Do you know what happens when you are unable to repay back your home loan?

After how many missed EMI’s will the lender get hold of your property and throw you out of it? What are your rights as a consumer and what exactly are the steps involved in the foreclosure process?

When we buy a home with a home loan, there is lots of enthusiasm as we are becoming the owner of our dream home, and the future looks bright, but the reality of life is that there are many homeowners who face financial difficulties in their life due to job loss, accidents, medical problems that they are unable to pay back their Home loan EMI’s for many months and eventually get into a situation when they are not able to repay back.

Today I am going to tell you all you need to know about this topic. Let’s start

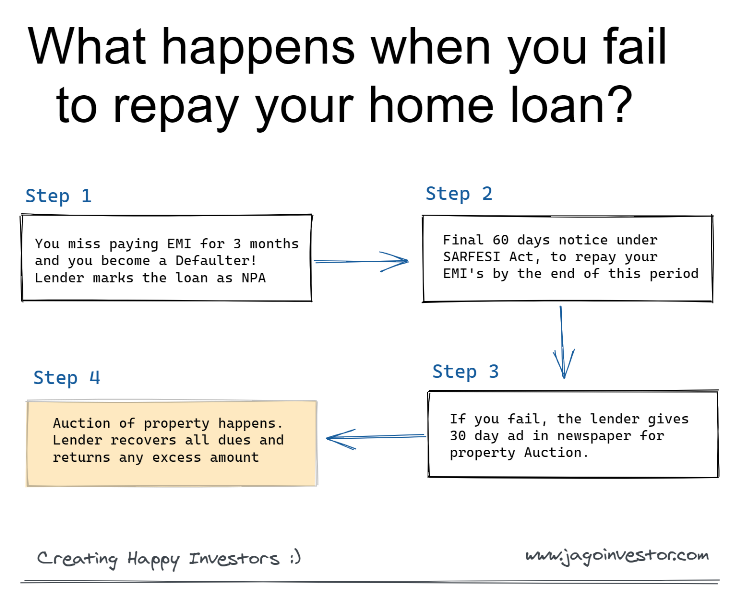

#1 – When you miss paying 3 months EMI

It may happen that you are miss 1-2 EMI payments due to some reason, in which case the bank will give you a reminder about it or give a small warning to pay back the missed EM next month. But if you miss paying the EMI for 3 consecutive months, that’s a big red signal and at this point, your loan account will be marked as NPA in the lender’s book.

This is a serious situation. The bank will mark you as a defaulter and the bank will send you a notice about it.

At this point make sure you do not ignore the bank notice and reply to them asap explaining to them about your situation and the reason why you missed paying the EMI’s. If your credit history is good and your reasons are very genuine, there is a possibility that the lender may give you some grace period for repayment.

Your CIBIL will also get impacted due to you getting marked as a defaulter.

#2 – Final 60 days’ Notice

If the bank is sure that they want to move ahead after you are marked as Defaulter, they will then send a full and final 60 days notice under a law called SARFESI Act (Securitization and Reconstruction of Financial Assets and Enforcement of Security Interests Act).

Sarfesi Act empowers banks and other financial institutions to directly auction residential or commercial properties that have been pledged with them to recover loans from borrowers and lays down all the processes to be followed.

Before this act came into power in 2002, the lenders had to file a case against the homeowner and the matter went to court which was a lengthy process and very time-consuming. But after this act, now the lender can directly auction your property and evict you out of it. Even Co-operative banks are covered under the Sarfesi Act

This 60 days period is your final chance to repay your EMI’s, else the lender can take hold of the property and sell it off after 60 days’ notice. After this 60 days period, you are expected to settle down all the money you owe to the bank which is the outstanding loan amount. Either you pay it back to the lender on your own or the lender will auction the house and recover back their money.

During this 60 day notice period, you can put up your case in front of the assigned officer and share with them what best you can do to pay off the EMI soon. If they accept your explanation, then well and good, otherwise they need to give you a written letter of rejection within 7 days after which the next step starts.

During this 60 day period itself, you may also get recovery agents to your doors who may demand that you settle your dues. Note that as per the RBI rules you have certain rights when it comes to recovery agents like.

- You can ask for the identity of the collection agents if you wish. They need to carry their ID Cards and an authorization letter from the bank

- Recovery agent must be an authorized agent as per the Indian Institute of Banking and Finance

- The recovery agent can visit only between 7 am to 7 pm and shall only talk to the defaulter and not family members (unless the defaulter is out of reach)

- The loan recovery agent cannot be disrespectful or shall use any objectionable language or behaviour

In real life, the above rules are not followed properly and recovery agents are infamous to threaten and humiliate loan customers. If that happens, you shall complain to the bank and also take up the matter with the banking ombudsman

#3 – 30 days’ notice in the newspaper for Auction

As the next step, the lender will get the property valued from their valuer’s to find out the fair value of the property. Now starts the property auction process.

The lender will advertise the property details and mention all details like the reserve price (shall be around the fair value of the property), the date & time, address for the auction of the property.

If the property owner feels that the fair value of the property is too less or not correct, then they can object and talk to the lender.

#4 – Auction of property and refund of excess money

And as the final step, the property will be auctioned in the open market and the bank will recover back all its dues. Note that the bank is only liable to recover the dues and not the excess amount. If there is any balance left, it has to be paid back to the homeowner. So keep an eye on the auction amount. Nowadays most of the home auctions happen online (e-auctions) and you have the data online.

Sell off your house if you become a defaulter

Let me guide you a bit on what you should do if you are unable to repay back your home loan amount and are marked as a defaulter. Yes!, The best thing to do is to sell off your house on your own and pay back the dues to the bank.

Here are 2 reasons why you should sell off the house on your own

- You will not get the best price in Auction – Home Auctions are distress sale from the bank side. Bank just wants to recover back their loan outstanding. Hence their focus is not on getting the best price for your house. If you sell the house on your own, you may get a much better price

- It will take a lot of time as the property will be stuck at the bank hand – The auction process is lengthy and may take a lot of time which may not be suitable for your timeline. If you sell off the house yourself, you may do it faster as you may be open to negotiating and ready to give some great deals to potential buyers. You can also offer the brokers extra or double commission so they can also put all their energy into finding a buyer.

How to avoid getting into the defaulter list in future?

What are some of the best practices you should follow so that you do not get into the defaulter list? Here are some things

- Try to keep your EMI amount less than 40% of your take-home – Always make sure that the EMI is not a big burden for you. Don’t go overboard and take a loan which is like a big burden for you.

- Try to pay as much down payment as you can – If possible, do make sure you pay a big down payment so that your loan outstanding is a smaller amount that is manageable for you. I would suggest that you pay more than 40% in the down payment.

- Restructure the loan – If the EMI is a big amount for you and each month you are on the edge of default, do try to bring down the EMI amount by increasing the tenure.

- If you have any investments in debt assets like FD, Saving account, Insurance policies, PPF or even EPF. you can use that to pre-pay your loan to bring down the loan outstanding. This is only for those people who are overburdened with high EMI amounts each month

I hope this was helpful and you got some new information!. Do let us know if you have any questions!