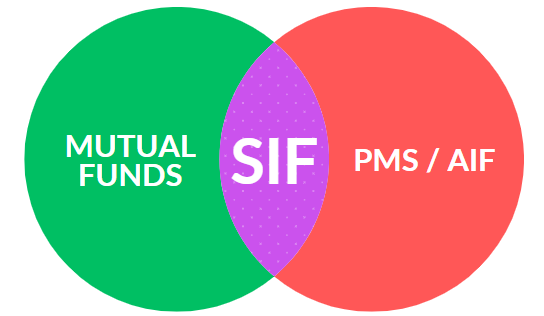

As India matures as an economy, every few years, we are bound to witness various financial innovations. The latest one, introduced by SEBI, is the Specialised Investment Fund (or SIF). It is an altogether new breed of investment vehicle, which is targeted at (supposedly) seasoned investors, has a higher ticket size, but is positioned as a bridge between traditional MFs and PMS/AIFs.

As I had written earlier, when SEBI had initially proposed this as NAC or New Asset Class in 2024, this is a differentiated category which clearly aimed to bridge the gap between Mutual Funds and PMS, and provide investors with greater flexibility and higher risk-taking capabilities within a regulated framework.

What is SIF (Specialised Investment Fund)?

The Specialised Investment Fund (or SIF) is neither a mutual fund nor a PMS.

Targeting comparatively wealthier investors (who are presumably considered more informed as well and may be willing to take more risk), it will have a minimum ticket size of Rs 10 lakh per investor. This means an investor must invest a minimum of INR 10 lakh across one or more investment strategies under the SIFs offered by an AMC/MF. So, it is like a Mini-PMS for Retail investors, and is structurally positioned between MF and PMS (which has a Rs 50 lakh entry barrier).

As per SEBI, this Rs 10 lakh threshold shall attract investors with Rs 10-50 lakh investible surplus, who are today being drawn to unauthorized and unregistered portfolio management service providers. Also, those who (wanted to but) did not have the full Rs 50 lakh to get into PMS, can now split the money (say they had Rs 30-40 lakh) across 3-4 new products (NACs) funds and invest here.

It is too early to say but given that it will be more tax-efficient and lower cost than a PMS/AIF (and like MFs), it may be of interest to many who wanted to explore PMS strategies but didn’t have Rs 50 lakh for PMS, and/or didn’t like tax headaches of PMS/AMF.

SIFs can have a wider range of investment strategies – from equity to debt – and everything in between. Interestingly and unlike MF/PMS, which are not allowed to, this new product will be allowed to use derivatives for non-hedging too.

7 Types of SIF (Specialised Investment Fund)

As per the regulator, this will provide more flexibility and risk-taking in investments and potentially generate higher returns for its investors.

Similar to mutual funds, SIFs will have asset-class-based categories. There will be seven categories—three equity, two debt, and two hybrid schemes.

Currently, as per the SEBI Circular dated 27-Feb-2025 (link), the following investment strategies shall be permitted to be launched under SIF:

- Equity Long-Short Fund – Minimum investment in equity and equity-related instruments – 80% and Maximum short exposure through unhedged derivative positions in equity and equity-related instruments: 25%

- Equity Ex-Top 100 Long-Short Fund – Minimum investment in equity and equity-related instruments of stocks, excluding the top 100 stocks by market capitalization – 65%. Maximum short exposure through unhedged derivative positions in equity and equity-related instruments other than large-cap stocks: 25%

- Sector Rotation Long-Short Fund – Minimum investment in equity and equity-related instruments of a maximum of 4 sectors – 80% & Maximum short exposure through unhedged derivative positions in equity and equity-related instruments: 25%

- Debt Long-Short Fund – Investment in debt instruments across duration, including unhedged short exposure through exchange-traded debt derivative instruments

- Sectoral Debt Long-Short Fund – Investment in debt instruments of at least two sectors, with a maximum investment of 75% in a single sector. Maximum short exposure through unhedged derivative positions in debt instruments: 25%*

- Active Asset Allocator Long-Short Fund – Dynamic investment across the following asset classes: Equity, debt, equity, and debt derivatives, REITs/InVITs and commodity derivatives. Maximum short exposure through unhedged derivative positions in equity and debt instruments: 25%

- Hybrid Long-Short Fund – Minimum investment in equity and equity-related instruments – 25% Minimum investment in debt instruments – 25% Maximum short exposure through unhedged derivative positions in equity and debt instruments: 25%

To avoid the proliferation of investment strategies and in line with the approach followed for categorization of MF schemes, only one investment strategy shall be permitted to be launched under each of the aforementioned categories.

As of now, and rightly so, only mutual fund AMCs can offer this product and not PMS or AIF managers. And even then, only those AMCs will be able to offer this product which have a minimum of 3 years of operational experience and an average AUM of more than Rs 10,000 Cr in the preceding 3 years. There is some flexibility in the rules to allow other AMCs or senior fund managers to launch these products as well if they are unable to meet these criteria.

The AMCs will have a Distinct Branding Requirement so that the SIF does not confuse investors, and it should be obvious that it is different from MFs and PMS. This new identity will help differentiate between the MF schemes currently being offered by the AMCs and the new SIF products under the new category.

Do you need to invest in SIF?

Clearly, this is a sophisticated product category which is ‘designed’ to be tilted towards high-risk and high-return opportunities.

These days, there are thousands of people who can easily find spare Rs 10 lakh to invest. But that doesn’t mean that they should blindly go and invest Rs 10 lakh in SIF. This is the same logic as I wrote about in Why you shouldn’t invest in PMS just because you have Rs 50 lakh.

This product category is best suited for those who understand risk well, have been investing in markets for years and have seen at least a full cycle or two.

If you’re cautious about taking risks, SIFs might not suit you. Similarly, if you’re uneasy with increased price swings and relatively higher fees (as these most probably will have higher expense ratios given exotic strategies that many of these funds will apply), SIFs may not be the best choice for you.

Also, given that there is a lot of flexibility that the SIF structure allows, we will also need to understand how different SIFs are being managed, given the different investment and portfolio management styles of different fund managers. It is still early days here.

For obvious reasons and a few which I mentioned above, SIF is not suitable for everyone. If someone is telling you otherwise, then they are lying. It is definitely worth exploring for a select few, but definitely not for everyone (with Rs 10 lakh spare).

At the cost of sounding boring, the fact remains that your existing, simple mutual funds still remain a super-product for most of your investment requirements!

But I still like this development, even though there are many who are against the introduction of new products. I feel financial innovation is necessary as India evolves and transitions from a developing to a developed economy. From what I understand initially, it will help widen the field (and deepen the market to some extent) by also allowing AMCs to participate in derivatives actively. Also, it will allow some of the adventurous AMCs to explore unique strategies.

But to be fair, the SIF regulations are still evolving, and we could see more variety and choices in the coming years. However, as of today, it is crucial for interested investors not to be in a hurry and thoroughly understand the risks/complexities involved in these exotic SIFs. Also, all investments should be goal-linked. So, they should also assess whether SIF investments can be aligned with their individual financial goals and risk tolerance or not.