Key Points

- President Biden forgave more than $188 billion in student loans for over 5 million borrowers, the largest amount of cancellation by any president.

- Despite record forgiveness, total outstanding student loan debt grew from $1.565 trillion to $1.640 trillion during Biden’s term, as new borrowing outpaced relief.

- Programs like PSLF, Borrower Defense, and Teacher Loan Forgiveness delivered billions in relief, but data on the true impact for individual borrowers remains limited.

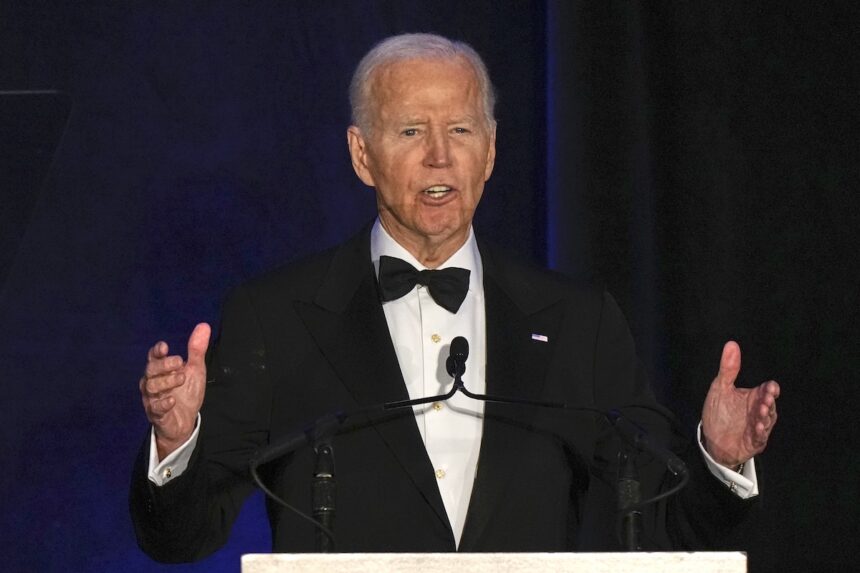

How much student loan debt has actually been forgiven? The number is staggering: more than $188 billion erased for over 5 million borrowers during President Biden’s presidency, the largest wave of student loan forgiveness in history.

But the story doesn’t end there. Despite record levels of forgiveness, America’s student loan balance still grew, climbing from $1.565 trillion to $1.640 trillion.

The reason: new borrowing and interest continue to outpace the relief provided. That paradox raises important questions about what forgiveness really means, who benefits, and how much it changes the bigger picture.

Although there is some information about the total amount of student loan forgiveness and discharge, there is very little information about the actual impact on individual borrowers. For example, Public Service Loan Forgiveness (PSLF) requires the borrower to make 120 monthly payments in an income-driven repayment plan before the remaining debt is forgiven. It is unclear how much of the original debt and accrued interest is ultimately canceled on average.

This article breaks down where forgiveness came from: including Public Service Loan Forgiveness, Borrower Defense, Teacher Loan Forgiveness, and more, and why the numbers don’t always match what borrowers feel in their day-to-day lives.

Understanding these details matters, because the future of forgiveness is shifting under the One Big Beautiful Bill Act (OBBBA) and new rules for student loan repayment.

Would you like to save this?

President Biden Forgave More Debt Than Any Other President

President Biden forgave more than $188 billion in student loans to more than 5 million borrowers, more than any other president. He did this by making existing student loan forgiveness programs more efficient and automated.

However, timing did work to his favor – with Public Service Loan Forgiveness finally hit its stride in 2024. The program started in 2009, but required 10 years of qualifying payments. However, to be eligible, it required Direct Loans and qualifying repayment plans. Most new students didn’t start taking Direct Loans until 2010 (then had 4 years of college), and repayment plans like PAYE didn’t start until 2014. So, the first “big wave” of borrowers hitting 10 years happened in 2024. And in October 2024, the 1 million PSLF borrower mark was hit.

