North Shore Uranium Ltd. (TSXV:NSU) (“North Shore” or the “Company“) is pleased to announce that on June 23, 2025, it signed a binding term sheet (the “Term Sheet“) with Resurrection Mining LLC (“Resurrection“), an arm’s length party, to acquire up to 87.5% of the Rio Puerco uranium project (“Rio Puerco” or the “Project“) in northwestern New Mexico (the “Transaction“).

TRANSACTION AND PROJECT HIGHLIGHTS

- Historical resource estimate of 6.0 million tonnes at an average grade of 0.09% eU 3 O 8 for 11.4 million lbs. of U 3 O 8 reported in 2009

- Substantial historical dataset to guide and optimize future exploration programs

- Preliminary review of historical data suggests the potential for In-Situ Recovery (“ISR”) mining, the lowest cost method for producing uranium

- Located in the Grants Uranium District, the largest producer of uranium in the United States and near two significant active uranium projects, Marquez-Juan Tafoya (Anfield Energy Inc.) and Cebolleta (Premier American Uranium Inc.)

- Strong US government support for nuclear power and uranium mining projects and a stated objective to reduce reliance on foreign nuclear fuel

- Executive Orders issued by President Trump in late May 2025 include a call for quadrupling US nuclear capacity by 2050, accelerating new reactor development, strengthening the US nuclear fuel supply chain and reforming the US regulatory environment

- Staged earn-in structure allows the Company to optimize exploration programs

- Would provide North Shore with uranium exposure in two North American jurisdictions, the Athabasca Basin in Saskatchewan, Canada and the western USA

Brooke Clements, President and CEO of North Shore stated: “The Rio Puerco project in New Mexico offers us exposure to a uranium project in the USA with excellent upside and signficant historical exploration data including a historical resource estimate. The US government has recently enacted policies designed to accelerate nuclear power and uranium mining activity in the country. In the 1970s, Kerr-McGee commenced mine construction at Rio Puerco, but activity was halted after a short trial-mining phase due to low uranium prices. The Project offers a great opportunity to confirm and expand upon previous work through drilling, modern 3-D modelling and continued assessment of the ISR potential. On completion of the Transaction with Resurrection, we will have uranium exposure in two North American jurisdictions that have seen signficant uranium production, the Grants Uranium District and the Athabasca Basin, at a time when future supply-demand fundamentals look great for the industry.”

