Shall you buy a single big health insurance policy or divide it between two policies (Base cover + a super top-up policy) for a cheaper premium?

The whole insurance industry is busy promoting and selling super top-up policies as a “cheaper way of upgrading” your health insurance cover. But no one is educating investors on the limitations of such combo or exactly why they are cheaper compared to a single cover.

Today, I will do that to the best of my abilities.

Investors have bought various combinations of base plan + super topup plan

- 5 lacs + 5 lacs

- 5 lacs + 10 lacs

- 10 lacs + 10 lacs

- 3 lacs + 7 lacs

- 10 lacs + 20 lacs

and many more…

Recently, we also saw health insurance policies of “Rs 1 crore” sum assured for unbelievable premiums and many investors have also opted for those. Basically, they are simply a combo of Rs 5 lacs + 95 lacs cover (with 5 lacs deductible).

Was that a great choice?

Let’s dive deeper!

Let’s start with an example!

A family of three people (with age 37 yrs, 36 yrs and 6 yrs) wants to buy a 25 lacs health insurance cover. They can do two things

[su_table responsive=”yes”]

| Option | Policy | Premium |

|---|---|---|

| 1st Option |

|

Rs 28,091 |

| 2nd Option |

|

Rs 17,907 |

[/su_table]

In this case, the premiums of the combo (2nd option) is 37% cheaper.

Most of the investors think that both the policies are a “25 lacs cover policy” and the 2nd option is exactly the same as the 1st option but with a cheaper premium.

This is obviously not true!

How is it possible that you get the exact same thing, but with a cheaper premium?

If a combo is cheaper, surely it will also have its own limitations or will fall short of in some situations? That’s exactly what we are going to look at today.

Disclaimer – “Super Top-up” policies are a great choice

I don’t want to sound against super topup plans. They are a wonderful product and have a great role in health insurance, but problem is that people are buying them as a replacement for a strong base cover policy and living in the illusion that they are getting the exact same deal as a big cover.

Let’s start to get into details now.

1. Two Claims instead of a single claim

What does a person wish for at the time of a health insurance claim?

The answer is a smooth and hassle-free claim experience.

I have already made 3 different claims (2 in my own policy and 1 in my father in law policy) in the last few years and hence I can tell you that the claim process is something you dont want to complicate.

When you have a single policy, it means a single claim each time.

What happens when you have a combo plan? Let’s see!

If both policies are from the same insurer

If the base policy and super topup cover are from the same company, then it’s quite a smooth and seamless process, as they can internally cross-check things and coordination is much better. Basically, they have to technically anyways settle both claims, so they will combine them and process the whole thing faster and easily.

If both policies are from a different insurer

However, if both your policies are from different insurers, then it can get complicated and confusing. Don’t worry, you are not losing any money here, but surely it’s a bit of hassle and delay in follow-ups and coordination if the super topup plan gets triggered (which will happen when your base plan is not large enough). Also,

- You will have to keep hold of 2 health insurance cards

- Dealing with 2 claim forms especially for pre & post hospitalization claims (even in case of a cashless claim)

- Communication for 2 policies (this may be easy when the insurer is the same)

- And finally, in case of reimbursements, more documentation (hospital bills/prescriptions)

- With 2 insurers, there may also be a wait time involved for getting the xerox of the bills/claim settlement letter

Also, imagine the scenario of how your family will be able to claim if you yourself will get hospitalized (due to any emergency). Will your spouse/family have enough understanding to follow the intimation and claim process from both the policies.

