Recycling materials has been a widely established process to promote sustainability and reduce carbon footprint. Now, thanks to both technology innovation and an increasing global sentiment toward resource resilience and security, this well-known process is carving a niche in the critical minerals space.

The global shift toward clean energy and advanced technologies is driving unprecedented demand for rare earth elements (REEs), yet the US remains almost entirely dependent on foreign sources, particularly China, for its supply. As the risks of this reliance grow more apparent, both industry and government are turning to recycling as a scalable, lower-impact solution to secure domestic access to these strategic materials.

Supply challenges

The rare earth supply chain is one of the most geopolitically concentrated in the world.

As of 2023, China accounted for nearly 90 percent of the global refined output of rare earth elements and dominates downstream magnet manufacturing capacity. This dominance poses significant supply chain and national security risks. According to the US Department of Energy, a disruption in REE supply would have a disproportionate impact on high-tech and defense sectors that rely on materials like neodymium and dysprosium.

Rare earth magnets, particularly neodymium-iron-boron (NdFeB) types, are central to an increasingly wide array of technologies. In addition to their well-known applications in electric vehicles, wind turbines and military systems, they are also vital to the high-performance motors and cooling systems used in artificial intelligence (AI) infrastructure.

As demand for AI models and cloud computing surges, so does the need for hard disk drives as well as more efficient data centers, which rely on REE-powered components for energy efficiency and reliability.

Consumer electronics, robotics, medical imaging devices and industrial automation systems also depend on these magnets to operate at high precision and speed. This broad dependency underscores why rare earths are not only an industrial necessity but also a strategic economic asset.

Recognizing the REE supply imbalance, the US government has prioritized rare earths as part of its critical minerals strategy, with policy initiatives aimed at supporting domestic production, recycling and innovation.

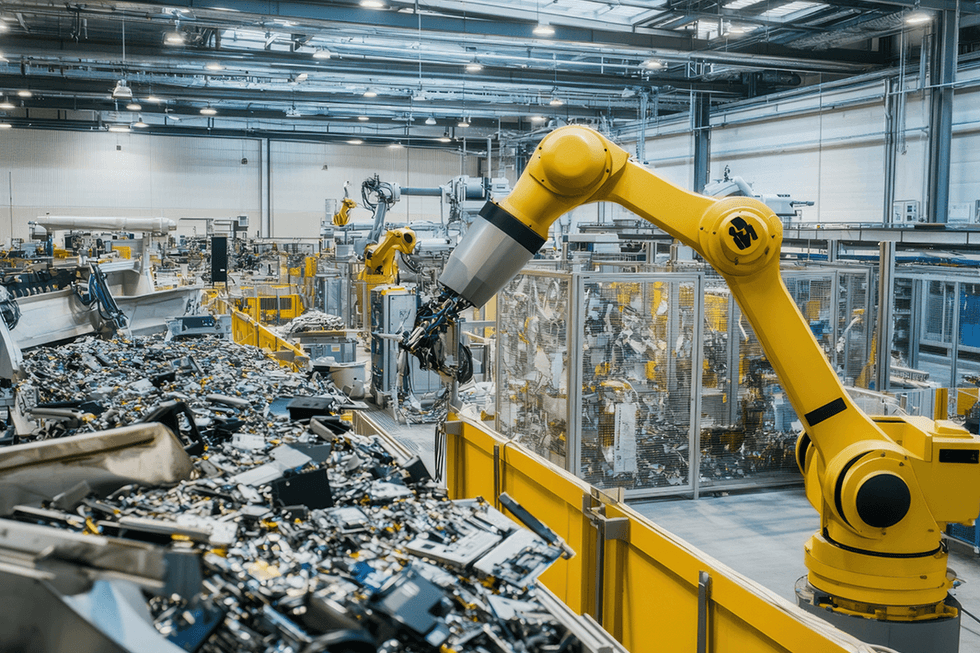

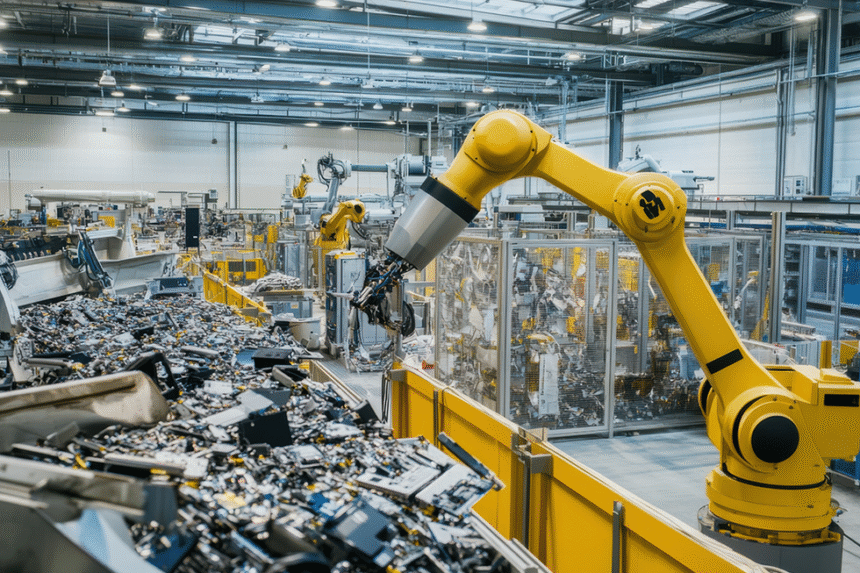

Beyond mining: Resilience through recycling

While new rare earth mining projects are in development across North America, they face well-known challenges: long permitting timelines, high capital costs and environmental concerns.