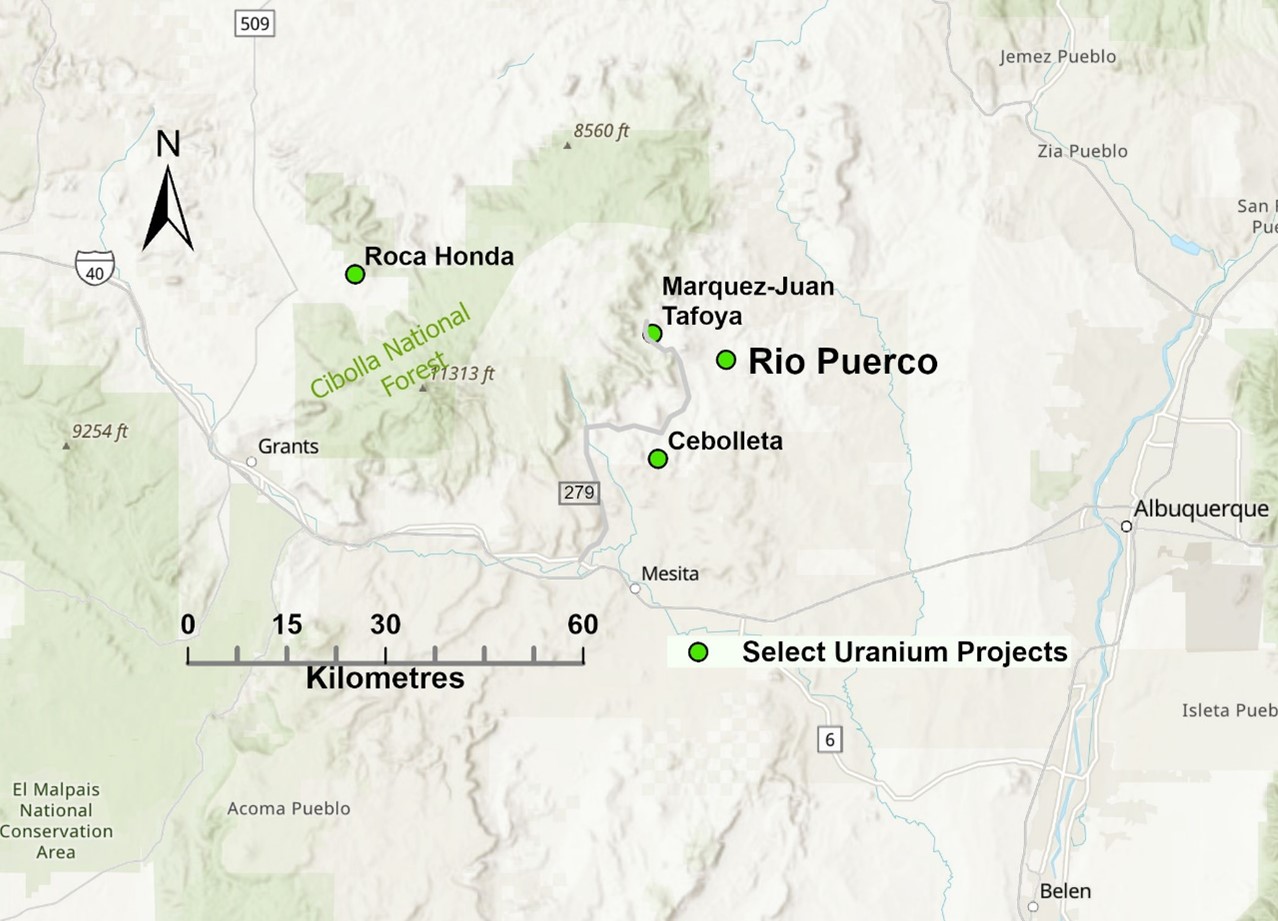

Rio Puerco is located at the eastern end of the Grants Uranium District, approximately 60 kilometres northwest of Albuquerque, New Mexico (Figure 1). Mines that operated between 1950 and 2002 contributed to make the Grants Uranium District the leading historical uranium producing district in the United States.

Figure 1: Rio Puerco Location Map, New Mexico. Roca Honda (Energy Fuels), Marquez-Juan Tafoya (Anfield Energy) and Cebolleta (Premier American Uranium) are advanced exploration/development stage uranium projects.

RIO PUERCO PROJECT SUMMARY

Rio Puerco consists of 37 Bureau of Land Management mining claims and significant historic exploration and mining data as well as the rights to a water well. Historical exploration and development work by Kerr-McGee Corporation ( “Kerr McGee” ) in the 1960s and 1970s, and geologic and resource modelling work completed by two Australian companies in 2009 and 2011 validate the potential for Rio Puerco to host a significant uranium resource.

Uranium was first discovered at Rio Puerco in 1968. The claims covering the discovery were ultimately optioned to Kerr-McGee who drilled over 1,000 holes. Based on the results of that work, they began the development of the Rio Puerco Mine in the 1970s. The uranium mineralization is hosted in sandstone of the Jurassic-aged Morrison Formation, host to almost all of the significant uranium deposits in the Grants Uranium District. The mine was intended to be a room and pillar underground mine but was never put into production. Activity ceased after a short trial mining phase likely due to low uranium prices at the time. The underground mine infrastructure included a 260m vertical shaft, ventilation shafts, mining adits and support buildings. The mining shaft remains at the site and road access to the site is excellent.

