After spiking above US$20,000 per metric ton in May 2024, nickel prices have experienced a downward trend, mainly remaining in the US$15,000 to US$16,000 range.

Indonesia’s elevated production levels have been a primary factor contributing to low commodity prices, as sustained high output continues to oversupply the market. The supply surplus has had a knock-on effect, putting pressure on Western producers who have been forced to slash their production to maintain profitability.

Elevated output coincides with electric vehicle (EV) demand, which is under threat as market uptake has slowed, and policy changes in the United States are expected to increase costs for consumers and lower sentiment for the vehicles.

Nickel sinks to 2020 lows

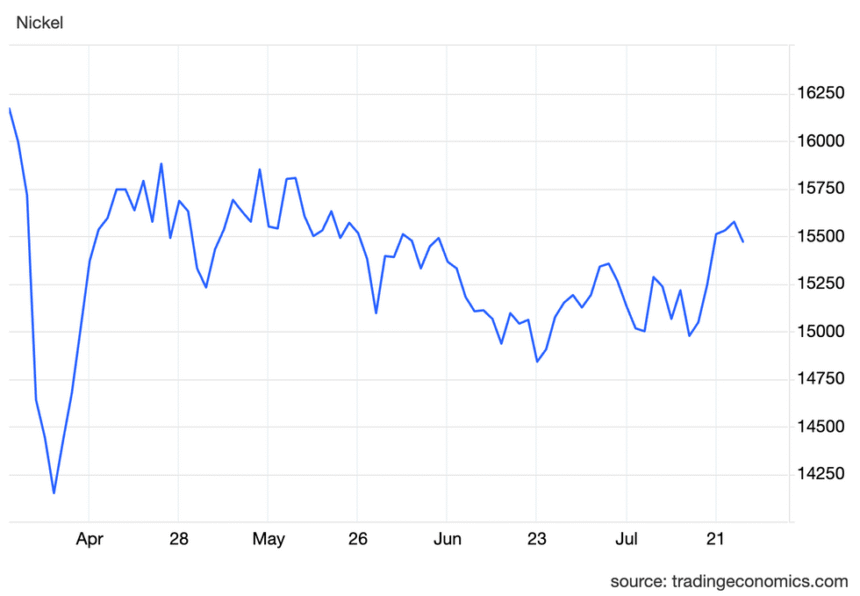

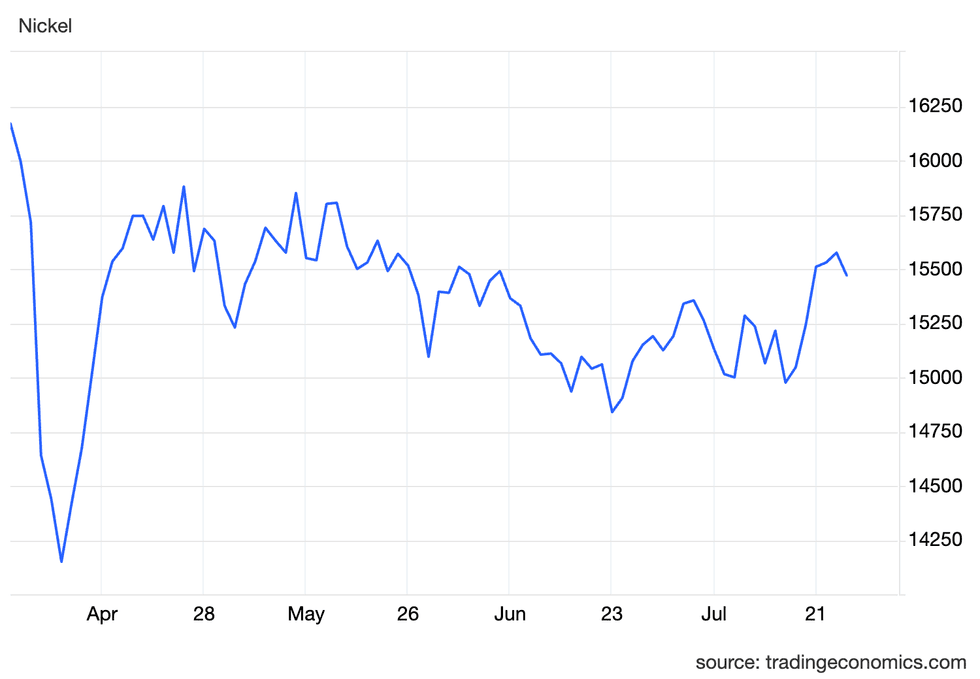

Commodity prices crashed at the start of the quarter, with nickel falling to a five-year low, reaching US$14,150 per metric ton on April 8. However, prices quickly recovered from the rout and reached US$15,880 on April 24.

