Silver took some luster from gold in Q2 as its price climbed to 14 year highs.

Many of the same contributors that affected the gold price were also in play for silver.

Uncertainty in financial markets, driven by a chaotic US trade and tariff policy, coincided with rising tensions in the Middle East and continued fighting between Russia and Ukraine, prompting investors to seek safe-haven assets.

Unlike gold, however, silver also saw gains as industrial demand strained overall supply.

What happened to the silver price in Q2?

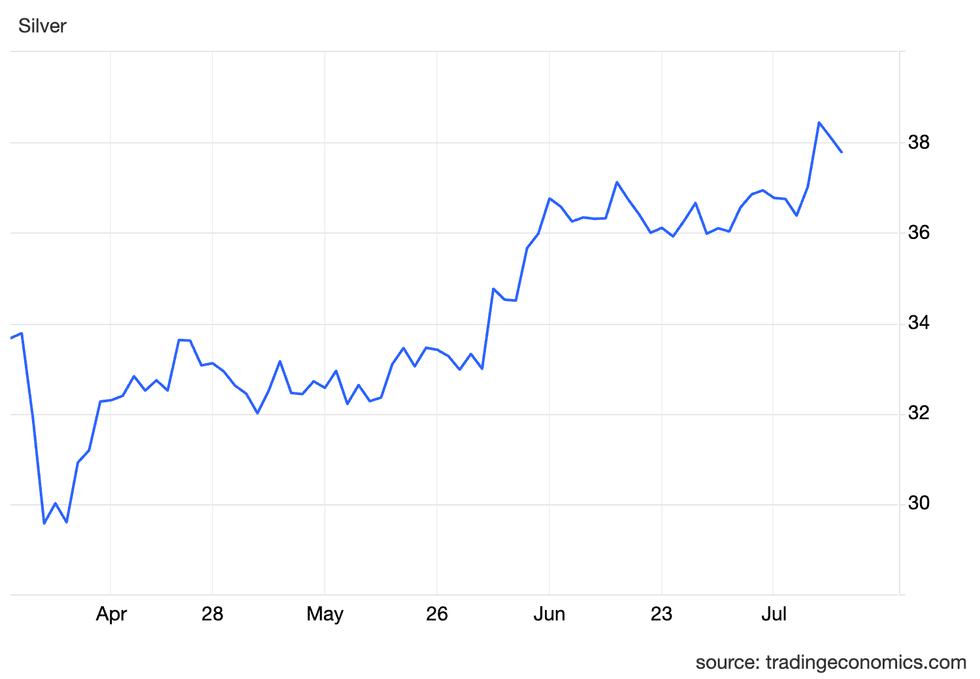

The quarter opened with the price of silver sinking from US$33.77 per ounce on April 2 to US$29.57 on April 4. However, the metal quickly found momentum and climbed back above the US$30 mark on April 9.

Silver continued upward through much of April, peaking at US$33.63 on April 23.

Volatility was the story through the end of April and into May, with silver fluctuating between a low of US$32.05 on May 2 and a high of US$33.46 on May 23.

Silver price, April 1 to July 17, 2025.

Chart via Trading Economics.

At the start of June, the price of silver soared to 14 year highs, opening the month at US$32.99 and rising to US$36.76 by June 9. Ultimately, the metal reached a year-to-date high of US$37.12 on June 17. Although the price has eased slightly from its high, it has remained in the US$36 to US$37 range to the end of the quarter and into July.

Silver supply/demand balance still tight

Various factors impacted silver in the second quarter of the year, but industrial demand was a primary driver in both upward and downward movements. Over the past several years, silver has been increasingly utilized in industrial sectors, particularly in the production of photovoltaics. In fact, according to the Silver Institute’s latest World Silver Survey, released on April 16, demand for the metal reached a record 680.5 million ounces in 2024.

Artificial intelligence, vehicle electrification and grid infrastructure all contributed to demand growth

At the same time, mine supply has failed to keep up, with the institute reporting a 148.9 million ounce production shortfall. This marked the fourth consecutive year of structural deficit in the silver market.

In a June 11 interview with the Investing News Network (INN), Peter Krauth, editor of Silver Stock Investor and Silver Advisor, said deficits are likely to get worse in the coming years as aboveground stockpiles are chipped away.