In 2009, Monaro Mining NL ( “Monaro” ) commissioned an independent geological review and resource estimate for Rio Puerco using exploration data generated by Kerr-McGee in the 1960s and 1970s. The data used for the resource estimate consisted of historical maps and data from 764 drill holes including downhole gamma-ray data converted to percent equivalent U 3 O 8 (e U 3 O 8 ), geological logs and drillhole survey data. They reported a JORC 2004-compliant inferred resource of 6.0 million tonnes at an average grade of 0.09% eU 3 O 8 using a cutoff grade of 0.03% eU 3 O 8 for 11.4 million lbs. of contained U 3 O 8 1 (the “ Historic Resource” ). JORC is the Australian Joint Ore Reserves Committee, a professional code of practice that sets minimum standards for public reporting of Mineral Resources.

In 2011, Australian-American Mining Corporation Ltd. commissioned a technical report on Rio Puerco. This most recent report validated and confirmed the Historic Resource 2 .

No significant exploration or development work has occurred at Rio Puerco since the 1970s.

HISTORICAL RESOURCE ESTIMATES FOR THE RIO PUERCO PROJECT

The historical resource outlined in this news release has not been verified and should not be relied upon. It is a historical estimate and not current and does not comply with Canadian NI 43-101 guidelines for the reporting of Mineral Resources. A qualified person has not verified the historical resource on behalf of the Company and North Shore has completed no work programs at Rio Puerco. Though not current, the Company views the historical resource estimates as reliable and sufficient to justify the initiation of work programs aimed at validating and potentially expanding upon the estimates. There is no guarantee that the work programs envisioned by North Shore will ultimately result in the definition of NI 43-101 compliant resources.

RIO PUERCO TERM SHEET

Completion of the Transaction is contingent on North Shore completing satisfactory due diligence, execution of a definitive agreement, completion of a minimum $750,000 financing by North Shore and approval by the TSX Venture Exchange (the “Exchange” ). A finder’s fee may be payable to an arms-length third party upon completion of the Transaction. The following highlights key terms of the Term Sheet executed by North Shore and Resurrection, all currency references are in Canadian dollars:

- Milestone 1: upon completion of the Transaction, a $125,000 cash payment and issuance of 9.99% of the issued and outstanding shares of the Company, post-financing.

- Milestone 2, to earn a 40% interest in the Project: on or before 18 months after completion of the Transaction, a $250,000 payment in cash or common shares, at the option of North Shore, and $750,000 in exploration expenditures.

- Milestone 3, to earn an aggregate 65% interest in the Project: on or before 36 months after completion of the Transaction, a $375,000 payment in cash or common shares, at the option of North Shore, and $1,000,000 in additional exploration expenditures.

- Milestone 4, to earn an aggregate 87.5% interest in the Project: on or before 60 months after completion of the Transaction, a $500,000 payment in cash or shares, at the option of North Shore, and $1,500,000 in additional exploration expenditures.

- North Shore may elect to not continue to sole-fund exploration expenditures at any time after earning a 40% interest in Rio Puerco at which time North Shore and Resurrection will enter into a joint venture agreement to govern the funding of Rio Puerco on a proportional basis.

- Carried interest: On completion of Milestone 4, North Shore will provide Resurrection with a 12.5% free-carried interest in the Project through completion of an NI 43-101-compliant Preliminary Economic Assessment at which time Resurrection can elect to form a participating joint venture or convert their interest into a 1.0% net smelter returns royalty. North Shore will be granted a right of first refusal on Resurrection’s 12.5% interest.

- Bonus payments: For the 78 month period after completion of the Transaction, North Shore will pay Resurrection a $100,000 bonus for each million lbs. of uranium estimated in current resources defined by the Company above 5 million and up to 20 million lbs. in accordance with NI 43-101 standards, if and when such resources are defined.

- Other terms: Resurrection shall have a participation right to maintain its 9.99% interest in the common shares of North Shore for 5 years from completion of the Transaction and the right, but not the obligation, to appoint one nominee to the North Shore Board of Directors. All share issuances will be subject to Canadian and US securities law and will be priced in accordance with Exchange policies.

