The U.S. tax landscape underwent significant changes in 2025 with the enactment of the One Big Beautiful Bill Act (OBBBA) on July 4th. Initially designed to prevent the expiration of key tax provisions from the 2017 Tax Cuts and Jobs Act (TCJA), the OBBBA not only made some TCJA provisions permanent but also introduced numerous changes and provisions affecting families and workers. These modifications are expected to bring temporary tax relief to some taxpayers, while the permanent provisions will provide stability. However, the overall effect is an increase in complexity for tax planning, making it crucial for individuals to stay updated on the latest developments.

Many of the new provisions are temporary, allowing taxpayers to take advantage of them for only a few years. For instance, the OBBBA changes will offer temporary tax relief to some taxpayers, while the permanent provisions will bring some stability. To navigate these changes, it’s essential to understand the key modifications for 2026. Our 2026 Key Financial Data Card provides a handy reference for these changes, covering topics such as tax brackets, standard deductions, and estate tax exemptions.

Tax Brackets Permanently Extended and Increased

The OBBB Act permanently extends the seven tax brackets established by the Tax Cuts and Jobs Act in 2017. For 2026, each bracket’s income limit received an inflation adjustment of 2.3%, meaning 2.3% more income is taxed at a lower rate than in the previous year. This adjustment aims to account for inflation and ensure that taxpayers are not pushed into higher tax brackets due to inflationary increases in their income.

Higher Standard Deduction

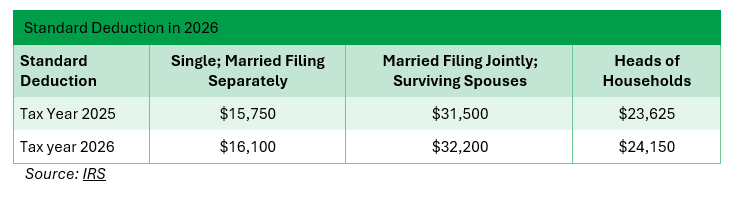

The standard deduction for taxpayers who do not itemize has increased, as part of the annual inflation indexing. The table below compares the 2026 standard deduction with the 2025 standard deduction, highlighting the changes.

New Senior Deduction (Temporary)

Seniors aged 65 and older will receive an additional deduction, with $6,000 available for single filers and $12,000 for married taxpayers filing jointly, provided both spouses are 65 or older. This benefit applies to both standard and itemized filers. However, it begins to phase out for individuals with modified adjusted gross income exceeding $75,000 and $150,000 for joint filers. This deduction will be available for the 2026, 2027, and 2028 tax years, offering temporary relief to eligible seniors.

In addition to this new deduction, seniors will continue to receive the extra standard deduction for seniors in 2026, with the amount increased to $2,050 for single filers and $1,650 for each spouse in a married joint filing, provided both are age 65 or older. This means a married couple, both over 65, can receive up to $41,500 in deductions, combining the new senior deduction and the standard deduction for seniors.

Increased SALT Deduction Cap (Temporary)

The OBBB Act raised the deduction cap for state and local taxes (SALT) from $10,000 ($5,000 for married filing separately) to $40,000 ($20,000 for married filing separately) for taxpayers earning less than $500,000 in 2025. The cap will increase by 1% annually through 2029. However, this is a temporary feature, and the cap will revert to $10,000 ($5,000 for married filing separately) starting in 2030.

It’s essential for taxpayers to understand the temporary nature of this change and plan accordingly, as the SALT deduction cap will affect their tax liability in the coming years.Increased Estate Tax Exemption

The estate tax exemption, which is the amount of assets someone can pass on at death without owing federal estate taxes, is $15 million for individuals in 2026, up from $13.99 million in 2025. This increase provides more flexibility for estate planning, allowing individuals to transfer more wealth to their heirs without incurring federal estate taxes.

The annual gift tax exclusion for 2026 remains at $19,000, and individuals can gift up to this amount without using any of their lifetime gift and estate tax exemption. If a gift exceeds $19,000, the excess amount can be subtracted from the lifetime gift and estate tax exemption. Married couples can combine their exclusions to gift up to $38,000 per recipient per year, providing an opportunity for tax-efficient wealth transfer.

Favorable Treatment for Long-Term Capital Gains and Qualified Dividends

Long-term capital gains, such as the profit from selling a stock held for more than one year, are taxed at a more favorable rate. Qualified dividends, which are dividends paid by most stocks and stock funds, are also taxed at these favorable rates. Understanding the tax implications of investment decisions is crucial for optimizing tax efficiency and minimizing tax liabilities.

The table below shows the rates at which long-term capital gains and qualified dividends are taxed, providing a clear overview of the tax implications of different investment scenarios.

Increased Health Savings Account Contribution Limits

If your health insurance plan allows for a Health Savings Account (HSA), the contribution limit for 2026 is $4,400 for self-only coverage and $8,750 for family coverage. These limits are up $100 and $200, respectively, from 2025. Individuals 55 and older who are not enrolled in Medicare can contribute an additional $1,000 as a catch-up contribution, providing an opportunity to save more for healthcare expenses in retirement.

Increased IRA Contribution Limits

For 2026, the IRA contribution limits are $7,500 for those under age 50 and $8,600 for those age 50 or older. These limits are up $500 and $600, respectively, from 2025, allowing individuals to save more for retirement and reduce their tax liabilities.

How to Navigate the Changes

Changes to tax laws, estate planning, retirement planning, and investment planning are constantly evolving. It’s essential to work with a trusted financial advisor who can help you navigate these changes and optimize your financial strategy. At Blankinship & Foster, our Wealth Management service includes in-depth and proactive retirement and tax planning, tailored to your unique situation and objectives. Your goals deserve a clear path forward. Meet with us to discuss how we can help you prepare for what’s ahead.

Disclosure: The opinions expressed within this blog post are as of the date of publication and are provided for informational purposes only. Content will not be updated after publication and should not be considered current after the publication date. All opinions are subject to change without notice, and due to changes in the market or economic conditions may not necessarily come to pass. Nothing contained herein should be construed as a comprehensive statement of the matters discussed, considered investment, financial, legal, or tax advice, or a recommendation to buy or sell any securities, and no investment decision should be made based solely on any information provided herein. Links to third-party content are included for convenience only; we do not endorse, sponsor, or recommend any of the third parties or their websites and do not guarantee the adequacy of information contained within their websites.