In the evolving world of decentralized finance (DeFi), institutional lending has emerged as a crucial frontier bridging traditional finance and blockchain innovation.

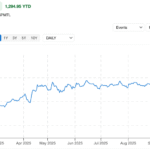

Maple Finance, a DeFi lending platform managing over US$4 billion in assets, stands out as a leader. It takes a unique approach to digital asset oversight, combining on-chain transparency with institutional-grade risk controls.

The Investing News Network (INN) spoke to co-founder and CEO Sid Powell, who shed light on how Maple has evolved, its strategic positioning amid regulatory and market shifts and the broader trends shaping DeFi lending today.

For investors and industry watchers alike, Maple’s story offers valuable insight into the maturation of cryptocurrency finance and the future of institutional participation.

INN: How has Maple Finance evolved since its founding, and what key milestones has the company achieved?

Sid Powell: Joe (Flanagan), my co-founder, and I founded Maple in 2019 during the very early days of DeFi. Initially we aimed to create tokenized bonds, similar to what we knew from traditional finance.

However, there wasn’t really a market for that back then. So as Maple evolved, we pivoted to becoming a direct lender to institutions, which has now become our core business.

Over the intervening five years, we’ve transitioned from uncollateralized lending in 2021 and 2022 to becoming one of the top five global over-collateralized lenders. All our loans are still tokenized and visible on-chain, but are now significantly over-collateralized by large-cap crypto assets like Bitcoin, Ethereum, Solana and XRP.

INN: What distinguishes Maple’s approach to institutional lending and DeFi compared to other platforms like Compound and Centrifuge?

SP: A lot of people are always asking us what differentiates Maple in what is becoming an increasingly competitive space. We’ve carved out a niche by focusing exclusively on institutions rather than retail customers.

One of the ways that we target and cater to institutions is that we accept native Bitcoin (collateral). Maple is actually integrated with all of the qualified custodians that these institutions already use today. This reduces counterparty risk because they retain control through a tri-party setup.

Another important distinction is that we avoid algorithmic liquidations. Instead, we maintain direct contact with borrowers, providing margin call warnings and working closely with them to manage risk.

This is critical for large institutional clients who cannot afford to have their collateral liquidated in one hit and be hit with a pretty expensive penalty. They choose to work with us because we have different risk triggers. We reach out and provide warnings and notifications to them, and they have somebody to interface with. We found that those have been critical steps for institutions, and it’s why once they take out one loan with us, the relationship will grow over time. The largest institutions that work with us today borrow over US$200 million through Maple.

INN: What was the strategic rationale behind Maple’s expansion to Arbitrum?

SP: We had been looking to go cross-chain for some time. After a successful syrupUSDC launch on Solana, we wanted to see if we could replicate that across other chains. Arbitrum was a logical next step for us due to our strong partnership with Morpho. We successfully launched on Solana with partnerships with Jupiter and Camino, which meant that syrupUSDC holders on those chains could use it in looping strategies and hostess collateral.

Morpho is well established on Arbitrum, so we felt very confident in launching syrupUSDC there.

We also prioritized launching on chains with significant stablecoin liquidity; Arbitrum had a substantial amount of USDC circulating, making it ideal. And that’s how we kind of prioritize the other launches that we’ll have coming for the rest of this year and into Q1 next year.

INN: What makes syrupUSDC different from other yield-bearing stablecoins?

SP: We’ve seen tremendous growth in stablecoins so far, to the point where there’s now over 270 billion outstanding. So syrupUSDC is still a relatively small portion of that, but how we’ve tried to stand out is with the sustainability of the yield. The interest income comes from high-quality borrowers; it’s not dependent on points farming, and there are no gimmicks at play.

Additionally, syrupUSDC is highly composable and well integrated with major protocols. Users can fix the interest on syrupUSDC using Pendle, exit the position using Uni Swap and post and borrow against syrupUSDC to run a looping strategy on Morpho or Euler. In the next few weeks, we hope to have it on Aave, which is, of course, the largest DeFi lending market.

INN: What role do you see institutional investors playing in DeFi’s next phase, and what are they asking from Maple?

SP: I think institutional investors will play a larger and larger role in DeFi. We already deal with a number of hedge funds that allocate either directly to syrupUSDC vaults or who borrow from us and post collateral.

I’ve already seen that one increase markedly since 2022. There’s now a lot more institutional participation. But I think if we want the space to grow, most of the growth in the pie from here on out is going to come from institutions entering and starting to use DeFi protocols like Maple and other prominent protocols out there.