A report from the Harvard International Review indicates traditional mining of REEs often produces up to 2,000 tons of toxic waste per ton of extracted material. Recycling mitigates these impacts by reducing the need for new mining operations, thereby preserving ecosystems and decreasing carbon emissions. Innovative recycling methods have emerged as more sustainable alternatives, not only recovering valuable materials but also minimizing environmental harm.

Recycling and recovery of rare earths from end-of-life products offer a faster, more sustainable route to building domestic capacity. Establishing domestic recycling facilities enhances economic resilience by reducing reliance on imported REEs, particularly from dominant suppliers like China. Such initiatives contribute to job creation and stimulate local economies. Moreover, recycling supports a circular economy by reintroducing materials into the supply chain, reducing waste and promoting sustainable resource utilization.

New technologies have made rare earth magnet recycling more viable. For instance, the use of copper salts in leaching processes has achieved recovery rates of up to 98 percent for certain REEs. Additionally, the selective extraction-evaporation-electrolysis process offers efficient separation and recycling of REEs from end-of-life magnets. The magnet-to-magnet approach — where spent magnets are processed into new ones without reverting to individual metal oxides — has gained traction due to its efficiency and lower carbon footprint. These advancements facilitate scalability, enabling broader adoption of recycling practices.

Several companies in North America and Europe are currently in various stages of advancing rare earth magnet recycling technologies, contributing to a more sustainable and resilient supply chain.

Supporting American critical minerals independence

One company gaining investor attention in this space is Vancouver-based CoTec Holdings (TSXV:CTH).

Through a joint venture with HyProMag USA, CoTec is bringing to market an innovative recycling method for rare earth magnets. The technology, known as Hydrogen Processing of Magnet Scrap (HPMS), was originally developed by researchers at the University of Birmingham.

This process uses hydrogen to break down and extract rare earth magnet alloy powders from end-of-life products, such as hard drives and electric motors, without the need for high-temperature smelting or acid-based leaching. Compared to traditional recycling methods, HPMS is energy-efficient, low-emission and scalable, enabling recovery of high-purity metalized magnet material while significantly reducing environmental impact. Because the extracted powder can be directly reused to produce new magnets — entirely within the US — the technology also eliminates the need to ship materials overseas for refining and metallization, cutting costs and reducing supply chain vulnerability.

HyProMag USA completed an independent feasibility study and ISO study of its carbon impact last year. The feasibility study, released in November 2024, targets a total annual production capacity of 1,041 tons of recycled NdFeB magnets over a 40-year operating life, post-tax net present value of US$262 million at current market prices, increasing to US$503 million at independent forecast prices. HyProMag USA is eyeing 10 percent of USA’s domestic demand for NdFeB magnets within five years of commissioning, with three plants targeting ~3,000 tons of recycled NdFeB magnets, which is three times what was contemplated in the November 2024 feasibility study.

CoTec owns 60.3 percent of HyProMag USA, including a 50 percent direct stake and an indirect interest through its 20.6 percent ownership in Maginito, HyProMag’s other JV partner. The company is building a rare earth magnet recycling facility in the Texas Dallas-Fort Worth area, positioning it to serve US manufacturing and defense industries.

This recycling-based approach not only supports US supply chain resilience but also provides investors with exposure to a lower-risk, ESG-aligned critical minerals strategy.

Investor takeaway

As demand for clean energy and digital technologies accelerates, rare earth materials will remain a strategic priority. While domestic mining plays a role, recycling technologies like HPMS offer near-term solutions to build secure, sustainable and traceable supply chains. Companies innovating in this space, particularly those that can scale effectively in North America, may benefit from rising demand, policy support and long-term structural tailwinds.

For investors, understanding the rare earth ecosystem, including its geopolitical risks and technical innovation pathways, will be essential in identifying resilient opportunities amid the energy transition.

This INNspired article is sponsored by CoTec (TSXV:CTH,OTCQB:CTHCF) This INNspired article provides information which was sourced by the Investing News Network (INN) and approved by CoTec in order to help investors learn more about the company. CoTec is a client of INN. The company’s campaign fees pay for INN to create and update this INNspired article.

This INNspired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with CoTec and seek advice from a qualified investment advisor.

e496g4