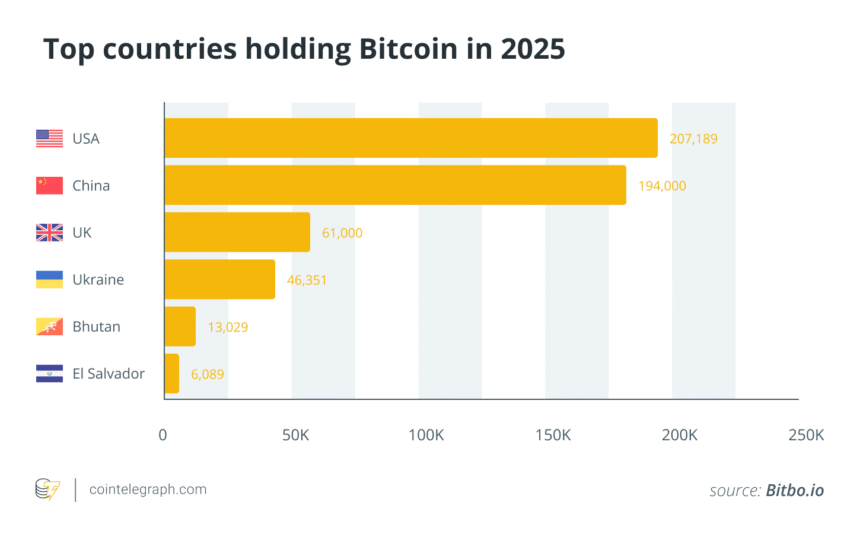

Bitcoin ownership by country 2025

Roughly 463,000 BTC — or about 2.3% of Bitcoin’s total supply — is currently held by governments around the world, according to publicly available blockchain data and legal disclosures.

While that might sound like a small percentage, it equates to tens of billions of dollars in sovereign Bitcoin wealth, giving Bitcoin (BTC) a growing role in national asset strategies and state-level accumulation.

Two countries dominate this list, and their positions are no secret.

The United States

The US government is by far the most visible player when it comes to Bitcoin holdings by governments. Through a series of high-profile seizures — ranging from the Silk Road marketplace to dark web operations and ransomware takedowns — it has accumulated nearly 200,000 BTC. As of early 2025, that stash is estimated to be worth between $18 billion and $22 billion, depending on market conditions.

But the US isn’t just holding these assets passively. In March 2025, President Donald Trump signed an executive order formalizing the creation of a Strategic Bitcoin Reserve, consolidating all seized BTC under federal control. Unlike previous administrations that auctioned off confiscated crypto, this signaled a new geopolitical mindset: Bitcoin isn’t just a forfeited asset — it’s part of the foreign government Bitcoin strategy.

China

Second on the Bitcoin ownership by country 2025 list is China, though its position is shrouded in opacity. In 2019, Chinese authorities shut down the PlusToken scam and confiscated over 190,000 BTC — one of the largest crypto seizures in history. But the fate of these funds remains largely unknown.

Some blockchain analysts suggest that parts of this holding were quietly liquidated. Others believe the coins are sitting dormant in government Bitcoin wallets, untouched in cold storage. Despite its ban on domestic trading and mining, China remains a key player in the geopolitics of Bitcoin ownership — perhaps one of the largest non-US Bitcoin reserve holders.

While the US and China dominate headlines, their stories are widely reported and routinely dissected by analysts and regulators.

What’s far less understood is the silent Bitcoin accumulation by countries outside of this duopoly. From Himalayan monarchies to debt-ridden democracies, a new group of nations is quietly reshaping the global Bitcoin ownership map.

Did you know? North Korea’s Lazarus Group held state-associated Bitcoin. The hacking outfit is believed to have amassed over 14,000 BTC before selling off more than $1 billion worth since March 2025.

Bhutan: The hydropower-fueled accumulator

Tucked away in the Himalayas, Bhutan has been quietly building one of the largest nation-state Bitcoin reserves in the world — and few outside the crypto space noticed.

Starting in 2019, Bhutan’s sovereign investment fund, Druk Holding & Investments (DHI), began mining Bitcoin using the country’s vast hydropower capacity. Cool temperatures, excess renewable energy and stable governance made it ideal for long-term accumulation.

By 2025, Bhutan is believed to have mined between 12,000 and 13,000 BTC worth $1.1 billion-$1.3 billion. That figure is staggering for a country with a GDP of just over $3 billion. Bhutan’s Bitcoin holdings by the government now represent as much as 30%-40% of its national economy — higher than any other country.

