Key takeaways:

-

XRP open interest remains elevated despite the recent drop, suggesting traders are still holding leveraged positions.

-

Low onchain activity on the XRP Ledger raises doubts about sustainable price gains above the $3 resistance level.

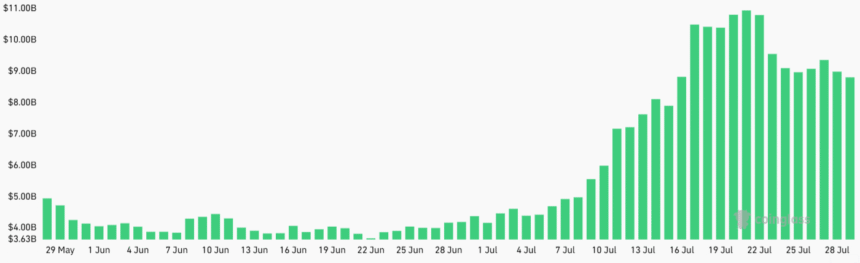

XRP (XRP) has fallen 15% since reaching $3.66 on July 18. This move was accompanied by a $2.4 billion drop in XRP futures open interest, a metric that reflects the total value of outstanding leveraged positions. Traders now fear that routine market volatility could trigger cascading liquidations, potentially driving XRP below $2.60.

The chart above clearly shows that leverage fueled the 68.7% rally between July 1 and July 18, when XRP climbed to $3.66 from $2.17. Aggregate XRP futures open interest reached an all-time high of $11.2 billion on July 18, before falling to the current $8.8 billion level—a 21% drop in US dollar terms. This decline has prompted speculation that some investors may have shifted their focus elsewhere.

Even measured in XRP units, the current 2.82 billion contracts represent a 12% decrease from the peak. One could argue that much of the excessive bullish leverage has already been flushed out, given that liquidations totaled $325 million during the two weeks ending July 25. Still, open interest remains 48% higher than one month ago in XRP terms, leaving valid reasons for caution.

XRP futures hold steady despite $3 retest and ETF speculation

To assess whether whales and market makers are showing greater concern for the $3 support, it is useful to analyze monthly futures pricing. Under neutral conditions, these contracts generally trade at a 5% to 10% annualized premium compared with spot markets.

Over the past week, monthly XRP futures have consistently traded at a 6% to 8% premium, indicating that neutral sentiment was not disrupted by the $3 retest. Importantly, even as XRP briefly rose above $3.60, there was no surge in demand for bullish leverage, reducing the risk of cascading liquidations under normal market swings.

Related: Trump’s Truth Social Bitcoin ETF among multiple crypto funds delayed by SEC

Part of the recent optimism surrounding XRP comes from speculation about the approval of a spot exchange-traded fund (ETF) in the United States, particularly after Ether (ETH) products surpassed $18 billion in assets under management. Such an event could benefit several altcoins, including Litecoin (LTC), Solana (SOL), and Cardano (ADA).

However, along with legitimate accumulation trends, the market has also been influenced by false claims of multiple banks adopting the XRP Ledger and of a Ripple partnership with SWIFT, the global payment messaging system. These unfounded rumors gain traction on social media, attracting trader attention despite a lack of credible evidence.

In practice, decentralized finance (DeFi) applications on the XRP Ledger have yet to gain significant adoption. According to RWA.xyz data, only $134 million in tokenized assets exist on the network, well short of a top-10 ranking and below Avalanche’s $190 million.

Similarly, decentralized exchange (DEX) activity on the XRP Ledger does not place it among the top 50 blockchains, according to DefiLlama. By comparison, the Sui blockchain processed $13.3 billion in 30-day DEX volumes, while Sei handled $1.43 billion over the same period.

Even though XRP derivatives currently reflect neutral market conditions, traders will likely seek clear evidence of sustained demand for the XRP Ledger before the price can establish consistent bullish momentum above $3.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.