The end of April saw the price once again retreat to US$15,230 as downward trend indications began to take hold. The price through May was largely rangebound, starting the month rising to US$15,850 on May 9 before collapsing again to US$15,085 on May 27.

Nickel price chart, April 01 to July 24, 2025

via TradingEconomics

June started with a short-lived rebound to US$15,510 on June 2, before falling to below the US$15,000 mark to reach US$14,840 on June 24. Since then, the price experienced some upward momentum, reaching US$15,575 on July 23.

Supply surplus causing price pressures

In a presentation at the Indonesian Mining Conference on June 30, Ricardo Ferreira, Director of Market Research and Statistics at the International Nickel Study Group (INSG) outlined the current state of the nickel market.

He suggested that high output from Indonesian miners continued to exert downward price pressures on nickel over the last several years, resulting in a decline from an average price of US$30,425 per metric ton in 2022 to an average of US$15,000 per metric ton during the first five months of 2025.

Meanwhile, combined inventories on the London Metals Exchange (LME) and the Shanghai Futures Exchange (SHFE) have exploded from 38,200 metric tons at the end of May 2023 to 230,600 metric tons at the end of April 2025.

This coincides with a 15.1 percent increase in global nickel production in 2023 and a 2.3 percent increase in 2024. The expectation is that nickel output will surge an additional 8.5 percent in 2025, with a significant portion to come from Indonesia, whose share is forecast to grow to 63.4 percent from 61.6 percent in the previous year.

The demand outlook

However, demand has not kept pace with the increase in production. Ferreira stated that demand increased by 7.8 percent in 2023, 4.8 percent in 2024, and is expected to grow by 5.7 percent in 2025.

Stainless steel has been the primary driver of nickel demand for decades. Still, Olivier Masson, Principal Analyst for Battery Raw Materials at Fastmarkets, predicts a changing demand landscape over the next couple of years.

During his CAM Minerals Market Forecast at the Fastmarkets LBRM Las Vegas conference on June 22 to 25, Masson provided insight into why he believes the current oversupply situation will begin to shift by 2027.

Currently, nickel’s primary demand driver is in the production of stainless steel, accounting for just over 2 million metric tons per year. However, the expectation is that between now and 2035, total demand for nickel will increase by 2 million tons, with stainless production accounting for just 564,000 metric tons. A compound annual growth rate (CAGR) of 2 percent.

“We expect to see more end-of-life scrap being generated within China, and then that should start slowing down the growth requirements for primary nickel in the Chinese stainless-steel industry,” Masson explained.

The remaining demand is predicted to come from a 12.8 percent, or 1.4 million metric ton, increase from the EV sector.

“Most of this growth will come from pure EV, so pure battery electric vehicles, where we expect sales growth of over 30 million vehicles… But we still expect an increase in plug-in hybrids with an additional 11.5 million vehicle sales over the next decade,” Masson said.

He went on to say that over that time, supply is expected to grow at a slower rate, with the majority owed to increases in nickel sulphate destined for battery manufacturing.

“So what does that mean for the balance for the nickel market? Well, the nickel market has been oversupplied for the past couple of years. We expect that to continue this year and for the next few years. So we are in a state of structural oversupply. That said, its only by around 2027 or 2028 that we think the market will start to return to a semblance of Balance,” Masson explained

In the long term, he stated that an additional 750,000 metric tons will be needed by 2035, which he doesn’t see as a significant problem.

Production curtailments continue

With the market currently experiencing a supply glut, more producers have taken to curtailing production or shuttering operations.

Since 2024, there have been closures of significant operations, including First Quantum’s (TSX:FM,OTC:FQVLF) Ravensthorpe and Panoramic Resources’ Savannah operations in Australia and Glencore’s (LSE:GLEN,OTC Pink:GLCNF,OTC:GLCNF) Koniambo Nickel mine in New Caledonia.

