Leading gold analysis firm Metals Focus published its annual Precious Metals Investment Focus report on Saturday (October 25).

The report outlines the investment options available for those interested in leveraging rising demand for precious metals such as gold and silver. The report also highlights key supply and demand trends shaping the precious metals market and driving prices now and over the next 12 months.

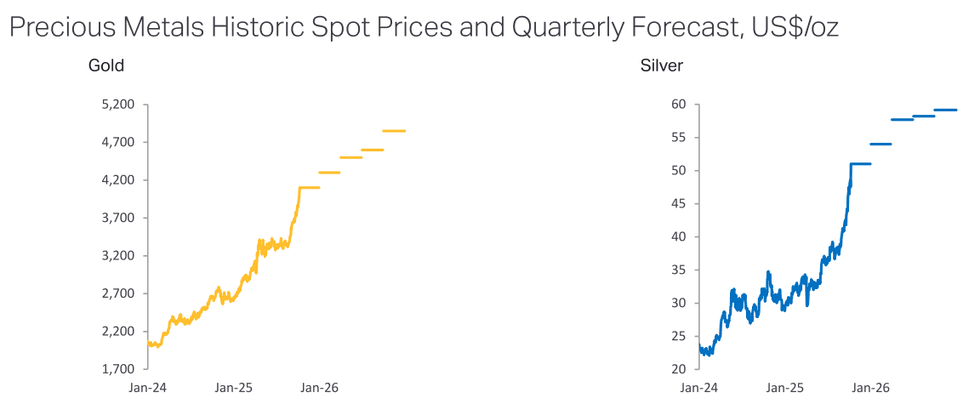

Gold surged more than 65 percent from the start of 2025 to its record high of US$4,379.13 per ounce on October 17. Not to be outdone, silver skyrocketed by more than 88 percent to peak at its highest-ever price of US$54.47 per ounce on the same day.

Although prices for both precious metals have since pulled back on profit-taking, Metals Focus believes the conditions that created these record high prices are still very much in play.

US trade policy driving gold prices in 2025

Metals Focus analysts attribute gold’s stellar performance in 2025 to a number of factors largely centered on growing global economic uncertainty and ongoing geopolitical conflicts. Gold’s safe haven status is highly favored in these conditions, attracting both retail and institutional investors as well as central banks.

However, the firm sees US President Donald Trump’s trade policies as the most influential: “In our view, the single most important factor has been uncertainty around US trade policy.”

Trump’s constant trade war waffling has businesses and governments scrambling to keep up and unable to plan for the future. As tariffs increase the price of goods while disrupting supply chains, inflation is becoming stickier. This is baking in more macroeconomic risks into the global economy, and in turn raising the risk for stagflation—an ideal environment for higher gold prices.

The Federal Reserve’s reversal of its monetary policy in mid-September 2025 with its first interest rate cut and the anticipation of further rate cuts to come are further boosting the gold price. The sustainability of growing US debt and the waning strength of the US dollar on the global stage are also price supporting factors for the yellow metal.

Central bank gold buying, which has reached record levels in recent years, also continued to be net positive in 2025, further driving demand. “Put together, these drivers explain why gold has not only reached fresh highs in 2025, but also why pullbacks have been shallow and short-lived, as investors have been rushing to buy dips,” states Metals Focus.

Silver shoots up on liquidity squeeze

The same forces sending gold prices to new heights are also bringing silver along for the ride.

Silver often lags behind its sister metal, and this latest price cycle was no exception. However, investor belief that silver remains undervalued given strong industrial demand and unprecedented tight supply finally pushed the metal to break on through to the other side of a 45-year record high.

Metals Focus also points to the liquidity squeeze in the silver futures market, specifically concerning the COMEX in London. As the immediate supply of silver has not been enough to meet rising demand, the spot price for silver has risen higher than the price of futures contracts, a phenomenon known as backwardation. This creates a squeeze on short sellers who must now buy back silver contracts at higher prices.

The situation amplified silver’s rally in early to mid-October. However, later in the month shipments of silver from New York and China helped to alleviate this pressure.

Gold price outlook for 2026

Looking forward, the trends underlying much of gold’s record-breaking price momentum are expected to remain strong well into next year.

Metals Focus sees the price of gold posting another annual average high of US$4,560 per ounce as it heads toward US$5,000 in 2026, potentially reaching a record US$4,850 in the fourth quarter.

These gains in gold are projected to materialize despite supply side growth. Metals Focus is forecasting a surplus of 41.9 million ounces in 2026, up 28 percent year-over-year. The firm sees gold mine production reaching another record high in 2026 at the same time that gold recycling could climb by 6 percent to a 14-year high in jewellery demand is likely to be affected by high prices, low consumer confidence, and economic uncertainty.

What will move gold prices higher in 2026?

Gold investors should take cues from interest rate moves, inflation levels, strength or weakness in the US dollar and sentiment surrounding the independence of the Federal Reserve. Of course, US trade policy will continue to be a main theme for precious metals over the next 12 months.

“As we have witnessed since the beginning of the Trump 2.0 administration, the abrupt and often unpredictable nature of US policy moves and the resulting uncertainty for the global trade system, and in turn the global economy, is expected to be a key driver of sentiment towards gold,” stated the firm.

Further driving demand, central banks around the world are expected to remain net buyers of safe-haven gold as the global push toward de-dollarization continues.

Silver price outlook for 2026

As for silver, the white metal will continue to be seen as a more affordable alternative to gold. Metals Focus is looking for silver to average US$57 per ounce next year and even take a run at the US$60 level in mid-to-late 2026.

Silver has not only benefitted from safe-haven investor demand and strong industrial demand but also tight supply. Yet, the firm notes that the ongoing supply deficit for silver is expected to fall from 143.6 million ounces in 2024 to 63.4 million ounces in 2025. That figure is expected to shrink further to 30.5 million ounces in 2026.

Nevertheless, the silver market remains in a supply deficit at a time when demand is strong. “We therefore remain bullish towards silver for the rest of this year and 2026,” noted the report’s authors, who expect silver to continue outperforming gold at least in the first half of the new year.

In response, the gold:silver ratio has the potential to continue falling in 2026. However, Metals Focus believes the market will see this trend reverse in the back half of the year as silver loses some steam.

Investor takeaway

Overall, Metal Focus is confident the precious metals bull market will continue throughout the remainder of 2025 and into 2026. Gold is especially benefitting from its safe-haven status at a time of heightened macroeconomic and geopolitical uncertainty. Silver is tracking gold’s ascent for the same reasons, in addition to tight above ground supply and sustained industrial demand.

For those who think they’ve missed out on the gains to be made in this latest precious metals bull cycle, there’s still plenty of upside to be had in the gold and silver markets in Q4 2025 and heading into 2026.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, currently hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web