Investor Insight

Leveraging early-stage land acquisition, accelerated drilling and a strong strategic partnership, Lithium Africa delivers maximum exploration efficiency, capital leverage and de-risked lithium discovery upside at scale.

Overview

Lithium Africa is an exploration company purpose-built to capitalize on the next cycle of lithium demand. Its mission is to discover, de-risk and monetize Tier 1 lithium assets through data-driven targeting, aggressive fieldwork and value-driven exits.

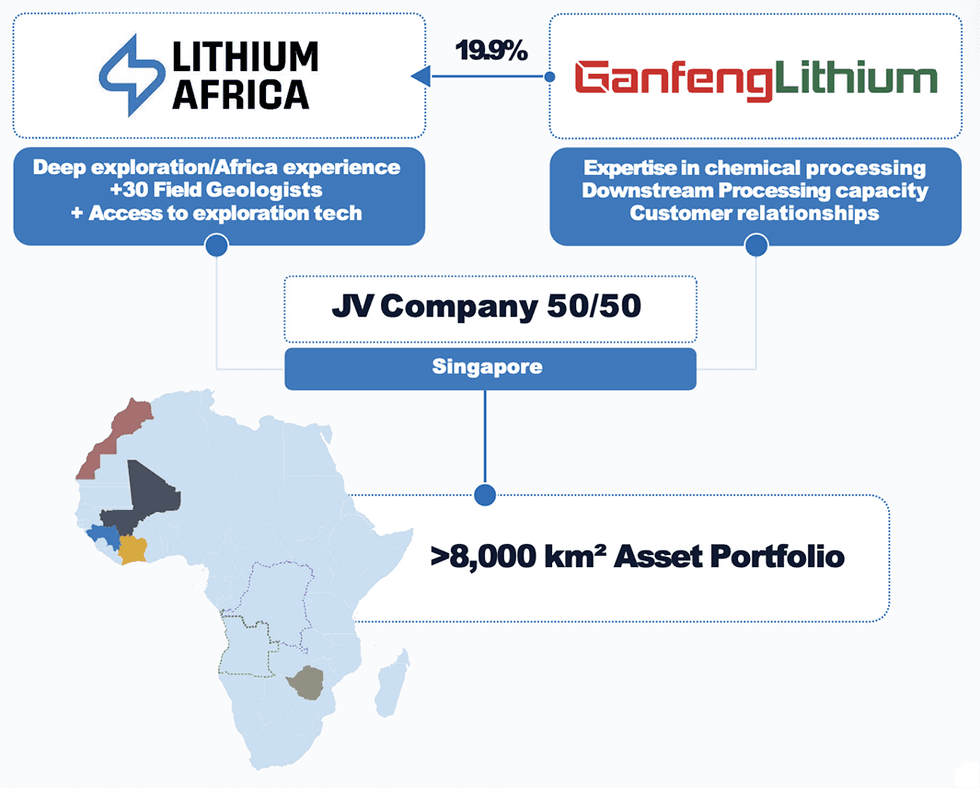

At the core of Lithium Africa’s strategy is its 50/50 joint venture with Ganfeng Lithium, one of the world’s largest lithium chemical producers. The partnership, established in 2023, doubles exploration efficiency, with every $1 raised by Lithium Africa equating to $2 spent in the field. The joint venture provides access to Ganfeng’s downstream processing expertise, customer network with Tier 1 OEMs, and long-term offtake flexibility, aligning exploration with industrial-scale lithium demand growth.

Lithium Africa does not intend to build or operate mines. Its business model is based on acquiring early-stage assets, de-risking them rapidly through trenching and drilling, and monetizing discoveries via royalties, sales or carried interests. The company is also pursuing counter-cyclical M&A, acquiring stranded or undervalued lithium assets during the downcycle.