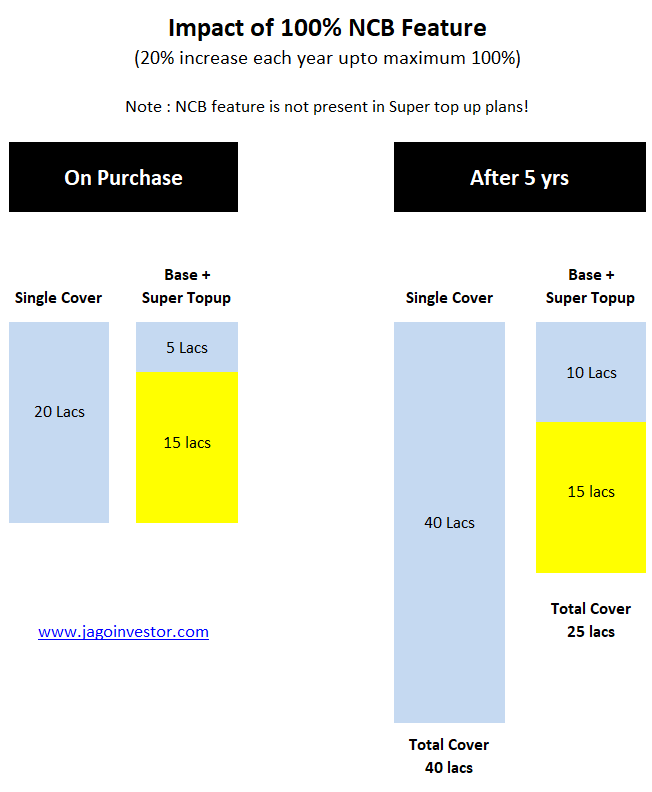

2. Lower Coverage due to NCB missing in Super topup

Contrary to popular belief, the combo (base + super top-up) gives you a lower coverage compared to a single large cover, simply because of the NCB component which many do not consider!

Surprised?

Almost all the policies come with the NCB feature (No Claim Bonus), where your sum assured keeps going up for every claim-free year. Here are some of the examples

[su_table responsive=”yes”]

| Policy | NCB |

|---|---|

| Care Insurance | 10% increase in sum assured up to a maximum of 50% of sum assured |

| Max Bupa Companion | 20% increase in sum assured per year up to a maximum of 100% of sum assured |

| HDFC Ergo Optima Restore | 50% increase in sum assured per year up to a maximum of 100% of sum assured |

[/su_table]

Now let’s see a case.

Assume a person wants to buy a policy with a sum assured of 20 lacs. He has two options

[su_table responsive=”yes”]

| Option | Option 1 – Single Cover | Option 2 – Combo |

|---|---|---|

| Combination! | The single policy of 20 lacs | The single policy of 5 lacs (base plan)

Super Topup cover of 15 lacs (with 5 lacs deductible) |

| NCB Benefit | 20% each year (up to 100%) | 20% each year (up to 100%) applies only on the base plan

NCB feature is NOT applicable in Super topup policies |

| Total Sum Assured at the start (when you buy policy) | 20 Lacs | 20 Lacs |

| Total Sum Assured after 5 yrs (claim-free years) | 40 lacs

(base policy X 2) |

25 lacs

(base policy X 2 + super topup) |

[/su_table]

Now you understand why the premiums for super topup cover is less than the single large cover.

Here is the pictorial representation of the above example

So, you can see how after a few years there will be a gap of 15 lacs in sum assured in the combo plan. Now do the maths for a total cover of 10 lacs. What will happen if you divide it into a 5+5 combo?

3. Lower Coverage due to Recharge Benefit (2 large claims in a single year)

There is something called “Recharge benefit” in health insurance policies these days, which refills your policy again up to the sum assured when the sum assured reduces due to any claim. Like if you have a 10 lacs cover, and you claim for 4 lacs, then the policy will come down to 6 lacs, but then due to recharge benefit, the sum assured will again rise to 10 lacs (the added sum assured can not be used by the same person for same illness for which he/she claimed)

Now, let’s imagine a case

Assume, that in the worst case there are two big claims in the same financial year. Like what happened with few people in this Pandemic. Imagine one person getting hospitalized due to corona and then after 4-5 months, another person in the family also getting hospitalized. Or imagine someone in the family getting treated for a big illness and then after a few months, another family member getting hospitalized due to a severe accident also.

Very low chances of this happening. RIGHT?

Yes, but it can not be ruled out at all!. It’s the extreme end I know.

