Key Points

- The Grad PLUS program ends July 1, 2026, replaced with new federal borrowing caps for graduate and professional students.

- Parent PLUS loans will be capped at $20,000 per year and $65,000 total per child, shifting more families toward private loans.

- New repayment options will shrink to two plans for new borrowers – Standard or Repayment Assistance Plan (RAP).

Starting July 1, 2026, the federal student loan system will enter a new era.

A sweeping set of federal policy changes will reshape how families and graduate students borrow for college starting in 2026. The legislation, passed this summer, eliminates some long-standing loan programs and replaces them with new caps and repayment plans.

While the reforms aim to contain debt growth and improve accountability for colleges, they also mark a clear shift away from the flexible borrowing model that has defined federal student aid for years.

The Result: fewer borrowing options, stricter limits, and new tradeoffs for both students and parents.

Would you like to save this?

What Changes For Borrowers

For borrowers taking out new loans after July 1, 2026, federal lending rules will look very different. While undergraduate loan limits remain the same (including having access to subsidized and unsubsidized loans), parents will face new limits.

Parents: For families, the most dramatic change will be to Parent PLUS loans, which will now carry a $20,000 annual and $65,000 lifetime limit per dependent child. The limit is fixed per student – paying off loans or qualifying for forgiveness will not restore eligibility. A three-year grace period allows parents who borrowed before June 30, 2026, to continue under the old rules through 2029.

Parent PLUS borrowers will also no longer have access to income-driven repayment, which may make repayment harder and honestly makes them a worse choice than private student loans.

Graduate Students: The Grad PLUS loan program is eliminated, ending open-ended borrowing for graduate school. In its place, graduate students will be limited to $20,500 per year and $100,000 in total under new unsubsidized Direct Stafford loans. Professional school students (including those pursuing law or medicine) will have higher limits: $50,000 per year and $200,000 total.

Students already enrolled in a program and who received at least one loan before June 30, 2026, will be allowed to continue borrowing under the old rules for the remainder of their program or up to three years, whichever is shorter.

