By Darren Brady Nelson

As an economist, I, perhaps somewhat sadly, have many economist friends. One of them recently alerted me to a post on X that was even a shock to me in the toxic 2020s. That being: “Almost all political donations by Fed employees go to one party. The Fed is already politicized.”

The post had a link to the data supporting this assertion, which was published at OpenSecrets. They are a “501(c)3” devoted to: “tracking money in US politics and its effect on elections and public policy.” Their theme is appropriately “Follow the Money,” as it is for this story.

Political money contributions, since 2016, from those at the Fed, range between 92 to 93 percent for Democrats and 8 to 9 percent for Republicans. As Public Choice economics teaches, it is crucial to “Follow the Money” in politics. Austrian and Chicago schools of economics teach the same for gold.

Gold pricing 101

Gold pricing is often characterized as being driven by “fear and uncertainty,” at least in the short run, including geopolitical fears like war and economic uncertainties such as recession. It is also typically recognized to be an “inflation hedge,” in the long run anyway.

Gold is an asset with a price determined in a 24/7/365 global auction, most often quoted per troy ounce, in the world’s reserve currency of US dollars. New supply plays an unusually small role compared to almost all other commodities, goods or services. Thus, highest bid wins.

Perhaps none of these things about gold, and its price, are new nor surprising. But what might be, despite the end of the gold standard in 1971 and legalization of gold investment in 1974, is that gold is still a shadow currency to fiat ones, especially US dollar, in the “always run.”

The annual gold price from 1960 to 2024 is displayed below, as sourced from the World Bank. Rises include: late 1970s; late 2000s; and mid 2020s. Slides include: early 1980s; late 1990s; and early 2010s. Overall growth was: Sum 555 percent; Ave 8.7 percent; Max 98 percent; Min –24 percent; and CAGR 6.8 percent.

Money supply 101

Gold is the inflation hedge, precisely because it is shadow currency. Money supply is the inflation source, precisely because it is fiat currency. As Chicago economist Milton Friedman wrote in Money Mischief (1994): “In the modern world, inflation is a printing-press phenomenon.”

There are multiple money supply measures, such as M0, M1, M2 and M3. M1 includes paper and coin currency held by the general public as well as liquid bank deposits (e.g. checking accounts). M3 includes M1, plus less liquid bank deposits (e.g. savings accounts) as well as “repos.”

Austrian economist Robert Murphy details in Understanding Money Mechanics (2021) just how the Fed’s printing, Treasury bonds and bank loans create US money supply, through open market operations. Since 2008 and 2020, the Fed has expanded to buying and selling just about anything.

Speaking on behalf of the Fed, and all major central banks, the Bank of England wrote in Money Creation in the Modern Economy (2014): “(B)ank lending creates deposits. At that moment, new money is created. (This is) ‘fountain pen money,’ created at the stroke of bankers’ pens(.)”

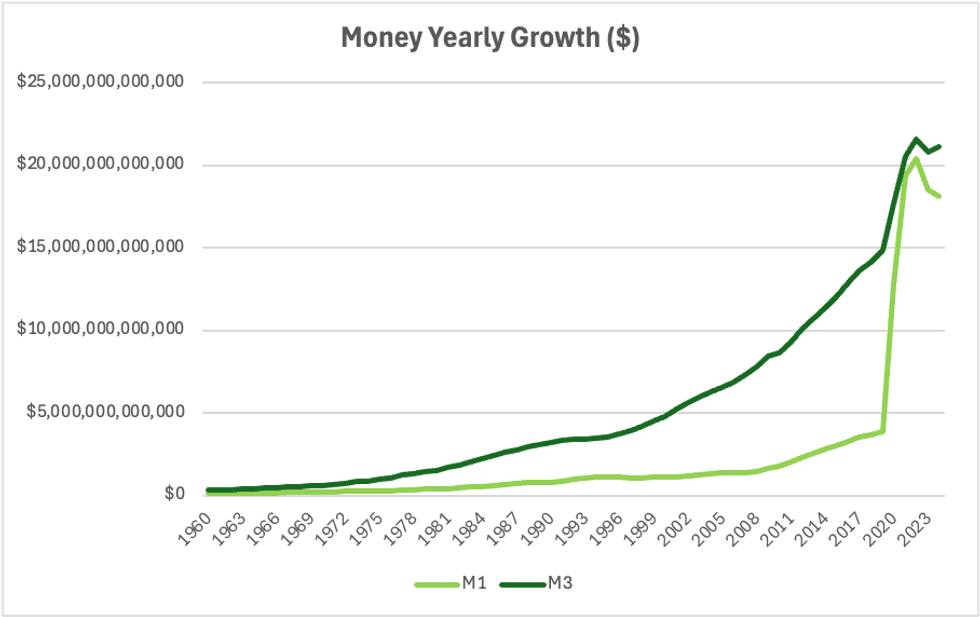

Annual M1 and M3 money supply from 1960 to 2024 are displayed below, as sourced from the OECD. M3 starts to take off from the mid 1990s. Both blast off in the early 2020s, M1 in part due to redefinition. Combined growth was: Sum 533 percent; Ave 8.3 percent; Max 126 percent; Min –6.4 percent; and CAGR 7.4 percent.