Strategic Footprint

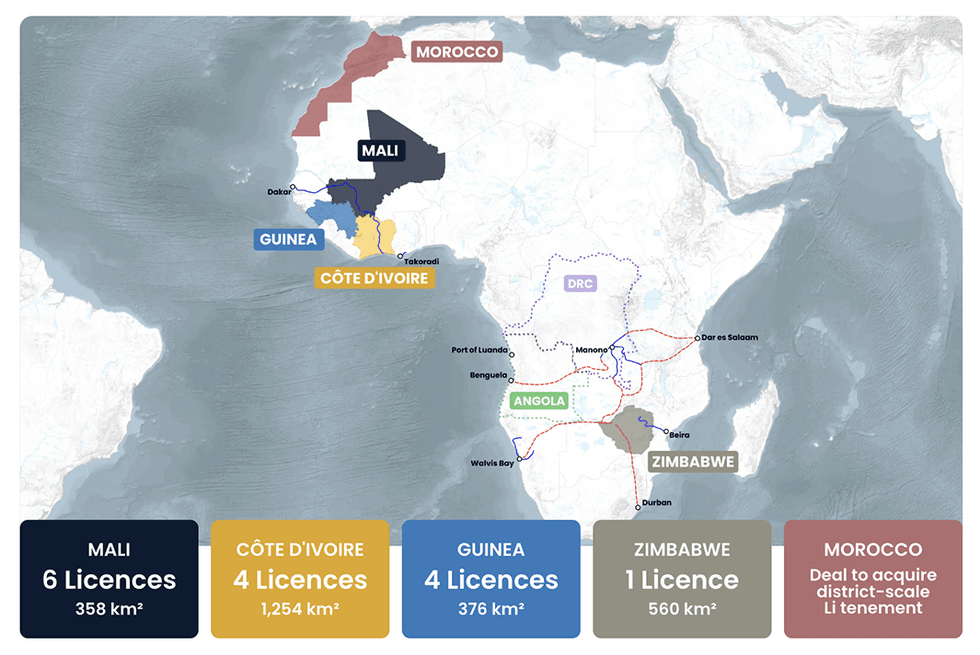

Lithium Africa now controls more than 8,000 sq km of exploration tenure across Zimbabwe, Mali, Côte d’Ivoire, Guinea and Morocco, representing one of the continent’s largest lithium-focused portfolios.

The company’s exploration model is designed to generate several discovery opportunities each year across premier geological terranes analogous to Canada and Western Australia.

Africa’s lithium potential remains largely untapped, despite its vast pegmatite fields, efficient permitting processes, and supportive mining jurisdictions. Lithium Africa’s approach combines technical excellence, low-cost scalability and strategic partnerships to unlock this potential.

Company Highlights

- Exploration-focused Model: Lithium Africa focuses on value creation through discovery but does this in a de-risked way.

- Strategic 50/50 JV with Ganfeng Lithium: Doubles exploration spending, minimized dilution and provides access to processing expertise and long-term downstream offtake partners.

- Pan-African Footprint: Over 8,000 sq km of tenure across Zimbabwe, Morocco, Mali, Côte d’Ivoire, Guinea and others – enabling diversification in discovery strategy.

- Contrarian, Countercyclical M&A: Well-capitalized and positioned to roll up distressed lithium juniors during a downcycle. Every dollar raised funds two dollars of drilling.

- Rapid Permitting & Scalability: Target jurisdictions offer three- to four-year discovery-to-mine timelines versus 10 to 15 years in North America.

