Platinum began the year trading between US$900 and US$1,100 per ounce.

While platinum and other platinum-group metals are considered precious metals, they largely trade on demand from the auto sector. Platinum is used as a catalyst to control emissions from internal combustion engine vehicles.

Over the past several years, demand for electric and hybrid vehicles has increased, which has led to a reduction in platinum loadouts and lowered overall demand. However, with changing environmental regulations, an end to electric vehicle (EV) mandates and tax credits, the market may be experiencing a turnaround in H1.

What happened to the platinum price in Q2?

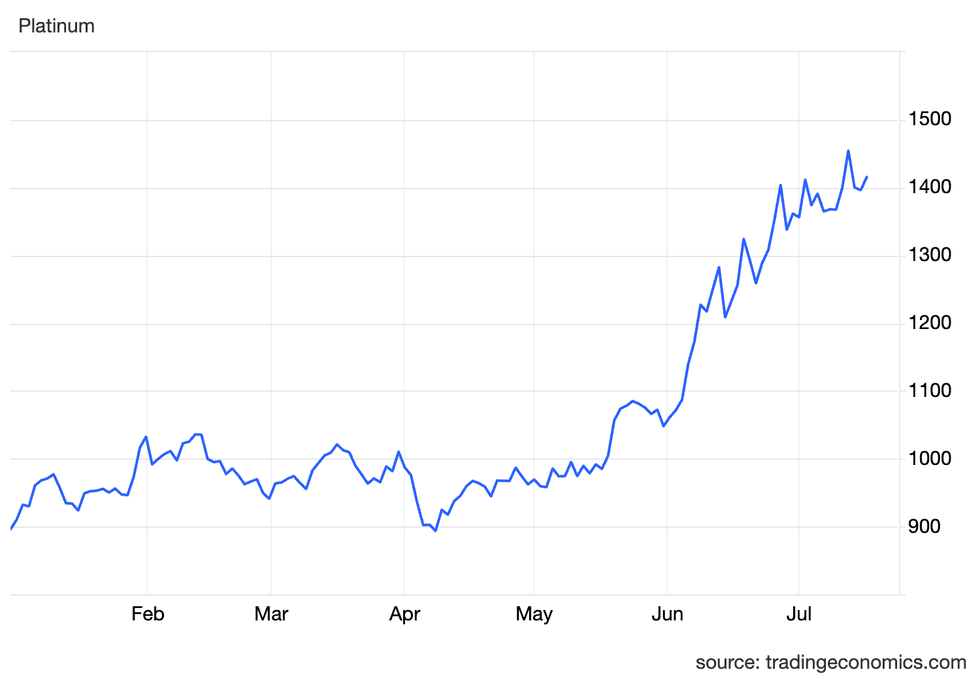

Platinum started the year at US$910 on January 2, reaching its Q1 high of US$1,035.40 on February 13.

It hovered around the US$1,000 mark to the end of the first quarter before falling to its year-to-date low of US$893.50 on April 8 on the back of US President Donald Trump’s “Liberation Day” tariff announcements on April 2.

Platinum price, January 1 to July 16, 2025.

Chart via TradingEconomics.

The price gained some momentum starting on April 9 after the US government announced a 90 day pause on tariffs. Platinum climbed back toward the US$1,000 range and remained there until May 16.

After that, the price of platinum saw a dramatic climb, first rising to US$1,081 on May 26 and then jumping even higher to reach an 11 year high of US$1,454.50 on July 14.

Platinum demand rises, supply shrinks

In its latest platinum quarterly, released on May 19, the World Platinum Investment Council (WPIC) reinforces many of the same beliefs it held at the beginning of the year, but adds nuance on evolving trade policy in the US.

In the first quarter of the year, demand for platinum increased by 10 percent year-on-year, rising to 2.27 million ounces from 2.06 million ounces. The growth came despite a 4 percent decline in demand from the automotive sector — its usage fell to 753,000 ounces during the first three months of the year from 784,000 ounces in 2024. There was also a 22 percent decline from industrial components, which sank to 527,000 ounces from 673,000 ounces.

Gains in platinum demand largely came from a more than 300 percent rise in investment, which jumped to 461,000 ounces in 2025’s first quarter from 113,000 ounces recorded in the first quarter of 2024.

Much of the increase was owed to significant additions to aboveground stocks held by exchanges, which gained 361,000 ounces during the quarter, versus an 11,000 ounce loss in the same period of 2024.

Additionally, jewelry demand saw a 9 percent increase, rising to 533,000 ounces. Jewelry makers are beginning to use platinum instead of gold as the price of the yellow metal trends near all-time highs.

The increase in demand was met with significant declines in supply.

Q1 saw a 25 percent decrease in supply, which fell to 1.46 million ounces compared to 1.95 million ounces a year ago. This is the lowest quarterly production since the second quarter of 2020.

Most significant were the declines from South Africa, the world’s largest producer of platinum, where output dropped to 715,000 ounces in Q1 from 1.16 million ounces in the year-ago period.

The WPIC attributes the decrease to heavy rainfall events and flooding, which has impacted mining activities. However, South Africa has been facing significant challenges in recent years as operations in the country have dealt with issues including declining grades and instability in the nation’s power grid.

In a July 9 interview with the Investing News Network (INN), precious metals analyst Ted Butler explained how South Africa has an outsized influence on the platinum market.

“Roughly 73 percent of the platinum supply comes from South Africa. South Africa is suffering from power outages. It’s dependent on this dilapidated infrastructure that needs really improving, and that obviously translates to the difficulty of mining platinum,” explained Butler, who writes for publications including the Morgan Report.

Butler added that the other primary supplier of the metal is Russia, whose output isn’t making it into western hands due to the sanctions stemming from its invasion of Ukraine in February 2022.

Rick Rule, proprietor at Rule Investment Media, also called out supply-side risks with South Africa and Russia.

“Neither of those places, politically, are garden spots. Russia is at war, which is difficult. South Africa has ongoing social challenges that haven’t yet really manifested themselves, but I suspect will,” he said.

“In the South African mining industry, first of all, the South African government keeps making noises about nationalizing the mines or increasing the social take. What that means is that the mining companies won’t make substantial capital investments in the mines because they don’t know who’s going to own them,” he said in an interview on July 9.

Industrial demand for platinum boost price

Industrial demand for platinum rose during the quarter on the back of speculative buying in the US and China, helping propel the metal above US$1,400. The buying was a result of carmakers stockpiling the metal in June ahead of a vote on a new US spending bill that was set to revoke consumer subsidies for the purchase of new EVs.

The bill was ultimately signed into law by Trump on July 4. It also eliminates penalties for vehicles that don’t meet Corporate Average Fuel Economy Standards. The laws have been part of the Environmental Protection Agency’s mandate for decades, and Congress can’t remove them entirely; instead, fines for violations are now zero.

The combination of removing penalties and dropping EV credits may cause carmakers to adjust plans to roll out new EVs in favor of hybrids or internal combustion engine vehicles.

“If the green energy transition doesn’t happen as swiftly as we believe it will, we could see a reversion back to internal combustion engines, and platinum is a crucial component in those cars,” Butler said.

Platinum price forecast for 2025

Platinum fundamentals are strong. Demand for the metal for the year is expected to outstrip supply by a considerable margin, with the WPIC predicting a deficit of 966,000 ounces this year.

That would follow a 992,000 ounce shortfall in 2024.

However, Rule urged some caution for investors due to overall market conditions.

“Platinum and palladium are economically sensitive … if the economy continues to deteriorate, likely that softness will extend to the internal combustion engine car sales, and that could impact platinum and palladium prices,” he said.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web