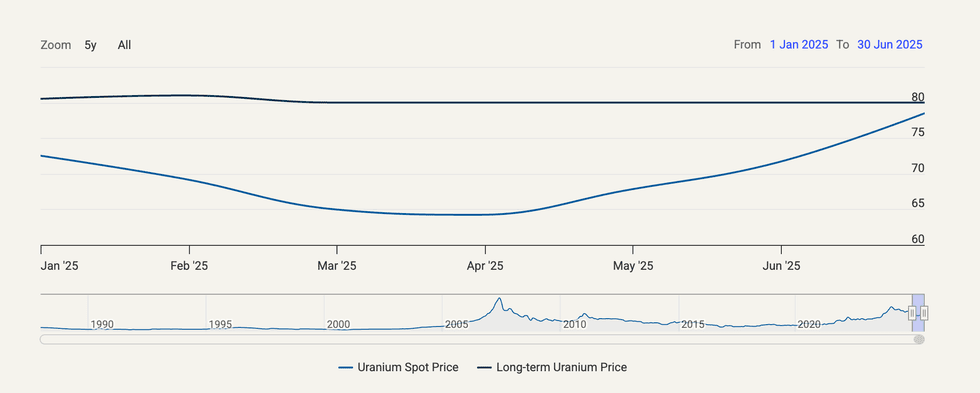

The uranium market entered Q2 on shaky footing, with spot prices slipping to around US$63.50 per pound (March 13)—the lowest level in 18 months—as utilities hesitated to contract amid ample secondary supply and demand uncertainty.

By early June, however, spot prices rebounded to the US$70–US$71 per pound range, buoyed by geopolitical tailwinds and renewed nuclear policy support in the US.

While the spot market showed typical volatility, long-term contract prices remained stable around US$80 for the first six months of the year, underscoring producer discipline.

Utilities have so far stayed largely on the sidelines, but expectations are mounting for a wave of contracting in the second half.

H1 2025 uranium pirce performance. Chart via Cameco.

H1 2025 uranium pirce performance. Chart via Cameco.

Uncertainty impacting utility sentiment

Trade tensions and tariff threats from US President Donald Trump have been a catalyst for volatility in the uranium market through the first half of 2025.

Term uranium contracting remains well below replacement levels despite firm prices and growing demand, according to Oceanwall’s Ben Finegold.

“Term prices are sitting around US$80 per pound right now—roughly US$6 to US$7 above spot—but it’s still extremely difficult to get reliable data on actual volumes and pricing,” said Finegold during the Bloor Street Capital Virtual Uranium Conference in June.

By mid-year only 25 million pounds had been contracted, putting the market on track to fall 75 percent short of replacement-rate contracting. That shortfall has been a recurring issue, with contracting volumes lagging for more than a decade.

While 2023 saw the strongest term contracting in years (160 million pounds), about 30 percent of that came from a single deal. In 2024, 110 million pounds were contracted, well above where 2025’s totals are likely to fall.

Uncertainty continues to weigh heavily on term uranium contracting, particularly among U.S. utilities, who remain unsure about the future of US-Russia relations and whether Russian supply will remain accessible.

“There’s a certain naivety among fuel buyers,” said Finegold, referencing a recent conversation with a former buyer who suggested utilities have grown used to a decade-long environment where they could easily dip in and out of the spot or term market.

But that era may be ending.

“I just don’t see a situation where the supply-demand fundamentals get better for utilities,” the source added.

Despite global momentum—31 countries aim to triple or quadruple nuclear capacity by 2050 and the US government has pledged US$75 billion toward domestic reactor builds—contracting volumes remain surprisingly low.

“It’s a pressure cooker,” said Finegold. “At some point something has to give—and when utilities return to the term market, history shows they tend to do so all at once.”

Supply gap to collide with surging demand

From a structural perspective, the market is grappling with a widening supply deficit: global production in 2024 met just 80 percent–90 percent of reactor demand, with the shortfall made up through inventories and spot purchases—a buffer that is fading fast.

Meanwhile, development pipelines are thin, projects suffer regulatory delays, and geopolitical constraints—including Russia sanctions—further limit available supply options. Further compounding the issue are the 69 nuclear reactors that are in the process of being built, in addition to the 440 operational reactors around the globe.

The need for uranium is especially prevalent in the US where 45 million pounds are consumed annually, while the country produces roughly 1 percent of that.

In an effort to remedy this discrepancy, President Trump issued several Executive Orders in early 2025 and targeted energy production in his “big beautiful bill”.

Included within these measures Trump has proposed an increase in nuclear energy targeting 400 gigawatts by 2050.

The uptick would mark a fourfold increase from the country’s current 100 gigawatts of capacity—far exceeding the International Atomic Energy Agency’s projected range of 89 to 142 gigawatts for all of North America.

If realized, this expansion would push U.S. uranium demand from about 50 million pounds of U3O8 equivalent annually to nearly 200 million pounds—an amount that alone would nearly double current global mine output, which UxC estimates at 164 million pounds for 2025.

“The US is signaling a once-in-a-generation commitment to domestic uranium independence and advanced nuclear deployment,” wrote Sprott’s Jacob White, in a June uranium report.