Several things make Bhutan’s strategy unique in the landscape of state-backed Bitcoin holdings:

- It’s green: 100% renewable hydropower, avoiding the energy debate that haunts most miners.

- It’s economically sound: Rather than sell electricity at low export prices, Bhutan transforms it into crypto assets held by countries.

- It’s centrally managed: The effort is coordinated through DHI, part of Bhutan’s long-term development plan.

Unlike others that gained reserves through law enforcement seizures, Bhutan’s approach is quiet, strategic and fully sovereign. It’s possibly the clearest example of hidden Bitcoin reserves by governments being used as a core economic pillar instead of simply a hedge.

United Kingdom: Seizures and strategic decisions

The UK rarely comes up in conversations about countries that own Bitcoin, but recent events put it among the top holders.

In 2021, British authorities seized approximately 61,000 BTC during a money laundering investigation. The coins, linked to a Chinese-origin fraud ring operating through UK shell companies, are now under the control of the Metropolitan Police and the Crown Prosecution Service (CPS). At current prices, the haul is worth around 5 billion British pounds.

What to do with that windfall is still being debated. Traditionally, the UK sells seized crypto and adds the proceeds to the treasury. But this case is different. The CPS has proposed retaining the Bitcoin rather than liquidating it, potentially establishing one of the world’s most unexpected sovereign Bitcoin holdings.

Not everyone agrees. Concerns about volatility and policy consistency persist. There’s no formal move yet to treat these assets as part of a strategic state-level Bitcoin reserve. Still, with 61,000 BTC, the UK is already in elite company — behind only the US, China and possibly the UAE (whose reported holdings are based on less transparent sources).

Whether Britain becomes a long-term custodian or offloads its stash, one thing is clear: It’s already a major stakeholder in the unfolding Bitcoin adoption by countries. Whether deliberate or not, the UK is now part of the crypto geopolitics conversation.

Ukraine: A digital war chest

Since the start of the war with Russia in 2022, Ukraine has become one of the first examples of Bitcoin adoption by countries driven not by ideology, but necessity. It used cryptocurrency as a large-scale, borderless fundraising tool for national defense.

In the first year of the conflict, Ukraine received over $70 million in BTC donations from around the world, sent by individuals, decentralized autonomous organizations (DAOs), exchanges and other players in the global Bitcoin ownership map. These funds were deployed rapidly for military equipment, humanitarian relief, infrastructure repair and emergency logistics.

By mid-2025, the government’s Bitcoin holdings had dropped to roughly 186 BTC, showing that the coins weren’t stockpiled but spent — fast. Unlike state-level Bitcoin accumulation through mining or seizures, Ukraine’s strategy was reactive: crypto assets held by countries not for reserve-building, but as real-time, wartime capital.

Did you know? Investigators have also tracked at least $4 million in crypto donations sent to pro-Russian groups, including paramilitaries in eastern Ukraine and associated militias.

El Salvador: The bold legal-tender experiment

In 2021, El Salvador became the first nation to declare Bitcoin legal tender. President Nayib Bukele framed the decision as a path to financial sovereignty and broader inclusion in a country where most people lacked access to banking.

By January 2025, the government had accumulated over 6,000 BTC, an amount placing it firmly in the upper tier of Bitcoin ownership by country in 2025. That number continues to grow, with daily purchases still ongoing under the “1 Bitcoin per day” initiative.

The country also launched state-backed “Volcano Bonds” to attract crypto capital, built geothermal-powered mining facilities and opened a National Bitcoin Office to coordinate strategy. It became a poster child for sovereign Bitcoin wealth, blending investment, infrastructure and nation branding.

Still, the plan hit turbulence. In early 2025, amid pressure from the International Monetary Fund, El Salvador agreed to repeal Bitcoin’s legal tender status in exchange for a $1.4-billion bailout. Businesses were no longer obligated to accept BTC, and citizens could no longer pay taxes in it.

Yet despite these changes, El Salvador’s government Bitcoin wallets remain active. Daily purchases continue, and the state still views Bitcoin as a long-term asset. Though no longer a legal currency, it remains central to El Salvador’s unique foreign government Bitcoin strategy.

Iran: Quietly turning Bitcoin into state reserves

Iran rarely appears on lists of countries with the most Bitcoin, but its influence is quietly growing through a legal-mining-for-reserves model.

Since 2019, Iran has treated Bitcoin mining as a state-regulated industry. Any licensed miner is required to sell mined Bitcoin directly to the Central Bank, turning cheap, often subsidized electricity into a pipeline for accumulating state-backed Bitcoin holdings.