New Repayment Plan Changes

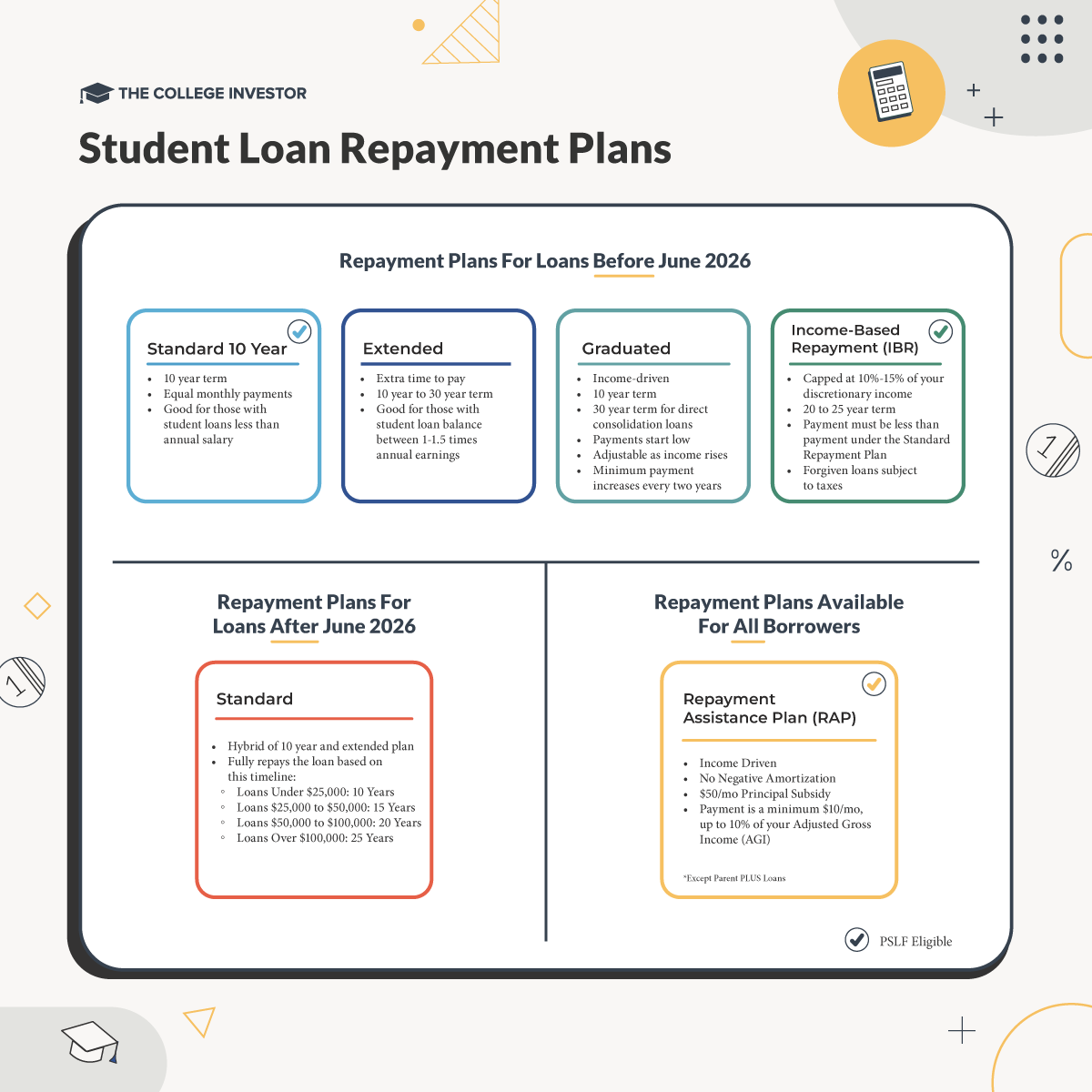

Borrowers taking out new loans after July 1, 2026, will have just two repayment options: the Standard Repayment Plan and the new Repayment Assistance Plan (RAP).

Standard Repayment Plan:

Payments are fixed based on the borrower’s loan balance.

- Under $25,000: 10-year term

- $25,000–$50,000: 15-year term

- $50,000–$100,000: 20-year term

- Over $100,000: 25-year term

This structure replaces multiple older repayment options and resembles the “extended repayment” plans previously used for larger balances.

Repayment Assistance Plan (RAP):

RAP bases payments on adjusted gross income (AGI), starting at just $10 per month for borrowers earning under $10,000 annually. Payment rates increase with income (from 1% of AGI for those earning $10,001–$20,000 up to 10% for incomes above $100,000).

Borrowers receive a $50-per-dependent deduction from their monthly payment, though payments cannot fall below $10. Any unpaid interest will be waived, preventing balance growth. After 30 years of payments, any remaining balance will be forgiven.

Parent PLUS borrowers are not eligible for RAP. Their only option will be the Standard Repayment Plan.

Existing borrowers will still maintain access to their “old” standard plans and IBR, but can also opt into RAP.

How These Changes Will Impact Borrowers

For families, the 2026 changes may shift how families pay for college. With lower federal borrowing limits, some students (particularly in high-cost graduate or professional programs) may turn to private student loans, which often require qualifying credit scores and lack federal protections.

Parents who borrow through the PLUS program may need to adjust borrowing expectations, and look at private loans vs. Parent PLUS loans.

Meanwhile, the simplified repayment system could reduce confusion but extend repayment timelines. The RAP plan’s 30-year term offers smaller monthly payments but may have higher total costs over time. Compared to existing plans, RAP may be cheaper than IBR for lower income borrowers, but is likely more expensive for families earning over $100,000 per year.

Don’t Miss These Other Stories:

Editor: Colin Graves

The post What’s Changing For Student Loans In 2026? appeared first on The College Investor.