NEXT STEPS

After completion of the Transaction, North Shore will begin working towards defining the first NI 43-101-compliant uranium resource at Rio Puerco. The Company’s initial work will aim to verify historical data and determine whether a resource can be defined in accordance with NI 43-101. First, geologic models of the previously defined deposit will be prepared using drill hole summary logs containing the interpreted zones of uranium mineralization. A number of confirmation drill holes are required to confirm the historic uranium grade and uranium disequilibrium, and for metallurgical testing. For the first program, 20 to 40 holes are contemplated, a combination of diamond core holes and rotary holes where a downhole gamma ray probe is used to determine uranium content. After the results of that program are received and interpreted, a comprehensive drilling plan would be developed aimed at defining a resource. Data from the drill programs will be used to further evaluate the amenability of ISR mining.

ABOUT NORTH SHORE

The nuclear power industry is in growth mode as more nuclear power will be required to meet the world’s ambitious CO 2 emission-reduction goals and the needs of new power-intensive technologies like AI. In this environment, new discoveries of economic uranium deposits will be very valuable, especially in established uranium-producing jurisdictions like Saskatchewan and New Mexico. North Shore is well-positioned to become a major force in exploration for economic uranium deposits. The Company is working to achieve this goal by exploring its Falcon and West Bear properties at the eastern margin of the Athabasca Basin in Saskatchewan, expanding its exploration efforts to include the Grants Uranium District in New Mexico and by evaluating other quality opportunities in the United States and Canada to complement its portfolio of uranium properties. North Shore summarized its exploration efforts at its Falcon property in a May 27, 2025 , news release.

QUALIFIED PERSON

Mr. Brooke Clements, MSc, P.Geol., a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects and the President and CEO of North Shore, has reviewed and approved the scientific and technical disclosure in this press release.

ON BEHALF OF THE BOARD

Brooke Clements,

President, Chief Executive Officer and Director

For further information:

Please contact: Brooke Clements, President, Chief Executive Officer and Director

Telephone: 604.536.2711

Email: b.clements@northshoreuranium.com

www.northshoreuranium.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains forward-looking statements that are based on the Company’s current expectations and estimates. Forward-looking statements are frequently characterized by words such as “plan”, “project”, “appear”, “interpret”, “coincident”, “potential”, “confirm”, “suggest”, “evaluate”, “encourage”, “likely”, “anomaly”, “continuous” and variations of these words as well as other similar words or statements that certain events or conditions “could”, “may”, “should”, “would” or “will” occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the completion and expected terms of the Transaction, the parties’ abilities to meet the closing conditions of the Transaction, the number of securities to be issued by the Company in connection with the Transaction, receipt of all necessary approvals for the completion of the Transaction, the completion of satisfactory due diligence, execution of a definitive agreement, completion of a minimum $750,000 or any financing by the Company, and the Company’s ability to meet the Milestones, make the bonus payments or meet other terms of the Transaction; the highly speculative nature of the Transaction given the early-stage nature of Rio Puerco; the actual results of current and planned exploration activities including the potential for the definition of a mineral deposit of potential economic value at the Company’s Falcon property in Saskatchewan; that drilling results, geophysical survey results and/or interpretations thereof are defining potentially mineralized corridors; results from future exploration programs including drilling; interpretation and meaning of completed and future geophysical surveys; conclusions of future economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in grades of mineralization and/or future actual recovery rates; accidents, labour disputes and other risks of the mining industry; the availability of sufficient funding on terms acceptable to the Company to complete the planned work programs; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated, or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Any forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

1 Monaro Mining NL, 2009, 250% increase in uranium resource inventory at Rio Puerco deposit, New Mexico USA: Monaro Mining NL ASX news release: (link)

2 Boyer, D. and Ostensoe, E., 2011, NI 43-101 technical report, Rio Puerco deposit, Sandoval county, New Mexico, USA: Independent report commissioned by Australian-American Mining Corporation Ltd.: (link)