How will be the claim experience in both cases? Let’s compare the same example (forget NCB for the moment)

[su_table responsive=”yes”]

| Option | Option 1 – Single Cover | Option 2 – Combo |

|---|---|---|

| What? | Single cover of 10 lacs | Single Cover of 5 lacs (base plan)

Super Topup cover of 5 lacs (with 5 lacs deductible) |

| 1st Claim by husband for Rs 8 lacs | The claim will be paid for 8 lacs | 5 lacs claim paid by the 1st base policy

3 lacs claim will be paid by super topup policy

|

| 2nd claim by a spouse in the same year for Rs 10 lacs | Because of the recharge benefit, the spouse will be able to claim for a total of Rs 10 lacs | Because of the recharge benefit, the base policy will pay 5 lacs

But the super topup will pay the remaining 2 lacs only. 3 lacs will have to be paid by policy-holder LOSS of Rs 3 lacs here compared to 1st option |

[/su_table]

The point is that recharge benefit can also come into play in some very unlikely situations, but that feature is missing in super topup plans.

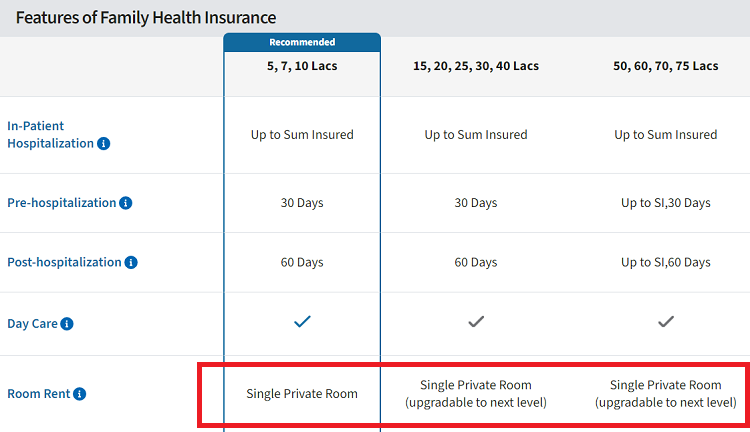

4. Difference in room rent limit

One major thing you have to consider is the difference between room rent limits in both base and super top-up.

Here is an example.

- At the time of writing this article MaxBupa Reassure plan (recently launched) has no room rent limits.

- However, its Health Recharge plan (the super topup policy) mentions that you only get a single private AC room in the plan.

Note that there are various types of single private AC rooms in a hospital. What you get from your insurance policies is the cheapest “Single Private AC room”.

Now let’s see 2 cases with an example

- Total health cover: 20 lacs

- The room category: A higher grade single AC room (higher quality and better facilities). Imagine the cheapest AC single room was not available or you wanted to go for the better facilities.

- Final Bill amount: Rs 11 lacs

Case 1: You have a single policy of 20 lacs (Maxbupa Reassure, just for example)

In this case, because there is no room rent limit, your total claim amount is admissible and your claim process will happen smoothly.

Case 2 : Now imagine that you have a 20 lacs cover but in combo form.

You have a 5 lacs base plan (Reassure policy) + 15 lacs of super topup with a deductible of 5 lacs (Maxbupa Health Recharge)

Now the first policy will pay the claim of 5 lacs easily because there was no room rent limit in the policy.

However when you go to claim the additional 6 lacs in the super topup, here is what will happen.

If you had chosen the cheapest AC single room, your total claim of 6 lacs would have got admissible and processed. However, because you choose a higher category room, you will not be paid proportionately only.

If the room rent for the cheapest AC private room was Rs 8,000 per day whereas you choose the one whose rent was Rs 12,000 per day. You will be paid just 66.66% (2/3rd) of the claim amount, which is only Rs 4 lacs

This is called a Proportionate claim in health insurance. This may happen in reality if your base cover is a small amount and a big claim arises. If you choose the cheapest single private AC room, then there won’t be any issues, but otherwise, there can be issues and this can happen even if you bought the policies from the same insurer (like in this example I gave)

Another example is of Care Plan from “Care Insurance” formally known as Religare Care.

