Why do smart people make dumb financial choices?

I sometimes wonder why people can’t foresee how their financial future will look?

- Don’t people know that there will be a day when the paycheck will stop?

- Don’t they realize that one day they might become obsolete, physically or professionally?

- That their health will decline? That emergencies will arise?

- Cant they see that they need to have wealth at age 60 to survive the rest of their life?

And don’t they see that inflation is real — silently eroding their purchasing power year after year?

Don’t they see?

But the answer, sadly, is NO.

People can’t see far enough.

After years of working with thousands of clients, observing their behavior and decision-making patterns, I’ve come to a stark realization:

Most people operate with a short-term mindset.

The reality is that most people don’t operate with a long term mindset!

- They live year-to-year.

- Salary-to-salary.

- Milestone-to-milestone.

Yes, deep down they have a vague idea of what the future holds, but their actions rarely reflect that understanding

And it’s this inability to think beyond the immediate that is slowly creating a retirement time bomb in India.

Millions of people will hit age 60 without a meaningful corpus. No financial cushion. No peace of mind. Just dependence — either on their children, or on a broken government system, or on hope.

Today, I want to talk on 4 mistakes which people need to correct in their life to move forward and create a better financial future.

Mistake #1 : Instant gratification

The desire to feel good now, even at the cost of the future is called Instant Gratification. This is the root cause of why most people have bad financial lives.

Their focus is so much on making their NOW better and amazing that they fail to see if its impacting their future badly.

- Have you seen people blindly buy useless insurance policies just to “save tax” for the current year — without even understanding how that product helps them in the long run

- Swiping your credit card for things you desire but can’t afford, then paying just the minimum due to “survive the month in peace” — it feels like a quick fix today, but all you’re doing is piling up interest and penalties, silently pushing yourself deeper into a future debt trap.

- Or those who register property at a lower value (by paying part of it in cash) to reduce registration charges now, only to realize years later that they’ll face huge capital gains tax — because on paper, their profit appears much higher?

- Then there are those who postpone buying health insurance in their 30s thinking they’re fit, only to be denied coverage later or hit with a massive hospital bill they have to pay out of pocket.

- And perhaps the most common — people who don’t save enough in their early years, thinking they’ll “start later,” and then find themselves in their mid-40s or 50s, stressed and anxious, wondering how will I ever retire?

Instant gratification is tempting. But the cost is silent, invisible, and irreversible.

If you want to build wealth, you need to master the art of delayed gratification — the skill of saying no today so that you can say yes to something far bigger, later.

Mistake #2: Blindly Extrapolating the Present

One of the most dangerous financial habits is assuming that the current good times will simply continue forever — as if life follows a straight line upward.

People confuse a short-term win with a long-term pattern. They anchor their future on recent success without factoring in uncertainty, volatility, or change. And this isn’t optimism — it’s delusion dressed up as confidence.

Your brain is wired to prioritize the present—what’s working now feels like what will always work

I often hear things like:

- “I’ve never had a health emergency — I don’t think I need health insurance yet.”

- “I just got a big salary hike — I’ll buy a luxury car on EMI”, assuming that the income will keep growing like this forever.

- “My crypto investments doubled in the last two years, so I’m going to pull all my money out of mutual funds and put everything into crypto”

But here’s the truth: just because something worked this year doesn’t mean it will work next year. Growth is never linear, and neither are careers, stock markets, or life itself.

That said, taking risks based on careful analysis and a clear understanding of potential outcomes is a different story. Calculated risks can pay off and are part of smart wealth-building.

The problem is blind extrapolation — making big moves based only on short-term results or hope, without contingency plans or room for error.

When you assume that today’s highs are tomorrow’s norms, you stop planning for risk, stop saving conservatively, and stop preparing for the possibility that things might slow down, plateau — or even reverse.

Good phases are not guarantees — they’re opportunities. Use them to build buffers, not fantasies.