This table shows the totals forgiven, as of January 15, 2025, based on U.S. Department of Education press releases. The U.S. Department of Education under the Biden Administration published press releases very frequently, whenever they had a significant amount of forgiveness. This yielded a continual drumbeat of new forgiveness announcements.

|

Program |

Dollars (Billions) |

Number of Borrowers |

Average per Borrower |

|---|---|---|---|

|

Public Service Loan Forgiveness (PSLF) |

$78.5 |

1,069,000 |

$73,396 |

|

IDR Payment Count Adjustment |

$56.5 |

1,400,000 |

$40,357 |

|

Borrower Defense And Closed School Discharge |

$34.5 |

1,945,880 |

$17,708 |

|

Total And Permanent Disability |

$18.7 |

633,000 |

$29,542 |

|

SAVE Accelerated Forgiveness |

$5.5 |

414,000 |

$13,285 |

|

TOTAL |

$193.6 |

5,461,880 |

$35,449 |

|

Total Exluding SAVE |

$188.1 |

5,047,880 |

$37,449 |

More than 40% of the total student loan cancellation was through the Public Service Loan Forgiveness (PSLF) program.

Despite all the forgiveness, there was more federal student loan debt outstanding when he left office than when he started. Total student loan debt outstanding increased from $1.565 trillion to $1.640 trillion.

This is because new borrowing exceeded the amount forgiven. Since the start of the pandemic, there has been more than $80 billion of new borrowing each year and about $15 billion in progress in paying down debt. That yields a net increase of $65 billion per year before subtracting the $47 billion in annual forgiveness.

Overall, the loan forgiveness during the Biden Administration represented more than 10% of the number of borrowers and dollars of federal student loans.

Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness (PSLF) forgives the borrower’s remaining federal student loan debt after the borrower makes 120 qualifying payments while working full-time in a public service job. Qualifying repayment plans include income-driven repayment plans and the standard 10-year repayment plan. Qualifying employers include government employers and 501(c)(3) organizations. Only Direct Loans are eligible for forgiveness (not FFEL or Perkins).

As of July 31, 2025, a cumulative total of $85.5 billion in loans to 1,155,400 borrowers has been discharged through the Public Service Loan Forgiveness (PSLF) program (Excel File). That’s an average of $74,000 per borrower.

Of the total, 421,600 borrowers received $33.1 billion in forgiveness through PSLF, 7,300 received $0.3 billion in forgiveness through TEPSLF and 758,800 received $52.1 billion in forgiveness through the Limited PSLF Waiver (PDF File) that ended on October 31, 2022.

An additional 2.5 million borrowers have eligible employment and total outstanding balance of $224.9 billion in debt, an average of $87,700 per borrower. The balance may decrease by the time they receive forgiveness as they continue to make payments through income-driven repayment plans.

Of borrowers who have applied from June 30, 2024 to July 31, 2025, 57% work for a government employer and 43% to a 501(c)(3) employer. 37% of applications were closed or cancelled without receiving forgiveness. 5% of the applications were closed because of employer eligibility issues.

A precise calculation of the impact of the PSLF is not possible with currently available data from the U.S. Department of Education. Calculating the percentage of the original loan balance that is ultimately forgiven by PSLF would require information about the original loan balance, the interest rate and the annual income and family size.

But, a back-of-the-envelope estimate suggests that as much as half to three quarters of the original loan balance plus subsequent accrued interest is ultimately forgiven.

Teacher Loan Forgiveness

Teacher Loan Forgiveness (TLF) provides student loan forgiveness for highly qualified teachers in low-income elementary and secondary schools. Up to $17,500 in loan forgiveness is provided after five years of full-time teaching in math, science and special education. Up to $5,000 in loan forgiveness is provided for teachers in other subject areas.

As of February 2025, a cumulative total of $4.2 billion of Teacher Loan Forgivneess (TLF) has been received by 486,300 borrowers from FY2009 through FY2024. That’s an average of $8,542 per borrower.

The average per borrower has increased from $7,963 in FY2009 to $10,238 in FY2023 and $9,681 in FY2024.

