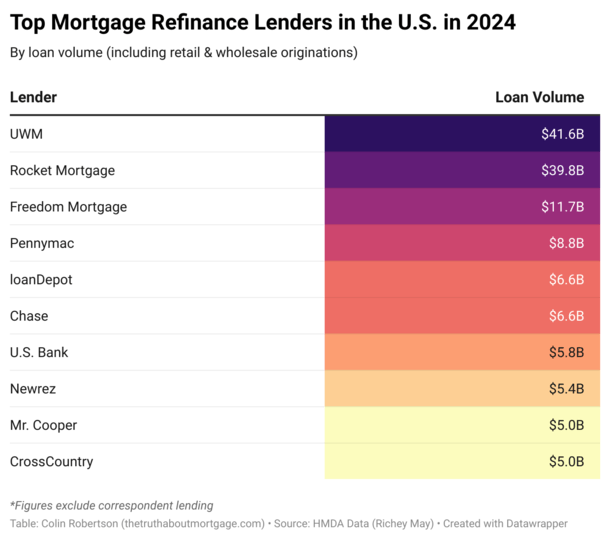

It’s time to take a look at the top mortgage refinance companies in the country, based on total loan volume.

As you may have guessed, United Wholesale Mortgage (UWM) led the way, though not by much over its crosstown rival Rocket Mortgage.

And if we consider the total number of refinance loans closed, Rocket actually beat out UWM with 147,000 total loans funded versus just 108,000 for UWM.

It wasn’t a big surprise seeing that they were the top mortgage lender overall in 2024 as well.

Read on to see which other mortgage companies made the top 10 refinance list.

Top Mortgage Refinance Companies (Overall)

| Ranking | Company Name | 2024 Loan Volume |

| 1. | UWM | $41.6 billion |

| 2. | Rocket Mortgage | $39.8 billion |

| 3. | Freedom Mortgage | $11.7 billion |

| 4. | Pennymac | $8.8 billion |

| 5. | loanDepot | $6.6 billion |

| 6. | Chase | $6.6 billion |

| 7. | U.S. Bank | $5.8 billion |

| 8. | Newrez | $5.4 billion |

| 9. | Mr. Cooper | $5.0 billion |

| 10. | CrossCountry | $5.0 billion |

Nearly 5,000 banks, credit unions, and mortgage companies funded about $370 billion in refis during the year.

As mentioned, Pontiac, Michigan-based mega wholesale lender UWM took first place in the mortgage refinance category with $41.6 billion funded in 2024 (latest complete year), per Richey May’s HMDA data.

While that sounds pretty good, consider that UWM funded $140 billion in refinance loans in 2021 when mortgage rates hit record lows!

There are two main types of mortgage refinances: the rate and term refinance (used to lower your rate and/or change your loan type/term) and the cash out refinance, utilized to tap equity.

UWM shined in both categories as a decent number of homeowners sought both lower mortgage rates after the 2023 rate shock and cash via their mounds of home equity.

As mentioned, their total refi volume edged out Detroit-based Rocket Mortgage, but their total number of loans was lower. In other words, UWM managed to close bigger loans, despite funding fewer of them.

And they did so as a company that works exclusively with mortgage brokers, which is pretty impressive.

By the way, Rocket funded $275 billion in refis during 2021…wild days those were.

In third was Freedom Mortgage with $11.7 billion in refinance loans, quite a bit better than fourth place Pennymac’s $8.8 billion.

Completing the top five was direct lender and MLB sponsor loanDepot with $6.6 billion funded during the year.

Others in the top 10 included Chase, U.S. Bank, Newrez, Mr. Cooper (now owned by Rocket!), and Cleveland-based CrossCountry Mortgage.

No huge surprises as these are all either big commercial banks or household names in the mortgage industry.

Top Mortgage Refinance Companies (Conventional Loans)

| Ranking | Company Name | 2024 Loan Volume |

| 1. | Rocket Mortgage | $23.0 billion |

| 2. | UWM | $21.2 billion |

| 3. | Chase | $6.5 billion |

| 4. | U.S. Bank | $5.7 billion |

| 5. | Bank of America | $4.8 billion |

| 6. | Wells Fargo | $3.2 billion |

| 7. | CrossCountry | $3.0 billion |

| 8. | loanDepot | $3.0 billion |

| 9. | Mr. Cooper | $2.9 billion |

| 10. | Citizens Bank | $2.9 billion |

If we filter out government-backed home loans, including FHA loans, VA loans, and USDA loans, the list changes a bit.