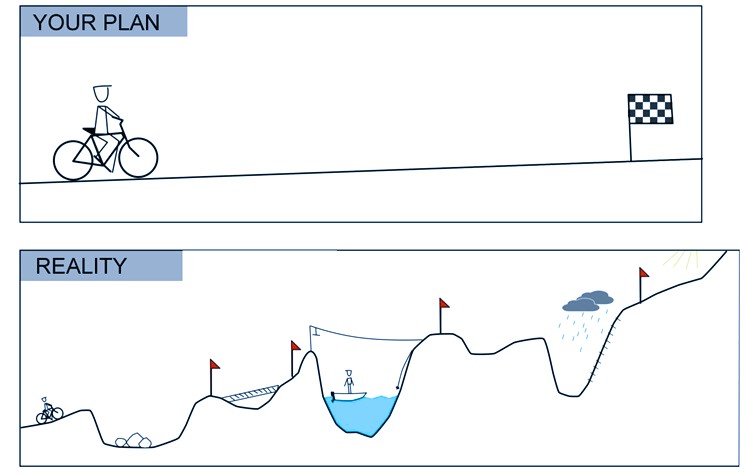

Mistake #3 : Overconfidence of Future Income

One of the most subtle — yet dangerous mistakes people make is over-relying on their future income. They assume that salaries will always rise, bonuses will keep coming, and promotions will be predictable. This assumption gives them hope — a comforting illusion that even if they’re not saving enough today, their future self will somehow fix it all.

- “I’ll start saving more once I hit the income of 25 lakhs per annum.”

- “My next bonus will take care of my credit card outstanding debt.”

- “I’ll buy that house now, and manage the EMI easily when my salary increases.”

I won’t say you shouldn’t be optimistic, but if you’ve had a history of financial struggles, these aren’t plans — they’re financial fantasies

The problem? Life doesn’t always go as expected.

Career growth is not guaranteed. Industries evolve, companies downsize, and roles become obsolete. The high performer of today can become irrelevant tomorrow if they stop learning or the economy shifts. A promising startup job may vanish. A high-flying role may suddenly come with burnout or health issues.

Health issues can derail careers. Accidents, mental health struggles, or chronic conditions can force people to slow down — or stop altogether.

You must learn to expect ugly surprises in life. Shit happens!

Based on thousands of client experiences, I can confidently say I’ve seen several cases… where mid-career professionals had to take long breaks or even quit because of personal or family health crises. After a point, a great career can stagnate and there may be less to no growth in salaries. There may be constant medical expenses which can eat out all the bonuses and salary rise.

Family responsibilities grow. Elderly parents may need support, children’s education costs may skyrocket, or a single income may suddenly have to support two generations.

In real life, your expenses rise faster than your income. But most people build their lifestyle on optimistic assumptions about raises, appraisals, and windfalls. They increase spending the moment income rises — and plan long-term liabilities like loans based on best-case salary scenarios.

This mindset creates a dangerous feedback loop:

- You don’t save enough now because you believe the future will take care of itself.

- But when the future arrives, it’s messier, costlier, and more uncertain than expected.

- And because you didn’t prepare, your future self is left scrambling — without buffers, without options.

Overconfidence in future income is a form of financial procrastination. It gives you a false sense of control, while quietly eroding your real control over your future.

The solution?

Plan for your future based on realistic assumptions — not wishful thinking. Build your lifestyle based on your current income, not projected growth. And treat any income jump or bonus as an opportunity to accelerate your goals, not inflate your lifestyle.

True financial freedom comes not from earning more — but from using what you earn wisely, intentionally, and with foresight.

