NextSource Materials Inc. (TSX:NEXT)(OTCQB:NSRCF) (“NextSource” or the “Company”) is pleased to announce positive results of a technical and economic study (the “Study”) on the construction of a proposed 30,000 tpa capacity battery anode facility (“BAF”) located in the United Arab Emirates (“UAE”). The Company further announces it has signed an agreement (the “Agreement”) to secure an industrial building in the Industrial City of Abu Dhabi (“ICAD”) and has launched a strategic partner process to consider expressions of interest it has received for funding the UAE BAF.

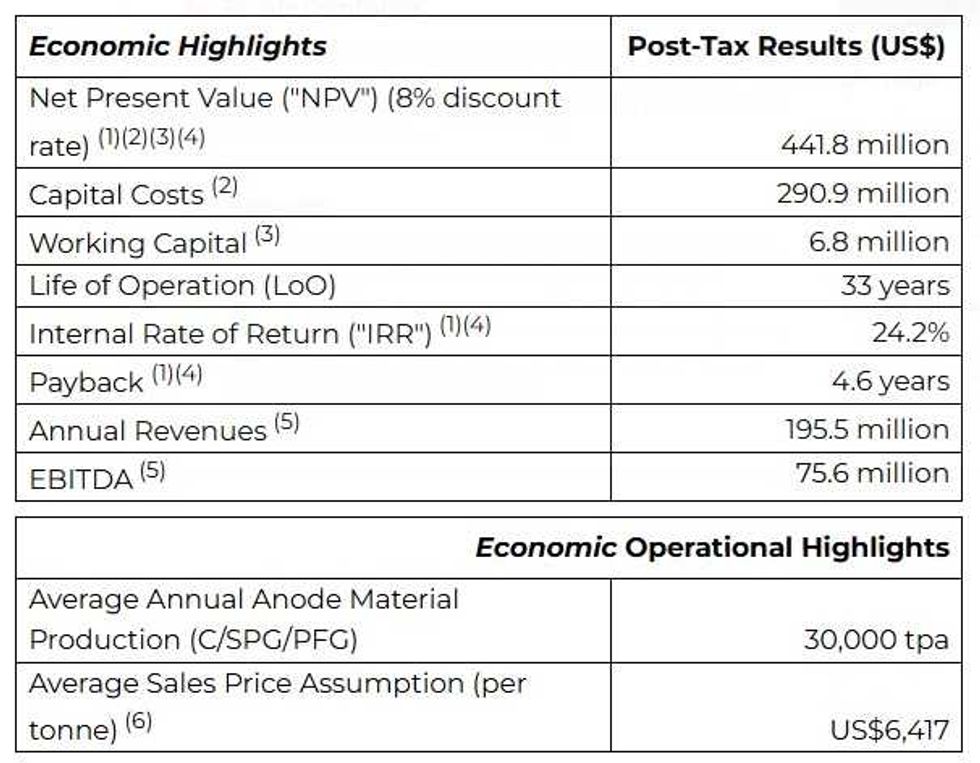

Technical and Economic Study Highlights

- Study confirms total UAE BAF production capacity of 30,000 tonnes per annum (“tpa”) of anode active material (“AAM”), satisfying production demands of existing Mitsubishi Chemical offtake agreement and accommodating future demand growth from new offtake agreements

- Compelling phased-project economics with total capital costs of US$291 million, including sunk costs and working capital of US$7 million, with post-tax NPV8% of US$442 million and an IRR of 24%

- The facility will be developed in two phases, with Phase 1 capital cost of US$150 million delivering AAM production of 14,000 tpa, more than satisfying Mitsubishi Chemical’s intial volume requirements of 9,000 tpa

- Average annual forecasted revenues of US$195 million and annual EBITDA of US$76 million, at full production

- Initial production planned for Q4 2026 with full production rate achieved in early 2028

- Strategic partner process launched: discussions underway with offtake partners and several global debt and equity investors

- Opportunities identified to further enhance the economics with debt funding and/or joint venture partnership

Property Agreement Highlights

- Agreement signed to secure site and existing building in Abu Dhabi, UAE with easy access to process materials, markets, port and logisitcs infrastructure and major international shipping routes

- Allows rapid installation of anode manufacturing equipment, and accelerated delivery of first anode product to Mitsubishi Chemical in 2026

- Offers significant options to expand AAM production capacity to supply additional customers, who are currently engaged in advanced negotiations to secure anode material

This annoucement is a key milestone in the Company’s strategy to achieve full vertical integration by 2027.

The construction of a proposed BAF in the UAE would position NextSource to become the largest anode producer outside of Asia and is part of its global expansion strategy to construct BAFs in key geographic locations, each with modular production capacities, that can be expanded in lockstep with automotive manufacturer (“OEM”) demand.

