Tornado Cash co-founder Roman Storm is set to stand trial on Monday in the Southern District of New York (SDNY) on federal charges that could put him behind bars for more than 40 years.

Prosecutors allege he conspired to launder money, violated US sanctions and operated an unlicensed money-transmitting business stemming from his role in creating Tornado Cash, an open-source protocol that allows users to conceal blockchain transactions — whether for privacy or to obscure illicit activity.

At the heart of Storm’s defense is the argument that Tornado Cash is not a business but a decentralized and immutable protocol that he no longer controlled. Also, code is considered protected speech under the First Amendment in the US.

The trial ultimately hinges on whether Storm’s actions amounted to protected speech or crossed into criminal conduct.

Here are the key facts to understand before Storm faces the court.

Why is Tornado Cash’s Roman Storm on trial?

Storm moved to the US from Russia in 2008 and later became a US citizen. In a recent interview with “Crypto In America,” he said the freedoms granted to individuals in the US deeply resonated with him and were a key motivator for his move.

While working as a software engineer in San Francisco in 2014, he discovered Bitcoin and was “blown away” by the idea of transacting freely with others on a decentralized network.

In 2019, Storm attended a conference representing his consulting firm, PepperSec. He met Ethereum co-founder Vitalik Buterin, who encouraged him to explore privacy in blockchain applications. That conversation eventually led to Storm co-creating Tornado Cash with Alexey Pertsev and Roman Semenov.

Pertsev was found guilty of money laundering in the Netherlands and is currently appealing the decision. Semenov remains at large and is on the US Federal Bureau of Investigation’s wanted list.

Launched in 2019, Tornado Cash is a tool designed to obscure blockchain transaction histories. When a user deposits crypto into the protocol, it generates a secret code that allows them to later withdraw the same amount to a different wallet address. Because deposits and withdrawals are recorded as separate transactions, they are more difficult to trace than typical blockchain transactions.

It quickly attracted illicit users, including North Korean hackers, prompting the US Treasury’s Office of Foreign Assets Control (OFAC) to impose sanctions on the protocol in 2022. However, in March 2025, those sanctions were reversed following a civil challenge in Van Loon v. Department of the Treasury, brought by Tornado Cash users.

Judge Katherine Failla, who is presiding over Storm’s case, recently said she was “inclined” to exclude the 2022 sanctions from the trial.

Related: From Sony to Bybit: How Lazarus Group became crypto’s supervillain

Failla has previously overseen major cryptocurrency cases, including the dismissal of a class-action lawsuit against decentralized exchange Uniswap and the Securities and Exchange Commission’s (SEC) now-dropped lawsuit against Coinbase.

Tornado Cash’s decentralization is central to the defense

Storm is being prosecuted by a team experienced in crypto crime: Thane Rehn and Benjamin Gianforti, assistant US attorneys in the SDNY. Gianforti secured convictions in the IcomTech and Forcount crypto Ponzi cases. Rehn was the prosecutor against FTX.

In Storm’s corner, he is represented by a legal team led by Brian Klein of Waymaker LLP and David Patton of Hecker Fink LLP. Klein is a white-collar defense attorney known for high-profile crypto cases, including his work defending Mango Markets exploiter Avi Eisenberg and crypto exchange Kraken. Patton, a federal trial lawyer, has represented major crypto figures such as Terraform Labs co-founder Kwon Do-hyung, better known as Do Kwon.

The defense argues that their client can’t be held responsible for how Tornado Cash was used because the protocol is decentralized and beyond his control. In May 2020, Tornado Cash developers began relinquishing control and moved toward a fully decentralized system.

According to the defense, Storm merely wrote and published open-source code. He didn’t run a business, offer a service or manage customers. They cite a 2019 Financial Crimes Enforcement Network (FinCEN) guidance that said developers of anonymizing software were not required to register as money transmitters.

That argument has gained traction in related cases. In Van Loon v. Department of the Treasury, the Fifth Circuit ruled that Tornado Cash’s immutable smart contracts were not “property” subject to US sanctions.

In Storm’s own case, firms like Paradigm have filed amicus briefs urging the court to weigh the broader consequences of prosecuting open-source software developers. The Blockchain Association, Electronic Frontier Foundation, Coin Center and DeFi Education Fund have also submitted briefs in his defense. A legal fundraiser supporting his case has raised $1.96 million at the time of writing.