This approach allows Iran to bypass sanctions and pay for imports — without declaring a single wallet address. It’s a textbook case of silent Bitcoin accumulation by countries, where the objective isn’t visibility, but utility.

While exact figures are unavailable, estimates once placed Iran’s mining activity at 4%-7% of the global hash rate — a significant share that likely fed into hidden Bitcoin reserves by governments. Domestic exchanges connected via Shaparak, Iran’s state-run payments network, ensure that all mined coins can be tracked and absorbed.

Of course, not all mining in Iran is legal. A thriving shadow sector operates in rural regions and industrial zones, often exploiting low-cost power. But whether through licensed channels or the gray market, much of the output is funneled toward the state.

Rumored and emerging players: The countries quietly stacking Bitcoin

Not every government publicizes its crypto strategy. Some accumulate in silence. Others are the subject of speculation.

As global attention sharpens on Bitcoin ownership by country in 2025, a few names keep surfacing — often without clear confirmation, yet impossible to ignore.

United Arab Emirates (UAE)

For years, crypto circles have whispered that the UAE may control up to 420,000 BTC — a number that, if true, would make it the world’s largest holder of state-backed Bitcoin holdings by a wide margin. These figures are usually linked to enforcement actions against fraudulent investment schemes and high-profile Ponzi operations reportedly shut down within the Emirates.

However, this remains one of the most debated examples of secret Bitcoin holdings by nations. There’s no government record, no public wallet address and no official acknowledgment. Blockchain analysts have failed to verify the claim. While it may reflect some truth — such as asset confiscations — most researchers agree the number is likely inflated or misunderstood.

Still, the UAE’s name often appears in lists of countries hoarding Bitcoin, keeping it a notable part of the conversation around sovereign Bitcoin wealth.

Bulgaria

Bulgaria’s Bitcoin story dates back to 2017, when authorities reportedly seized over 200,000 BTC in a raid on a cybercrime network. At the time, this haul briefly made Bulgaria one of the most Bitcoin-rich governments on the planet — at least on paper.

But as time passed, clarity faded. Official statements became contradictory. Some reports claim the coins were sold off, others that they were never actually in government wallets. A 2023 Freedom of Information request yielded a blunt denial: No such BTC is currently held by the state.

Even so, the tale persists — a prime example of how the line between actual government Bitcoin wallets and rumors can get blurred. Whether or not Bulgaria still holds any coins, it remains a case study in the geopolitics of Bitcoin ownership.

Other smaller players

A number of smaller nations have documented, if modest, nation-state Bitcoin reserves — typically the result of legal seizures rather than strategic policy.

- Finland is believed to hold around 90 BTC, stemming from criminal investigations.

- Georgia has around 66 BTC, also tied to court actions.

- Venezuela is estimated to possess roughly 240 BTC, possibly linked to Petro-related crypto activity or confiscations.

These holdings are small in global terms, and there’s no public evidence of ongoing state-level Bitcoin accumulation in these countries. Still, they’re part of the broader global Bitcoin ownership map, reflecting how even minor players are being drawn into the crypto reserve race.

Did you know? CoinGecko also lists Germany and Hong Kong among the top sovereign Bitcoin holders. Analysts peg both as emerging holders alongside known names like the US, China, UAE, El Salvador and Bhutan.

Why quiet Bitcoin accumulation matters

You don’t need to issue a press release to enter the Bitcoin game.

Some governments loudly declare their intentions. Others mine in silence, regulate quietly or build holdings through indirect means. The motivations vary, but the pattern is increasingly familiar: Silent Bitcoin accumulation by countries is rising.

For some, it’s strategic diversification. Bitcoin acts as digital gold — scarce, borderless and disconnected from central bank policy. It’s especially attractive to nations looking to hedge against inflation or de-dollarize reserves.

In Bhutan, mining turns surplus renewable energy into sovereign capital. In Iran, Bitcoin bypasses global sanctions to help fund imports. Even in the US, a government Bitcoin wallet once used to liquidate seized assets is now part of a federally managed “Strategic Bitcoin Reserve.”

This quiet movement isn’t without challenges. Volatility remains high, transparency is rare, and geopolitical pressure (especially from traditional financial institutions) could push some countries to rethink or conceal their strategies.

Still, nations that hold Bitcoin are no longer outliers. Whether their accumulation is loud or discreet, they’re shaping a new layer of global economic strategy.

Ultimately, all are part of the same emerging reality: Bitcoin is now a tool of the state.