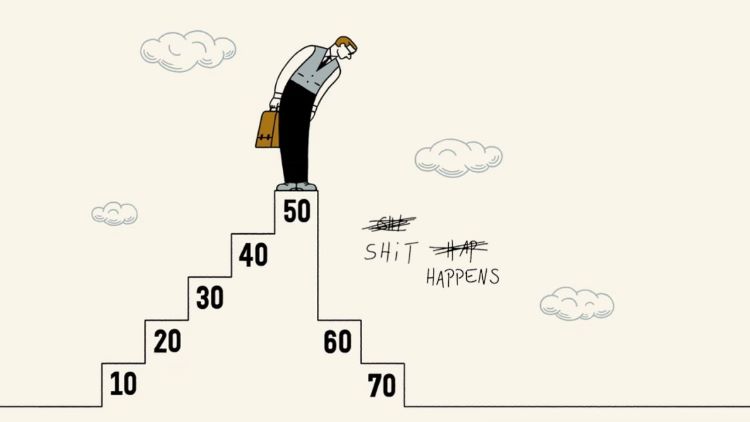

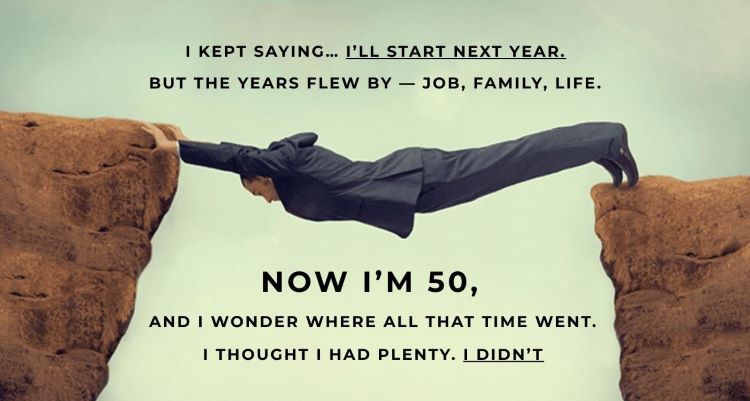

Mistake #4 : Myth of “Plenty of Time”

When we’re young — say, 25 years old and just starting our careers — retirement feels like a distant, almost imaginary event. Bursting with energy and optimism, you feel like time stretches endlessly before you.

There are so many more exciting priorities: romance, adventure, spontaneous trips with friends, and all the first tastes of true independence. You’re finally free—earning your own money, making your own choices, living life on your terms.

Why worry about some far-off future when there’s so much to experience right now?

We tell ourselves, “I have so much time ahead to plan, save, and do what’s necessary.”

But if you ask most people in their 40s, they’ll laugh at that 25-year-old’s confidence. By then, they’ve experienced how fast time really flies, and how life throws challenges and complexities that demand constant attention. Managing a career, family, health, and unforeseen events eats up years quickly.

The biggest regret many people in their 50s share is that they started “late.” They always thought they’d get to important financial and personal goals “later.” Without setting firm deadlines, the future keeps moving away: at 25 you say later, at 28 later, at 30 maybe at 35, at 35 you’re busy with kids and work, and at 40 you realize you’re only halfway — but the clock keeps ticking. By the time you hit your 50s, you realize you’re already behind.

This myth of having “plenty of time” is another trap of present bias. It leads to procrastination and underestimating the power of compounding—whether in investments, health, or relationships. It’s easy to defer important actions when you believe you have infinite tomorrows, but time waits for no one.

Understanding that time is limited—and acting early and deliberately—is one of the most critical steps toward building lasting wealth and a fulfilling life.

What’s the way out?

When you are young, you just have to make a small start — and then build on it.

Even saving 5–10% of your income is enough to begin with. If you earn ₹50,000, start a SIP of ₹5,000. Then slowly increase it to ₹7,500 and ₹10,000 over the next 2–3 years. What matters most is not how much you start with, but that you start early and stay consistent. That’s how wealth — and peace of mind — is built.

Final Thoughts: Build Meaningful Wealth, Not Just a Number

If you’ve read this far, take a moment to reflect on the four mistakes we discussed above.

Each of them — instant gratification, blind extrapolation, overconfidence in future income, and the myth of plenty of time — quietly eats away at your potential to build lasting wealth.

These aren’t just financial missteps. They are mental frameworks that stop people from creating the life they truly want.

But the goal is not just to get rich.

The goal is not to win some imaginary race and wake up one day with money in the bank — but bad health, broken relationships, and a deep sense of emptiness.

Create your Wealth with Jagoinvestor Team

If you’re serious about transforming your financial life and avoiding these costly mistakes, the Jagoinvestor Team is here to guide you. We’ve helped thousands build meaningful wealth with clarity, discipline, and a proven roadmap. If you’re ready for real progress — not just information — join hands with us. Fill up this form and let’s start your wealth journey the right way, with the right support

Wealth is not the end. It’s the enabler. It’s the tool that gives you freedom, options and security.

It’s what allows you to take care of your loved ones, enjoy life on your terms, and age with dignity — not dependence.

So yes, fix your mistakes. Start taking your financial future seriously. Create systems that help you grow your money with discipline and clarity. But don’t lose your soul in the process.

ipupd2