The role that we see them playing as far as it pertains to working with us will be more on the borrower’s side, as well as allocating to the syrupUSDC vaults. We saw that already happen in a pretty big way two weeks ago when we launched on Plasma. A number of institutional hedge funds deployed capital to that vault, and we’re seeing more and more of these hedge funds raise capital from traditional investors.

INN: What motivated Maple’s expansion to the Plasma blockchain, and how does its architecture improve syrupUSDT’s utility?

SP: We’ve had a very good relationship with the Plasma team since we started speaking. Looking at a strategic level, we’ve been very interested in the idea of a stablecoin-focused chain.

Stablecoins are among the fastest-growing segments in DeFi and seem to be the Trojan horse bringing traditional finance investors and allocators like Stripe and PayPal Holdings (NASDAQ:PYPL) into crypto.

There was also a strategic alignment there; Plasma has a very close relationship with Tether, with which we have worked in the past, and there are obviously incredible network effects for USDT.

The Plasma team moves exceptionally fast, and we think they have a lot of institutional credibility that really aligns with Maple as an institutional lending platform.

INN: How does Maple approach competition with traditional asset managers like BlackRock?

SP: Maple has achieved some success in terms of managing US$4 billion, but in the context of the overall US$1.5 trillion private credit market, we’re still a relatively small drop in the ocean. That’s why I dwell a lot on the concept of niches.

We differentiate through speed, onboarding, bespoke facilities and integrating multiple custodians for client flexibility. Traditional banks face regulatory hurdles and may partner with platforms like Maple that already have distribution set up, rather than build competing tech. We position ourselves as partners, not competitors.

As Peter Thiel would say, competition is for losers.

INN: Is regulation a headwind or an opportunity for Maple?

SP: It varies by jurisdiction. Within the US, I would have said it was a headwind last year. This year, I see it more as an opportunity. We participated in the US Securities and Exchange Commission’s roundtable, and see a regulator intent on balancing innovation with consumer protection, whereas before, I would have said perhaps they erred too much on the side of consumer protection at the expense of innovation.

I see the GENIUS Act and the forthcoming Clarity Act as huge tailwinds for the space. If the US is able to set a tone of pro-innovation, that will then set the tone for the other prominent jurisdictions like Singapore, Hong Kong and Europe.

INN: Are there jurisdictions the US should emulate or avoid in crypto regulation?

SP: The US should look to Hong Kong and Singapore, known for innovation and asset manager engagement.

I think the US should be mindful of emulating Europe’s restrictive MiCA legislation too much. You’re already sort of seeing it perhaps smother the startups early on. I’d say the US would be better served by looking at Singapore, Hong Kong and probably a little bit less at what Europe is doing on the regulatory front, at least in terms of in terms of footsteps to follow, rather than footsteps to avoid.

INN: What is Maple’s approach to risk and credit assessment?

SP: Credit risk assessment is indeed the most important thing we do. Since all of our loans are over-collateralized, we focus on the quality and volatility of large-cap collateral like Bitcoin.

We monitor loan-to-value ratios, margin call thresholds and liquidation levels carefully. Maple’s operations team has proprietary alert systems and 24/7 monitoring. Borrowers receive automatic notifications if their collateral hits margin call levels and have 24 hours to top up collateral. If they fail to do so, Maple may liquidate the collateral to protect lender funds. Loan terms are conservatively set to ensure protection beyond 100 percent collateralization.

What’s next for Maple Finance?

Looking ahead, Maple Finance plans to expand its presence across multiple blockchain networks, while integrating syrupUSDC as collateral on lending platforms such as Aave.

“It’s always difficult in a startup,” Powell concluded. “You have a temptation to do too many different things. I look at what Steve Jobs said, which is that he was almost as proud of the things they didn’t do. And so in Maple’s case, that means focusing our business on institutional lending and being the dominant on-chain asset manager.”

The company aims to grow its AUM by 25 percent to US$5 billion by year end.

On a macro scale, Powell anticipates a substantial increase in global Bitcoin-backed lending, potentially growing from around US$20 billion to 25 billion today to as much as US$200 billion. The company aims to capture a sizable share.

As Powell put it, the focus remains on disciplined growth and narrowing priorities, a measured approach fitting for a maturing DeFi landscape.

This interview has been edited for clarity and length.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web