Key Projects

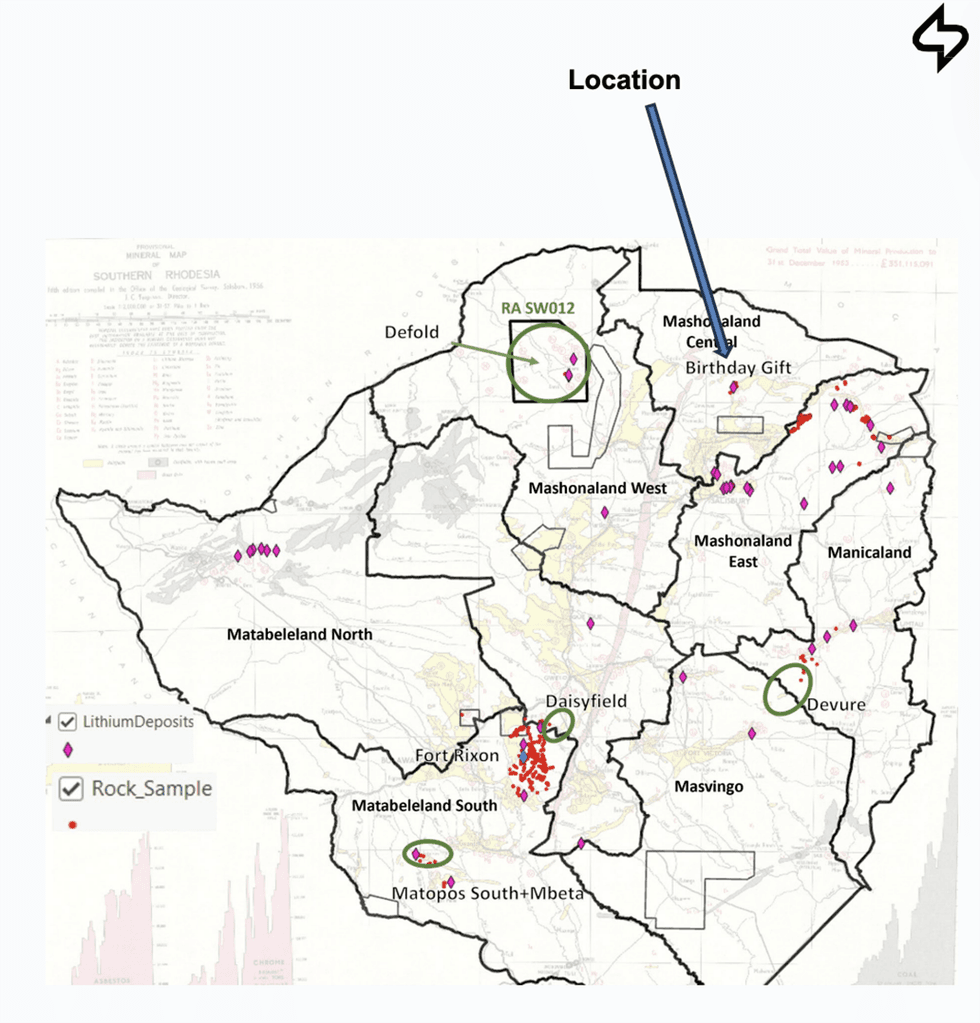

Zimbabwe

Birthday Gift Project (Flagship)

The Birthday Gift project is Lithium Africa’s flagship asset and highest-priority exploration target. Located along a >12 km pegmatite corridor, the project hosts three parallel, flat-lying spodumene-bearing pegmatites within metasediments. Surface trenching has returned multiple significant intercepts, including 100 m, 67 m and 55 m widths with true thicknesses averaging ~35 m. Rock chip samples from fresh spodumene zones have returned assays as high as 5.25 percent lithium oxide. More than 3,000 geochemical samples have been collected, and a 1,500-meter RC drill program commenced in January 2025 to test a 1,300-meter strike length.

The Birthday Gift asset has strong potential to support an inaugural resource estimate by late 2025.