While the scale of future demand will depend on execution challenges such as permitting, grid infrastructure, and financing, analysts say the scenario presents “asymmetrically positive” risk, offering potential upside to long-term uranium demand forecasts.

This thesis was further bolstered when the Trump admin fast tracked permitting for the Anfield Energy’s (TSXV:AEC,OTCQB:ANLDF) Velvet-Wood project in Utah and Laramide Resources’ (TSX:LAM,ASX:LAM,OTCQX:LMRXF) Crownpoint-Churchrock and La Jara Mesa uranium projects in New Mexico.

“For the first time under the current policy framework, a uranium mine, Anfield’s … received US approval in just 14 days,” the Sprott report noted.

“This demonstrates how quickly support for domestic supply can translate into tangible action. The project was permitted under Trump’s emergency energy declaration, reinforcing a shift toward uranium as a strategically vital input.”

Elsewhere uranium supply could face headwinds. Kazakhstan, which accounts for roughly 40 percent of global uranium output, is unlikely to boost production meaningfully.

“I see Kazakhstan as sort of the 800 pound gorilla in the room,” said Finegold.

Kazatomprom, the country’s state-owned uranium company, reduced its 2025 production guidance, by 12 percent–17 percent, due to a critical shortage of sulfuric acid, the chemical essential for its in-situ leach mining process.

Further complicating the outlook, the company’s planned acid production facility isn’t expected online until 2026 or later. Additionally, anticipated increases in Kazakhstan’s mineral extraction tax beginning in 2025 threaten to raise production costs significantly, eroding the company’s historical cost advantage over peers.

Finegold also sees potential issues arising in projected Canadian supply. He noted that the market assumes that developers like NexGen Energy (TSX:NXE,NYSE:NXE), Denison Mines (TSX:DML,NYSEAMERICAN:DNN), Fission Uranium (TSX:FCU), and Paladin Energy (ASX:PDN,OTC:PALAF) will hit timelines and budgets

“And that’s just not how uranium mining works,” he said, pointing to similar issues with North American counterpart Peninsula Energy ASX:PEN,OTC:PENMF).

Peninsula just canceled contracts for 2 million pounds—that demand doesn’t disappear,” he said. “It’ll need to be filled elsewhere, likely via the spot market.”

Uranium-themed equities surge on global nuclear momentum

As highlighted in the Sprott report uranium’s mid-year price ignited a rally in mining equities which posted a 16.22 percent gain by June.

“This sharp equity rebound points to the sector’s leverage to increases in the spot price and catch-up potential, especially as investor sentiment begins to recover,” it read.

Furthermore, the Sprott Physical Uranium Trust’s (TSX:U.U,OTCQX:SRUUF) mid-June US$200 million capital raise bolstered market sentiment and boosted uranium prices and equities.

As John Ciampaglia, CEO of Sprott explained during the virtual uranium event, the move was a strategic play aimed at taking advantage of what the firm viewed as a temporary and unsustainable dip in uranium prices.

He noted investors from Australia led the raise, followed by North American and European interest.

Van Eck’s Uranium and Nuclear Technologies UCITS ETF (LSE:NUCL), also made large gains in 2025, growing its assets under management to over US$500 million in mid-June and then to US$926.6 million by the end of July.

Discussing the significant uptick, Kamil Sudiyarov, senior product manager at VanEck Europe, told the Investing News Network the growth has been attributed to heightened interest in the energy sector.

“Nuclear re-entered the public conversation in 2024,” said Sudiyarov, noting the shift followed years of muted sentiment in the wake of the 2011 Fukushima disaster.

While 2022 marked the initial turning point—spurred by Europe’s energy crisis and an urgent search for stable power sources—it wasn’t until last year that nuclear power fully took center stage.

“In 2022 and 2023, the uranium price story led the narrative, but in 2024, nuclear itself became the headline,” he said, pointing to growing political support and corporate endorsement, including power purchase agreements signed by major US tech firms.

The fund also benefited from its lighter exposure to uranium prices compared to peers, allowing it to outperform during a period of spot price softness. “That combination of strong nuclear sentiment and more resilient positioning helped us attract significant inflows.”

Tracking the MarketVector Global Uranium and Nuclear Energy Infrastructure Index, the fund holds roughly 33 companies across the uranium fuel cycle, reactor technologies, services, and utilities.

The ETF is structured around three distinct pillars, according to Sudiyarov.

“The first pillar is uranium miners and companies in the uranium business,” he said, noting this includes traditional miners as well as firms like Yellow Cake that stockpile physical uranium.

The second category focuses on nuclear pure plays, including small modular reactor (SMR) developers like NuScale (NYSE:SMR) and domestic nuclear fuel producers such as Centrus Energy (NYSE:LEU).

The third pillar was developed to broaden exposure beyond competitors’ uranium-heavy strategies.

“We wanted a more even split,” Sudiyarov explained. “So we decided to tap into industrial conglomerates with significant nuclear business units.”

On the investor side, interest in uranium appears to be growing.

“Last year, I had maybe one or two calls about uranium. This year, I’ve had a lot already,” he said, suggesting rising attention from institutional investors.

Growing political acceptance, especially around energy security and defense, has helped reduce the hesitation seen among more conservative investors.

“Once they realize the theme is back in vogue, they feel more comfortable,” he said.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web