Key Points

- The White House is signaling that not all furloughed workers may receive back pay, creating new financial risks during the shutdown.

- Until workers receive notice they are not exempted and actually stop receiving paychecks, they can’t adjust their loans.

- If paychecks do stop, and workers aren’t paid, re-certifying your student loan income-driven repayment plan with a $0 income can lower payments and protect PSLF eligibility.

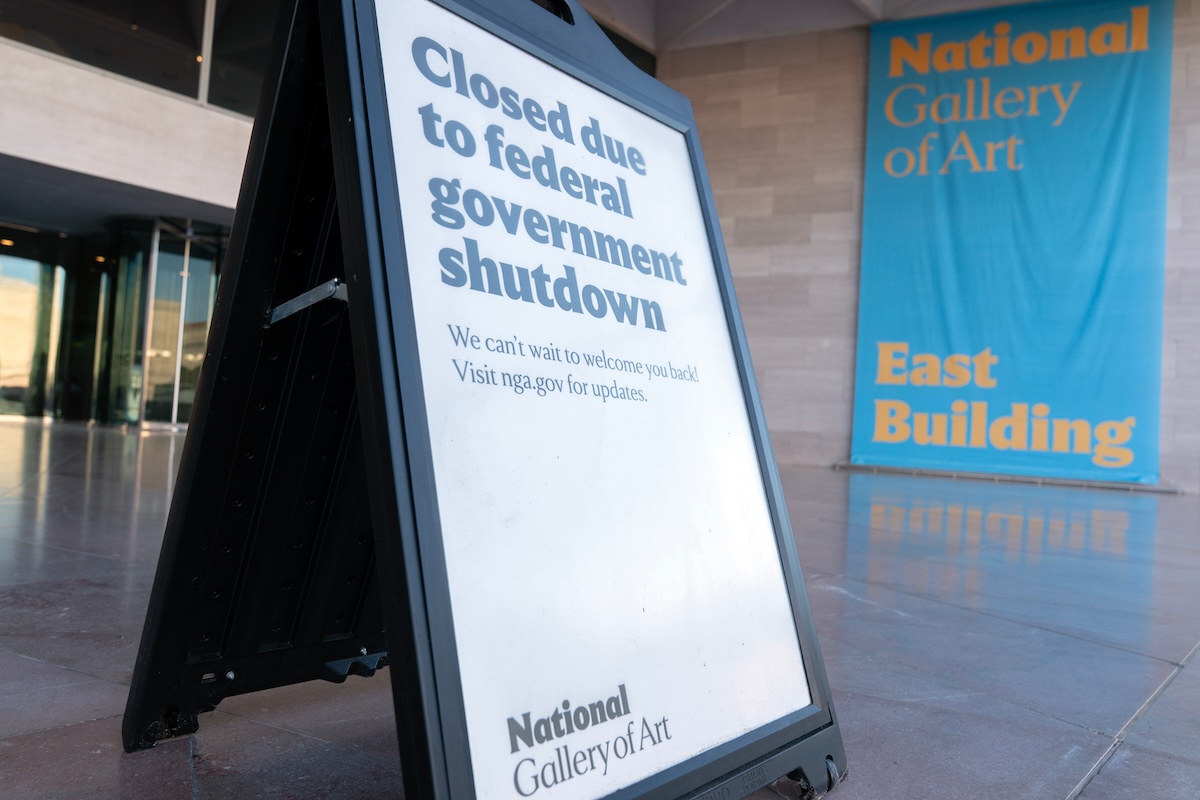

The October 2025 government shutdown has entered its second week, sidelining more than 620,000 federal employees and disrupting key government functions. The IRS alone has furloughed 46% of its workforce this week, while large portions of the State Department, Department of the Interior, and Justice Department remain partially shuttered.

Tomorrow, October 10, is going to be the first paycheck Federal employees will see that’s less than normal (since it includes the period of the first days of the shutdown).

But the financial stress deepened after President Trump suggested that some furloughed workers might not receive back pay once the shutdown ends, despite a 2019 law that was designed to guarantee it.

The Government Employee Fair Treatment Act of 2019 (PDF), passed after the record 35-day shutdown in 2018-2019, added language to the Antideficiency Act requiring that all furloughed and excepted employees receive back pay automatically “at the earliest date possible” once appropriations resume.

However, the new White House draft memo interprets that clause differently, arguing that Congress must still pass appropriations before any back pay can be issued.

An earlier Office of Management and Budget memo from September 30 reaffirmed the 2019 law’s guarantee of back pay. But that reference was removed in an October 3 update, signaling an internal debate within the administration about whether the law is self-executing.