Banks and mortgage lenders primarily originate conventional loans, which includes conforming loans backed by Fannie Mae and Freddie Mac, along with jumbo loans.

Rocket took #1 in this category $23 billion in conventional mortgage refinance loans, followed by UWM with $21.2 billion, and NYC-based Chase with $6.5 billion.

Clearly it’s a two-horse race here between the two nonbanks from Michigan, with everyone else far, far behind.

Chase and U.S. Bank climbed the leaderboard since they tend to do more conventional than government-backed lending, and Bank of America entered the fray as well.

The bottom half of the top 10 was different as well, with Wells Fargo, CrossCountry Mortgage, loanDepot, Mr. Cooper, and Citizens Bank included.

There were five banks and five nonbanks in this list as depositories are generally focused on conventional lending.

Top VA Refinance Loan Companies

| Ranking | Company Name | 2024 Loan Volume |

| 1. | UWM | $13.4 billion |

| 2. | Rocket Mortgage | $7.0 billion |

| 3. | Freedom Mortgage | $6.7 billion |

| 4. | Veterans United | $4.3 billion |

| 5. | Pennymac | $3.9 billion |

| 6. | Village Capital | $2.9 billion |

| 7. | Newrez | $1.8 billion |

| 8. | New Day Financial | $1.8 billion |

| 9. | loanDepot | $1.6 billion |

| 10. | The Federal SB | $1.3 billion |

If we focus solely on VA refinance loans, UWM was tops again and with room to spare, funding $13.4 billion during the year.

That was more than enough to beat out #2 Rocket’s $7.0 billion and third place Boca Raton-based Freedom Mortgage’s $6.7 billion.

It then dropped off quite a bit with Veterans United Home Loans in fourth and CA-based Pennymac in fifth with about $4 billion funded each.

The rest of the best included Village Capital, Newrez, New Day Financial, loanDepot, and The Federal Savings Bank.

Most VA loans that are refinanced are done so via the streamlined IRRRL program, which requires less documentation than typical mortgage loans.

Also be sure to check out my post for the top VA lenders for all loan types.

Top FHA Refinance Loan Companies

| Ranking | Company Name | 2024 Loan Volume |

| 1. | Rocket Mortgage | $9.7 billion |

| 2. | UWM | $7.0 billion |

| 3. | Freedom Mortgage | $4.0 billion |

| 4. | Pennymac | $2.7 billion |

| 5. | loanDepot | $2.0 billion |

| 6. | Mutual of Omaha | $1.7 billion |

| 7. | Mr. Cooper | $1.4 billion |

| 8. | Newrez | $1.2 billion |

| 9. | Lakeview | $1.2 billion |

| 10. | CrossCountry | $1.2 billion |

When it came to FHA refinances, Rocket Mortgage blew away the competition with $9.7 billion funded last year.

You knew they were going to win one of the categories since they’re known as a refinancing machine. And so here it is.

They will get even bigger in 2025 and beyond thanks to their acquisition of Mr. Cooper.

Meanwhile, UWM snagged second with $7.0 billion, followed by Freedom Mortgage with $4.0 billion funded.

Pennymac took fourth with $2.7 billion, and Irvine, CA-based loanDepot grabbed fifth with $2.0 billion in FHA refinances.

In case you weren’t aware, Irvine is basically the mortgage epicenter on the West Coast.

Others in the top 10 included Mutual of Omaha Mortgage, Mr. Cooper, Newrez, Lakeview Loan Servicing, and CrossCountry Mortgage.

I would add a category for the top USDA refinance companies, but loan volumes are just too low. It’d be mostly pointless.

The majority of homeowners with USDA loans probably either refinance out of the program, keep their loan to maturity, or sell their home before refinancing. Though it is an option…

Check out my post with the top FHA loan lenders across all transaction types for more.

Who Are the Best Refinance Companies Out There?

If you want to change the terms of your existing home loan, you might be wondering who the best refinance companies are.

After all, “best” generally equates to excellent service and perhaps the lowest mortgage rates and lender fees.

The lists above feature the largest refinance companies in the country based on loan volume, not necessarily the best lenders out there.

Some large companies might have mediocre ratings while smaller companies could have 5-star reviews across multiple ratings websites.

Take the time to read reviews/complaints and research the companies you’ve got your eye on before you proceed to apply.

While large companies have proven the ability to close lots of refinance loans (which is a good thing if you want to get to the finish line), they may not be the cheapest option, or the best choice for you.

Consider refinance companies large and small, whether it’s a local credit union, large commercial bank, direct lender, or an independent mortgage broker.