Unlocking the Lipstick Index: A Key to Understanding Consumer Behavior

The Lipstick Index, a concept introduced by Leonard Lauder, former chairman of Estée Lauder, during the early 2000s recession, reveals an intriguing phenomenon. When economic downturns occur, consumers tend to opt for affordable luxuries, such as lipstick, over more expensive items. This behavior indicates that even in challenging times, people seek minor indulgences to boost their morale and maintain a sense of normalcy.

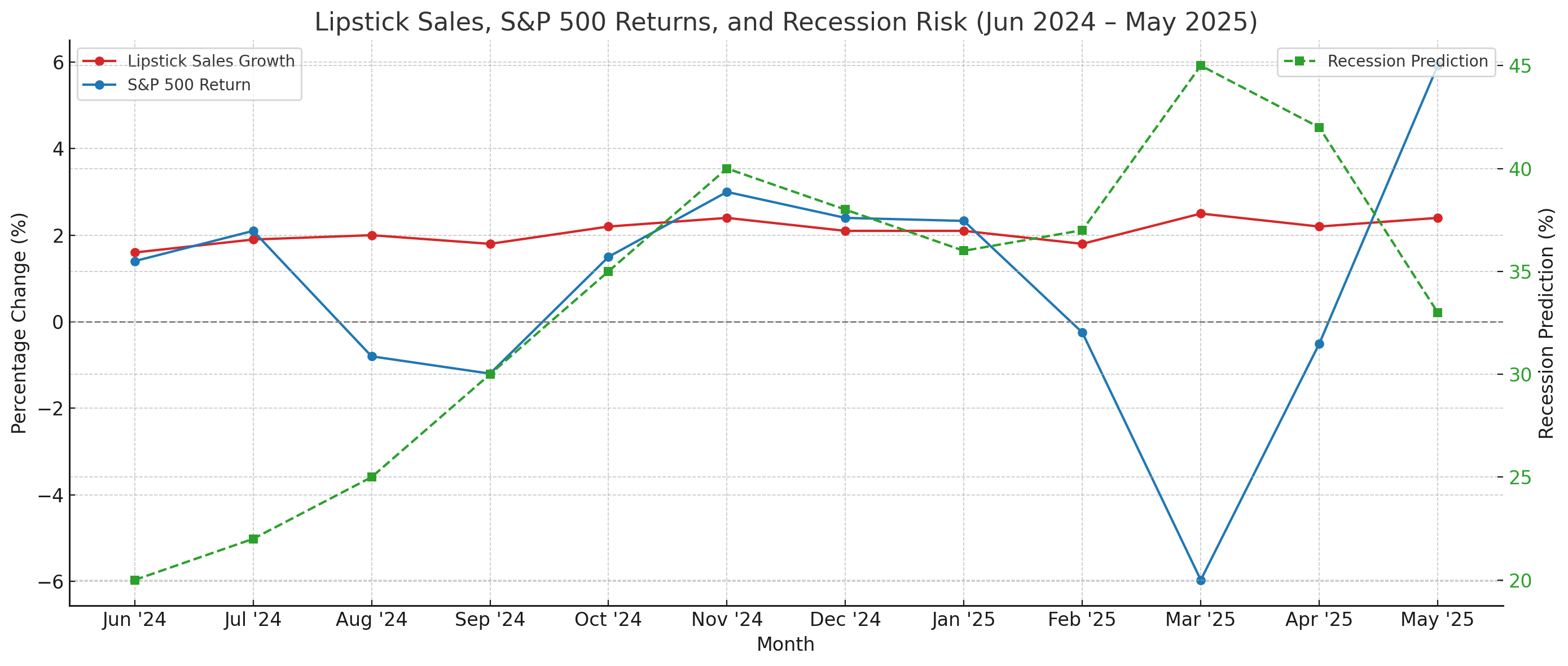

Lipstick Sales vs. Market Performance: A Comparative Analysis (June 2024–May 2025)

Analyzing the period from June 2024 to May 2025 yields valuable insights into consumer spending habits and market trends:

-

Lipstick sales experienced consistent growth, with an average month-over-month increase of 2%, demonstrating the resilience of the cosmetics industry.

-

In contrast, the S&P 500 displayed significant volatility, with notable declines in March (-5.97%) and April (-0.51%) 2025, followed by a rebound in May (+5.92%), highlighting the unpredictability of the stock market.