It’s important to note that many teachers benefit from PSLF, and you cannot “double-dip” benefits (though the can be earned sequentially).

Borrower Defense To Repayment Discharges

The Borrower Defense to Repayment Discharge cancels a borrower’s federal student loan debt if their college engaged in fraud or false and misleading information concerning the college’s educational programs, charges or employability of graduates. The fraud must have affected the student’s decision to enroll in the college or borrow federal student loans. In addition to discharging the borrower’s remaining federal student loan debt, the borrower will receive a refund of loan payments they have already made.

Data provided by the U.S. Department of Education in response to a FOIA request shows that 22% of borrower defense claims involve public or private non-profit colleges and 78% involve private for-profit colleges. The approval rate for borrower defense claims is 50% for private non-profit colleges and 23% for private for-profit colleges.

The U.S. Department of Education has also published a list of 3,379 colleges (Excel File) as of June 30, 2025 that have received a total of 979,580 borrower defense to repayment complaints. Only 5% of the complaints have been denied or closed, but 47% are still pending.

The top 25 colleges received 46% of the complaints. 88% of the top 25 colleges are for-profit.

The complaints tend to parallel the geographic distribution of college students, with 13% of the complaints concerning California colleges, 9% Florida colleges, 9% Texas colleges, 6% Georgia colleges, 5% Illinois colleges, and 4% Ohio colleges.

The average amount discharged is an estimated $23,000 per borrower.

Closed School Discharges

The Automatic Closed School Discharge report (Excel File), which was last updated in June 2022, reports a cumulative total of 153,100 borrowers eligible for discharge of $1,889,800,000 in student loans due to attendance at a school that closed. About 5% of the discharges were still pending.

The average amount discharged was $12,344 per borrower.

Death And Disability Discharges

Based on data from the federal budget, death and disability discharges represent an estimated 0.7% to 1.3% of outstanding federal student loan debt each year. That’s roughly $1.6 billion in student loans cancelled each year due to death or total and permanent disability.

Total and permanent disability discharge processing has experienced delays in 2025 due to system upgrades, so the data from earlier this year may be skewed.

Impact Of OBBBA On Student Loan Forgiveness

The OBBBA legislation has made several changes that will reduce the amount of student loan forgiveness.

- The legislation affects Public Service Loan Forgiveness (PSLF) by replacing the four income-driven repayment plans with just one. The new Repayment Assistance Plan (RAP) has higher payments than under the SAVE repayment plan, which has been repealed. Payments under RAP may be lower than under Income-Based Repayment (IBR) for low- and moderate-income borrowers, but the payments are higher for borrowers with income over about $75,000. You can see a full RAP vs. IBR breakdown here.

- The RAP plan forgives the remaining debt after 30 years of payments, longer than the 20 or 25 years required for forgiveness under IBR.

- Borrowers of Parent PLUS loans are not eligible for the RAP plan, which effectively ends the eligibility for PSLF for new parent borrowers.

- The legislation repeals the Grad PLUS loan. The Grad PLUS loan had an annual limit up to the full cost of attendance minus other aid received, with no aggregate limits. Although the legislation compensates by increasing the aggregate Federal Direct Stafford loan limits for graduate students and professional school students, these limits are low enough that they may shift some borrowing from federal student loans to private student loans. Private student loans are ineligible for loan forgiveness.

- The legislation delays the effective date of the 2022 Borrower Defense to Repayment regulations and closed school discharge provisions, thereby reverting to previous, more restrictive rules for new loans.

In addition, the Trump administration has temporarily paused IBR forgiveness and has created a backlog for processing IDR Plan Request forms and PSLF Buyback Option application forms.

The Trump administration has also proposed changing the definition of qualifying employer for PSLF to exclude employers that engage in a “substantial illegal purpose” even if the employer is a government agency or 501(c)(3) non-profit organization. These changes could further limit student loan forgiveness.

Don’t Miss These Other Stories:

Editor: Robert Farrington

The post How Much Student Loan Debt Is Actually Forgiven? appeared first on The College Investor.