Are you one of the NRI’s who wants to know if you should invest your money in India and how to do it? Then this article is a good place to start with.

There are close to 3 crores NRI’s and PIO from India in different parts of the world, however, this post is mainly for those NRI investors who go out of India for 2-10 yrs and will mostly return back after few years of work.

Generally, there is a perception that NRI’s make a lot of money outside India as they are paid in Dollars and Dirhams! While this is true in general, one can’t deny that their expenses are also high and their life out of India is challenging as it’s a different city, culture, and environment overall.

NRI’s earn well, spend well and in most cases also “save” a decent amount of money every month. Even if one some is saving $2,000 in USA it’s close to 1.5 lacs a month after all. So the first challenge is to “save” money while you are NRI and the second one is to invest it properly and manage it well, especially if you are have limited time in your hands as an NRI.

What a person can save in India in 5 yrs, many NRIs can do that in just 1 yr – which means that if an NRI plans well – he/she can do financially very well in 8-10 yrs and come back to India semi-retired or fully retired.

In this article, we are just going to do some conversation regarding the various options available to NRI’s for investments and why they should choose India for their investment purpose. I will not cover too many technical rules or aspects related to investments in this article and will keep it quite too the point.

Which bank account to use – NRE or NRO?

A lot of NRI’s keep using their saving bank account for many years, without realizing that it’s illegal. The moment you become an NRI, one needs to convert their savings bank account to NRE or an NRO account. Or one can open a new NRE/NRO account if needed.

NRE account is a bank account where the money is full repatriable – which means that you will be able to take out all the money back from the NRE account and use it in a country where you are residing. It’s an account where you can deposit both your foreign and Indian income.

On the other hand, the NRO bank account is only partially repatriable and you can only deposit your Indian income in this account.

So depending on your situation and income type, you need to open these accounts. One can have any number of NRE/NRO accounts if required. There are too many aspects you need to consider between NRE / NRO account, which is explained in the table below

[su_table responsive=”yes”]

| Comparison | NRE Account | NRO Account |

| Income can be Deposited | Foreign earnings and Indian Earnings | Only Indian Earnings |

| Meaning | Tax-Free | Taxable |

| Repatriability | Fully Repatriable | Partial (interest fully and principle within set limits) |

| Joint Account | Can be opened by 2 NRI’s | Can be opened by an NRI along with another resident or NRI’s |

| Deposits and Withdrawals | Can deposit in foreign currency, and withdraw in Indian currency | Can deposit in foreign as well as Indian currency, and withdraw in Indian currency |

[/su_table]

Click here to learn more about NRI investment services by Jagoinvestor

4 reasons why NRI’s should invest in India?

Should you be investing your money in the country where you are residing or in India? Does it make sense to earn and stay in the US or the Middle East, but invest all that money in India? Many NRIs are confused about this, so I will just give you 4 small points which you should be aware about.

Reason #1 – India is one the fastest growing and a stable Economy

Note that India is one of the fastest major economy and quite a stable country compared to many others where NRI’s live. It’s important to make sure that your money is invested in the country which is stable enough. On top of that, you also help in growing the foreign exchange of your country.

Reason #2 – High-Interest Rates

Compared to many developed economies, the interest rates or “returns” you can get in India is quite good. Japan has negative interest rates and the US has not more than 2-3%. Many NRI investors make the mistake of keeping too much money in the bank accounts outside India and earn very little interest rates.

Reason #3 – Because you understand the investments in India

There is a high probability that you already understand various Indian investments options and financial products. Also, you will never fear what happens to your money because there is a sense of familiarity with India’s markets and financial ecosystem.

Reason #4 – Mostly you will be back to India

A vast majority of NRIs return back to India after working for a few years outside and finally use all their investments back in India. That’s one strong reason why you should invest a major part of your money in India itself.

I don’t mean to say that no investment products outside India are better than Indian financial products. There will surely be options which can be looked at, please do that in case you feel you want to.

