There is significantly less portfolio overlap among active Smallcap Funds than among Largecap funds.

One of the reasons for this might be that, given the very nature of the small-cap space, there are numerous different styles/strategies that different fund managers adopt to (potentially) generate alpha. Also, unlike the largecap space (which is limited to top-100 stocks), the universe of stocks available for picking smallcaps is pretty large.

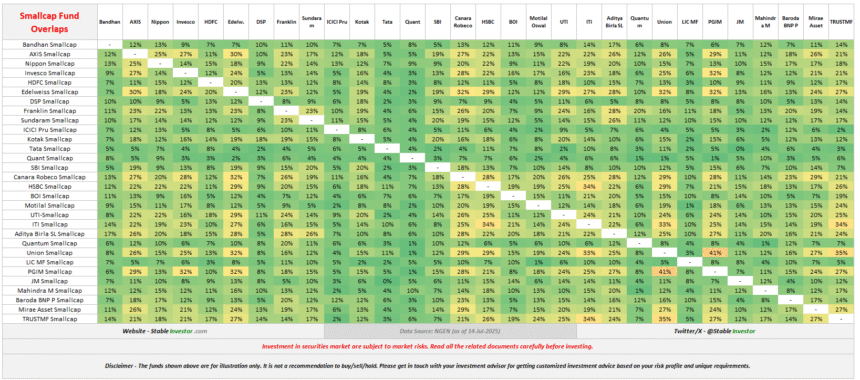

Have a look at the table below to see the overlap amongst the Smallcap funds:

(Please download the images to view better. There are too many funds, and hence, this complicates the table and increases its size).

If you have a reasonably large portfolio with not-so-small allocation to smallcaps, then it’s better to invest in more than one smallcap fund to diversify a bit (given low overlaps and availability of different styles). Also, because this helps reduce the risk of being in the worst fund in the category to some extent. And picking the right fund (or avoiding the bad ones) is very, very important in the smallcap space in the long term, as is quite visible in the table below comparing 3, 5, and 7 year returns for all the active smallcap funds:

Note – The Smallcap funds look extremely tempting if you look at their returns after a few good years. But everyone should not be investing in smallcap funds. This is because everyone’s risk appetite is not suited for the risk-return profile of smallcaps.

I also feel that, in general, it is okay to pick active funds in smallcap space rather than passive ones, given the potential (and reasonably reliable past data) of active smallcap funds in delivering benchmark-beating and desirable investment outcomes.

But in the largecap space, it won’t be wrong to simply pick passive largecap funds based on Nifty50, Nifty100 (and/or mix them in some weightage with Next50 too) instead of trying to guess the next best active largecap fund.

And since we are talking about overlaps, for completeness, let’s have a look at the overlaps among the active largecaps funds too:

There is almost no reason to invest in more than one active largecap fund. There is just way too much overlap and index hugging in general. So, as I have said many times earlier, too, it is sufficient to invest in pure passive funds for your largecap exposure.

Related Reading:

Please note – Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

Disclaimer – The funds shown above are for illustration only. It is not a recommendation to buy/sell/hold. Please get in touch with your investment advisor for customised investment advice based on your risk profile and unique requirements.