Gold inflation 101

Christian economist Gary North points out in Honest Money (2011) that businesses have three choices in the face of money inflation: A) profit deflation; B) price inflation; C) quality shrinkflation. Investors have a fourth: D) gold inflation. A, B, and C are all bad options. D is good.

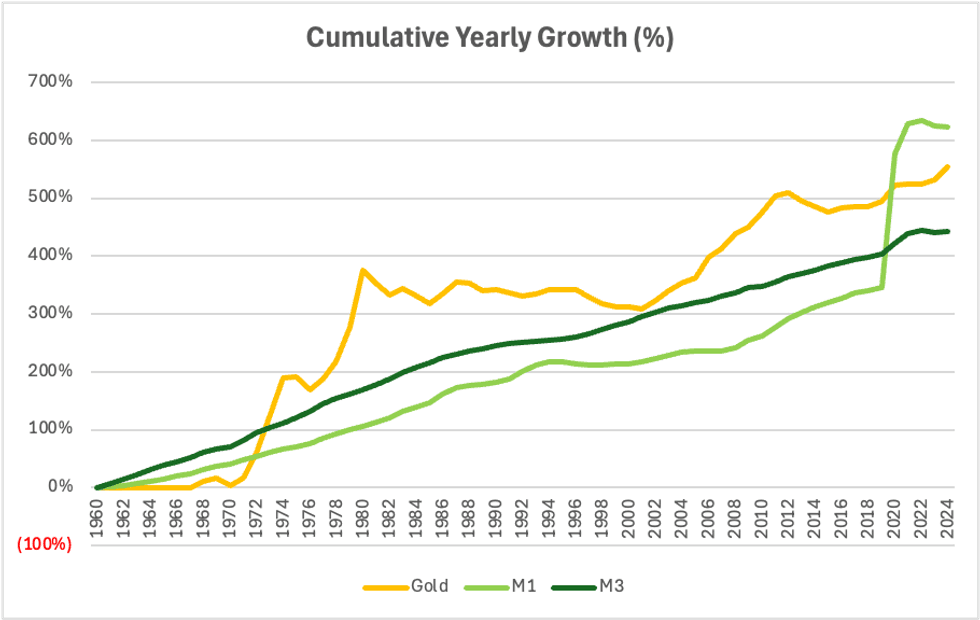

The chart below shows cumulative annual growth of gold versus M1 and M3. Gold performs and protects against both M1 and M3 from 1974 to 2019, even in 2001, but not against M1 from 2020 to 2024. In 2019, gold had a 150 percent lead on M1 and 92 percent on M3. By 2022, it shrunk to –110 percent and 80 percent.

Cumulative yearly growth (percent).

Sources: OECD and World Bank.

A 2020 regression study found: “When the Federal Reserve increases money supply by 1%, gold prices increase by 0.94%.” A 2023 academic paper: “Confirms a long-term relationship between gold price and US M2.” Note that M1’s 2021 redefinition has now made it nearly identical to M1.

