Multimillionaire cryptocurrency trader James Wynn returned despite numerous previous liquidations, signaling renewed confidence in Bitcoin’s near-term upside momentum.

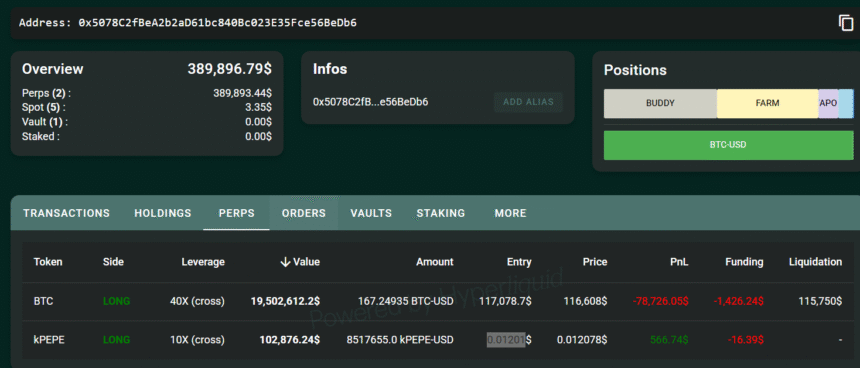

Wynn returned with two new leveraged positions, including a 40x leveraged Bitcoin (BTC) long position worth over $19.5 million at $117,000, which could be liquidated if the price fell below $115,750. Wynn has already incurred $1.4 million worth of funding fees to maintain the position, which has a current unrealized profit of $78,000.

Wynn’s second position is a 10x leveraged long on the popular Pepe (PEPE) memecoin, worth over $102,000, was opened at $0.01201, but the position’s liquidation price remains unknown, according to blockchain data from Hypurrscan.

Wynn rose to popularity among crypto enthusiasts at the end of May, after his first leveraged $100 million position was liquidated on May 30, when BTC briefly dipped below a 10-day low of $105,000.

The pseudonymous trader opened a second leveraged $100 million Bitcoin bet on June 3, before he was liquidated and lost nearly $25 million on June 5, Cointelegraph reported.

Related: Bitcoin flips Amazon’s $2.3T market cap to become 5th global asset

After opening his second $100 million leveraged Bitcoin position, Wynn claimed that his liquidation level is being deliberately targeted by orchestrated efforts from major market participants.

“They’re coming for me again,” wrote Wynn, disclosing his previous liquidation level in a June 2 X post. “Don’t let these evil bastards liquidate me,” he added.

Related: Grayscale submits confidential IPO filing with SEC

Leveraged positions use borrowed money to increase the size of an investment, which can boost the size of both gains and losses, making leveraged trading riskier compared to regular investment positions.

Illustrating its heightened risks, a crypto whale was liquidated for over $308 million on a 50x leveraged position in March, when Ether’s (ETH) price fell below its liquidation price of $1,877.

Market makers are “out of gun powder,” says Wynn

During his previous leveraged Bitcoin bets, Wynn said that crypto market makers were carrying out organized efforts to crash Bitcoin’s price below his liquidation level.

“Beautiful timing for a 40x long,” wrote Wynn in an X post on Tuesday.

“Never financial advice of course. But the MM’s are out of gun powder,” added Wynn after opening his latest leveraged positions.

Still, not all traders are betting on Bitcoin’s upside. Popular trader Qwatio opened a 40x leveraged short position worth over $2.3 million, which effectively bets on Bitcoin’s price decline, according to Hyperdash data shared by blockchain analyst EmberCN.

Qwatio was previously liquidated eight times within a week, losing a total of $12.5 million across its leveraged positions, Cointelegraph reported on June 30.

PEPE has also dipped more than 3% over the past 24 hours, according to CoinMarketCap, but appears to be recovering.

Magazine: Baby boomers worth $79T are finally getting on board with Bitcoin