Corporation.

Geopolitics and rising gold prices: A prime investment opportunity

The gold price climbed to around US$3,364 per ounce in July 2025, with analysts from firms like JPMorgan Chase (NYSE:JPM) projecting an increase to US$3,675 by year end.

The trend has sparked heightened interest in the gold mining sector as investors look to leverage this upward trajectory. This comes amid rising geopolitical tensions, volatile monetary policy and growing political uncertainty in major economies — conditions that have historically increased demand for gold as a safe-haven asset.

This surge is also aligning with favorable policy shifts. The Trump administration’s March 2025 executive order to expedite the extraction of critical minerals — including gold — is expected to streamline permitting timelines, particularly for projects in domestic US jurisdictions.

As a result, companies are increasingly turning to historically prolific but previously overlooked mining regions, such as parts of California, which had fallen out of favor due to cost, regulatory or price-related barriers. The combination of high prices, strategic urgency and permitting reform is making these areas viable again.

Federally designated Opportunity Zones are even more attractive to investors as they provide incentives like capital gains deferral and tax exemptions. For example, Mariposa County, a significant site during the gold rush era, is a designated Opportunity Zone and is home to Lode Gold Resources’ (TSXV:LOD,OTCQB:LODFF) Fremont project.

The convergence of multiple favorable factors — an elevated gold price, growing strategic urgency, evolving federal priorities around domestic mineral supply and investment incentives — has created a perfect storm for renewed interest in historically rich districts like Mariposa.

Leaders advancing California’s mining sector

California’s mining landscape is anchored by a trio of strong operators delivering tangible results:

- Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX), led by its chairman and Canadian Mining Hall of Fame inductee Ross Beaty, acquired the Castle Mountain mine in December 2017 for about $200 million. The company successfully advanced the project from acquisition to Phase 1 production in just three years, achieving first gold pour in 2020. This was made possible in part through the permitting expertise of Martin Stratte, a specialist in California mining projects, who now serves as permitting advisor on other in-state developments, such as Lode Gold’s Fremont mine. Since 2020, Castle Mountain’s Phase 1 heap-leach operations have produced roughly 30,000 to 45,0000 ounces per year, and its Phase 2 expansion — supported by a 2021 feasibility — targets ~218,000 ounces annually over 14 years.

- Andean Precious Metals (TSXV:APM,OTCQX:ANPMF), formerly Golden Queen, has reactivated the Soledad Mountain mine, which has produced over 340,000 ounces of gold since the mid‑2016. Following its 2023 acquisition, the mine generated approximately 18,400 ounces of gold in Q4 2023. In 2024, Soledad Mountain contributed around 54,275 gold equivalent ounces across Andean’s operations.

- Blue Moon Metals (TSXV:MOON,OTCQX:BMOOF) is advancing the Blue Moon polymetallic volcanogenic massive sulfide critical metals project in Mariposa County. In mid‑2025, the company received Bureau of Land Management approval to develop a portal and underground decline for exploration — a milestone aligned with the March 2025 federal executive order to increase domestic mineral production. With permitting achieved, site prep is underway for a two year drilling program slated to commence in Q3 2025.

These are just a few examples of active projects in California, each underscoring the state’s untapped potential when aligned with the right operators, policy conditions and permitting strategies.

As geopolitical pressures and supply chain risks intensify, more mining companies and investors are turning their focus to US-based assets, with California re-emerging as a region of interest.

Investment case: Lode Gold reactivating the historic Fremont gold mine

Lode Gold Resources offers a compelling investment opportunity in California’s Mother Lode Belt, a 190 kilometer mineral-rich corridor through the Sierra Nevada foothills from Mariposa to Georgetown holding significant untapped gold potential from historic mines. Despite having produced an estimated 50 million ounces of gold from high-grade quartz veins and orogenic systems in the 20th century, some of these mines were rarely explored beyond 250 meters in depth and remain primed for reactivation.

The Fremont project, located on over 3,000 acres of privately owned land in Mariposa County, is an advanced-stage exploration and early stage development asset with a storied history. The mine was producing gold at 10.7 grams per ton until operations ceased in 1942 due to wartime restrictions when price of gold was US$35 per ounce. The project’s infrastructure — 23 kilometers of underground workings, 14 adits and 43,000 meters of drilling with preserved core samples — supports efficient resource validation and conversion to NI 43-101 compliance.

The project has a 2023 preliminary economic assessment estimating a net present value of nearly $554 million (after tax) at a conservative gold price of US$2,300 per ounce, based on 1 million ounces (indicated) and 2 million ounces (inferred). Payback is 2.5 years with an internal rate of return of 42 percent and a 12 year mine life.

A new 2025 mineral resource estimate (MRE), filed on April 25, 2025, refines the project’s potential by assessing cut-off grades, mined grades and the feasibility of both bulk mining and selective vein extraction.

Using a 1 g/t cut-off grade, the average true width is 53 meters, while a 3 g/t cut off yields 16.8 meters, presenting significant gram-meter values that offer a compelling case for further evaluation of the potential for high-tonnage extraction, particularly through bulk underground mining.

The 2025 MRE also pointed out that 92 percent of the resource has been left unmined.

Lode Gold’s tightly held share structure, with four major shareholders owning half the company, creates strong alignment for advancing the Fremont mine. Key upcoming milestones include completing a prefeasibility study (PFS) within 18 months and a full feasibility study (FS) within 30 months. In the near term, the company will begin channel sampling to upgrade resources and initiate a PFS.

Investor takeaway

California’s gold mining legacy is re-emerging under modern conditions — driven by a high gold price and positive shifts in US mining policies. Lode Gold’s Fremont mine is uniquely positioned to benefit from these changes.

Fremont is brownfield, with a suspended mining license that can be reactivated. It is located in a federally designated Opportunity Zone that provides significant tax incentives.

With four shareholders owing about half the company and a newly completed 10:1 share consolidation, it has a tight share structure. Lode Gold is currently seeking a fifth strategic partner to advance its project quickly, with a plan to complete PFS in 18 months and FS in 30 months, as well as targeting a small-scale pilot plant and its first gold pour in early 2028. With these key milestones, Lode Gold is poised for growth and revaluation.

This INNSpired article is sponsored by Lode Gold Resources (TSXV:LOD,OTCQB:LODFF). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Lode Gold in order to help investors learn more about the company. Lode Gold is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Lode Gold and seek advice from a qualified investment advisor.