Tune in to Today’s Talk Your Book, Brought to You by Invesco

We’re excited to partner with Invesco, a leading global investment management company, to bring you today’s episode of Talk Your Book. For more information on Invesco’s investment solutions and services, visit their website here.

Today’s Discussion Topics:

- Understanding the current real estate landscape and its implications for investors

- The impact of fundamental undersupply in the housing market and lack of new construction on investment strategies

- Why renting might be a more attractive option than buying in the current market

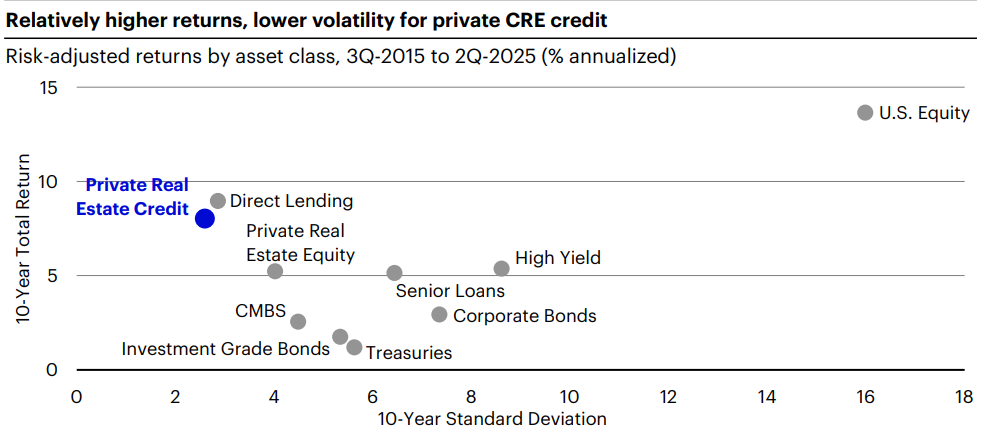

- Introduction to real estate credit and its growth as an asset class

- How real estate credit offers low correlation with other alternative investments

- Resolving defaults in real estate credit and its effects on investors

- The shift from institutional investors to the wealth channel and its significance

Listen to the Full Episode:

Catch the latest episode of Talk Your Book on The Compound News or listen below:

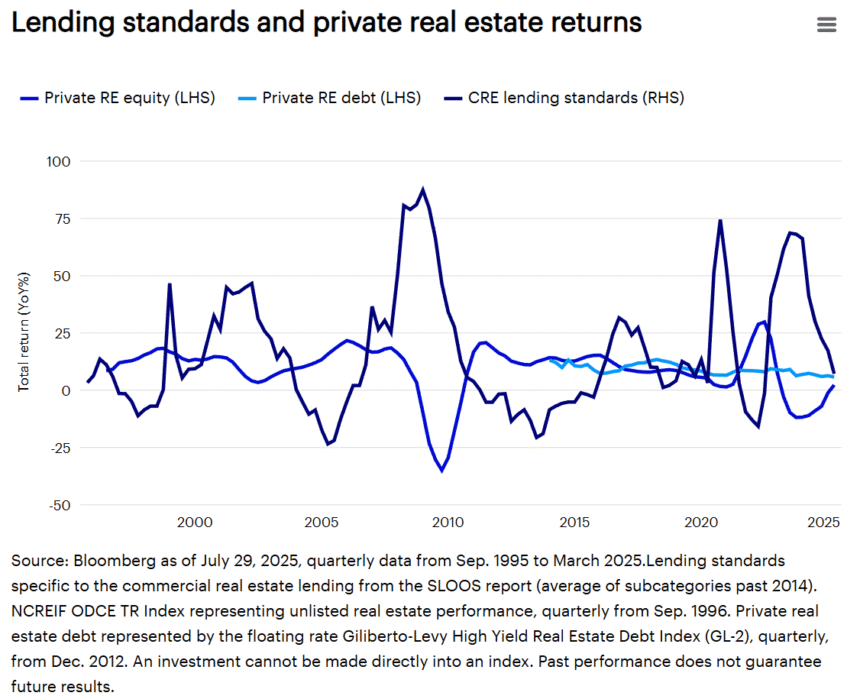

Episode Charts and Visuals:

Check out the accompanying charts and graphs for a deeper dive into the topics discussed in today’s episode:

Stay connected with us on Instagram and YouTube for the latest updates and behind-the-scenes insights.

Check out our exclusive merchandise, including t-shirts, stickers, and coffee mugs.

Subscribe to our podcast and join the conversation:

Please note that nothing in this blog post constitutes investment advice, performance data, or a recommendation to buy or sell any particular security. The opinions expressed herein are for informational purposes only and do not reflect the views of Ritholtz Wealth Management or its employees.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship, or recommendation by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss, and nothing on this website should be construed as an offer to sell or a solicitation of an offer to buy or hold an interest in any security or investment product.