Key takeaways:

-

Derivatives data shows traders remain wary despite the recent ETH price gains and strong ETF inflows.

-

Ethereum faces competitive pressure from Solana and BNB Chain amid stagnant network activity growth.

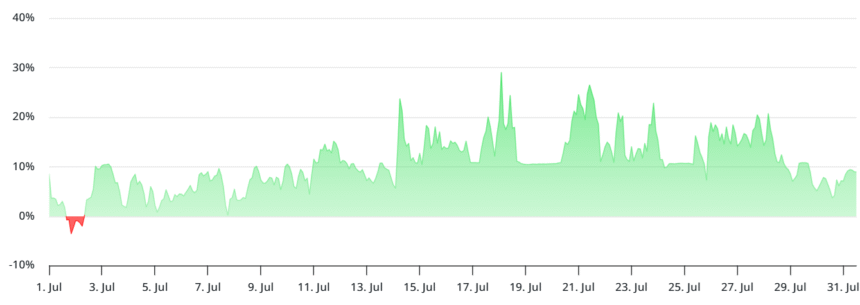

Ether (ETH) price has surged 56.5% over the past 30 days, yet ETH derivatives metrics suggest traders remain cautious.

This sentiment may reflect anxiety, since Ether has repeatedly failed to break the $4,000 psychological threshold since March 2024. Persistent weakness in Ethereum onchain metrics adds to investors’ frustration.

The annualized funding rate for Ether perpetual futures fell to 9% on Thursday, indicating lower demand for leveraged bullish positions. In contrast, the 19% funding rate from Friday to Monday showed moderate excitement. Currently, the funding rate has returned to its level from July 7, when ETH traded near $2,600. This is unexpected since ETH has gained 46% since then.

ETH traders disappointed as Ethereum TVL drops

Part of traders’ disappointment stems from an 11% decrease in network deposits. The total value locked (TVL) in the Ethereum ecosystem fell to a five-month low of 23.4 million ETH on Wednesday, down from 26.4 million ETH thirty days earlier.

By comparison, TVL on Solana dropped just 4% in SOL terms, while BNB Chain deposits grew by 15% in BNB terms.

Ethereum has also lost its top spot in decentralized exchange (DEX) volume, with $81.4 billion in activity over 30 days, according to DefiLlama. In comparison, Solana handled $82.9 billion, while BNB Chain led the market with a remarkable $189.2 billion in volume during the same period.

Network activity is crucial because, ultimately, transaction fees are necessary to pay validators and encourage other decentralized applications (DApps) to build on the network.

Therefore, even if Ethereum maintains its lead in TVL and active developers, these advantages mean little if network activity stalls compared to rivals.

To gauge whether ETH whales and market makers have adopted a more cautious approach, it’s important to analyze the ETH monthly futures market. Under typical conditions, those contracts should trade at a 5% to 10% annualized premium, compensating for the longer settlement period.

Currently, the ETH futures annualized premium sits at 6%, down from 8% on Tuesday, maintaining a neutral range for the last three weeks.

More notably, this dip in bullish leverage demand occurred as spot Ether exchange-traded funds (ETFs) saw net inflows for nearly three weeks straight.

Related: Corporate crypto treasury holdings top $100B as Ether buying accelerates

The lack of enthusiasm at the $3,800 ETH price mark may stem from fears that competitors Solana and BNB Chain are more user-friendly thanks to their higher capacity at the base layer.

Additionally, there are concerns about the lasting impact of Ether reserves held by corporations, the rise of which has played a significant role in Ethereum’s recent price surge.

Nine publicly listed companies have accumulated at least 2,000 ETH each, including Bitmine Immersion Tech (BMNR), SharpLink Gaming (SBET), and The Ether Machine (DYNX), according to data resource Strategicreserve.xyz.

If corporate reserve buying activity continues, ETH could march to $5,000. However, for now, traders remain skeptical and are not giving the benefit of the doubt that $4,000 is within striking distance.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.