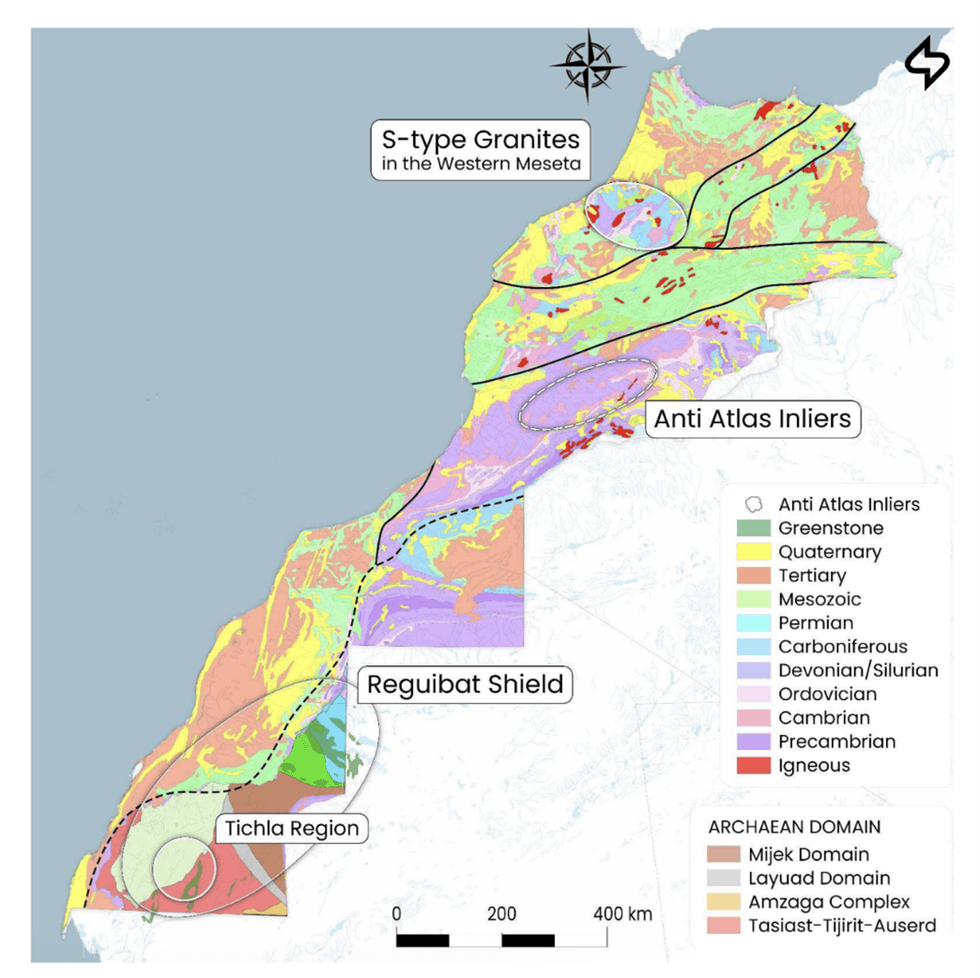

Morocco

Bir El Mami

In 2024, Lithium Africa acquired a 585 sq km, district-scale land package in the Bir El Mami region of Morocco, located on the northern extension of the Tasiast greenstone belt. The project is notable for its spodumene-bearing pegmatites confirmed by surface rock samples, which include lithium values up to 862 parts per million (ppm), and historic soil anomalies up to 363 ppm. The region is emerging as a key lithium district given Morocco’s favorable trade agreements and a growing domestic EV battery manufacturing base. Lithium Africa is currently Morocco’s only major lithium concession holder, and early-stage target identification is underway. The company is well positioned to be Morocco’s lithium sector leader and consolidator.

West Africa

Torakoura in Bougouni District, Mali

Lithium Africa holds six licenses within the Bougouni Basin, a proven lithium district hosting Leo Lithium’s Goulamina and Kodal Minerals’ Bougouni deposits. Exploration includes surface mapping, rock sampling, and RC drilling initiated in Q4 2024, targeting spodumene-rich pegmatites aligned with key structural corridors.

These assets offer scale and proximity benefits within an established mining region with favorable development infrastructure.

Adzopé & Regional Licenses, Côte d’Ivoire

In Côte d’Ivoire, Lithium Africa holds four early-stage but highly promising permits totaling 1,254 sq km. The Adzopé license has returned rock samples with lithium oxide values up to 0.98 percent. Field mapping and lithological sampling have been completed, and a 21,700-meter auger drilling program is planned to refine targets for follow-up RC and core drilling. The region is emerging as a new pegmatite belt in West Africa, and Lithium Africa has first-mover status in building a pipeline of discovery-stage projects.

Kobikoro Project, Guinea

The Kobikoro project in southeastern Guinea consists of four licenses covering 376 sq km in the Archean Kinema-Man domain. This district is part of the underexplored Kissidougou pegmatite belt. Historical stream sediment geochemistry conducted by BRGM highlights multiple anomalous trends in lithium, tantalum and niobium. The standout feature is a 20 km-long lithium-tantalum-niobium anomalous zone aligned with regional structures and underlain by fractionated granite intrusions.

Management Team

Tyron Breytenbach – CEO

Tyron Breytenbach is a former Detour Gold resource geologist and leading equity analyst at Stifel Canada and Cormark. He blends deep geology with institutional capital markets acumen.

Carl Esprey – Executive Chair

Carl Esprey is a former M&A analyst at BHP Billiton and fund manager at GLG Partners. He is the founder of several resource ventures and current CEO of Waraba Gold.

Coulibaly Mamadou – Executive Director

Coulibaly Mamadou is a geologist with 12 years’ experience in mineral exploration. Coulibaly started his career with Randgold, and has extensive knowledge of and experience with the West African Birimian geology.

Ben Gelber – VP Exploration

Ben Gelber is a former VP at Gold Line Resources and exploration manager at Barrick in Guyana. He has more than 19 years of lithium and gold exploration experience.

Dr. Jeroen van Duijvenbode – Development Geologist

With a PhD in geometallurgy, Jeroen van Duijvenbode is an expert in lithium pegmatite targeting and geochemical data interpretation.

Jamie Robinson – CFO

Jamie Robinson is a chartered accountant with extensive mining CFO experience across private and public markets. Prior to his stint in the mining sector, he worked with Deloitte in Vancouver, British Columbia.

Chris O’Connor – General Counsel

Chris is a lawyer with over 19 years of private practice and in-house experience, focused on capital markets, corporate finance and M&A transactions in emerging markets throughout Africa, Eastern Europe and the CIS.

Toluwalase Seriki – Non-Executive Director

Toluwalase Seriki is Ganfeng Lithium’s head of business development in Africa. He possesses a strong M&A and finance background.

Roy Zhang – Advisor

Roy Zhang has nearly 10 years of experience in investment, M&A and corporate development, and is experienced and knowledgeable in lithium trading through his role at Ganfeng.

Dr. Tom Benson – Advisor

Tom Benson is a Stanford PhD volcanologist who leads global exploration at Lithium Americas. He is a widely respected authority on caldera-related lithium resources across the industry.