“(We have) flat supply, growing demand — demand that’s nearly 20 percent above supply,” he said. “And our ability to meet those deficits is shrinking because we’re tapping into these aboveground stockpiles that have shrunk by about 800 million ounces in the last four years, which is equivalent to an entire year’s mine supply. So it’s the perfect storm.”

But industrial demand can send the silver price in either direction.

The chaos caused by Trump’s on-again, off-again tariffs has caused some consternation among investors.

While gold and silver have traditionally both been viewed as safe-haven assets, silver’s increasing industrial demand has decoupled it slightly from that aspect. When Trump announced his “Liberation Day” tariffs on April 2, silver was impacted due to fears that a recession could cause demand for the metal to slip.

Although the dip in silver was short-lived, it was one of its steepest falls in recent years.

In an email to INN, Julia Khandoshko, CEO of Mind Money, said a recession could have consequences for silver, but she wouldn’t expect them to last long:

“If a global recession really starts, silver will most likely nosedive momentarily. In terms of its 2025 performance, silver growth has been largely bolstered by consolidated precious metals group appreciation, additionally beefed up by relative USD weakness.”

Geopolitics and the silver price

Adding to the tailwinds is a growing east-west divide. Due to its usage in industrial components, particularly those related to the military and energy sectors, and its role as a safe haven, silver is being influenced by geopolitics.

June’s price rally came alongside growing speculation that Israel was preparing to attack Iranian nuclear sites. Investors became concerned that war could disrupt international trade and oil movements in the region.

Ultimately, their concerns were proven right, and Israel launched attacks on June 12; the US then bombed key nuclear facilities on June 21. While the escalation is new, the underlying politics have been simmering for years.

Sanctions against Russia have strengthened support among the BRICS nations, which have been working to reduce their reliance on US dollar assets, such as treasuries, and increase trade in their own currencies.

But they may also be working to separate themselves from western commodities markets. In October 2024, Russia floated the idea of creating a precious metals exchange to its BRICS counterparts. If established, it could shake up pricing for commodities like silver, allowing Russia to circumvent sanctions and trade with its bloc partners.

While the exchange is still just an idea, a bifurcated world is not. While the US has targeted most nations with tariffs, it has singled out China. Much of the first half of the year saw the world’s two largest economies escalate import fees with one another, with China even restricting the export of rare earth elements to the US.

Discussions on national security and critical minerals have been at the forefront for the last several years. Still, they have become even more pronounced with the US and China on tense footing.

In a July 9 interview with INN, economist and author Dr. Nomi Prins suggested that national security demands are likely to offset the impact of any economic downturn on the broader economy.

“Even if that’s going to happen, industrial use value — building infrastructure, building national security, national energy priorities — needs a lot of silver, and there just simply isn’t enough supply out of the ground to meet the demand. That’s long-term demand above the ground. This has been a thing, but right now, because of these geopolitical forces and realignments, silver is going to drop more into that industrial role,” she said.

Silver price forecast for 2025

Overall, the expectation is that without new mine supply and dwindling aboveground stockpiles, silver is likely to remain in deficit for some time. Other factors, like Trump tariffs and geopolitics, aren’t likely to disappear either.

Demand could ease off if a global recession were to materialize, but safe-haven investing could offset declines.

For his part, Krauth thinks the silver price is likely to remain above the US$35 mark, but it could fluctuate and he suggested a rally in the US dollar could push the silver price down. However, he also sees some pressure easing on the recession side of the equation if the US signs tariff deals that would eliminate some uncertainty.

“US$40, let’s say by the end of this year,” he said, adding, “Frankly, I could see something really realistically above that, maybe an additional 10 percent if the scenario plays out right.”

He doesn’t think that’s the end. In the longer term, Krauth sees silver going even higher. He pointed to the current gold-silver ratio, which is around 92:1, compared to an average of 60:1 over the last 50 years.

“So we could go to, who knows, somewhere like maybe 40 or 30 to one in the ratio. That would be tremendous for silver — that could bring silver above US$100. I’m not saying that’s happening tomorrow, but in the next couple of years I would say that’s certainly something that could easily be in the cards,” Krauth said.

Fundamentals and geopolitics aligned for silver in the first half of 2025, and barring a recession, they are likely to provide tailwinds in the second half. Whether the price climbs or continues to find support at US$35 is yet to be seen.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web