In Care Insurance the room rent for a 5 lacs base cover and 15 lacs of super topup cover is “Single Private AC Room”

Whereas if you take a larger single cover, the room rent is “Single Private AC room (upgradable to next level). This gives you enough flexibility and freedom to enjoy better quality health care and facilities. Sometimes, the single PVT AC room of the lowest category may not be what you wish for.

Imagine you need a bigger space and better facilities in the room, in that case, more deluxe rooms will be required by you. This is where you may lose in a big way (not today, but maybe in future or in case of large claims).

Here is the snapshot from the Care Health Insurance website.

Old Policies – If someone has taken 3-5 lacs of sum assured a few years back (especially from PSU companies), there is a good chance that there is a room rent limit of 1% of sum assured (example – Oriental Happy family floater plan). Now if you are buying a super topup plan, there will surely be a difference in the room rent limit.

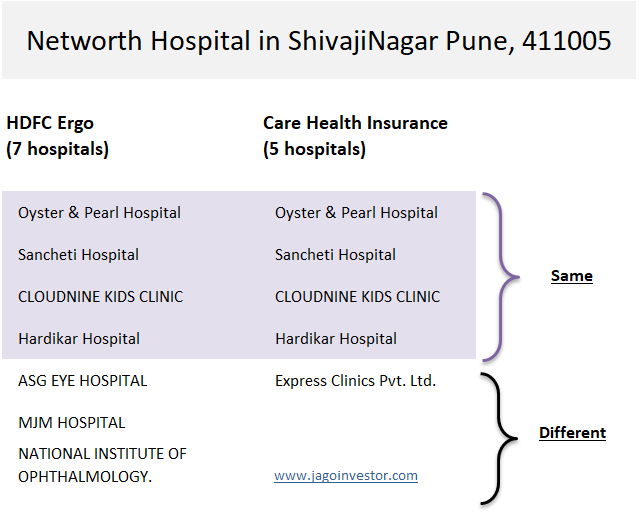

5. Different Cashless Network of Hospitals

If your base policy and super topup policies are from different companies, there may be a possibility that the hospitals in their cashless network are different to some extent. You may face some issues in future due to this.

Here is an example

I checked for network hospitals between HDFC Ergo and Care Insurance for Pincode 411005, which is Shivajinagar, Pune.

I found that HDFC Ergo has 7 hospitals and Care Insurance had only 5 hospitals in their network (in March 2021). Out of these 4 hospitals were common, the rest were different.

Now, what if your first policy is cashless but your sum assured in the first policy is small. In that case, the 2nd policy (super topup) will get triggered, but here you will first have to spend the money as it’s out of the network of the 2nd insurer)

You will then have to file a reimbursement claim later and do the documentation part too.

This will not be the case if you had a single large cover from the 1st company itself. You may argue that you will plan well before getting admitted to the hospital and try to match the one which is there in both policies, but trust me, in real life it will be tough.

When a doctor tells you or recommends that you get admitted to hospital XYZ (often he is also a practising doctor in that same hospital), it becomes quite tough to challenge that or counter his suggestion.

6. If policy tenures are different for both policies

In some cases, you can face issues in the claim, if you purchased both base and super topup policies in different months (same or different insurer, does not matter).

It may happen in some specific cases that your claim is not admissible under any policy.

This is explained very well by Mahavir Chopra of Beshak.org in his article here. I am just sharing what he wrote originally.

Say you have the following Combo plan.

Base plan of Rs. 2 Lakh (Plan year: January 2021 to December 2021)

Super Top-up of Rs. 5 Lakh with an annual deductible of Rs. 2 Lakhs (Plan year: April 2021 to March 2022). (This means for the Super Top-up to pay, the hospitalization expenses should cross Rs. 2 Lakhs in the policy period in question – which is April 2021 and March 2022.)

Now, say you undergo two hospitalizations in the year 2021.

The first one happens in January 2021, the bill amount is Rs. 2 Lakh. Now this is covered by your base-plan there is no confusion, and the claim amount is paid.

