In the delicate balancing act between meeting the rising global demand for critical minerals and ensuring environmental responsibility in resource extraction, processes and technologies that can achieve both aims are winning in the eyes of junior explorers and investors.

In copper mining, in-situ recovery (ISR) is emerging as a cost-efficient and lower-impact alternative to open-pit and underground mining. ISR is a mining method that extracts copper directly from orebodies without traditional excavation. Projects that are amenable to the ISR process, which involves injecting a leaching solution into the ground and recovering dissolved copper through wells, are attracting growing interest from miners and investors alike.

This shift comes as the global push for electrification accelerates copper demand across industries — from electric vehicles and solar power to grid expansion and data infrastructure. Traditional copper mines, often burdened by rising costs, deeper orebodies and environmental opposition, are struggling to meet this demand.

With reduced capital requirement, minimal surface disruption and quicker permitting timelines, ISR represents a scalable and ESG-aligned approach to copper extraction. Active projects in the US and Central Asia are already demonstrating ISR’s feasibility, and exploration is expanding into new regions where the geology is suitable.

ISR gains momentum

One of the most compelling reasons ISR is drawing investor interest is its potential to solve several longstanding issues in copper mining. Traditional mines are facing higher costs as they chase deeper and more complex orebodies. At the same time, environmental and social opposition to disruptive mining practices is on the rise. ISR, by comparison, generates less visual and physical disturbance, often making it more palatable to regulators and communities.

ISR also offers scalability and flexibility. In regions where suitable geology exists, it enables smaller companies to bring projects online faster and with fewer permitting delays.

In the current market, where supply chain pressures and copper scarcity are top of mind, the ability to deploy a lower-cost extraction method with fewer environmental risks presents a strong value proposition.

Several ISR copper projects have already demonstrated commercial and technical viability. In the US, the Florence copper project in Arizona, operated by Taseko Mines (TSX:TKO,NYSEAMERICAN:TGB), is advancing toward production with an estimated 85 million pounds of annual copper output and a pre-tax net present value of more than $1 billion.

Gunnison Copper’s (TSX:MIN,OTCQB:GCUMF) Gunnison copper project, also in Arizona, has completed permitting and begun phased implementation with minimal surface impact. Similar ISR applications are being tested in Kazakhstan and Chile, expanding the global footprint of this technology.

ISR-amenable geology

Not every copper deposit is suited for ISR.

Success depends on a specific set of geological and hydrogeological conditions. The ore must be permeable enough to allow the leaching solution to flow and interact with copper minerals. It should ideally be located below the water table in a contained setting, reducing the risk of solution migration outside the target zone. Mineralogy matters too; minerals like chalcocite, which are highly amenable to acid leaching, make the best candidates.

Regions like Arizona and parts of Central Asia have long been recognised for these attributes. Now, new ISR frontiers are emerging in Africa, where countries such as Botswana offer favorable geology and a stable mining jurisdiction. Botswana’s Kalahari Copper Belt, in particular, is rapidly attracting exploration interest for its sediment-hosted copper systems and untapped ISR potential.

Cobre Limited: Pioneering ISR in the Kalahari Copper Belt

One of the most promising ISR prospects in Botswana is being developed by Cobre Limited (ASX:CBE), an ASX-listed junior explorer with a strategic footprint in the Kalahari Copper Belt. Through its flagship Ngami copper project, Cobre is positioning itself as a first mover in ISR development across the region.

The Ngami deposit meets key ISR criteria. Metallurgical testing has confirmed that its copper-silver mineralisation — primarily fine-grained chalcocite — is highly suitable for acid leaching. Fracture mapping and pump tests have demonstrated that the orebody is permeable, with strong fluid connectivity and competent bounding rock that can contain solution flow. Most of the ore lies below the water table, an essential condition for effective in-situ leaching.

“Our goal is to bring a scalable, low-impact copper project to life in Botswana, using cutting-edge ISR technology. This isn’t just about producing copper — it’s about doing it smarter and more sustainably,” said CEO Adam Wooldridge.