“Roman wrote and deployed open-source code. He didn’t launder funds or run a business,” Amal Ibraymi, legal counsel at Ethereum privacy network Aztec Labs, told Cointelegraph.

“Prosecuting him for others’ use of that code risks setting a deeply concerning benchmark where writing code for privacy tools becomes a legal liability even when that code is public, permissionless and not under the developer’s control.”

Meanwhile, the prosecution’s indictment distinguishes Tornado Cash’s immutable smart contracts and its frontend interface. Prosecutors allege that Storm and his co-founders paid for US-based web hosting and maintained a website that allowed users to interact with the protocol. They claim the developers retained the ability to modify the UI at will.

Related: Bitcoin to benefit from Trump’s ‘Big Beautiful Bill,’ analysts predict

A key development has been the Trump administration’s crypto-friendly stance compared to that of Joe Biden’s. During the Biden era, the Securities and Exchange Commission faced criticism for its “regulation by enforcement” approach; however, the agency has since dropped several major crypto cases — including some before Judge Failla.

Under the Trump administration was the Department of Justice’s (DOJ) April Blanche Memo. It instructed federal prosecutors to avoid bringing regulatory charges in digital asset cases — such as for unlicensed money transmission — unless they can show the defendant acted willfully and knew of any licensing requirements.

“The Blanche Memo makes clear that the DOJ shouldn’t prioritize cases against developers of open-source, general-purpose tools without clear criminal intent,” Ibraymi said. “For this defense team, this presents a strong argument that the prosecution contradicts the DOJ’s own guidance.”

Tornado Cash trial in the US may influence Dutch appeal

Tornado Cash co-founder Pertsev was found guilty of money laundering by a Dutch court in 2024 and sentenced to over five years in prison. His conviction was based largely on the same argument now being made by US prosecutors.

However, the legal framing in the US could sway Pertsev’s appeal process in the Netherlands. Pertsev’s legal team is currently challenging the ruling, arguing that the protocol’s immutability and decentralization make it fundamentally different from a company or custodial service.

If Storm is acquitted, or if the US court affirms that writing open-source code is protected speech, it may bolster the defense’s argument that Pertsev was wrongly held accountable for the autonomous actions of a decentralized protocol.

“There’s no doubt that prosecutors in both countries are watching these cases closely. But that scrutiny cuts both ways, and strong legal arguments made in one case can help reinforce the defense in the other,” Ibraymi said.

“In particular, with the Fifth Circuit already affirming key principles around decentralization and code, there’s growing momentum to push back against efforts to criminalize developers for building tools they don’t control,” she added.

European courts are not bound by US decisions, but the high-profile nature of the case and its implications for developers globally mean that Storm’s trial is being watched closely by privacy advocates, legal scholars and regulators across jurisdictions.

The case against Storm ultimately tests whether publishing open-source privacy software can be considered criminal conduct when that code is later used for illicit purposes. The prosecution argues that Storm knowingly facilitated money laundering beyond coding itself, such as through the project’s user interface.

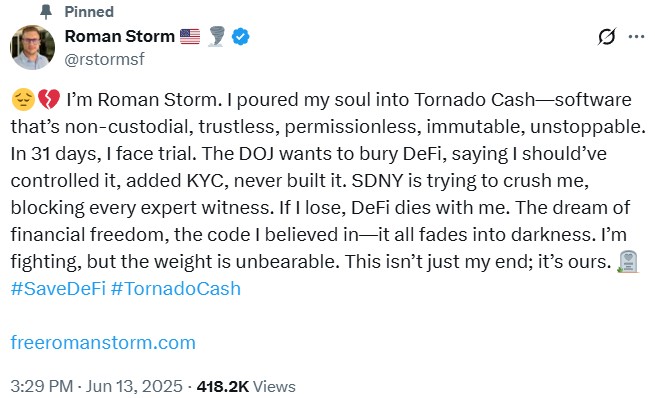

The defense maintains that he simply wrote decentralized code that now operates beyond his control. In a late twist, they also accused prosecutors of misrepresenting key Telegram evidence, saying the government only disclosed critical metadata — showing a reporter’s message was forwarded by Storm, not authored. His trial begins Monday in the SDNY.

Magazine: Inside a 30,000 phone bot farm stealing crypto airdrops from real users