Key points:

-

Bitcoin is preparing for a range expansion in the next few days, and the trend favors the bulls.

-

ETH, BNB, AVAX, and PENGU are looking set for a possible upside move.

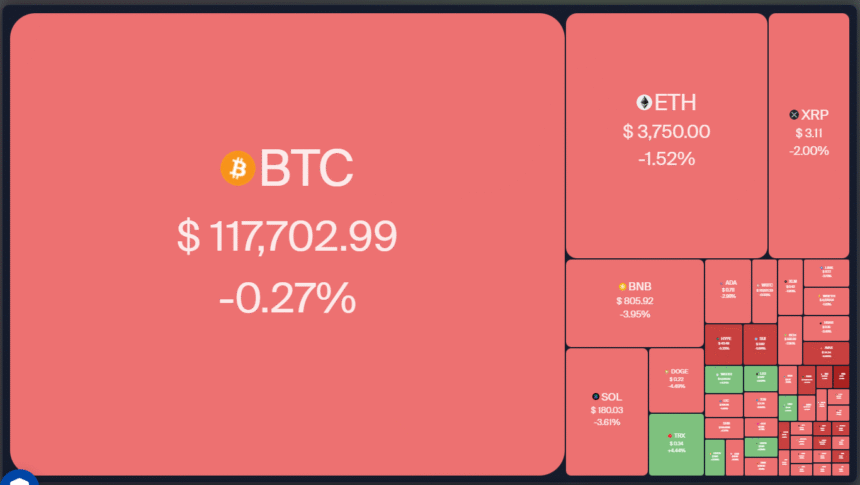

Bitcoin (BTC) has failed to break above $120,000, but a positive sign is that the bulls have not ceded much ground to the bears. Investors have again resumed pouring money into the BTC exchange-traded funds, which witnessed net inflows for the past three trading days, according to Farside Investors data.

American billionaire and hedge fund manager Ray Dalio said during an appearance on the Master Investor podcast that a 15% allocation to BTC or gold could optimize the “best return-to-risk ratio,” and act as a hedge against devaluation of fiat.

BTC’s consolidation near the highs has shifted investors’ focus toward Ether (ETH) and other select altcoins. Ether-focused treasury firms have acquired roughly 1% of the total ETH supply since the beginning of June, and that number could eventually increase 10x from current levels, according to a new report from Standard Chartered shared with Cointelegraph.

Several other firms have revealed plans to add select altcoins to their treasury, suggesting an increased institutional interest.

Let’s analyze the charts of the top 5 cryptocurrencies that look strong on the charts in the near term.

Bitcoin price prediction

Buyers have repeatedly failed to propel BTC above the $120,000 resistance, indicating a lack of demand at higher levels.

The upsloping 20-day simple moving average ($118,170) and the relative strength index (RSI) in the positive territory enhance the prospects of an upside breakout. If buyers overcome the barrier at $123,218, the BTC/USDT pair could soar toward $135,729 and thereafter to the pattern target of $150,000.

Conversely, if the price turns down and breaks below $115,000, it suggests profit-booking by short-term traders. The pair may dip to the neckline of the inverse head-and-shoulders pattern and then to $110,530. Buyers are expected to defend the $110,530 level with all their might because a break below it increases the risk of a drop to $100,000.

Both moving averages have flattened out on the 4-hour chart, and the RSI is just below the midpoint, signaling a balance between supply and demand. A break and close above $120,000 suggests the bulls are trying to take charge. The pair may then challenge the $123,218 overhead resistance.

On the downside, a break and close below $114,723 shifts the balance in favor of the bears. That could pull the pair to solid support at $110,530.

Ether price prediction

ETH turned down from $3,941, but the bulls are trying to maintain the price above $3,745. That suggests the bulls are trying to flip the level into support.

The upsloping 20-day SMA ($3,473) and the RSI in the overbought zone signal an advantage to buyers. If the price turns up and breaks above $3,941, the ETH/USDT pair could challenge the $4,094 level. Sellers are expected to fiercely defend the $4,094 level because a break and close above it could propel the pair to $4,868.

This positive view will be invalidated in the near term if the price turns down and breaks below the 20-day SMA. If that happens, the pair may enter a deeper correction toward $3,250.

The price bounced off the $3,745 support, but the bulls could not clear the hurdle at $3,941. That has pulled the pair to the $3,745 level. A break and close below $3,745 could trap the aggressive bulls, pulling the pair to $3,500. Buyers are expected to defend the $3,500 level because a break below it could start a deeper correction toward $3,250.

The bulls will have to thrust the price above $3,941 to seize control. The pair could then soar to $4,094, where the bears are expected to step in.

BNB price prediction

BNB (BNB) pulled back from $861 on Monday, indicating profit booking by the short-term buyers.

The BNB/USDT pair could dip to the breakout level of $794, which is a vital support level to watch out for. If the price rebounds off $794, it suggests that the bulls have flipped the level into support. That improves the prospects of a break above $861. If that happens, the pair may rally to $900 and eventually to $1,000.

Alternatively, a break and close below $794 signals that the bulls are closing their positions in a hurry. The pair may plunge to $761, a critical level for the bulls to defend.

The pair has plunged below the 20-SMA on the 4-hour chart, indicating selling at higher levels. The pair may tumble to the 50-SMA, which is a critical level to watch out for. A break and close below the 50-SMA could sink the pair to $761.

On the other hand, a solid bounce off the 50-SMA suggests demand at lower levels. The bulls will try to push the price above the 20-SMA. If they succeed, the pair could retest the $861 resistance. A break and close above $861 could start the next leg of the uptrend to $900.

Related: Bitcoin analysts say this must happen for BTC price to hit new highs

Avalanche price prediction

Avalanche (AVAX) has been consolidating between $15.27 and $27.38 for several weeks, indicating buying on dips and selling on rallies.

The upsloping 20-day SMA ($23.52) and the RSI in the positive zone suggest that the buyers have the upper hand. If the bulls pierce the $27.38 resistance, the AVAX/USDT pair could start a new up move. The pair could rally to $36 and then to the target objective of $39.49.

Contrarily, if the price turns down and breaks below the 20-day SMA, it suggests that the bulls have given up. That could sink the pair to the 50-day SMA ($20.48), extending the stay inside the range for some more time.

The pair turned down sharply from $27.38 and broke below the 50-SMA on the 4-hour chart. That suggests the bulls are rushing to the exit. That may sink the pair to $23, which is expected to act as strong support.

If the price turns up from $23 and breaks above the 20-SMA, it suggests solid buying at lower levels. The bulls will then try to push the pair to $27.38. A break and close above the overhead resistance could start the next leg of the up move.

Pudgy Penguins price prediction

Pudgy Penguins (PENGU) rallied sharply in the past few days, but the bulls are facing significant resistance at $0.046.

The upsloping moving averages and the RSI in the positive territory suggest that buyers have the edge. If buyers drive the price above $0.046, the PENGU/USDT pair could start the next leg of the up move to $0.054 and later to $0.065.

The 20-day SMA ($0.033) is the crucial support to watch out for on the downside. A break and close below the 20-day SMA indicates that the bulls are booking profits. That may sink the pair to $0.028.

The price turned down from the $0.046 overhead resistance and broke below the 50-SMA on the 4-hour chart. The next support on the downside is at $0.035. If the price rebounds off $0.035, it signals demand at lower levels. That may keep the pair stuck inside a range between $0.035 and $0.046 for some time.

The bears will gain the upper hand on a break and close below the $0.035 support. That opens the gates for a decline to $0.028.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.