Investor Insight

South Harz Potash (ASX:SHP) is an advanced-stage potash development company unlocking value from one of Europe’s most strategic fertilizer assets. Headquartered in Perth, Australia, the company is currently advancing a dual-asset acquisition strategy to complement and enhance the long-term value proposition of its wholly-owned South Harz Potash Project.

Overview

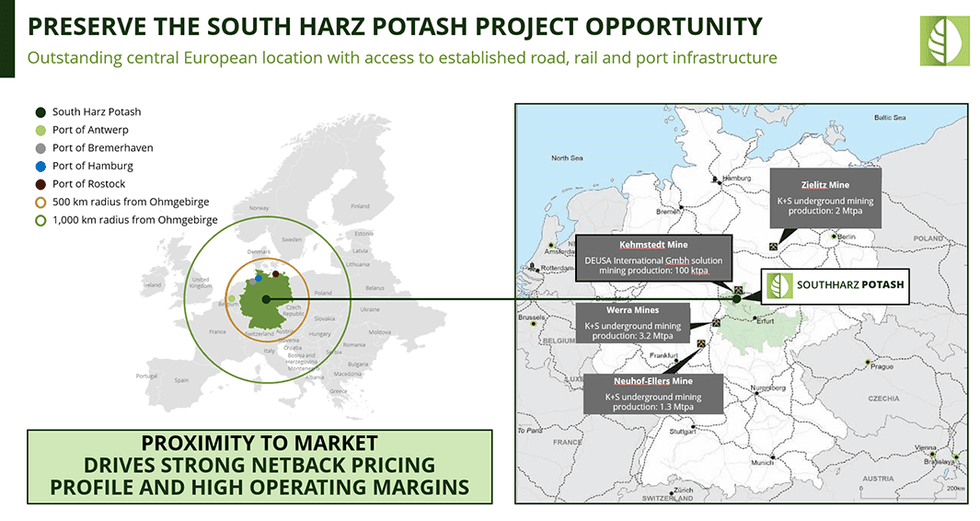

South Harz Potash (ASX:SHP) holds a high-potential critical minerals opportunity strategically located in central Europe. Due to its central location, the South Harz Potash Project is primely positioned to capitalise on long-term potash price upside via its direct access to European agricultural markets, electrified rail infrastructure, and existing brownfield underground access.

Europe is seeking to enhance critical mineral resilience amid tightening global potash supply chains. European MOP supply has declined over the past decade, while imports face growing geopolitical risk due to sanctions and restrictions on major exporters such as Belarus and Russia. South Harz Potash offers a potential reliable, low-carbon, and locally-sourced future potash supply to Western Europe’s agricultural centres.

South Harz Potash completed a Pre-Feasibility Study on Ohmgebirge in May 2024, which confirmed strong project economics and scalability. The company’s key potash assets are situated over perpetual mining licenses, underpinning sustained tenure security.

A disciplined capital allocation approach sees South Harz Potash exercising ‘strategic patience’ and aligning further advancement and development of Ohmgebirge with more favorable potash market dynamics. In the meantime, the company is carefully preserving and growing the long-term real option value that it holds from being a potential world-class future domestic potash supplier to Western Europe.

Company Highlights

- Advancing a Dual-Asset Strategy: Targeting acquisition of a second critical minerals project complementary to the company’s flagship Ohmgebirge Development, part of its broader South Harz Potash Project in Germany.

- Preservation and Growth of Long-Term Potash Option Value: Amidst current global and potash market volatility, the South Harz team is focussed on advancing its potash assets via non-dilutive funding sources such as German R&D tax rebates, ERMA funding, and ongoing engagement with financial and industry parties on potential strategic asset-level investment.

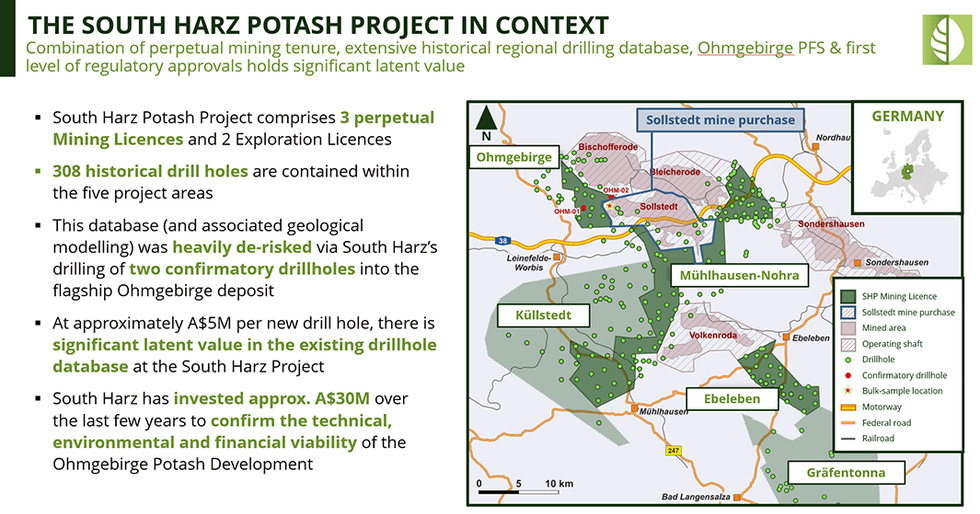

- Western Europe’s Largest Potash Resource: The South Harz Potash Project comprises a dominant 659 sq km land position in Germany’s South Harz Potash District, being three perpetual mining licences (including Ohmgebirge) and two exploration tenements.