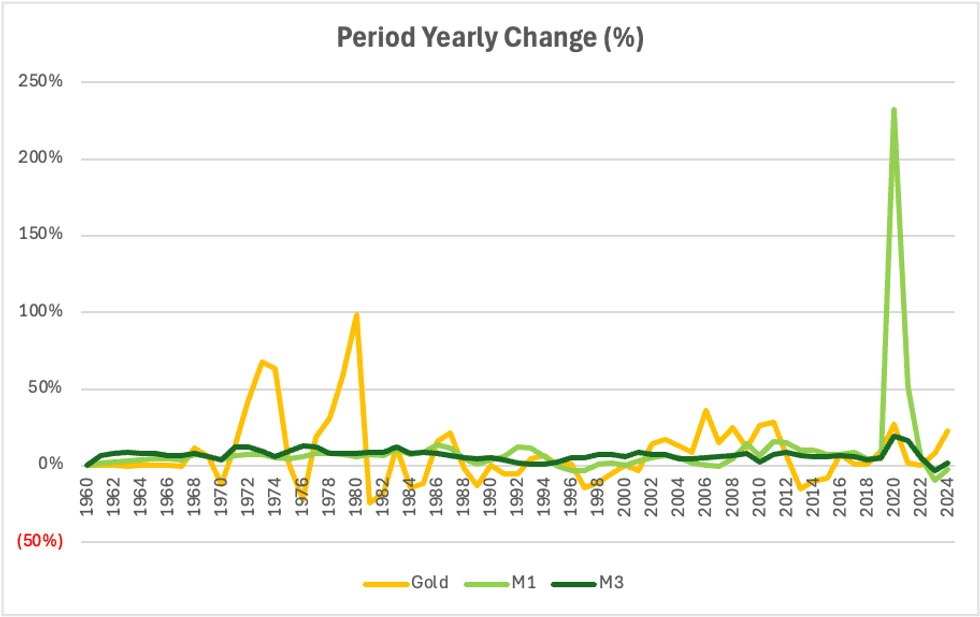

Period yearly change (percent).

Sources: OECD and World Bank.

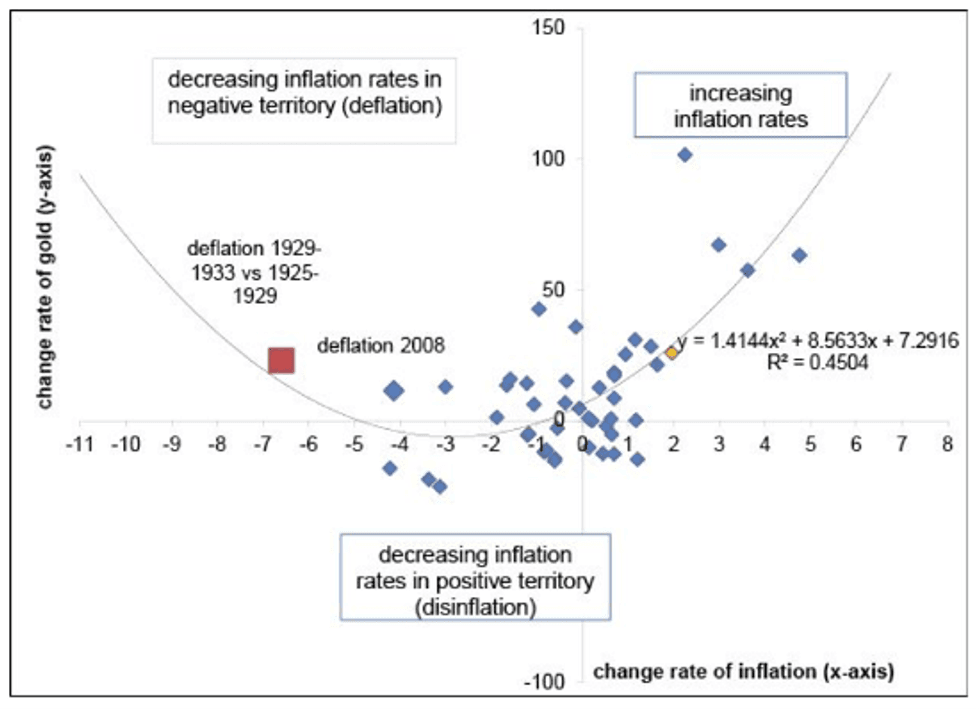

However, the authors of Austrian School for Investors (2015) wrote: “Gold does not correlate with the rate of inflation as such, but with the rate of change of the inflation rate. In order to buttress this hypothesis, we calculated the regression depicted in (the chart below).”

Source: Austrian School for Investors: Austrian Investing between Inflation and Deflation.

In conclusion, as per my Wokenomics 101 (2023) ghost blog, money inflation by: “increasing demand puts upward pressure on price and quantity and downward pressure on quality.” That puts upward pressure on: nominal CPI and GDP statistics; as well as real gold investment and price.

Inflation doesn’t harm all. It helps some. They are the “Bootleggers and Baptists,” as Public Choice economist Bruce Yandle dubbed them in 1983. Bootleggers are crony capitalists, politicians and bureaucrats whose inflated revenue outpaces costs. Baptists are the “useful idiots.”

Thus, “Follow the Money” back to the “inflationistas” of: Big Business; Big Government; and Big Banks. All gain supernormal profits from easy money: one, making more money; two, collecting more money; and three, creating more money. Also, “Follow the Money” when it comes to gold.

And, sadly, there is one policy that is always bipartisan; print more money. But, gladly, gold will always win.