Likewise, Refiners have also been under pressure as BHP (ASX:BHP,NYSE:BHP,LSE:BHP,OTC:BHPLF) suspended operations at its Nickel West refinery in Australia until 2027, and Sibanye Stillwater (NYSE:SBSW) repurposed its Sandouville nickel refinery in France to produce precursor cathode active material during the first half of 2025.

According to INSG data, 32 percent of global nickel production lines are currently offline.

One of the few companies to buck the trend was Vale (NYSE:VALE), which announced a 44 percent year-over-year increase in nickel production in its Q2 2025 report released on July 22. The report indicated that nickel output rose to 40,300 metric tons from 27,900 during the same quarter last year. The company said gains were driven by strong performance from its Canadian assets and the Onca Puma mine in Brazil.

While there was some speculation that Indonesia may reduce its output, no cuts have materialized, which has in part led Australian investment bank Macquarie to downgrade its nickel outlook to US$14,500 per metric ton by the end of the year, from the US$15,500 it predicted at the end of Q1.

The impact of trade uncertainty

Base metals were caught up as part of the fallout from Donald Trump’s “Liberation Day” announcement on April 2. The move applied a 10 percent across-the-board baseline tariff to all but a handful of countries and threatened to impose more significant retaliatory tariffs starting on April 9.

However, a steep US$6.6 trillion sell-off in equity markets and a squeeze in the bond market that sent yields for 10-year Treasuries up more than half a percent caused the US administration to walk back its plans. Instead, it announced a 90-day pause on the higher tariff rate and stated that it would work to negotiate new trade agreements.

The commodity price rout came as more analysts began to speculate about a recession later in 2025, which would reduce consumer spending on steel-dependent goods, such as light vehicles and new home builds.

In statements made during S&P Global’s State of the Market: Mining Q1’ 25 webinar on May 14, Naditha Manubag, Associate Research Analyst of Metals and Mining Research, suggested that nickel is likely to experience headwinds from the evolving trade policy in the United States.

“We expect nickel prices to remain volatile in the near term as the Trump administration’s trade policies continue to evolve. Forecast for 2025 global primary nickel demand is lowered to 2.8 percent year-over-year due to the expected slowdown in global economic activity,” she said.

Manubag said the slowdown would have a negative impact on demand for Chinese consumer goods, which would come alongside a rising Indonesian mining quota in 2025. Although prices spiked in March, she explained that it was due to tight supplies from the rainy season and increased royalty rates.

Manubag suggested that S&P’s overall expectation is that the nickel market will be in a surplus of 198,000 metric tons in 2025. As a result, the organization has lowered its nickel price forecast to US$15,730 per metric ton.

It’s more than just US tariffs that are expected to weigh on nickel prices in the short term. When Donald Trump signed the “One Big Beautiful” spending bill into law on July 4, it marked an end to the federal EV tax credit and other tax credits aimed at expanding charging infrastructure, a cornerstone of the Inflation Reduction Act.

The consumer credit was meant to provide a US$7,500 rebate toward the purchase of new EVs, and is expected to have an impact on overall demand when it expires on September 30.

Although the majority of nickel’s demand comes from the production of stainless steel, the growing demand from EV battery production has provided additional tailwinds; however, a decline in EV demand could impact future demand growth.

“If and when this bill is passed, a slowdown of EV uptake is expected to lead to higher EV prices and slower rollout of charging infrastructure,” Manubag said.

The big picture for investors

Currently, the easiest way to sum up the nickel market is that it’s widely disliked. The fundamentals aren’t there. A significant portion of nickel is being produced at a loss.

In an interview with the Investing News Network on July 22, Steve Barton, host of the “In It To Win It” podcast, suggested that while investors have avoided nickel, there may still be opportunities in the sector.

“You know, nickel is hated right now. I think there’s a decent case for nickel, just like when we went into platinum, right? Platinum did nothing for a decade; it just hung around US$900 to US$1,000, and now we’ve finally broken out… You have no idea when, but buy it when it’s boring. At US$900, no one cares, and then you get to ride the wave up. So I think that would be it. Pay attention to what’s unloved and hated and buy that,” he said.

Others in the investment community have expressed a similar sentiment. Although fundamentals for nickel are currently lacklustre, demand, especially from the automotive sector, is expected to grow over the next 10 years.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web