- Perpetual Tenure: The South Harz mining licences are perpetual with no holding costs and no royalty obligations, ensuring maximum project flexibility and value retention.

- Long-Term Macro Tailwinds for Potash: Europe faces declining MOP supply and is increasingly reliant on imports amid geopolitical disruption in Belarus and Russia. South Harz Potash is primely positioned to deliver stable future supply of sustainable, low-carbon potash to European markets.

- Strong Project Viability: South Harz completed a Pre-Feasibility Study (PFS) in 2024 which confirmed Ohmgebirge as a world-class brownfield development with robust technical parameters and excellent economic returns.

The South Harz Opportunity: A Dual-Asset Strategy

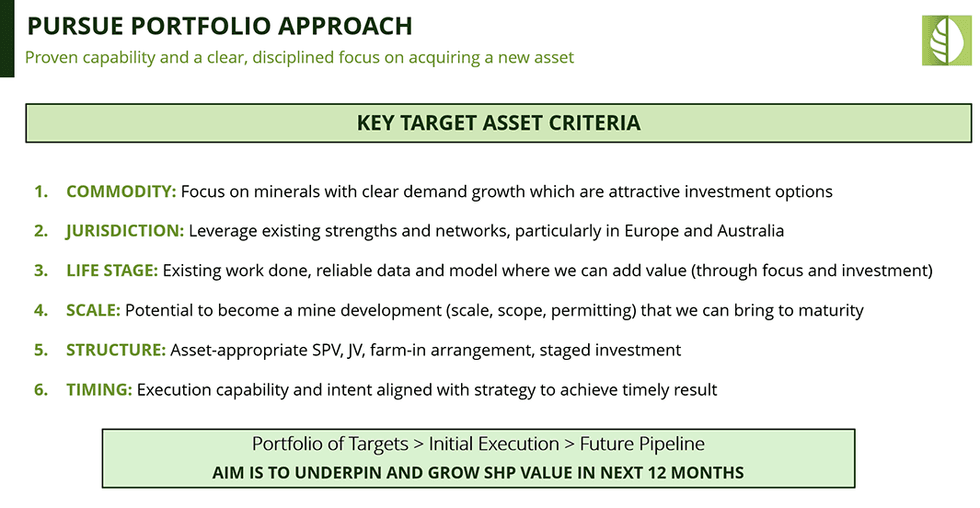

South Harz Potash has a dual-asset strategy designed to drive long-term value growth complementary to its South Harz Potash Project.

#1 Acquire and Advance Second Critical Minerals Asset

Leveraging its existing corporate foundation and established presence in Europe and Australia, the company is targeting the strategic acquisition of new critical minerals assets that offer strong potential to drive shareholder value creation while potash markets progressively recover.

With global market conditions rapidly evolving, South Harz Potash holds the purpose and patience to explore new opportunities, backed by a steadfast and supportive major shareholder base.

#2 Preserve and Grow Long-Term Value in South Harz Potash Project

South Harz Potash’s flagship Ohmgebirge Development, part of its broader wholly-owned South Harz Potash Project, is centrally located in Germany’s historic South Harz mining district. It is associated with established regional infrastructure, offering valuable and highly differentiating brownfield development opportunity.

Ohmgebirge hosts a maiden Ore Reserve of 83.1 Mt at 12.6 percent potassium oxide (K₂O) and a total sylvinite Mineral Resource exceeding 286 Mt. The future development of Ohmgebirge benefits from access to over 60 percent renewable grid power, electrified rail to major European ports, and water recycling systems – supporting a low-impact, sustainable operation.

Ohmgebirge forms the foundation of South Harz’s potash strategy, with nearby licences – Ebeleben, Küllstedt, and Mühlhausen–Nohra – offering modular long-term expansion potential.

Management Team

Len Jubber – Executive Chairman

With over 30 years in the mining sector, Len Jubber has held leadership roles including managing director and CEO of Bannerman Resources, managing director/CEO of Perilya, and chief operating officer of OceanaGold. He began his career with Rio Tinto in Namibia and brings a wealth of technical, commercial, and entrepreneurial experience to the company.

Dr. Reinout Koopmans – Non-Executive Director

Dr. Reinout Koopmans brings 15 years of investment banking experience from London, having led global public equity raising for natural resource companies at Deutsche Bank and headed the European equity capital markets team at Jefferies International. He also served as a management consultant at McKinsey & Co in Germany and Southeast Asia. Koopmans holds a PhD and MSc from the London School of Economics and a degree from Erasmus University, Rotterdam.

Rory Luff – Non-Executive Director

Rory Luff is the founder of BW Equities, a specialist Melbourne-based equities advisory firm, with over 15 years of experience in the financial services industry. He has spent most of his career advising resource companies on capital raisings and financial market strategies.

Richard Pearce – Non-Executive Director

Richard Pearce has over 30+ years’ experience in the mineral industry across critical, industrial and energy minerals. His participation spans the full asset life cycle and value chains, and includes key roles held across board directorships, exploration and operations management, mining finance, M&A, business strategy and operational improvement. He has a proven business development and asset commercialisation track record.

Dr. Babette Winter – Regional Director and Managing Director of Südharz Kali GmbH

Dr. Babette Winter holds a PhD in chemistry and has extensive experience in politics, communication, public administration, environmental issues, and technology. She served for over five years as state secretary for Europe in Thuringia and held various leadership roles in environmental policy and public relations within German governmental bodies.

Graeme Smith – Company Secretary

Graeme Smith is an experienced finance professional with over 30 years in accounting, corporate governance, and company administration. He is a member of the Australian Society of Certified Practising Accountants, the Institute of Chartered Secretaries and Administrators, and the Governance Institute of Australia.