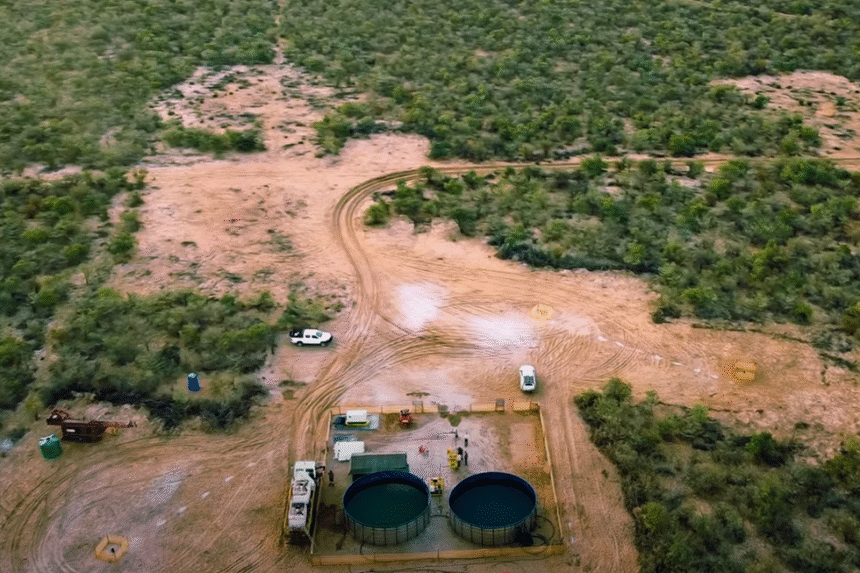

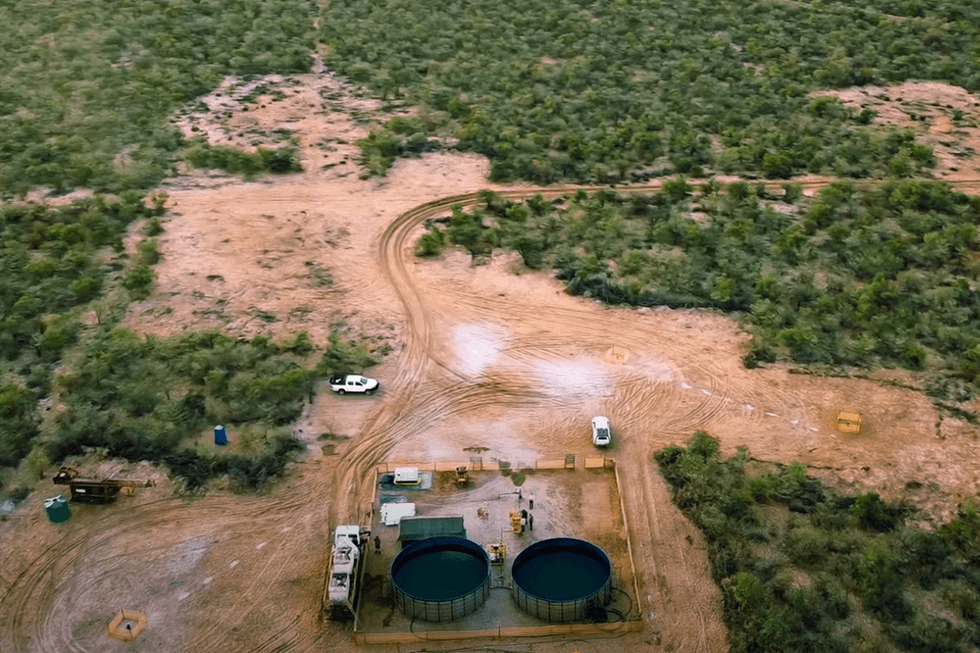

The company has already completed injection and pumping tests, simulating fluid movement between wells to build a three-dimensional model of the orebody’s hydrology. Initial results indicate excellent permeability and fluid flow characteristics. Bottle roll tests have yielded copper recoveries as high as 90.7 percent, with low reagent consumption. In addition, long-term leach box tests designed to simulate the in-situ environment have been successfully completed with recoveries of up to 82 percent copper.

The company is backing this technical progress with a comprehensive exploration and development strategy. It has outlined a significant exploration target, recently completed infill drilling to upgrade parts of the resource into the JORC category, and is pursuing engineering and financial modeling to support future feasibility studies.

These milestones, coupled with an earn-in agreement with mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP), strengthen Cobre’s position as a credible ISR innovator in the African region.

Investor takeaway

Cobre’s ISR approach reflects the broader trend of aligning mineral extraction with ESG principles. By minimising land disturbance, using water-efficient systems and reducing surface infrastructure, ISR fits well into modern sustainability frameworks. In Botswana — a country ranked among the top 10 mining jurisdictions, globally — Cobre is also benefiting from strong institutional support and a clear regulatory environment.

As copper demand continues to outpace traditional supply growth, in-situ copper recovery offers a timely and compelling alternative. For investors seeking exposure to scalable, ESG-conscious mining opportunities, ISR is no longer just an experimental method; it is a practical solution with growing momentum.

This INNspired article is sponsored by Cobre Limited (ASX:CBE). This INNspired article provides information which was sourced by the Investing News Network (INN) and approved by Cobre Limited in order to help investors learn more about the company. Cobre Limited is a client of INN. The company’s campaign fees pay for INN to create and update this INNspired article.

This INNspired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Cobre Limited and seek advice from a qualified investment advisor.