Stantec, a global engineering service provider and partner firm with NextSource, has completed a preliminary design and produced both a capital and operating cost estimate in line with AACEi guidelines as part of the Study to develop a UAE BAF.

The Study is based on a specific site and existing building that the Company has signed an agreement to secure in the ICAD, a major industrial free zone consisting of an existing, high-quality heavy industrial building requiring minimal modification with a significant land parcel that provides sufficient space to accommodate a 30,000 tpa capacity BAF.

The site and existing building arein an expedited permit zone, where an Environmental Impact Study and Assessment is not required to begin construction, and strategically situated along major international shipping routes and supported by extensive and world-class infrastructure, including local deep-water ports, industrial parks, and commercial free zones. It is immediately adjacent to a wide range of industries, including petrochemicals, refining, manufacturing, and logistics, offering easy access to raw materials, markets, and transportation networks, making the facility an attractive location for the Company to service domestic and international customers.

Site and Building of Proposed 30,000 tpa Natural Graphite Battery Anode Material Processing Facility

Site and Building of Proposed 30,000 tpa Natural Graphite Battery Anode Material Processing Facility

Hanré Rossouw, President and CEO commented,

“Securing our facility in the UAE is a pivotal step in expediting NextSource’s downstream strategy under our offtake agreement with Mitsubishi Chemical Group, and the site’s readiness allows for rapid project execution. The results of our BAF Study confirms our unique position to deliver high-performance graphite anode material at scale, with compelling economics and a clear path to scalable commercial production. This milestone validates our global expansion strategy and reinforces our commitment to supporting the electric vehicle supply chain with vertically integrated, ESG-compliant solutions. We are excited to move forward with our strategic partners and have launched a process with debt and equity investors to unlock the full value of our proprietary technology and feedstock advantage.”

Partnership with Japan’s Mitsubishi Chemical Corporation

As announced on August 5, 2025, NextSource executed a binding, multi-year offtake agreement with Mitsubishi Chemical Corporation (“Mitsubishi”) for the supply of approximately 9,000 tonnes per annum of AAM to the North American electric vehicle (“EV”) market. The Company is the sole supplier of AAM to Mitsubishi and today’s announcement strongly supports the ability to satisfy the offtake agreement and other potential offtakes.

UAE BAF

The UAE BAF will be capable of producing natural graphite AAM for lithium-ion batteries used in EV applications, and serve as a secure, transparent, and fully traceable source of supply for battery and OEM customers, entirely decoupled from existing Chinese supply chains, and a critical alternative for US Government-compliant supply chains. Approximately 35% of the weight of a lithium-ion battery comprises of the anode and at least 95% of the anode is made from graphite, making it the most critical raw material of all battery metals (Benchmark Mineral Intelligence, July 2025).

The Company and Stantec have worked in conjunction with NextSource’s technology partners to develop a UAE-compliant plant design, using proven process technology to reduce qualification times. The Study included an assessment of the process design and equipment, an application of relevant design standards and codes, an analysis of future operational requirements, and an environmental permitting analysis. The facility will be installed in an existing building located in the ICAD and will leverage proven and established anode process technologies currently supplying intermediate anode active material to major OEMs.

Study Results

The proposed production capacity of 30,000 tpa, comprising 10,000 tpa of PFG, 16,000 tpa of SPG, and 4,000 tpa of coated SPG (“CSPG”), accommodates the expected growth of Mitsubishi’s volume requirements beyond the initial 9,000 tpa and the expectation that the Company will secure additional volume capacities with other OEM offtakes. The facility will be developed in two phases, with the initial phase (Phase 1) targeting an annual production capacity of 14,000 tpa of AAM, comprising 10,000 tpa of purified flake graphite (“PFG”) and 4,000 tpa of spherical purified graphite (“SPG”).

Total capital costs are US$291 million, inclusive of US$13 million of sunk costs and working capital of US$7 million, with Phase 1 estimated to cost an initial US$150.2M.

The following presents the economic results of the UAE BAF with a proposed production capacity of 30,000 tpa.

- Assumes Project is financed with 100% equity.

- CAPEX includes process equipment, ancillary civil & infrastructure, electrical and utilities, project and construction services, and contingency of $31.5 million.

- Working capital for first 6 months of operation and raw materials inventory.

- As measured from start of operation and assumes no inflationary adjustments in sales price or operating costs .

- Average over the life of the operation and excludes royalties, taxes, depreciation, and amortization .

- Based on projected contract pricing and Benchmark Minerals Intelligence (BMI) forecast data for flake graphite from Q2 2025. Excludes sales of graphite fines and other by-products.

Note: Unless otherwise noted, all monetary figures presented throughout this press release are expressed in US dollars (USD). Capital cost estimates were prepared by Stantec Inc. to a confidence level of [+/- 25%] and are preliminary in nature. These results should not be relied upon for investment decisions. The BAF Study is not a technical report for the purposes of National Instrument 43-101 but rather is a technical study relating to the design, construction, and operation of the UAE BAF.