What options do NRI have for investments in India

Quickly, let’s see what various options are where NRI’s can put their money for short – long term. This is not a guide which will give you very detailed information, but a quick commentary of what the option is all about.

#1 – Bank NRE Deposits

Bank NRE deposits are one of the wonderful choices an NRI can make. The interest you earn on NRE deposits is tax-free and it’s a simple product that gives you decent risk-free returns. You can choose the NRE deposits for some part of your investments if you don’t want to complicate things and are investing for less than 5 yrs.

Many NRIs take a loan from the local banks at low-interest rates and invest in NRE deposits and earn the margin. See if this is a profitable thing to do in your case of not.

#2 – Real Estate

One the hot favorite for NRIs is real estate in India. Real estate investments require big-ticket investments and many NRI’s have that. Even if you are buying a flat or land on installments, it works well for NRI’s are they have a big disposable income per month. One of my close friends also invested in the Hiranandani project in Bangalore by making a down payment because they knew that the installments to be paid will be easy on the pocket with NRI income.

The only negative side is that many NRIs choose real estate just based on the limited information sitting outside India or in a hurried manner. So make sure you take your time in researching the property and take decisions slowly. As it’s a high ticket transaction, its highly recommended to hire a real estate lawyer, pay them fees and get all the work done like title search, property inquiry. If needed go with a real estate broker who can manage everything for you!.

One more thing NRI should know is that they are allowed to only buy residential or commercial real estate, but not agricultural properties.

#3 – Insurance Policies

There are many Insurance policies (which are actually investment polices) that are marketed well for NRIs. These, in my opinion, are to be carefully chosen as many traditional products can turn out to be dud investments and a very bad choice of long term investments. Some ULIP’s in the market have got reintroduced with lower charges and much better structure – so please choose them after a lot of studies and only for the long term.

I would strictly advise against traditional investment option which does not have exposure to equity in them because they are not better than normal NRE deposits.

NRI’s can and should buy the pure insurance policy (term insurance) if they require it.

#4 – Direct Equity

Direct equity is a good choice for NRI investors, provided they know the equity game and are able to pick the right stocks with proper research (either on their own or on someone’s advice). Make sure you do not over diversify your stock portfolio, because with too much money you may go on a shopping spree, which will make your portfolio very complex and with bad stocks.

If you want to do equity and want to take high risk, you can also look at PMS. If you want help in PMS, our team can help you out with that. Note that in order to invest in equity, an NRI needs a PIS permission (portfolio investment scheme). These are generally done by your broker or trading account provider and you don’t have to worry about it.

#5 – Mutual Funds

Mutual funds are quite hot these days among NRI’s and it surely is one of the best choices for investments, provided you have proper guidance about it.

In Mutual funds, you have two choices – Equity mutual funds and Debt Mutual funds.

Equity mutual funds are long term financial products that can deliver extremely good returns if managed well. Those who are ok with volatility in their portfolio and want very tax optimized inflation-beating returns for their long term goals, for those NRI’s mutual funds are a very good choice.

Even Debt mutual funds are a very good choice for those NRI’s who do not want to get into equity risk and want alternatives to bank deposits and bonds. Debt mutual funds are quite a good option even taxation wise if you are ready to invest for more than 3 yrs.

[su_table responsive=”yes” alternate=”no”]

| Taxation | Equity Mutual funds | Debt Mutual funds |

| Short Term Capital Gain (STCG) (Before 1 yr) | Taxable @ 15% | Taxable as per Income tax slab rate |

| Long Term Capital Gain (LTCG) (After 1 yr) | Taxable @ 10% where LTCG>1 lakh (No indexation benefit) | Taxable @ 10% without indexation or 20% with indexation |

[/su_table]

NRI’s from USA and Canada can also invest in mutual funds, but only with some limited mutual fund houses due to FATCA compliance. Here is a detailed guide on NRI’s investments in mutual funds

We at Jagoinvestor manage more than 140 NRI families’ investments in mutual funds. If you want to explore what we have to offer, please do let us know by clicking here and schedule a phone call with us.