-

Recession prediction models peaked in March 2025 at a 45% probability, underscoring the heightened economic uncertainty and the need for investors to adapt their strategies.

This divergence suggests that while investor confidence wavered, consumer spending on small luxuries remained relatively resilient, providing a unique opportunity for investors to capitalize on the Lipstick Index.

The Lipstick Index in Action: Visualizing the Data

Key Observations:

-

March 2025: As recession risk peaked and the S&P 500 declined sharply, lipstick sales growth remained positive, indicating that consumers continued to prioritize affordable indulgences.

-

April–May 2025: Despite market volatility, lipstick sales continued their upward trend, highlighting consumer inclination towards affordable luxuries during uncertain times and the potential for the cosmetics industry to thrive.

Michael Burry’s Strategic Shift: Doubling Down on Estée Lauder

In a notable move, Michael Burry, renowned for predicting the 2008 financial crisis, has restructured his investment portfolio to capitalize on the Lipstick Index:

-

Scion Asset Management, Burry’s firm, doubled its stake in Estée Lauder, acquiring 200,000 shares valued at approximately $13.2 million, according to their latest 13F filing, demonstrating a strategic bet on the resilience of the beauty industry.

-

Concurrently, Burry liquidated most of his other holdings, including significant positions in Chinese tech companies, and initiated bearish bets against firms like Nvidia, further emphasizing his confidence in the Lipstick Index.

This concentrated investment suggests Burry’s confidence in Estée Lauder’s potential resilience amid economic downturns and his strategic approach to leveraging the Lipstick Index for investment gains.

Interpreting Burry’s Move: A Bet on the Lipstick Index?

Burry’s focus on Estée Lauder aligns with the principles of the Lipstick Index, which highlights the importance of understanding consumer behavior and market trends:

-

Consumer Behavior: Even during economic hardships, consumers tend to indulge in small luxuries, such as cosmetics, providing a unique opportunity for investors to capitalize on the Lipstick Index.

-

Market Resilience: The beauty industry, particularly companies like Estée Lauder, often demonstrates stability during market downturns, making it an attractive investment opportunity.

By investing heavily in Estée Lauder, Burry appears to be banking on the enduring demand for affordable luxuries, even as broader markets face volatility, and leveraging the insights provided by the Lipstick Index to inform his investment strategy.

Investment & Marketing Implications

For Investors:

-

Estée Lauder (EL) and similar beauty companies may offer defensive investment opportunities during economic downturns, providing a potential hedge against market volatility.

-

Monitoring consumer behavior trends, such as those highlighted by the Lipstick Index, can provide valuable insights into resilient sectors and inform investment decisions.

Limitations of the Lipstick Index

While the Lipstick Index offers valuable insights into consumer behavior and market trends, it’s essential to consider its limitations:

-

Evolving Consumer Preferences: Shifts towards skincare and wellness products may influence traditional lipstick sales, and investors should be aware of these changes to adapt their strategies.

-

Global Market Dynamics: Factors like supply chain disruptions and geopolitical tensions can impact the beauty industry, and investors should consider these risks when making investment decisions.

Final Thoughts

The convergence of consistent lipstick sales growth, market volatility, and Michael Burry’s strategic investment in Estée Lauder underscores the relevance of the Lipstick Index in 2025. As consumers continue to seek comfort in small luxuries, and investors adjust their portfolios accordingly, the beauty industry remains a focal point in understanding economic and consumer behavior trends, and the Lipstick Index provides a valuable tool for investors to navigate these trends.

Read Next: Why is the US Dollar Losing Value?

Hey there! I’m Russ Amy, and I’m excited to dive into the world of investments, technology, and consumer behavior. With a background in finance and a passion for staying ahead of the curve, I explore how trends in tech, such as blockchain and artificial intelligence, impact investment opportunities and consumer spending habits.

As someone who started investing in 2008, I’ve learned a thing or two about navigating uncertain markets and making informed investment decisions. I believe that staying updated with the latest developments in technology and consumer behavior is key to success in today’s fast-paced investment landscape.

From the Lipstick Index to the latest advancements in fintech, I’m committed to providing insights and analysis that help investors make sense of the complex and ever-changing world of finance. Whether you’re a seasoned investor or just starting out, I invite you to join me on this journey of discovery and exploration, as we uncover the latest trends and opportunities in the world of investments and beyond.