Next Steps

The next steps for the Company are to conclude legal documentation and approvals for the land and building acquisition, which will enable the transport of BAF processing equipment to the UAE. In parallel, the Company will finalize the front-end engineering and design in preparation for project execution.

Informed by the outcomes of this Study, the final investment decision and financing options will be considered to advance the project into execution. As part of the strategic partner process, the Company is in active discussions with offtake partners and several debt and equity investors globally that have expressed interest in funding the construction of the UAE BAF.

After obtaining the required funding and concluding operating permits, the Company will procure the remaining plant equipment, after which the Project will move into the installation phase and finally into commissioning, which is targeted towards the end of 2026. The process will also include engagement with KEZAD, the government organization in charge of ICAD, and other regulatory authorities to finalise permitting and approvals required for installation and production.

Stantec has prepared a preliminary site layout and conceptual designs for the Project, integrating the provided vendor equipment designs, partner recommendations, and site constraints. These designs will be further developed and adapted in the future detailed engineering and design phase to incorporate site-specific details. NextSource will engage with regional contractors to provide location-specific operational requirements, legal and regulatory requirements, technical criteria, operational specifications, equipment selection, and mitigation of environmental impacts. Regional contractors will also complete civil and non-process critical design elements.

The project will leverage proven process technologies and benefit from strategic partnerships with leading industry players. NextSource is committed to operating the facility in compliance with international standards and UAE regulations, ensuring the highest levels of safety, environmental sustainability, and social responsibility.

Investor Conference Call

Chief Executive Officer Hanré Rossouw, Chief Financial Officer Jaco Crouse and Chief Commercial Officer Craig Scherba will host a conference call at 9:00am EST on October 6th, 2025, to comment on the latest annual financials and MD&A.

To join the webcast, participants should access the following link:

https://www.webcaster5.com/Webcast/Page/3080/53051

To dial in by phone:

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 362480

A recording of the call will also be available on NextSource’s website within a 48-hour period.

About Stantec

Stantec is headquartered in Edmonton, AB, Canada and is a publicly traded engineering and design consultancy. With over 30,000 employees in 450 offices and across 6 continents, Stantec delivers sustainable and innovative design solutions for their customers. For more information visit www.stantec.com .

About NextSource Materials Inc.

NextSource Materials Inc. is a battery materials company based in Toronto, Canada that is intent on becoming a vertically integrated global supplier of battery materials through the mining and value-added processing of graphite and other minerals.

The Company’s Molo graphite project in Madagascar is one of the largest known and highest-quality graphite resources globally, and the only one with SuperFlake® graphite. The Molo mine has begun production through Phase 1 mine operations.

The Company is also developing a significant downstream graphite value-add business through the staged rollout of Battery Anode Facilities capable of large-scale production of coated, spheronized and purified graphite for direct delivery to battery and automotive customers, in a fully transparent and traceable manner. The Company is now in the process of developing its first BAF in the UAE.

NextSource Materials is listed on the Toronto Stock Exchange under the symbol “NEXT” and on the OTCQB under the symbol “NSRCF”.

For further information about NextSource Materials, please visit our website at www.nextsourcematerials.com or contact us at +1.416.364.4911 or email Brent Nykoliation, Executive Vice President at brent@nextsourcematerials.com ,

Safe Harbour: This press release contains statements that may constitute “forward-looking information” or “forward-looking statements” within the meaning of applicable Canadian and United States securities legislation. Readers are cautioned not to place undue reliance on forward-looking information or statements. Forward looking statements and information are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “potential”, “possible” and other similar words, or statements that certain events or conditions “may”, “will”, “could”, “expected” or “should” occur. Forward-looking statements include any statements regarding, among others, timing of construction and completion of the BAF and proposed timing of future locations of additional BAFs, timing and completion of front-end engineering and design and ESIA permitting, the economic results of the BAF Technical Study including capital costs estimates, operating costs estimates, payback, NPV, IRR, production, sales pricing and working capital estimates, the construction and potential expansion of the BAFs, expansion plans, as well as the Company’s intent on becoming a fully integrated global supplier of critical battery and technology materials. These statements are based on current expectations, estimates and assumptions that involve a number of risks, which could cause actual results to vary and, in some instances, to differ materially from those anticipated by the Company and described in the forward-looking statements contained in this press release. No assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur or, if any of them do so, what benefits the Company will derive there from. The forward-looking statements contained in this news release are made as at the date of this news release and the Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements, whether because of new information, future events or otherwise, except as may be required by applicable securities laws. Although the forward-looking statements contained in this news release are based on what management believes are reasonable assumptions, the Company cannot assure investors that actual results will be consistent with them. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the Company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.