The gold price has been on the rise in 2025 as a slew of factors work in its favor.

Central bank buying has long been a key point of support, as has escalating conflict in the Middle East and elsewhere. A newer addition is tariff tensions as the Trump administration fleshes out trade policies.

The gold price has benefited from safe-haven demand amid the turmoil, but concerns that the yellow metal itself might face tariffs have also impacted the sector as industry insiders react to uncertainty.

Read on to learn how tariffs have affected the gold market and price so far.

How have tariffs affected the gold price?

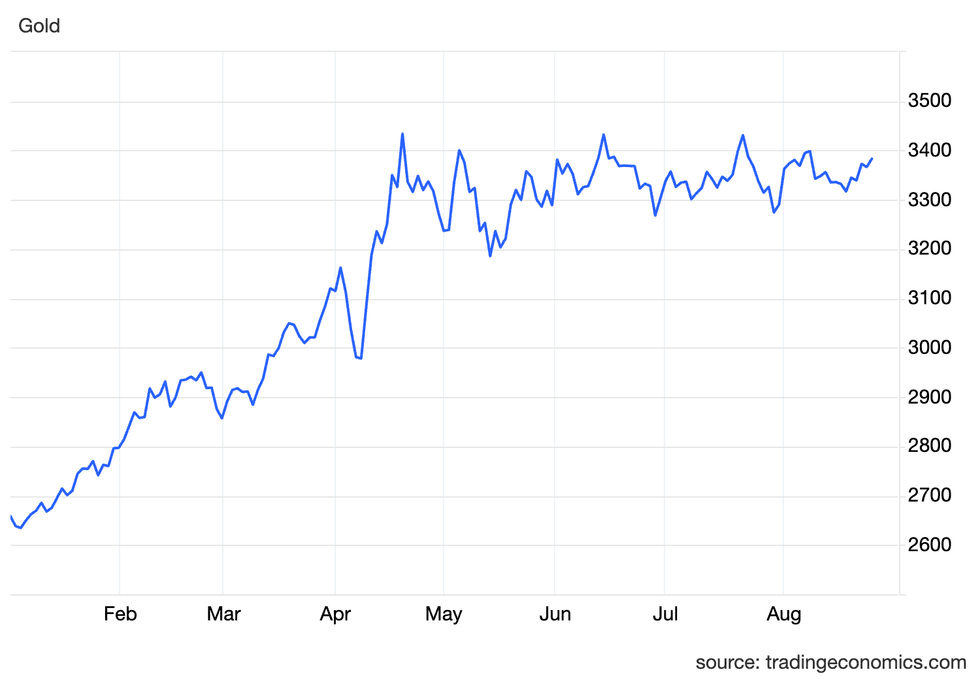

The gold price has been on the rise since the beginning of the year. After briefly touching the US$3,500 per ounce level in May, it has pulled back and was trading just under US$3,400 as of Tuesday (August 26).

Gold price, January 1 to August 26, 2025.

Chart via TradingEconomics.

Although some of its increase is attributable to the points mentioned above, a significant portion is owed to a lack of information surrounding US President Donald Trump’s tariff policies.

Initially there was no clarity on what or who was being tariffed, or when the levies would ultimately be implemented, and investors started to move into gold for greater stability and portfolio diversification.

Uncertainty about whether gold would be tariffed also had an effect, prompting traders in the US to import physical gold; this created a price differential between New York futures and the London spot price.

Concerns dissipated as the Trump administration began to nail down tariffs, but were reignited once again when US Customs and Border Patrol posted a ruling on July 31 indicating that the 39 percent tariffs against imports from Switzerland would include 1 kilogram and 100 ounce gold bars.

The news caused spot gold to spike more than 3 percent, from US$3,290 to US$3,398, and sent December futures to an all-time high of US$3,549. Meanwhile, traders halted imports of Swiss bars.

After several days of turmoil, Trump said the ruling was incorrect, and the bars would not be included in the tariff measures being applied to other Swiss imports; the gold price then retreated.

How would gold tariffs have impacted the market?

Gold functions as both a commodity and an essential part of the world’s financial system.

One kilogram and 100 ounce gold bars are used to back futures trading, and regular shipments of the metal are needed to settle contracts once they come due. A 39 percent tariff on gold from Switzerland would have been particularly disruptive, as Swiss refineries account for approximately 70 percent of the world’s gold.

According to the UN Comtrade database, in 2024, Switzerland exported more than 1,400 metric tons of unwrought gold worth more than US$106 billion, representing nearly 30 percent of the country’s total exports. Tariffs would have forced US buyers to pay a significant premium for the precious metal versus buyers in London or Shanghai.

Because gold is often used as a store of value in times of uncertainty, any kind of disruption could have had broader implications for investors looking to add stability to their portfolios.

In an email to the Investing News Network (INN), Lauren Saidel-Baker, CFA, an economist with ITR Economics, explained that gold stands out as a unique investment mechanism:

“There are psychological nuances to gold, which is commonly viewed as a safe store of value during uncertain times and an inflation hedge. Overall, the tariff would have added another facet to the already elevated policy uncertainty.”

If the tariffs had remained in place, the US gold price would have had to rise to around US$4,700 per ounce to cover levies, while international prices would have remained closer to the US$3,500 mark.

“Tariffs have already complicated supply chains across industries, and this gold tariff would have been another example of added cost and complexity — but in this case, one with the potential to more directly impact investment activities,” Saidel-Baker went on to explain, emphasizing that US investors would have felt the pinch.

Could gold tariffs happen in the future?

Given Trump’s unpredictability, especially when it comes to tariffs, it’s possible that gold levies could enter the conversation again. However, by and large experts agree that the matter is closed.

“I think it’s pretty clear at this point that there’s no intention to put tariffs on physical gold imports, and I think that would be very damaging and destructive if they did,” Stefan Gleason, CEO of Money Metals, told INN.

Keith Weiner, founder and CEO of Monetary Metals, offered another perspective, saying that although the gold tariff threat is over, the tumult could have long-term effects on the market.

“Once you’ve put the scare into everybody, you can’t just say, ‘Oh, sorry, just kidding.’ You can’t really do that. And so now we’ve done damage, and we’ll see what happens to that spread over time. We’ll see how users of the futures market adapt. There are other markets in the world that would be competing for,” he explained.

“This hedging business, you know, maybe it moves to Singapore, maybe it moves to Dubai, maybe it moves to London, and the US loses not only a little more trust, but also a little bit of volume on what had been the biggest — or what is currently the biggest — futures market,” Weiner added to INN.

Market participants will be watching closely for future impacts on the yellow metal.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web