Next – you undergo a hospitalization in April 2021. And the bill comes to 1.5 Lakhs.

Now, take a guess on – who will pay for this?

A. Base-plan

B. Super Top-up

C. You

If you guessed A or B – then you’ll be up for a BIG surprise! Here’s how your two insurance plans will look at the second claim.

Your base plan will not pay: Because – you have already exhausted the cover amount available for the year (January 2021 – December 2021)

Your Super Top-up will not pay: Because the Super Top-up plan pays only when the hospitalization expenses during the policy period of April 2021 to March 2022 crosses the deductible of 2 Lakhs. In this case, the total hospitalization expenses during the period in question (Apr 21 to Mar 22) are only Rs. 1.5 Lakhs – hence the claim won’t be payable.

These were some limitations of the super top-up you should be aware of. It’s better to get educated about this aspect, rather than getting shocked and disappointed in future.

Some other small Differences

Apart from the major points discussed above, there are other minor but important points you should know

- Annual Health Checkup Benefit: With a single large cover, you may get superior annual health checkup packages that cover more tests. But with combo plans, you may get normal test packages in both base policy and super topup, which is of less use as no one will do the test twice just for the sake of it. Some policies also offer health checkups only once in two years for smaller covers.

- Hospital Cash Benefit – In many small base plans like 5-10 lacs, the hospital cash limit is Rs 1,000 per day. However for a bigger sum assured, the hospital cash will be in the range of 3000-4000. If you stay in the hospital for 10 days, this means getting 10k only in combo plan vs 40,000 in a single bigger cover.

- Organ Donor Cover / Ambulance Charges – Again, a lower sum assured plan night have a lower benefit compared to a single big cover.

- Waiting period – It might happen that the waiting period for pre-existing illness is different in both policies, just check that.

- Pre & Post Hospitalization Tenure is different – It may also happen that both policies have different pre & post hospitalization tenure.

- Other Minor Changes – Apart from the points above, there are many other minor differences in the bigger sum assured (single policy) which may be useful for you in some specific cases, which we are not covering here

How to look at Super Top-up policies? What is the right combination?

Everyone shall have a large enough cover with a single policy as the first step.

With NCB benefit, that large cover will also get ballooned to every large cover. And with recharge benefits, you will also get those edge cases covered. This will make sure that for many years to come, this single policy will be enough for you.

There are very low chances that in some worst cases, you may still have a very big claim when this single big large cover will not be enough, and that’s when super top-up cover shall come into the picture and that’s exactly why they were designed for.

To cover those extreme end cases!!!

But investors have just started using them with a small cover for the sake of saving some premiums. No doubt you will have a few thousand for many years to come, but there are also limitations which we talked about.

Considering the point above, the minimum base sum assured which I feel one shall take in 2021 is Rs 10 lacs. With NCB benefit, it may become a 15/20 lacs cover, which is good enough for the majority of claims. Anyways the average claim is quite small!

How big was your last #healthinsurance claim?

(Only for those who filed a claim, irrespective of how much was paid)

— jagoinvestor.com (@jagoinvestor_) March 17, 2021

Does it mean you need to take a 50 lacs cover? NO 🙂

So what combination to buy?

Speaking for the majority, I think a Rs 10 lacs base policy with an NCB of 50%/100% and a super topup of 30-40 lacs with Rs 10 lacs deductible is a good enough choice right now. This will balance the premiums and coverage. If you want an even high single cover policy like 15-20 lacs, go ahead!

But also remember, that within the next 10-15 yrs, even the 10 lacs coverage may look like a small one and you may feel that the base policy should have been for at least 20-30 lacs. So take your decision after careful thought.

You can always upgrade your base cover sum assured at the time of renewal.

Do let me know if you have any queries or comments?

Credits – Thanks to Mahavir Chopra of Beshak.org to correct me on some points in this article and also give his valuable insights from time to time because of which I was able to bring depth to this article. Mahavir Chopra is a veteran and a well-known name in the insurance industry and they are doing some cool stuff on beshak.org in the area of insurance. Do check out their website!