For furloughed workers with federal student loans, the implications are especially serious. Missed or delayed pay can quickly translate into missed loan payments and potential delays to Public Service Loan Forgiveness (PSLF) progress.

Would you like to save this?

Protecting PSLF Eligibility If Paychecks Stop

For most government workers, the goal is simple: avoid missing payments and keep PSLF progress intact.

Under PSLF, federal employees can have their student loan balance forgiven after 120 qualifying monthly payments while working full-time for a government or nonprofit employer. Payments made under an income-driven repayment (IDR) plan count and months in forbearance usually don’t.

That means the safest way to handle a missed paycheck is to update your IDR plan immediately to reflect your current income, which, during a furlough, could be $0.

This keeps your loan in good standing, preserves forgiveness progress, and protects your credit, all while allowing you to make an affordable payment.

It’s important to note that receiving backpay is different than not receiving pay. If you receive backpay, your income didn’t drop to $0. You were just delayed in being paid. In which case, you can’t lie about your income. A forbearance may be the only choice if you can’t afford your payment.

However, if you actually don’t get paid for this time, your income is $0. Then, you’re eligible to change your repayment plan amount based on your current income. The nuance matters.

How To Setup Your Student Loan Payment Based On $0 Income

Here’s the step-by-step process for furloughed workers who are not getting paid:

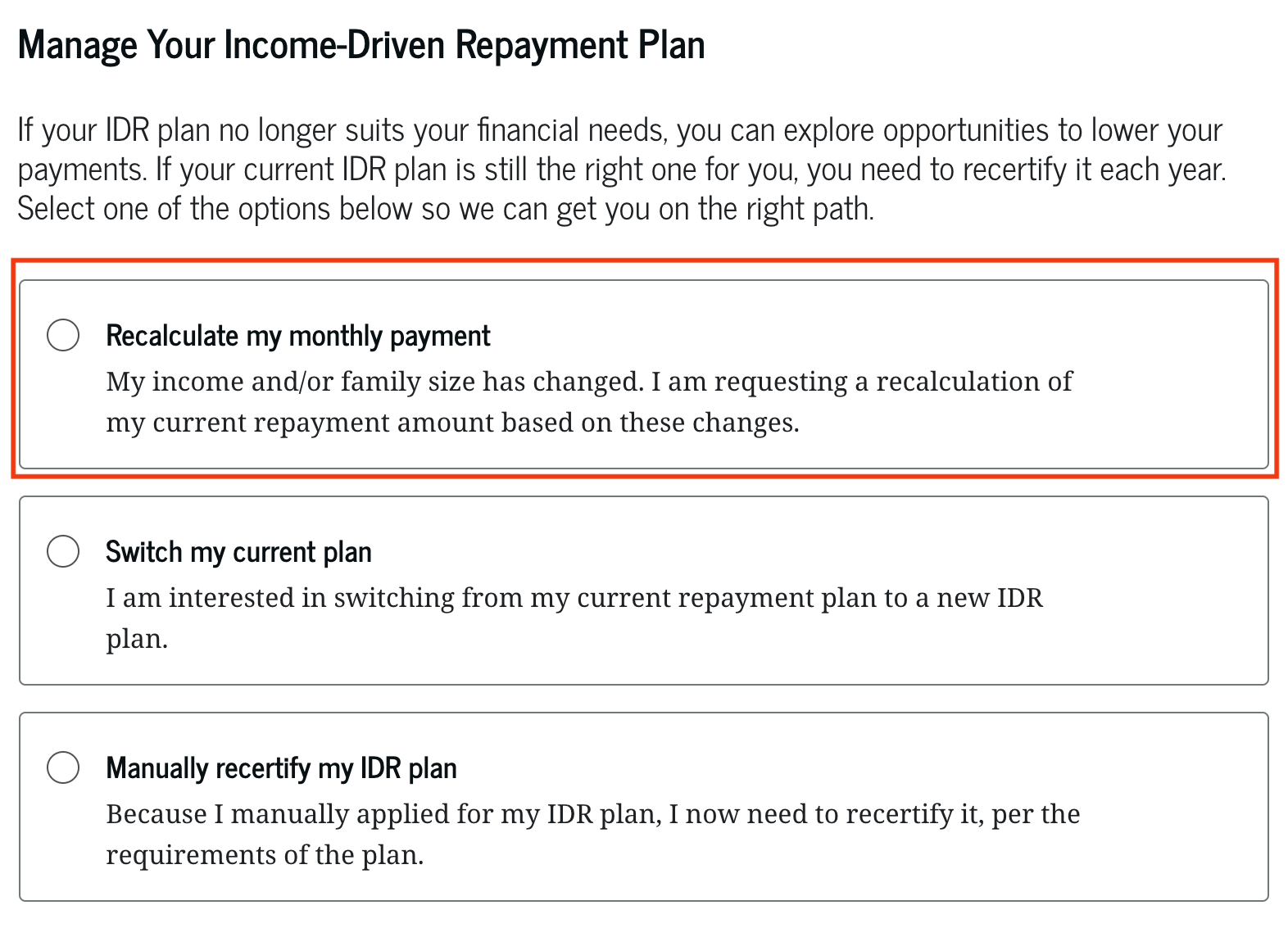

1. Log in at StudentAid.gov and choose “Income-Driven Repayment Plan.”

2. Select “Recertify or Change Your Income-Driven Repayment Plan.“

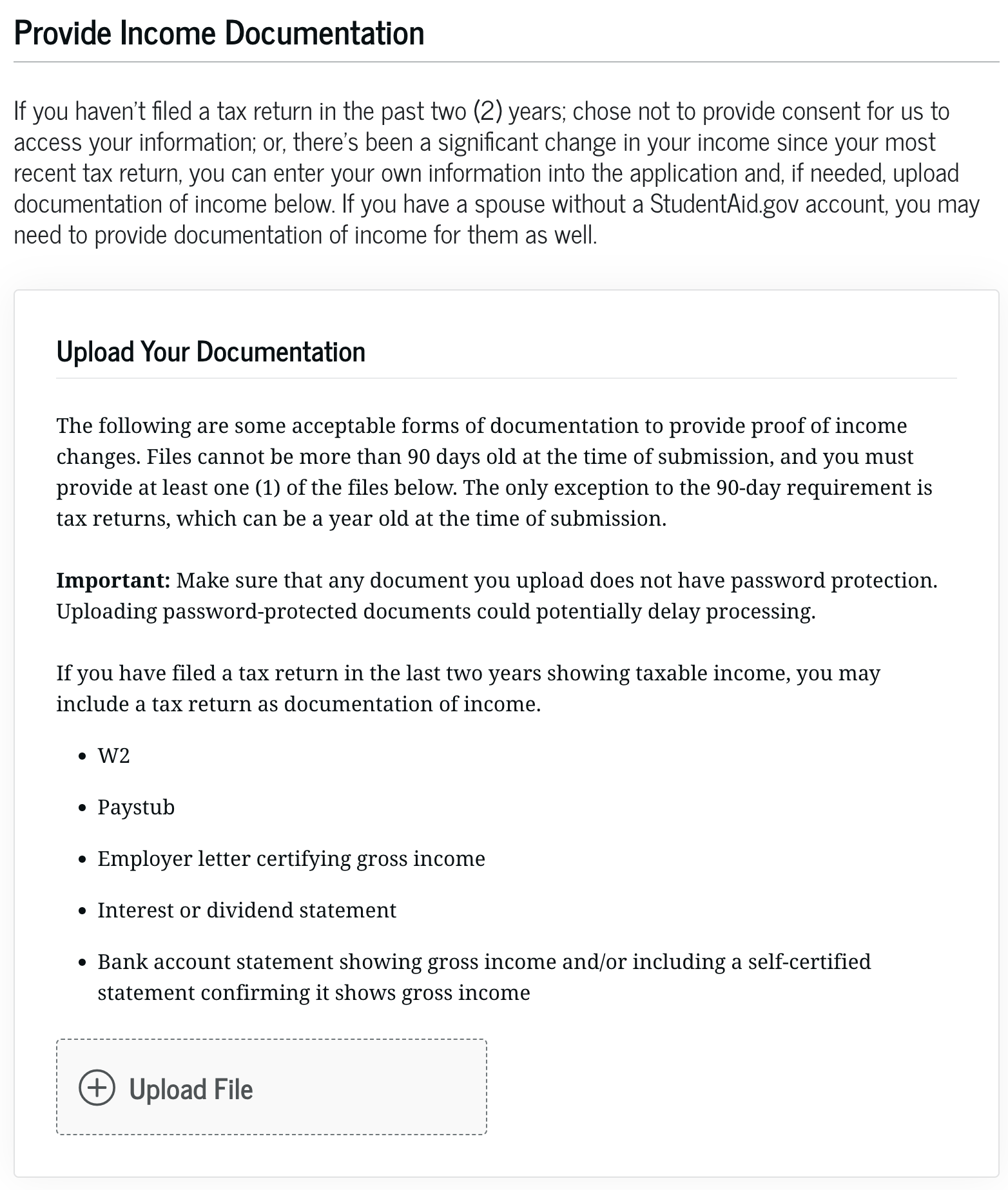

3. Enter your current income as $0 if you’re not receiving pay during the shutdown (but realize you may have other income).