#6 – Bonds and NCD

NRI’s can also invest in various bonds and NCD’s which are issued from time to time. These instruments have fixed interest which you can get every year credited in a bank account and you get your principle on maturity. The liquidity has to be compromised in these instruments as getting out of these before maturity becomes very tough even if these are tradable in the secondary market.

#7 – PPF

PPF is a choice for those NRI investors who already had it opened while they were in India because an NRI can’t open a fresh PPF account. Also, PPF is going to be a limited time product as one can’t be extended beyond 15 yrs.

#8 – NPS

NPS is another choice for your long term investments if one wants equity exposure in their portfolio, and pension benefits embedded into the product itself. Only NRI’s who are Indian citizens can invest in NPS. PIO and OCI are not eligible for opening the NPS account. In NPS, you get choices between equity investments, govt securities, and other fixed-income instruments.

Note that in NPS your savings get locked in till your retirement and only after that you get a part in a lump sum and rest is used for a pension. So choose NPS if you are very clear that your retirement is going to be in India.

KYC compliance and taxation For NRI’s

Note that once you become an NRI, there are lots of compliance which has to be followed by you. There are limits on where you can invest and where you can’t? Even the taxation for NRI’s is different and rules regarding TDS are different. We are not going into detail in this article regarding this as its out of scope.

How to avoid double taxation for NRI investments?

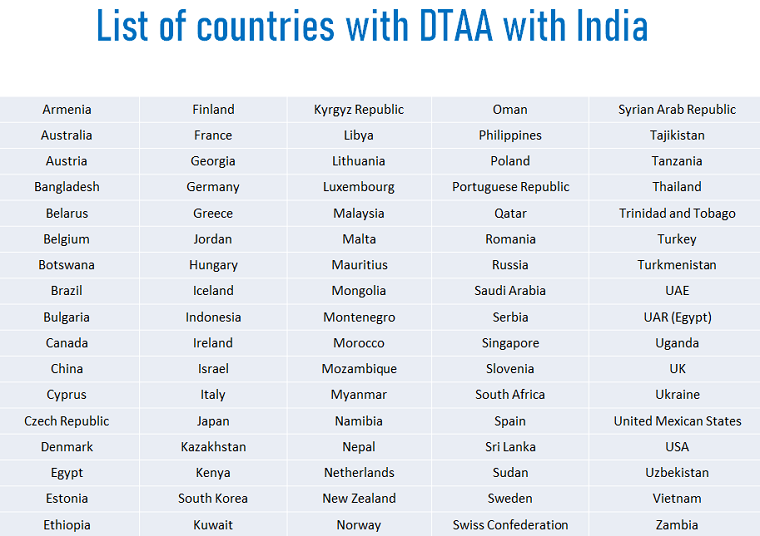

A lot of countries have DTAA agreements (double taxation avoidance agreement with India. In the case of NRIs – one can avoid paying double taxes in country of residence and India due to these agreements. You can get an equivalent deduction if DTAA exists between both countries.

Let me give you an example – In USA, a person has to pay the income tax on global income, so if an NRI has Rs 1 crore of FD in India they will pay the tax in India as well as in USA, but because of DTAA they will be avoiding it. There is paper work involved here, but you can surely save the double taxes.

When should an NRI invest outside India?

While India is a great place to invest for NRI’s overall, there may be certain life situations and some cases where investing in the country where you are working may be a good idea. There may be certain countries that might also be offering similar or better interest rates and returns compared to India. However, makes sure you consider the safety and return of your capital while you are investing along with tax to be paid.

Do let us know if you have any more questions related to NRI’s investments in India? Share your questions in the comments section.