4. Upload documentation, such as your furlough letter, or write a brief statement explaining your loss of income.

5. Submit your application and monitor your account for confirmation that your payment has been recalculated.

Under IDR rules, payments are tied to discretionary income. If your income falls to zero, your monthly payment can too—and those $0 payments still count toward PSLF as long as your employment remains active.

Why Forbearance Should Be A Last Resort

If you are going to receive backpay and simply need a short reprieve until you get paid, then a short forbearance for a month or two can make sense. Since you’ll eventually be paid for your time working.

While forbearance offers a quick payment pause, it usually comes with hidden costs:

- Interest continues accruing, increasing your total balance.

- PSLF progress stops, since most forbearance periods don’t count toward qualifying payments.

- Restarting payments after forbearance can take time and require additional paperwork.

If you’re eligible for a lower payment because you’re not getting paid but you can’t get your IDR request processed in time, ask your servicer for a short-term forbearance (30–90 days) to avoid delinquency while you wait.

Are Furloughed Workers Still “Employed” For PSLF?

Yes, you’re still employed when furloughed. Even if you’re unpaid during a shutdown, you’re still considered employed by your federal agency.

However, after that it may get tricky. Most government shutdowns only last a few days to a week. In those situations, your “full-time 30+ hours per week” requirement likely won’t be impacted since you’d still have several full time weeks during the month.

If this government shutdown lasts over a month, it’s possible that the Department of Education could say this entire month would not qualify for PSLF, since you didn’t work full time. Whether they will get into the details (or have the staffing to do so) remains to be seen.

But, assuming you remain on the payroll and haven’t resigned, you should consider yourself eligible for PSLF during the period.

To protect your record:

- Save your furlough notice and HR emails.

- Continue submitting your PSLF Employment Certification Form as usual.

- Ask your HR office to verify your employment dates once the government reopens.

This documentation ensures your PSLF progress isn’t interrupted later by confusion over furlough status.

What About Government Workers Who Are Working With No Paycheck?

While nearly half of the federal government is furloughed, another half are working without pay. What are the best options for them?

It’s a similar scenario: since you are working full time, and you will receive back pay (since you’re working, not furloughed), your time will remain PSLF-eligible. And as long as you continue your payments, they will count as qualifying payments.

The issue comes with making that payment if you can’t afford it due to not receiving a paycheck.

In this scenario, you’re faced with an unappealing choice: forbearance. It’s unappealing because that means your time working won’t count for PSLF. But if you truly can’t afford your payment because you need to save cash for essentials like housing and food, then you can’t worry about your student loan payment.

Is IDR Processing Delayed?

If you want to change your repayment plan due to a change of income, won’t it take forever? Not really.

We’re seeing most IDR applications processed within 3-7 days, since most of this work is handled by third-party contractors like student loan servicers.

If you do start missing paychecks and can’t get your IDR application processed, you can ask for a processing forbearance during that time so that no payments will be due while the IDR application is being processed.

Dealing With A Cloud Of Uncertainty

With the administration questioning whether back pay is guaranteed, furloughed workers should plan for the possibility that paychecks lost during the government shutdown may not be reimbursed for time spent not working.

Practical steps include:

- Prioritize essential expenses like housing, utilities, and food.

- Pause nonessential spending and automatic transfers where possible.

- Tap emergency savings if available, rather than high-interest credit.

- Choosing a bank that provides shutdown support like Navy Federal Credit Union, which is offering shutdown assistance to impacted members.

For families counting on back pay to catch up, this uncertainty underscores the importance of reducing fixed obligations now, including student loans.

Takeaways for Federal Workers

- Plan for delayed paychecks: back pay is not guaranteed, so manage expenses conservatively.

- If you are not going to be paid: Recertify your IDR plan now if eligible to reflect your $0 income before missing a payment.

- Keep PSLF progress intact by avoiding forbearance except as a last resort.

- Track official updates from the Department of Education, Office of Personnel Management, and StudentAid.gov.

- Keep records of your employment, communications, and applications to protect your eligibility later.

Don’t Miss These Other Stories:

Editor: Colin Graves

The post Student Loans And Furloughs: What to Do Now appeared first on The College Investor.